Top of the Pops

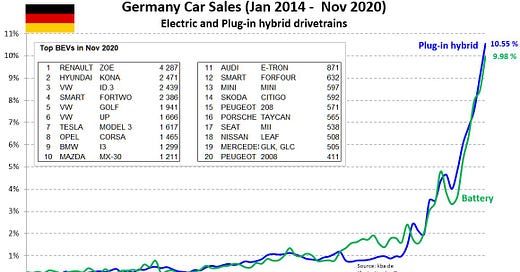

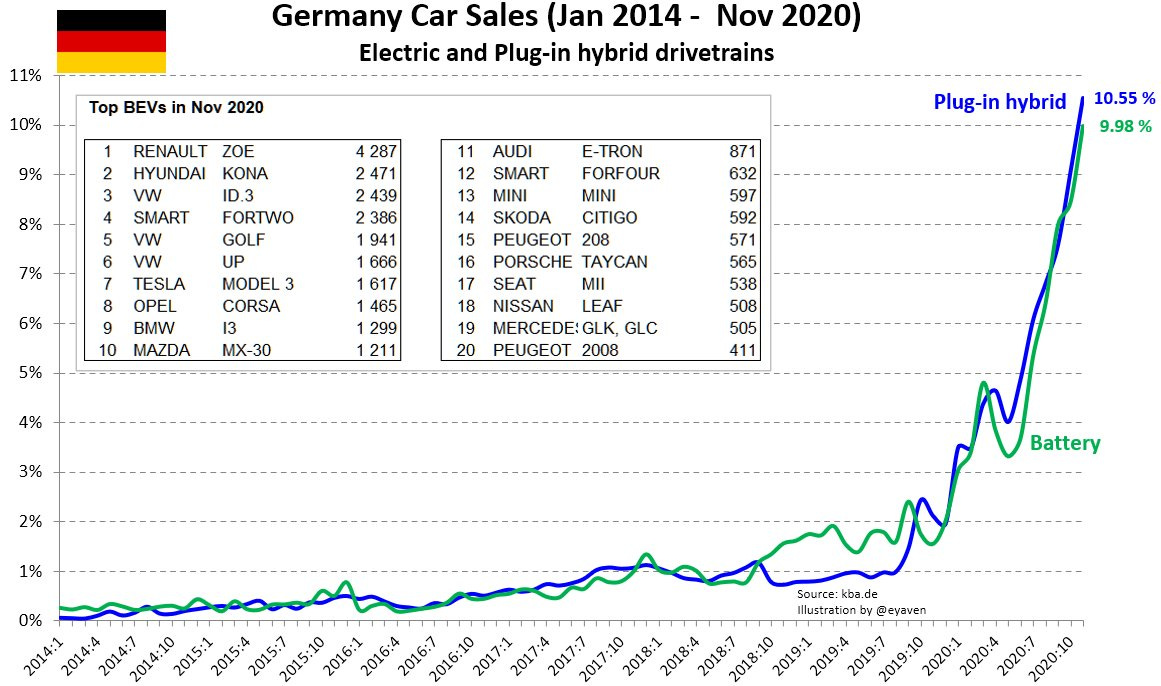

The argument that EVs will only account for 30-50% of the car fleet by 2035, while solidly grounded in how long it takes for fleets to turnover (usually about a decade), is underselling the rate of growth on markets where models are available and infrastructure is being rolled out. The data from Germany points to just how rapid the shift in the last 2 years has been:

A net 20% share of car sales for plug-in hybrids and pure battery EVs is a huge underlying change from a 4ish% market share of new sales just over a year ago. It certainly exceeds the expectations of the management consultancies like Deloitte pushing their own forecasts through 2030 earlier this year:

However, further bullishness on EVs requires fiscal policies supporting infrastructure programs, and likely as well buybacks and regulatory changes to mandate retirements. Look at Europe’s share of global vehicle sales (both passenger and commercial vehicles per OICA data):

China’s market will soon be roughly equivalent to NAFTA and Europe (which includes Russia, Ukraine, Belarus, etc.) combined. Sales of EVs and hybrids (labeled ‘new energy’) hit 200,000 units for November in China, posting very strong growth over 2019. Biden just named former Michigan governor Jennifer Granholm to be his energy secretary, which tells you he’s hoping to deliver for Detroit, the Rust Belt, and the auto industry to push the transition along in the US. The squeeze on copper, nickel, lithium, and cobalt is fast coming. While it may slowdown adoption rates with higher end-costs, don’t discount how quickly consumer preferences and policy support are changing. The next commodity bull market won’t necessarily be great news for oil, but it will be for everyone else.

What’s going on?

The Community of Energy Consumers has written Nikolai Shul’gin at MinEnergo complaining (once more) about the current legal framework to retire ineffective power-generating capacity in the energy sector. Under the existing system, newer plants and upgrades for existing plants can offer receive what are effectively more attractive market regulations because they are paid for providing baseload capacity when needed to Russia’s ‘United Energy System.’ Older plants in need of major investment or eventual retirement can be shut down, operate only charging for power used by consumers, or be legally classified as necessary for the system’s functioning while replacement capacity is built up. In practice, this sets up a scenario where companies will drag out the transition period as long as possible since power plants already given that designation often charge tariffs 200-400% the market rate for electricity. The very law that’s supposed to head off expected significant energy price inflation after 2025 could trigger it in the short-run while dragging out the timeline for investment projects to be completed. MinEkonomiki seems open to amending the law as is. Another regulatory cluster**** for Russian industry incoming.

New polling from SuperJob shows that the number of Russians willing to take “gray wages” paid out in cash stuffed into envelopes — an oldie, but goodie — has risen back near April levels to 44% in December. There’s a clear connection with the runway the initial stimulus provided running out over time for more and more people desperate for payment. The following is in % terms:

Gray = hard to answer Green = yes Red = no

Given the reference points in Sept. 2018 and 2019, things haven’t changed much. on the surface. But watch to see if those figures rise in Jan.-Feb. polling. The data shows that those on the lowest end of the wage scale or else those working for the least on a given job are the most comfortable taking payment in cash, traditionally a challenge for the country’s tax administrators and economic policy institutions trying to move as much activity into the formal sector as possible. It turns out that doing little to help people get through a demand shock doesn’t help.

The government commission on foreign investment has ok’d the creation of a joint venture between Sibur and Sinopec to build the long-planned Amur gas chemical complex. Sinopec will own a 40% stake in the project. Now the project awaits the Federal Anti-Monopoly’s Service decision to allow it to proceed, something which may well happen more quickly now that Artyomev is no longer heading it. Vygon has estimated construction costs at $10-10.5 billion with a planned capacity of 2.7 million tons a year in polymer production — 2.3 million tons of polyethylene and 400,000 tons of polypropylene. Cheaper feedstock is the main selling point, but COVID is beginning to pressure the geography of product flows and China is rapidly becoming the world’s biggest overall refiner of petroleum products, supplanting a position the US has long occupied. The deal’s as political as it is business. State-backed investments into the Far East net Beijing brownie points, can be used to serve northern regions in China with cheaper labor inputs across the border, and Leonid Mikhelson continues to expand his business ties.

November industrial data showed a mini-recovery of a net 5.5% annual decline vs. last year in October to a 2.6% decline. The trouble is there’s not convincing basis for the improvement. The bump looks like companies clearing past orders, seasonal variation, small upticks for extractives and refining, and a calendar effect — November had one more working day than October. All the while, expected orders for January 2021 on the books have actually fallen to their lowest levels since the beginning of 2014. The real kicker is budget expenditures since they’re up over 27% year-on-year before the new round of fiscal consolidation chokes growth once again. The industrial sector’s struggles map onto the diminishing reserve of savings for households and falling wages as well as some fluctuation on foreign markets. Lacking any demand-side stimulus, the only big customer left is the state and it’s going to hinder a recovery in industrial orders by pulling back to balance spending while scrambling for new tax revenue streams.

COVID Status Report

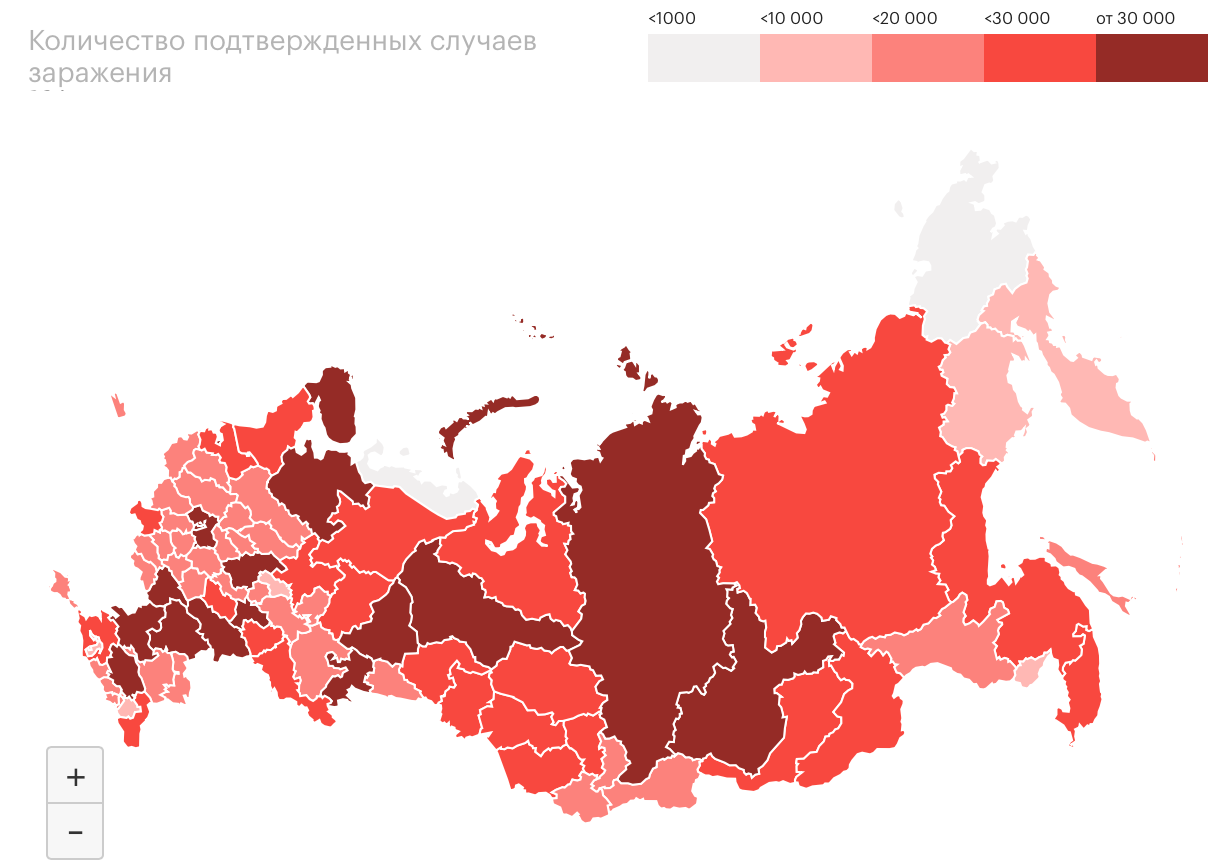

Cases stood at 26,509 for the last 24 hours with a small uptick in deaths to 596. Regional cases did rise again, but not by much whereas Moscow showed a larger drop-off per its daily see-saw pattern. The regional spread doesn’t look much different, save that St. Petersburg and Karelia now have more cases per 100,000 people than Moscow, which suggests that improvements in St. Petersburg in coming weeks will have a larger impact on national numbers than most other hotspots:

Fortunately, COVID hasn’t disrupted much production in Russia despite the limited attempts to control the spread, earlier problems with hospital capacity, and the risks posed by winter forcing everyone indoors together. But even in St. Petersburg, the country’s second city, there’s reportedly a lack of available refrigerator capacity to store and cool vaccines. The total death rate for Jan.-Oct. in Russia reached its highest level in a decade, recording 113.2 deaths per 10,000 people, a 10% rise year-on-year. It’s still significantly better than in the 2000s up to 2010-2011, but the figure symbolizes the problem COVID poses for Russia: it’s setting back years of progress addressing underlying problems and distorting the state’s ability to respond to ones that became apparent in 2013-2014. I’d say never let a crisis go to waste, but the crisis has been constant for 7 years with no end in sight.

Murder Inc.

In light of the general themes I’ve been following for this newsletter and reflections on Russian political economy and power in the world, I’ve come to think of the Russian state, not as a criminal enterprise slotting in the generally lazy bromides of ‘analysts’ like Anders Aslund, but rather as a zombie corporation facing serious problems for internal succession, the survival of its business model, and risks of (political) market disruption. The Federation Council has formalized into law the right of ex-presidents to become life-long senators and to receive legal immunity from prosecution, opening yet another door for Putin to manage a potential exit from the presidency (if one assumes he’s grooming a figure like Mishustin to replace him since Mishustin has no political base of support without the presidential administration and has very limited exposure to foreign policy matters). For some reason the news today struck me juxtaposed with Navalny’s latest video walking us through how there were multiple attempts on his life by the FSB:

Setting aside my own qualms with the faith placed in organizations like Bellingcat who aren’t formally trained as intelligence analysts, yet claim comparable authority on a wide range of topics from crater analysis to actual intelligence tradecraft with little consideration for whether or not they’re being fed something, this investigation (definitely convincing) encapsulates how radical the problem and worldview has become for political elites in Russia as well as those trying to navigate the system to try and effect change. On the one hand, yes, this is indicative of a deepening turn towards a siege mentality permeating all decision-making. The various factions within Russia’s security apparatus appear to be priming Putin and United Russia to run to win a commanding majority in the Duma while railing against foreign interference. The party just put forward a bill that allows the data of members of the security services to effectively be classified or else denied to the general public. The economic bloc responded by pushing forward a proposal to give the Federal Tax Service access to bank secrets, also granting the CBR access to people’s tax histories. Everyone’s looking for every means available to protect their own assets, to go after others’ stuff, to be able to improve the state’s capacity to take wealth from those profiting off of the system (and the multitudes more who aren’t). It’s not just about Soviet-era holdouts or diehard nationalists trying to Wormtongue their way into reorienting the entirety of Russian policy to further expand the power of the state and fight the West. It’s reflective of the inertia and frequent lack of formal power within Russia’s economic and social political institutions that remain unable to resolve things or really shape policy.

The siege mentality, however, isn’t really that interesting to me by itself. It makes for easy mood music analytically for those who need to fill columns or express their horror at how violent the regime has become as a sort of signal. What is interesting to me is how closely this turn tracks with the theory put forward by Grigoriy Yavlinsky — admittedly a guy still trying to resurrect what could have been with his 500 Days Program — that the constant struggle to centralize power in the state’s hands to maintain its viability as a major power despite being ringed by richer neighbors stems from the country’s limited level of integration into the global economy. Russia has been a resource exporter constantly in search of hard currency earnings to address domestic shortfalls for half a millennium. Once the empire was established, Siberian exploration yielded precious metals deposits and more to sell abroad. Then grain became Russia’s biggest source of exports, tax revenues (thanks to liquor excise taxes and mandates that peasants drink), and influence on world markets (cotton playing a role too after the American Civil War). Soviet grain requisition eventually led to mass expansions of oil production in the 50s and 60s and lo and behold, the 73’ oil shock and petrodollar suddenly gave the Soviet budget a windfall and new instrument to finance loans to sustain proxy conflicts across the Third World. Low oil prices hurt Russia through the 90s until it could no longer maintain the post-94’ ruble peg and the domestic default in 98’ triggered a currency devaluation that helped bring the oil sector with its dollar earnings abroad back from the dead.

This dependence on commodity exports to sustain the internal structure of the Russian economy, with its endemic suppression of demand, the high costs imposed by geography and climate, and weak institutions, reinforces the increasingly visible violence of its political class at critical junctures. Identity and institutions have a place in state behavior, but if political elites mostly have hammers to attack problems, those problems look like nails. Externally, Russia has relied far too heavily on coercion, the limited and pointed use of its military power, and other facets of ‘hard’ power precisely because of its own domestic economic failures. If the Russian economy hadn’t stalled in 2013 and had shown signs of diversified growth after 2008, it’s quite possible Ukraine would have been much more interested in joining an EAEU with a dynamic ‘core’ economy for just one example. Obama’s retort that powerful countries generally don’t have to invade their neighbors to get them to go along was spot on, even if it didn’t please the Washington think tank peanut gallery. Susan Strange’s taxonomy of power remains useful — the power to coerce, cajole, convince, or carrot others into doing what they wouldn’t otherwise is one thing (relational power), the power to shape the structures of global political economy (demand, financial flows, reserve assets, norm-setting, etc.) another much more powerful thing entirely. Russia’s Soviet inheritance — its military-industrial complex and security institutions and dominant role on key energy markets — gave it a comparative advantage in matters of relational power. But being successful primarily at investing into these existing ‘assets of advantage’ provided diminishing returns as global affairs evolved, globalization changed course slightly, the balance of power on energy markets shifted, and Russia’s lack of economic heft undermined all of the gains it would make from foreign policy ventures. There’s relatively little reason the Russian economy should be less complex today than it was 20 years ago, yet it is, even with import substitution. Some of that reflects just how hard it is to build up new supply chains, but much more of it reflects the political consequences of a permanently deflationary economic model that lacks attractive institutions or a safe and stable investment climate.

Structures such as this shape the domestic political front as well. So long as demand is suppressed and wealth generated primarily through channels reliant on external demand, being close to the state or controlling state resources is the easiest path to wealth. Russia’s political institutions reflect the externally and internally-imposed shortages that plague it. Wealth, value, power are extracted, not ‘grown.’ Maintaining that access, control, or other means of extraction for personal gain or the gain of one’s lobby encourages the security services to use violence for political ends. Any individual who becomes publicly popular threatens the fragile equilibrium in Russian politics whereby politics are largely a simulacrum for politics. Local figures are given responsibilities to take the blame while depending on resources from the Center, elections are stage managed, problems that go unsolved are never the fault of the ultimate authorities at the top in Moscow. As the country’s formal political institutions have been hollowed out over the last 15 years, the space for violence to resolve disputes has expanded. And the growth elites used to be able to count on to redistribute rents to maintain the country’s social contract depended on others. There was no coherent plan in place for how to generate enough wealth domestically to create a more sustainable status quo.

Putin 4.0 is therefore a CEO presiding over a large incumbent enterprise that’s too big to fail outright because of its dominance, but is facing rising costs to maintain its position. Assassination attempts and murder are sanctioned moves from trusted middlemen trying to wring out more value from an aging set of products they can push to maintain order domestically and act abroad. There’s no doubt that as non-oil commodities come into much higher demand and prices rise, Russian firms and the state will extract significant value that can filter into the budget. But economic stagnation dovetails with political stagnation, and the system is clearly increasingly de-centered from the Kremlin when it comes to sanctioning violence and similar actions. It’s a bit like middle management knows the C-Suite doesn’t want to hear bad news or else doesn’t fully grasp how bad things look on the ground floor. Russia’s foreign policy once appeared to be where the Kremlin was most in command as opposed to the chaos of domestic policymaking as Putin retreated from being a major player save when interest groups have to be balanced. Even that veneer is slipping, I’d argue. Nations’ foreign policies in no way have to reflect the values and assumptions of domestic political preferences or ideologies, but they do reflect the institutional health of the state executing them. Optimization is just the latest tired rebrand trotted out, now with a new face in Mishustin to take the hit if it fails. Reforming development institutions and the like is tinkering at the edges. It’s true in world affairs that the weak are beaten, but the costs of weakness look mighty different when you sit on a nuclear arsenal, a UNSC seat, and a system full of individuals who’ll kill if need be to please you. The great irony for Russia is that Putin has staked its relevance in world politics on its relational power at precisely the time structural power matters more than ever. Can’t wait for the next marketing effort to cover up this one.

For a more mainstream account of the challenges to come, check out this event from Carnegie with a great lineup, including Andrei Kolesnikov, Kadri Liik, and Angela Stent:

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).