Top of the Pops

President Lukashenka has swapped Ministers of Internal Affairs in Minsk, now giving the job to Yuri Karaev. Notably, he feigned towards handing Karaev the job of working with regional heads to improve the ‘normative’ basis on which the Ministry operates. Translation: build a new system for accountability while snuffing the life out of the protests.

Those expressing surprise that Iran has stepped up in talks over the conflict in Nagorno-Karabakh have probably not paid attention to the dynamics at play. Given the historical concern in Iran about Azeri separatism, real or imagined, Tehran is well aware that a complete Azeri victory - reclaiming lost territory and restoring the land bridge to Aliyev’s home enclave in Nakhichivan - is an outcome that would be sensitive politically. More importantly, though, it’s what the US has basically setup. Back in 2018, then NSA John Bolton came to Armenia demanding they shut the border with Iran. They refused. The entire course of US policy since 2017 on Nagorno-Karabakh has been predicated on reducing Russia’s regional influence and making trouble for Iran, especially since Israel and other outside powers have an in interest in maintaining easy access to Azeri territory in Iran for future covert operations. They know that if Russia can’t deliver a diplomatic solution, the alternative is not just a massive escalation risk that could spill over the border, but yet another powder keg to go off in the next US administration and force more reticent US political leaders to follow along with whatever the Department of Defense and hawks at Langley hand them with their allies in Congress.

Tomorrow, I’ll be looking mostly at US shale, the current state of plays, and how it’s adapting to the market.

What’s going on?

There’s a growing crisis of shortages for medications. The National Hematology Center says that 26 vital drugs are now in short-supply, oncologists are concerned about maintaining treatment regimes due to delivery delays, and social media sites increasingly host conversations about getting access or even trading for medications. It seems that the state’s procurement system using a complex combination of reference prices and auctions - nothing screams efficiency like a mixed market in Russia - is misallocating resources while production struggles to keep pace with real demand. Any increase in prices would lead to significant price inflation for crucial goods in the middle of a pandemic, but is probably necessary to improve manufacturers’ investments into production capacity to meet real needs.

The Bank of Russia is worried about consumer demand as its indicators for incomes are increasingly reflecting failures of fiscal policymaking and distorting the future job market and recovery:

Title: dynamics of wages in Russia (%, in year-on-year terms)

Yellow = private sector Blue = state sector Red = real wages Green = nominal wages

In annual terms, state jobs and budget transfers saw an 8.5% increase for wages as of August vs. a decline in the private sector of 2.8%. The 3Q decline in real incomes slowed to 4.8% from 8.4% in 2Q. Basically, earlier support schema and commitments to still increase state salaries this year are masking how bad the private sector side in some respects given that budget transfers are factored into real incomes. It’s not terrible per the data all things considered, but the CBR has no firepower to change the direction of travel and consumer demand is going to fall.

The mortgage subsidies pushed by MinFin and the CBR are working - apartment prices are rising across the country, not just in Moscow. In Kursk oblast - 8% price growth. In North Ossetia - 7% price growth. In a slew of others from Buryatia to Leningrad oblast - 5-6%. It also seems that new-builds aren’t as big a draw as you might expect, with more buyers trending towards finished apartments (presumably furnished as well). That suggests that while deals on mortgages are moving up purchasing activity, people are still trying to scrimp and save once they move in.

RZhD is running into trouble over tariff adjustments, including raising the rate for empty mileage. The monopolist - never that profitable given that it’s a hobbyhorse for cross-subsidization and price controls - is duking it out with Andrei Belousov and the presidential administration as the tariff increases were intended to help finance its investment program. RZhD has sought a flat 3.7% tariff increase or a 0.1% decrease for loaded mileage and a 15.8% for empty mileage. Transoil head Igor Romashov wants to use debt financing and increased budgetary support from regional governments to plug the gap. Crazier still, there are current tariff discounts and exemptions for “innovative” rail wagons to act as an indirect subsidy for domestic manufacturers, but that’s not having a big impact. This situation is a mess and going to weigh heavily on consumer price inflation expectations once resolved.

COVID Status Report

Caseloads keep ticking up, hitting 17,717 people yesterday alongside a record 366 deaths. In a rather bleak bit of “good” news, TASS oddly put out a report that 35% of the staff at the Botkinsky hospital in Moscow have COVID immunity. Setting aside that what we do know suggests that immunity will fade after 3 months’ time, the staff are also an interesting microcosm of transmission problems given that they’ve reportedly helped out in Pskov, Kamchatka, Kazakhstan, and Uzbekistan. Systemic underinvestment in healthcare resources doubles the transmission pressures on medical staffs as hospitals scramble to keep pace with rising infection rates. From RBK’s daily check-in:

Number of confirmed cases of infection

Note that these stats are taken from the operational staff that is considerably underreporting cases compared to Rosstat data, so the situation is almost certainly worse. The more it spreads in regions reliant on extractive industries that can’t send people home to work, the riskier it gets. Winter is going to be nuts, especially for turnarounds at oilfields, refineries, anywhere where operations throttle down but the onsite staff are crammed in small spaces together inside.

Late Expectations

Kommersant had a good story today on defining down the national goals for exports into a smaller, more focused policy package. One of the main focuses, it seems, is reducing domestic trade barriers for exporters assuming a future policy climate rife with trade wars. The original aim from Putin’s 2018 inauguration was to achieve annual non-energy exports of $250 billion by 2024, $205 billion of which were to be industrial. That was always a farcical number but the financing being provided for international logistics and exports of services was still important. The new target for 2024 is $146 billion, and industrial financing has been reduced from 423 billion rubles ($5.3 billion) to 299 billion rubles ($3.77 billion). The aim is to unify and simplify all financial and non-financial support measures for projects intended to export goods and services.

A quick hit of the balance of payments for 3Q from the Central Bank:

As we can see, the current account surplus has been squeezed mightily by the oil price crash, with metals, minerals, and agricultural exports currently doing the heavy lifting. Imports of machinery and consumer goods are covered by Other, and are still up there. In structural terms, the challenge for Russian policy is relatively straightforward: how can you make use of budget funds, heavily reliant on oil & gas revenues, to stand up other sectors, invest into infrastructure, and reduce the regulatory burden for exporters in order to better balance imports, exports, and the ruble. Thanks to Janis Kluge for pulling a state of play chart for revenues:

As I mentioned yesterday about Sechin, it turns out in today’s Vedomosti that the Eurasian Commission is talking up coordination between the EAEU and China to return economies to growth. There’s a massive structural problem with that approach: China’s terrible at offering market access freely and has heavily politicized its import targets for the things in the “Other” category now carrying Russia’s current account surplus. A considerable part of China’s import surge in September came from trying to catch up on trade targets per the agreements negotiated with the Trump administration. As noted by Chad Bown from PIIE:

The US still lags, and others are filling the gap as the country’s import needs are certainly rising. But China’s own current account surplus is delaying the type of domestic adjustment needed to allow Russian industrial exporters to gain market share, particularly given the exchange rate shift between the RMB and ruble this year:

The RMB has appreciated over 25% against the ruble, which in a world of frictionless trade would have provided Russian producers a big opening. It hasn’t because of the failure to liberalize trade, driven by mutually competitive interests among industrial interest groups in both countries.

Worse, though, is that the European Commission and EU seem ready to pick more fights with the Russian government over trade goods that Russia has historically had a competitive advantage exporting. On October 23, the commission put out a report on how Russian energy subsidies and related forms of policy support significantly distort prices for ammonium nitrate, broader chemicals exports, even steel (though more cautiously worded in the report). The report, linked here, is meant to be used in trade defense proceedings against Russian firms. It speaks to a broader problem of the international trade system and WTO accession that, I think, is going to become a more salient issue given carbon adjustment policies are now on the docket. This from the report notes that average applied tariff rates for imports into Russia have declined since 1996:

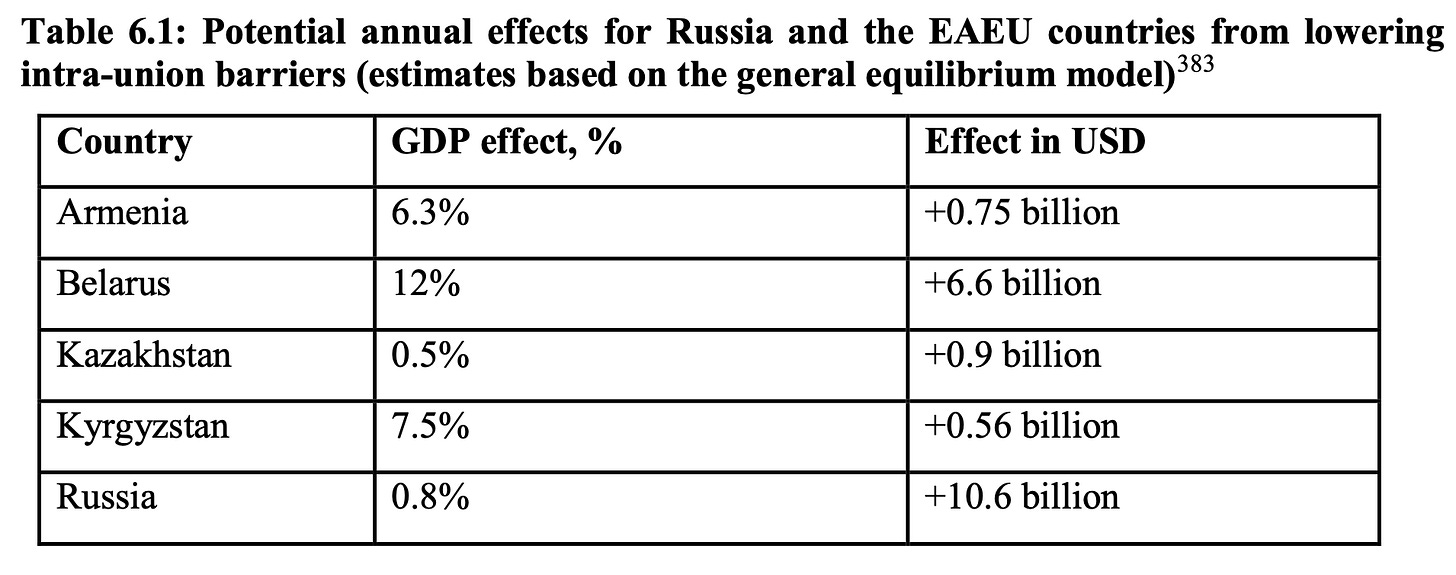

But as tariffs fell, there hasn’t been a similar decrease in state support via direct and indirect subsidies and spending. What’s more notable, however, is that the EU took the time to calculate the positive growth effects of lowering trade barriers within the EAEU:

This is where trade politics can get a bit interesting for Russian export lobbies. They don’t want to lose state support, and they don’t want to lose foreign market access or face discriminatory trade practices, so it makes more sense to try and push forward on managed market integration within the EAEU where language, business practices, migration, and more make it easier to operate on friendly markets and manage foreign assets. That obviously meets immense resistance, but China’s market is really only the consumer of first resort for natural resource and commodity exports, not the areas of diversification meant to drive the export strategy forward. The EU is muscling up on trade defense rationales to hit Russian exporters, and that may end up pressuring them to take the EAEU more seriously as a means of getting further in trade talks with both Brussels and Beijing. I’m very skeptical that these targets are significant and achievable, but all trade norm progress with China is going to require negotiations in Europe. The EU would like to see internal barriers in the EAEU dropped as that would actually aid European firms looking to invest and better align negotiating interests for future talks. If the drumbeat of China stories concerning the EAEU continues, hopefully they’ll realize that.

Oh, the humanity

Hydrogen’s getting a serious look these days, and while Russia undoubtedly wants in on the action, the market’s being led elsewhere. Iberdrola and Fertiberia in Spain are investing €1.8 billion into a plan to generate 800MW using green hydrogen at a plant in Puertollano. The aim is to produce ammonia using it, which by extension would supply fertilizer feedstock. But there’s a massive concern: water use. You have to have access to a large supply of clean freshwater and be able to purify it.

Assuming you can power production and purification using renewable energy, that’s a lot of steel (coking coal), metals, minerals, and scope 2 emissions already built into standing up the plant. Then you get major concerns about the governance of water. This academic study (sorry if you can’t access it! Written up here) finds that somewhere between 30-50% of global water used in production for agriculture and related uses is stolen i.e. not paid for. Not only does water theft pose serious issues of governance for future hydrogen use, but it compounds the need to ensure that infrastructure investments keep pace. Recall that Russia faces systemic shortages of clean water for residents across much of the country. If an SOE is tasked with developing a green hydrogen plant anywhere near water systems for major urban centers with less than pristine water, you can imagine that the priority will be big industry.

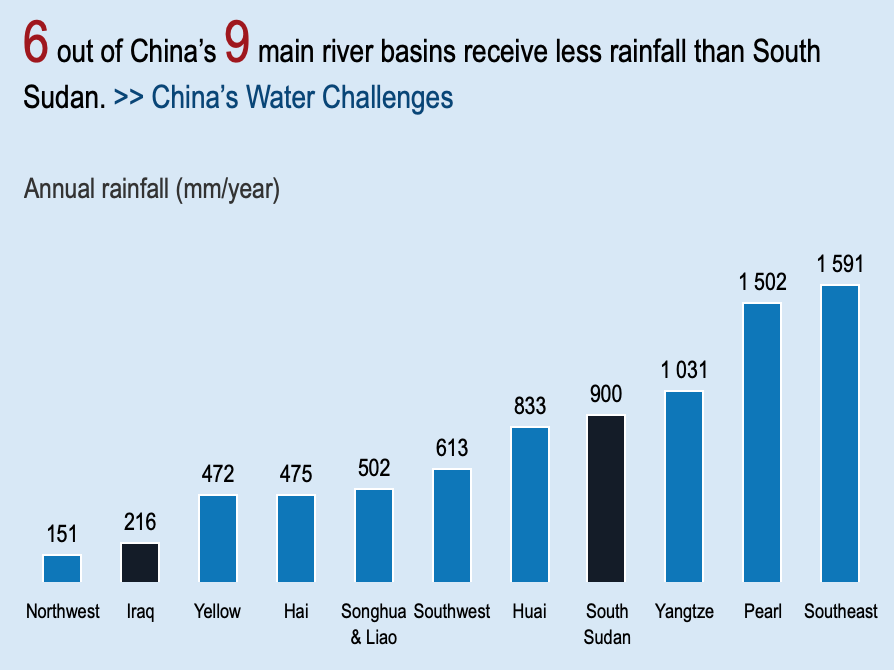

The picture gets more complicated again looking at the hurdles China would face trying to implement it. From China Water Risk using older data, still worth a look given that surface water accounts for the large majority of supply in much of China:

I pulled China cause I’m fairly confident that European regulations are going to protect domestic industries trying to make the leap to Russia’s detriment. Moscow needs to develop a better relationship with China’s energy SOEs to make serious export headway, and it’s going to need a robust investment plan for its own infrastructure if it wants to keep pace.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).