Top of the Pops

The hits keep coming. It appears that Finland’s aims of achieving carbon neutrality by 2035 — note that the national strategy includes calculations of the carbon sink effect from land in the equation — and its EU commitments to reduce emissions by 2030 could cost Russia 22 billion rubles ($288 million) in annual energy exports. Fingrid modeled its scenarios assuming a 10-year freeze on Rosatom’s hoped-for expansion of nuclear capacity at Hanhikivi-1 or a full cancelation. The initial orders have already been agreed and Rosatom estimates it’ll go live in 2028. The issue here is ultimately one of regulatory regimes and the parallel securitization of energy policy in both Russia and the EU. The Baltic States had pledged to link their power grids with that of the EU via Poland as as early as 2020 back in 2017. The initiative fell under the umbrella of the more expansive Baltic Energy Market Interconnection Plan, a series of projects, regulatory alignments, and cooperative agreements designed to create an open and integrated electricity and gas market between all the Baltic States: Finland, Estonia, Latvia, Lithuania, Germany, Denmark, Sweden, and Norway (as an observer). Last year, Gazprom lost a third of its market share in Finland to LNG imports via the Baltic Interconnector Pipeline from Estonia:

Gazprom isn’t a loser on the Finnish market since 2020 depressed prices for much of the year, which made LNG far more competitive and reduced price differentials between Baltic markets. Still, the lesson should be that renewable energy, energy efficiency, and buyer optionality drives meant to improve energy security in the pre-COVID world have laid the groundwork for Russian losses in the coming decade. The open question is how much natural gas Finland will still need to backstop its grid, particularly as it continues to invest in north-south connectivity so that the national power market operates without significant regional distortions e.g. living nearer to Estonia shouldn’t massively change the end-user cost for power. Rosatom seems likely to finish construction on its schedule for 2028, at which point you’d assume that Finland would prefer to use more nuclear power for its base load while having built out renewables capacity. That’s great news for Finnish energy security, bad news for Russian power exports via Vyborg as Finland tips into power surplus per its own expectations (assuming they pan out), and while Rosatom may earn a little bit off that project, we know that it wildly inflates the profitability of its export portfolio and the main customers are developing economies with weak credit ratings being extended massive lines of credit under commercial market rates that ultimately fall on Russia’s reserves to underwrite. Rosatom isn’t pivoting to profit off the energy transition because of its business model, nor will Russia keep its market share. The energy transition is a securitization story, one that disrupts the power of traditional exporters to securitize their export strategies (though not necessarily cede their market share).

What’s going on?

AKRA has bad news for Russia’s coal miners — you may have enough reserves for 370 years, but coal’s role as a leading energy source may only last 5-10 years depending on transition scenarios. It’s hard to know what exactly the move from coal looks like, but consider that it creates considerable logistical (and revenue-based) drags on the economy. Coal accounts for 44% of the freight haulage for RZhD, yet it’s one of the lowest revenue-generating goods in terms of the tariff regime and only accounts for 4% of national export earnings. It’s not just dirty, it doesn’t make Russia much money without being plugged into a value chain like steel production. Demand dropped by 7% in 2020 against a net 0.9% increase in electricity demand. The writing’s on the wall as that pace is likelier to accelerate quickly than not. The 2015-2020 price range for coal sat at $42-95 a ton against a normal production cost of $45-50 a ton. Russian producers aren’t turning real profits, and even Medvedev before he got the sack had warned repeatedly of risks of stranded coal assets. Russia will have to find new employment for a lot of those working in the industry, and to start unwinding some, not all, of the effective subsidy support that coal extraction receives to redeploy that money to better uses.

The construction sector showed signs that it managed to level off around 2019 levels by the end of 2020, but the recovery is skewed towards residential construction works. Even with seasonal adjustments, demand in December was down 10.9% so not everything was rosy headed into 2021:

Title: Dynamics of Construction Works 2019-2020 (%)

Blue = construction works (total) Salmon = residential construction

The sector accounted for 9.5 trillion rubles ($124.7 billion) of turnover in 2020, 0.1% higher than in 2019. As we can see from the data, housing took a massive hit, as expected, but recovered driven by the mortgage subsidy program lifting demand. Yet in relative terms, there was still a large drop-off from 2019, which coupled with lockdown and work-from-home experiences, set up a relative shortfall against consumer preferences (which helps explain rising housing price inflation in 4Q). On the other, we can see that other commercial, infrastructural, and industrial works were relatively unaffected. I suspect what they really tells us is that the commercial segment is weaker overall regardless, hence the other sectors could help hold up the figure. Construction has proven more durable in other advanced economies like Germany, so some of this is also just a reality that the pandemic hasn't totally short-circuited longer-run demand for space or investment plans made prior to 2020 that had begun when the pandemic hit.

Russian consumers are steadily losing choices on the auto market as 45 models were taken out of production in 2020, a record since 2015. Whereas there were 442 consumer models to choose from in 2014, now there’s 309. What’s worse is that Russia’s share of those models grew in %, but fell in absolute terms from 22 to 16. In short, import substitution and localization policies are diminishing consumer choice and haven't actually spurred the creation of new domestic models for manufacture. Some of this is a global trend towards greater unification across production lines, thus reducing internal corporate costs and increasing production flexibility. But the technical requirements for manufacture are legally more stringent in developed markets and that doesn’t explain Russia’s poorer performance. Most of the losses seem to be happening for cars that are priced in the middle. We’re seeing a functional stratification between the high-end, more luxury oriented segment and the rest on the auto market disguised by better macroeconomic wage data regarding inequality as state policies and market conditions accelerate model consolidation. Fast-changing regulations and weak incomes have undermined all of the potential gains from localization policy. Shocker.

VEB.RF sank a record 46% of its portfolio into non-state securities last year. In the past 11 years, investments into corporate bonds had yielded a total of 480 billion rubles ($6.3 billion) in earnings for pensioners invested with VEB.RF off a net investment position of 1.5 trillion rubles ($19.7 billion). The big story here is that 1.2 trillion rubles ($15.8 billion) was reported invested into the real economy via infrastructure, construction, the power sector, oil & gas, utilities, and more. Of course, VEB.RF doesn’t transparently release whose bonds its bought for pensioners. But if that’s the scale of pension investments from VEB.RF over 11 years, then no wonder there’s a massive shortfall of investment potential in the Russian economy. Net returns for VEB.RF’s portfolio hit 124.5 billion rubles ($1.6 billion) last year, beating out inflation but not as strong as you might hope. It appears that private pension funds elsewhere underperformed VEB because 54% of their portfolios were held in bank deposits at a 3% interest rate trailing inflation, a very, very conservative approach. I’m all for rigorous financial sector regulation, but it’s obvious that Russia’s non-financial institutions aren’t generating enough return for future retirees or a large enough pool to finance real economy activity without higher incomes, yet another example where income support measures would produce positive knock-on effects for savers at a certain income threshold while lifting wages by increasing net domestic demand for goods and services.

COVID Status Report

Cases stood at 19,238 with the reported death toll slightly lower at 534. The slight uptick is shared between Moscow and the regions:

Red = Russia Black = Moscow Blue = Russia w/o Moscow

Tatiana Golikova is again using her cabinet post on social policy to shoot down the idea of introducing a nation-wide COVID passport in yet another sign that Moscow’s irked by regional governments moving ahead with it. Newer polling shows that 57% of Russians view mass vaccinations positively, so unless the federal government has more tricks up its sleeve, it’s hard to see how regional governments can avoid introducing such measures as reticence to get vaccinated in the first place will delay herd immunity considerably. Golikova’s intervention probably reflects the internal consensus at Rospotrebnadzor that infection rates will drop to those seen last summer by the end of March. Then again, Russia’s population declined by about 500,000 in 2020, so you’d think the curator for social policy would see the value in a public campaign to restore trust across the economy and prevent longer-run demographic effects that’ll inevitably increase state costs for pensions without a healthier labor/retiree balance.

It Came from the Supply Side

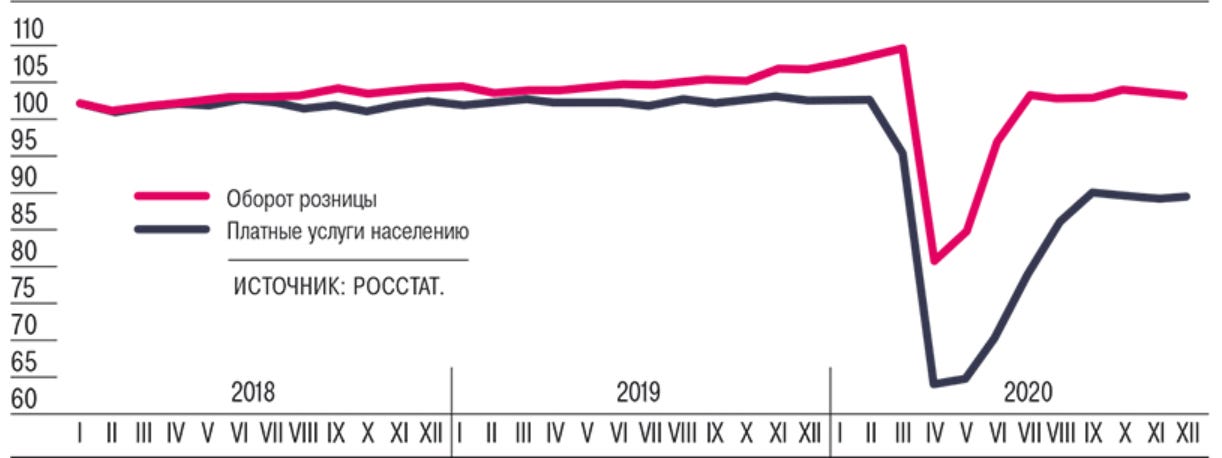

Lots of observers have made a big deal of China’s supply side stimulus and I’ve followed on regarding Russia. But I hadn’t seen side by side recovery data quite as stark between goods and services till this morning thanks to Kommersant:

Title: Dynamics of consumer demand for goods and services (% against 2017 avg., seasonally adjusted)

Red = retail turnover Dark Blue = paid services

As we can see, retail turnover is basically hovering just above the 2017 level for now after it rose in 3-4Q 2019 with a final burst upward just before COVID hit full force (I’m guessing stockpiling played a role by February as oil prices plummeted). Services have always been weak, which I’d argue reflects the underlying real income dynamics at play since 2013. Rosstat note that real incomes dropped 3.5% in 2020 are down over 10% against their 2013 levels. The following is 2014 through 3Q 2020:

First, as usual, Rosstat has probably tweaked some methodology again rendering it almost impossible to meaningfully compare stats to each other since the data above shows a more positive picture than a 3.5% fall indicates (unless it all happened in Nov.-Dec. which is possible). The Moscow Times today capture it better including GDP per capita, GDP, and a focus on disposable incomes:

When the state moves back towards surplus during an economic crisis, it forces the net deficit of borrowing onto the population, worsening their finances precisely when they need the most help. The bottomline is that it’s quite difficult to expand services’ share of the economy without a policy solution for wages for a simple reason: goods demand is much stickier than most services demand. People will keep buying groceries to feed themselves but forego going out during a pandemic, but keep it up if they’ve lost their jobs, have only found part-time work in the interim, or worked in services to begin with and face a very uncertain future. The difference, however, is that for a country like China, a supply side recovery creates problems, but ultimately just prolongs the adjustment process the economy has to undertake. For Russia, a supply side recovery risks locking in the unfavorable dynamics of domestic economic imbalances for a much longer time because it lacks the same domestic growth drivers that China does.

This is where I think some of the more hopeful analyses of the latest protest activity that Navalny has spurred fall flat: the current political climate, even if it doesn’t end up significantly changing anything for the regime come the September elections, reflects much of the political experience of the rest of Europe after the Global Financial Crisis. Austerity and supply side economic policies suppressed wages and real incomes to maintain the export competitiveness of Germany and similar core Eurozone exporters while imposing spending cuts, constraining demand, worsening standards of living for many, and prompting political backlashes that tend to be populist. In the Russian case, the initial ‘austerity shock’ that really begins as investment levels in the economy drop after mid-2013 was held off by the political excuse of sanctions and the much-vaunted ‘Crimea bump.’ Corruption loses its salience as a public rallying point when a rising tide lifts all boats. Instead, a receding tide exposing where the richest have stashed their money brings with it anger at an ineffectual political system seemingly disinterested in solving mundane problems everyone faces. To my mind, it explains why the municipal waste protests lasted so long and the public pressure on the matter continues to this day, even if in a generally more subdued form. The problem now for the presidential administration, cabinet, governors, and security bloc is ultimately an ideological one, but one I think borne out of their economic worldview as much as their political preferences.

The decision to hold Navalny in custody and seek a long prison sentence obviously reflects a fear of political pluralism. Even if those protesting don’t expressly support Navalny’s political platform, he’s become a symbol of the closure of the political space to any non-systemic challenge, and therefore the illegitimacy of most political processes in the country. But more importantly, I think, the age profile of the protests — trending towards 18 year olds to 30 somethings — reflects the discontent of everyone who’s come of age in Russia after the oil boom vanished and austerity politics reigned supreme. If economic policymakers insist on suppressing domestic demand, on restraining real incomes, on stockpiling export earnings into state hands and obsessively controlling spending through the center, they lack alternatives to repressive measures to handle discontent once the political system has been debauched, as it has since the 2011-2012 protests. Bread and circuses ceases to work when the bread’s stale and fewer and fewer people can afford tickets to the circus. The aggregate data cited above corresponds to where job creation is taking place in the aggregate in the Russian economy. The following aren’t complete, but cover most of the major categories from Rosstat:

The Russian economy was basically not creating jobs in 2018 when things ostensibly stabilized, or in 2019 when they went from a more positive growth outlook into a slowdown. It’s telling that retail jobs are the single biggest expansion post-2014, both a sign of some market growth and innovation among Russian firms as well as M&A activity for large retailers, but also proof that most of the new jobs being created are actually low-wage service work not exactly known to keep a fairly well educated population under 40 happy. Finance jobs would naturally expand as a consequence not just of organic growth, but sanctions and CBR oversight requirements, some of the equity market performance (though it’s detached from real economic growth as we’ve seen), and also some shifts of focus for foreign financial partners requiring new expertise etc. Finally, you get IT as a driver for 2015-2017, much of which comes down to protectionism policies and the expansion of the state’s oversight of the sector. Really, there’s nothing creating high-wage jobs in the economy for the last few years on top of real income decline, and there’s no intention of spending state money in such a way as to sustain better job growth. In fact, the AI and digitalization push is likelier to increase aggregate unemployment levels since declining real incomes means there’s less of a domestic market for higher-end services and Russia lacks a competitive export footprint for most of them. In effect, the regime’s strategy of optimization and automation are a renewed attempt at Soviet policy that never came together — the ghost of Kantorovich come back to haunt Russia in a newer, stranger form. Protests emerged in 2018 just as job creation cratered (again).

The underlying political fervor and fears are, in large part though far from entirely, a result of economic malaise. The lack of any net job creation towards higher-wage, higher-productivity sectors in 2018-2019 when the oil market was stable points to just how bad things can still get. As Zack de la Rocha once said, “hungry people don’t stay hungry for long.” Austerity — Putinism’s ‘antidote’ to Soviet profligacy, inflation, and exposure to the oil market — may well be what brings the structure crashing down. When it does is an open question. If it will, however, seems less of one, though we should never discount a regime refashioning its economic orthodoxy in a crisis. But it’s hard to see Moscow pulling it off so long as it doubles down on it’s ‘energy superpowerness’ at a time when power on global power markets has shifted towards buyers and those with the mightiest central banks and currencies.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).