Frozen Assets

An interview with Aleksei Chekunov reifies Institutional Investor State Capitalism

Top of the Pops

If you have the time, I highly suggest skimming this report from the Bank of International Settlements that looks at the relationship between coal use for power generation and economic overheating. The authors were examining the link between GDP growth and the use of coal looking for non-linear relationships. GDP growth has historically tracked pretty closely with energy demand, with developed economies scrambling to ‘decouple’ growth from energy consumption slowly but surely since 2000. But one might expect that it’s possible to see an increase in coal use (and therefore emissions levels) that doesn’t follow this linear relationship, and might in fact outpace GDP growth in circumstances where economies with significant coal path dependencies exist, or else where demand increase has taken place amid weaker growth conditions:

The model they built shows that coal’s share of energy consumption and contribution to emissions grows ‘stickier’ because of the overheating seen during the EM boom of the 2000s, led by China. Coal demand, therefore, appears to grow more quickly when overheated economies strain their existing energy resource base. Trends since 2016 have affected this dynamic — there’s been a global expansion of LNG capacity and more interest in EMs to expand natural gas use and imports — but the lesson is an important one for Russia’s energy strategy through 2035. There may theoretically be latitude to increase Russian coal exports if the shifting macroeconomic paradigm in the US (and to a much lesser extent, Europe) runs developed economies hotter, spurring more resource and power demand for production across EMs. But these findings have to be updated to a reality where China is now trying to move out of coal, even if we won’t see capacity reductions till 2026 . Still, it’s a useful reminder that while it’s a good thing we’re seeing the steady erosion and, one hopes, erasure of the deflationary neoliberal paradigm in developed economies, they need to more aggressively work decarbonization into trade, investment, and development with emerging markets since net resource demand will increase across the board without it. Moscow is betting against the multilateral power of the West to make that transition work. I don’t know that I’d take that bet the more the market makes it diplomatically feasible.

What’s going on?

Shipbuilders are asking Putin to order the government and presidential administration to review the legal framework mandating that firms fulfilling state defense orders limit their profit margin to 5%. They’d rather they be allowed to go up to 20% to allow for greater re-investment into civilian production and import substitution instead of being saddled with profits so low, they can only really service debt. The firms backing the letter include Admiralteiskiye Verfi, Baltiiskiy Zavod, the “Pella” plant, and 37 others. These policy fights exemplify the inefficiencies transmitted from the defense sector into the civilian economy via the administrative ‘curation’ of efficiency. No one in Moscow wants defense spending to balloon, so they used an administrative measure to control costs back in 2015. The measure capped costs and profits were calculated as 20% of the cost to the head contractor + 1%. While profit margins were at 15-18% prior to the rule, it reduced them to 5% or less. In effect, the measures reduced the resources available for manufacturers to invest into more production capacity, which caps their ability to ramp up production and diversify to reduce imports of ships and ship components from South Korea, Japan, and China. An artificially hard budget constraint to avoid sectoral cost inflation undermined investment, which then reinforced the logic of negotiating prices and for resources from local, regional, and the federal governments. The moderation of Russian defense spending since 2014-2015 is partially reflective of these approaches, which are now weighing on diversification efforts. Loan interest rates for these firms have normally run at 10-12% with the lower key rate environment now pushing that down to 8.5%. Shipbuilding firms owed a collective 2 trillion rubles ($26.8 billion) in debt in 2019, which rose 50% to 3 trillion rubles ($40.2 billion) last year. They need profits to dig out from under the hole they’re in, otherwise they won’t be able to modernize production or infrastructure. Procurement costs have to rise after the cumulative effect of producer price inflation and limited capacity modernization.

As expected, the commodity price surge globally, scramble to source components for cars and other goods that use electronics inputs, and pressures on supply chains have hit Russian producers very hard. IHS Markit’s PMI Input Price Index for Russia shows producer prices rises faster than they have since the decision to let the ruble float in late 2014 created a surge in import prices and for longer at the current levels than even during the worst of the global financial crisis:

Rosstat and the more optimistic business outlets say that consumer price inflation has slowed, producer price inflation risks ripping up, made worse for the sectors now navigating price control measures. Production and wholesale price pressures are still going up and up. Raw material inputs for industrial production are up nearly 33% year-on-year. The optimism that economic recovery will take root in the months ahead has to square with the reality that, in theory, producers have experienced more price inflation than for most consumers based on the topline CPI data. That theoretically means their profit margins are diminished, but leaves a lot of firms in a bind — domestic demand is perpetually weak, so significant expansions of manufacturing capacity can threaten their margins. The “recovery” taking place now has the IHS PMI for output barely hovering above 50, a stone’s throw from recession (again). Under-utilization of capacity and lower investment levels make inflationary pressures worse since factories lack the ability to ramp up, and that’s parking aside the role that budgetary procurements play in propping up a significant chair of industrial production. It’s hard to see producer prices easing faster than consumer prices, and the price control measures in place for key goods will worsen those distortions.

Russia’s retailer boom is evolving. After large strides in the initial years post-Crimea , the gains from scaling operations, managerial innovations, rerouting supply chains to domestically source more production, capital raises from equity markets, appear to have slowed down. The X5 Retail Group, Lenta, Magnit, and M.Video have all slipped in Deloitte’s rankings for top 50 fastest growing retailers globally. Russia’s slow population decline and falling consumer incomes are expected to hurt their bottom line in the year ahead. But more interestingly, some are now forecasting that Russia’s new generation of online retailers — Wildberries, Ozon, Vkusville, Svetofor, Fix Price — and Mercury Retail Group Ltd. — owners of Dixie, Bristol’, and Krasnoye and Beloye — might join the top 50 by 2023. It’s a good news, bad news story. Retail has been the rare sector in Russia that’s truly competitive for the obvious reason that there is no effective manner for the state to generate rents off of it and it’s also adapted best to the cumulative effects of import substitutions and counter-sanctions measures. But retail, mainly for food but other goods as well, is often a low-margin business. The Kommersant writeup is a good starting point, and reminder that e-commerce in Russia has the potential to grow rapidly because foreign firms have a harder time entering the market and the fall in real incomes creates a market for lower-cost alternatives. My question is what happens if the labor market tightens while new job creation and industrial investment continues to cluster in labor-intensive industries with higher levels of inflation and low levels of aggregate investment. Put another way, businesses will have to pay more to compete for labor but those pay increases will be of limited use increasing real incomes without growth across the economy. Retail’s still the post-Crimea “success story” for Russia Inc. It’s just unfortunate that so much of the innovation is in response to falling living standards.

Russian investors are moving their money out of mutual funds and away from more weakly performing bonds and into higher risk equities. In April, retail funds saw an inflow of 28 billion rubles ($375.2 million), down from 31 billion rubles in March ($415.4 million) and 38 billion rubles ($509.2 million) in February. MOEX returned to record highs in the second half of April following this turnover in investor positions in search of yield. Over the last year, equity and mixed funds in Russia have managed to return 20-90%, but the effect of US stimulus on global bond markets — inflation expectations have risen, increasing the expected discount on future cash flows from bonds — has dovetailed with spiraling inflation in Russia. The Central Bank’s rate hikes mean that investors buying OFZs since the start of the year have realized 0.2-0.8% losses. Yields aren’t high enough with expected ruble inflation to draw more money in unless the rates go up significantly higher. There’s less pressure on OFZ issuances to finance budget spending since the oil price recovery has lifted revenues for the budget, but inflation is affecting the attractiveness of sovereign debt yields for domestic investors. I’d expect that state banks would have to buy more OFZs as a result of declining private investor interest. We still don’t know what % share of non-resident purchases they account for. Regardless, expect that to rise since the new inflation scare in the US is ridiculously overblown and US Treasuries are still a safe buy for portfolio management.

COVID Status Report

7,639 new cases were recorded against 351 deaths. These figures clash more and more with the mortality data that now hints at 500,000+ excess deaths for Russia since the pandemic started (and are starkly high at the moment). Hospitalization in Piter fell 22.7% week-on-week yesterday, which is good news. The question is whether the mortality data will reflect lower levels, or if people are dying of other conditions exacerbated by COVID without being properly registered in hospitals or in mortality. I’m happy to be wrong about a 3rd wave. It’s just hard to believe that vaccinations are responsible for the current plateau. Conditions for the resumption of air travel with Turkey are now being laid out. Negotiations hinged on Turkey purchasing Sputnik-V vaccines before reopening can take place. Turkey’s pushing for a tentative June 1 resumption of full flight access. The peak observed in Turkey has eased considerably:

The closure was a useful public health measure for Russia, but reopening is clearly now a political football. Cases in Egypt have almost returned to levels seen just before the last peak in January in the wake of the flight negotiations with Moscow.

Investment on Ice

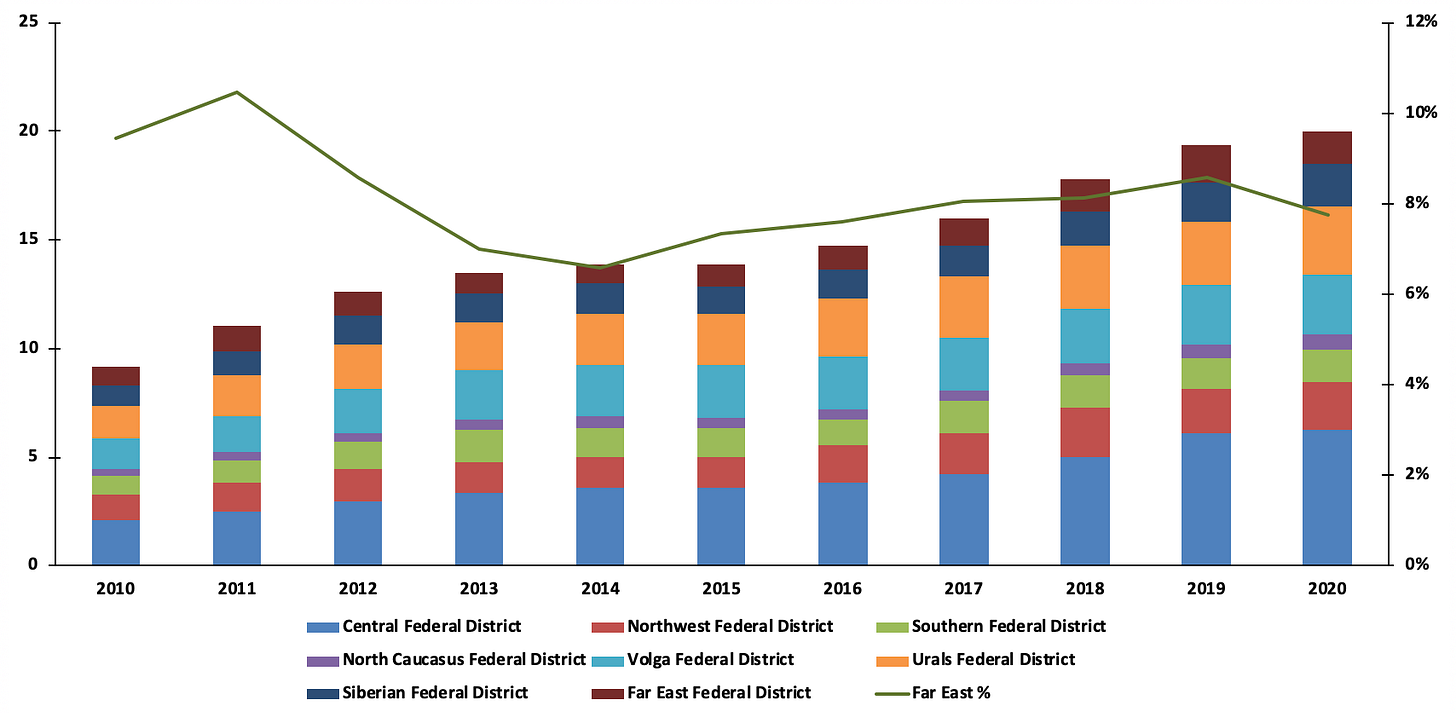

Aleksei Chekunov, the head of the Ministry of Far Eastern and Arctic Development, gave an interview with Kommersant about the best laid development plans. It offers some more insight and confirmation about where Moscow’s policy planners are at when it comes to investment and socioeconomic development. The first success stories Chekunov offers aren’t really the success stories they might appear to be: Far East agriculture and logistics. Cultivation of land is rising and Far Eastern ports, roads, and railways handle 220 million tons worth of cargo a year. These are important metrics, but are part of larger national stories. The gains made by the agricultural sector are really reflective of efficiency gains from subsidized investments to modernize plant and improve domestic manufacturing capacity. LHS is production in blns of rubles (current prices) and RHS is 000s of units:

Importantly, the earnings also reflect commodity price levels. But these gains haven’t really been that smashing a success in the Far East. Moscow has attempted to stanch the long-standing depopulation of the Far East by offering free land, but few are interested in the program and the state reserves the right to take the land back if you fail to follow their development requirements. Increased logistical turnover has come after some capacity expansions, but are also largely about transit. They’re of limited value for diversification so long as it’s resource exports and finished good imports using that capacity. Look at Kazakhstan since 2013. Few solutions can readily resolve the region’s problems, however, for the simple reason that it’s massive size, remoteness, and limited population mean that it has to ‘import’ a large volume of its consumption internally from very far away and can only diversify so much. When Chekunov cites positive data that industrial output has risen 24% in the Far East in the last 5 years vs. the national average of 12%, he’s spinning distortions into positive developments. The Zvezda shipyards boost those figures through regulatory rents mandating procurements and the largest investments into new petrochemical capacity are in the Far East. Infrastructure, or the absence of it, still define much of the region’s prospects. With a small population and export-oriented economy, domestic demand is unlikely to be significant enough to sustain diversification. That means spending more on physical links and coping with the capture of economic policymaking by state and private sector raiders alike. Since the Far East ministry was handed oversight of the Arctic as well, the same problems apply. The only distinction for the Arctic is that SOEs and Novatek have more direct federal support to build the base level of infrastructure needed for extractive, exporting projects because they provide significant budget revenues federally and support the current account surplus.

Nowhere in the interview does Chekunov say anything about efforts to attract foreign capital and suggests that the regional government is focused on using concessions agreements to leverage its scant budget resources into a much greater volume of investment. That is far and away the most significant tell for what’s happening in the regime and growth expectations. When asked about who will invest in projects supported by ‘accelerators’, namely the development institutes in this case that are meant to provide pockets of managerial competence and investment resources, here’s what he led with:

“Banks first of all, insurance companies, pension funds — in general, what we’d call institutional investors. Those who complete these projects are the initiators who, as a rule, will use this infrastructure in the future. That is if conditionally some large initiator is developing a deposit, for example, they need a road, as a rule it’s always a strong group that will be able to provide the volume of resources that the concessioner needs to get thing going, which is 10-15% of the capital. The response that we are withdrawing from the market give us confidence that we’re moving in the right direction here.”

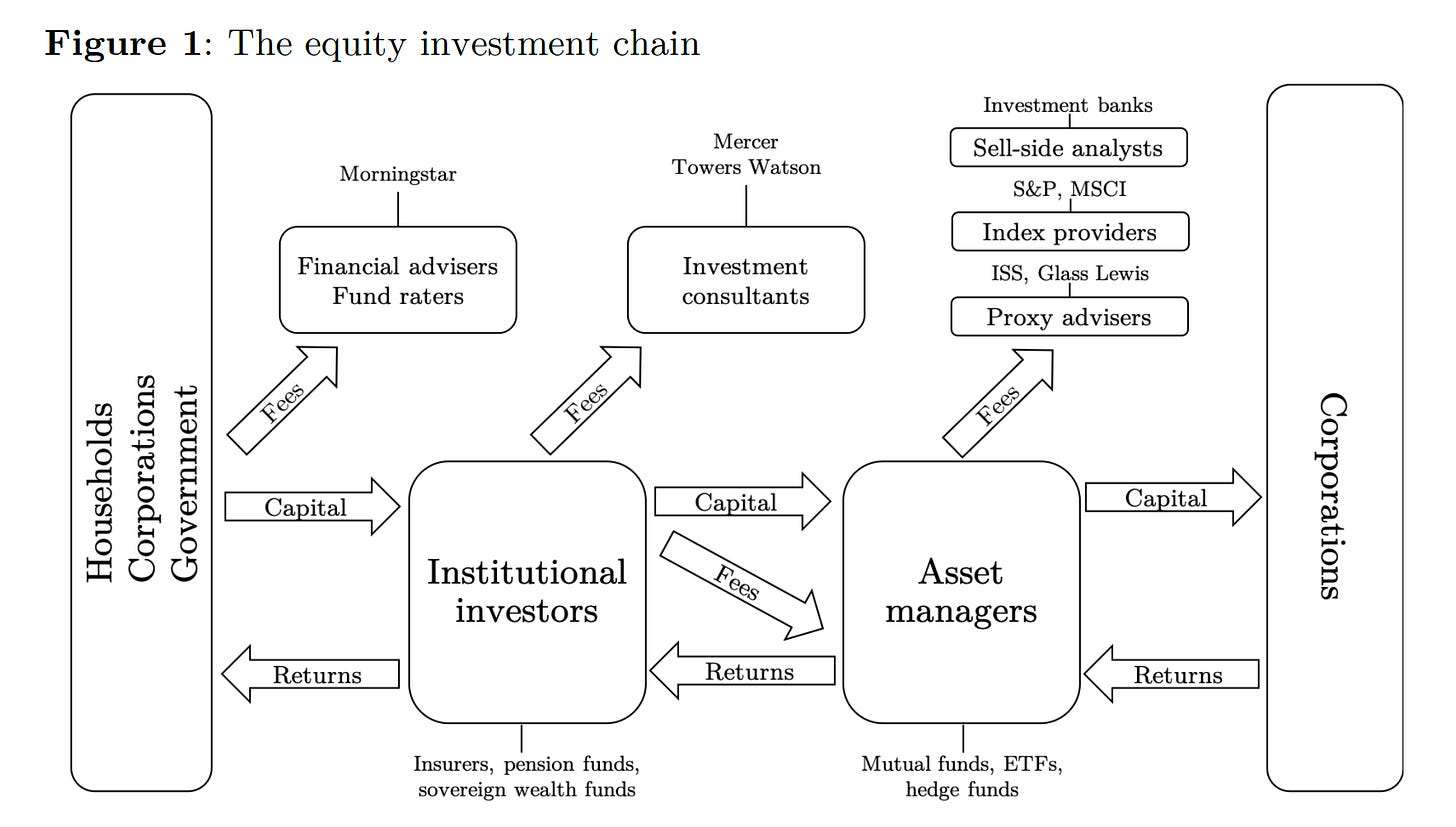

This paragraph is a masterclass in bureaucratic nonsense and the evolution of late Putinism towards a what we can think of as Institutional Investor State Capitalism. I thought of this after skimming through this fantastic article by Benjamin Braun on the evolution of what he calls Asset Manager Capitalism — in the West, we can say that asset managers now hold such large shares of corporations on traded indices that they represent a new mode of corporate governance:

If we reconceptualize this map for a Russian context, the investment consultants are the formal and informal figures in regional and local government collecting rents to organize tenders, ensure access, pick winners, and so on. The financial advisers are the business lobbies, federal ministries, and private sector consultants dependent on SOE and parastatal business. The institutional investors are the insurers, pension funds, and development institutes in coordination with the banks and the Asset Managers are the SOEs, parastatals, or big firms supported by these investments. The difference is that unlike the equity investment chain you see in the US or OECD, the money that enters the system is basically only domestic at this point. Moscow has conceded defeat on foreign investment and now has to deepen its domestically available pool of capital. But do so, the state is forced into an absurd dance. It must “withdraw” to encourage private capital to build and manage assets, but the capital filling the gap from this withdrawal is effectively coordinated by the state. Rather than accept a direct liability onto the national balance sheet, the preference is to use budget resources to underwrite credit and the creation/acquisition of assets and liabilities to reward political constituents. The state is still the driver of investment, but structurally creating an intermediary layer directing investment in a manner that poses long-run political risks if central control isn’t adequately maintained. There’s also the handy problem that the federal government has to create more demand to sustain private sector investment. The Far East and Arctic are particularly dependent on federal support since low population density reinforces the incentives to support investments that generate more budgetary resources rather than maximize growth. LHS is trillions rubles (current prices) and RHS is % of all investment nationally. The region already absorbs far more investment in relation to its population than most of the country:

Without a significant increase in direct federal expenditures on the Far East, I’m not really sure how private capital can fill in the gap from the state “withdrawing.” Rather the new scramble for investment mobilization, I wager, will be a war waged primarily via the boardrooms and offices of the development institutes, state banks, and development ministries in the absence of increased spending levels. The institutional investors will act as a new managerial layer and class tasked with muddling through late Putinism’s underinvestment crisis. These institutions aren’t new, but as we constantly see in Russia, institutions invested with formal authority lacking actual power can, in a flash, suddenly become significant political actors in moments of crisis when the state demands their capacity to govern be utilized. Mishustin’s optimization drive in the fall to reform the development institutes was most certainly intended to strengthen their efficacy and grip over pockets of rents to distribute with him playing a central role running the circus. But if we think of them as nodal points in rent networks, those connections run both ways. Regions can exploit these institutions in reverse, and will have to fight harder and harder for these resources if they aren’t given greater fiscal powers or more direct federal budgetary support. The longer Russia starves its capital of productive investment, the more starved of capital it will be and the greater the strain on the institutional investors now tasked with holding it all together to produce returns for the regime.

The ‘withdrawal’ of the fiscal state in these instances is the expansion of the informal, coercive state in economic policy. That’s a recipe for disaster and Chekunov’s interview copped to it without a second thought. The big investors are expected to already have the resources needed for the project anyway. That either means they have a strong growth market or are sitting on enough rents to finance investment without borrowing much. There’s far more of the latter since the self-imposed limitations on Russia’s fiscal capacity deepen rentierism amid stagnation.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).