Top of the Pops

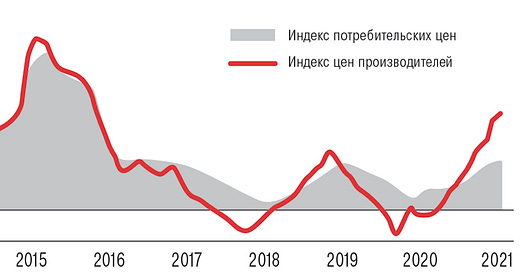

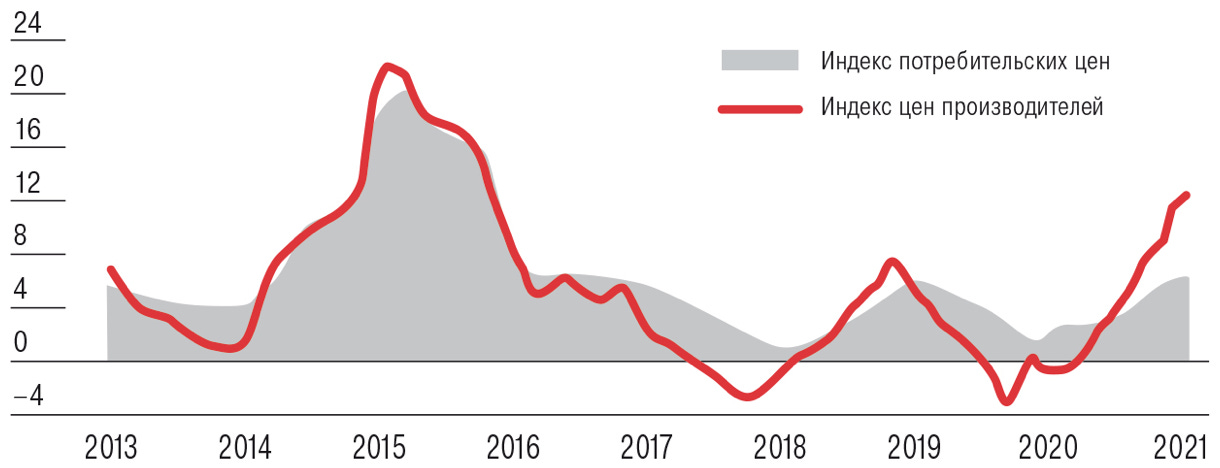

The Central Bank’s now expecting that inflation levels won’t come down before Fall arrives as price increases are currently on course for 5.8-5.9% annualized inflation. The question now is how long wholesale prices exceed retail prices since producers are currently experiencing much higher levels of inflation than consumers based on retail vs. wholesale data. The gap right now is stark and distorted by state pressure and price controls:

Grey = index of consumer prices Red = index of producer prices

According to the CB’s analytic team, higher levels of PPI won’t come down till the end of July at the earliest. The current surge in business costs is insane, and puts paid to the idea that profits are actually taking off for productive investments. What’s far more likely is that, on the whole, businesses are absorbing cost increases to try and keep their customers and the state happy but that doesn’t stop wholesale prices from being constantly bid up and passing on some costs to consumers. Russian outlets and leaders continue to fixate on the wrong causes of global inflation as a defensive tactic, with a Kommersant writeup blaming the expansion of US dollar liquidity for a large chunk of commodity price increases despite the fact that said liquidity expansion had no strong relationship to the ebb and flow of commodity prices since 2010. They also acknowledge that “de-globalization” contributes to inflation, an indirect manner of pointing to the costs of import substitution. Inflation was a huge topic at SPIEF given that the Bloomberg commodities index is at a decade high now and these problems are evident across the Russian economy. We shouldn’t lose sight of just how uneven they are, however. An inflationary “boom” in the US is something like 3ish% inflation this year, maybe touching up towards 4% if the economy is actually run really hot (it likely won’t be without a bigger infrastructure bill). US corporates have newfound pricing power on global markets because the US is driving the recovery. That’s going to show up in Russian inflation data and hurt given the state in Moscow refuses to nudge capacity utilization above the 60-70% range across the economy.

What’s going on?

The M11 Neva is set to host driverless trucks as soon as next year after an agreement at SPIEF signed between Kamaz, NTS, X5 Retail Group, and the First Expedition Company. The route linking Moscow and Piter will be used for testing purposes, which should eventually setup the adoption of the technology. It’s an important development to follow for several reasons — self-driving vehicles struggle most with snow usually, it’s an area of tech that has implications for military applications as well, and it will affect a large area of employment in the medium to longer term. As of 2019, the transport sector employed about 5.37 million in total — truckers comprise a large chunk of this. was digging around for good recent data, but ran out of time. Suffice it to say that we’re talking somewhere in the range of 1.2-5 million jobs (could be lower, probably not much higher if so). The longer-run impact is compounded by the fact that post-2014 net job creation in Russia has tended to cluster in retail. The pilot program is expected to run through 2024 and give the state some experience so it can bette regulate driverless vehicles and begin to roll back the complete ban assuming it goes decently well. This is a very early measure and a long-term challenge, but one exacerbated by the inefficiency of economic development approaches in Russia and growth in gig/part-time employment to complement full-time jobs since real incomes started declining.

AKRA’s latest review of regional debts show that pressure points remain, but also highlight the extent to which the “debt problem” is as much result of choices to maintain it as a political tool as any actual default risk. The rise of green and social bond issuances was the biggest focus from the writeup here, but I was struck by the net debt data AKRA published that was converted into a graphic. The following are listed in trillions of rubles:

Red = total revenues of regions Yellow-Green = total regional debts

Left to right, we see that 46 regions have debt levels less 50% of their gross regional product, 30 regions are stuck in the 50-85% range, and 9 are above 85%. This isn’t intended to brush off the risks here, but rather to point out that given the total volume of debts are in the range of 2.4 trillion rubles ($32.76 billion). That could easily be covered with the various forms of reserves available to backstop credit or else converted or used as liquid assets. The likely better route is to help regional governments transform their debts into lower-rate long-term maturity instruments to improve their ability to direct local investment and spending effectively while boosting local tax powers. Restructuring efforts, however, are really aimed at preserving or expanding the center’s power to distribute rents. Since these are ruble denominated debts, you don’t even have to utilize reserves (despite Moscow’s assumption they must) to address the issue, and you’d think that they’d devolve more fiscal authority to pay them off if they were really concerned. These financial relationships are fraught and a huge pressure point. Just don’t forget that the institutional and political logic of restructuring are choices, not bound by ironclad ‘laws’ of economics however much the monetarists in Moscow wish it were so. That leaves space for the fallibility of these assumptions to shift political thinking in the regions and center over time.

Non-resident investors aren’t returning to buy Russian sovereign debt based on the latest issuances. State banks — this last time VTB — continue to ‘bail out’ the state for its deficit needs. MinFin can keep using state banks so long as they need to hold safe assets and, after all, the state’s currency reserves anchoring any borrowing are at nominal record high levels. What’s weirder and more worrying are the persistent concerns that state interventions and the constant funneling of these purchases to state banks are distorting profits in the banking sector — in 1Q, Russian banks earned 1 trillion rubles ($13.66 billion) from the difference in the price of raising funds and allocating them for investments/lending alone. State banks get preferential treatment and report better earnings. 1% of Russia’s banks account for 80% of its capital, and the massive returns reported are effectively all down to state banks having the best access to the cheapest capital while everyone else struggles in what’s proving to be an uneven recovery that’s weaker than it appears on the surface. Swelling profits for banks reflect the problems across the real economy — they buy sovereign bonds that are assets paying out while their liabilities, like cash deposits, have thinned out due to consumer concerns and inflation. State banks have far more means to bring in money and profit off of lending for major projects than small ones. We’re not talking about another financial crisis yet, though the currency reserve scramble in 3-4Q last year points to ongoing fragility. But the main cost of MinFin’s strategy to use state banks to cover the deficit isn’t really monetary inflation or rising interest payments. It’s the growing political strength of state banks whose interests may well not align with those that would foster a stronger, more equitable recovery and economic policy framework as they further centralize market power and financial risks in their hands. Consumer and industrial confidence are improving so it’s not all bad news. Hard to see much growth past the base effects and export boosts though, and that filters into bank lending patterns.

NLMK is trying to get ahead of emerging EU carbon adjustment mechanisms targeting steel and cement imports by sinking 250 billion rubles ($3.4 billion) into low-carbon production at its Stoilensky plant to produce hot briquetted iron (HBI). The NLMK plant is expected to have an annual capacity of 2.5 million tons and enter use by 2028. This marks the second major such project in the metallurgical sector after last year’s plans from OMK and Anatoly Sedykh announced plans for a similar low-carbon HBI capacity investment. The sector as a whole faces considerable pressure now that it’s facing a likely rising tax burden and pressures on marginal profits for domestic sales to get ahead on the matter of decarbonization to the extent that it can. Steel and other metals exports to the EU are directly threatened by the current wave of proposals — we haven’t yet seen any move to apply levies to oil & gas imports based on emissions levels from producers, but I personally expect that to be put on the table as EV sales rise. It’s worth following up on these plans in the months ahead because it seems to me that the metallurgical sector will be the leading edge of the corporate response in Russia as EU policy discussions creep closer to reality. Kneecapping sector profits through price controls, though, might crimp some of these plans unintentionally in the shorter-run, particularly if the commodity price increases for metals & minerals stick for longer (note: they will).

COVID Status Report

8,993 new cases and 393 deaths reported per the Operational Staff. Health minister Mikhail Murashko is now using the line that restrictions can be lifted in full only if enough of the public get vaccinated. It’d be far more effective if those restrictions had really been observed or enforced nationally rather than a patchwork of local and regional responses. All the same, it’s smart to make it about convenience at this point since a majority of the public doesn’t want to get vaccinated. Anna Popova from Rospotrebnadzor has announced that vaccinations for foreign nationals will begin soon — one imagines that migrant laborers who want vaccines will perk up. And in free banner copy for Sputnik-V, Assad has officially been vaccinated with it. All told, it was a quiet day for COVID-specific stories.

Aging Gracelessly, American Imports, and Other Headaches

The St. Petersburg International Economic Forum has given us some decent insights into the consensus upon which Mishustin has built his best laid economic plans. According to Elvira Nabiullina, inflationary pressures aren’t temporary, but longer-term challenges due to the composition of inflation and fact that inflation expectations are at 4-year highs. Finance Minister Anton Siluanov is confident that current inflation levels reflect “overheating” in the economy. Inflation, in his words, “leads to the depreciation of money, [and therefore] the depreciation of social benefits and salaries. Do we really want this? No.” The Central Bank is talking about returning to a neutral monetary policy and the Ministry of Finance is reiterating intentions to ease back on spending to rein in inflation.

Despite Nabiullina’s assertions that the Central Bank is committed to a neutral policy course, the policy response to the mortgage expansion suggests something a little more complicated. To simplify, the plan is to let real interest rates in the economy rise in response to higher inflation and expected key rate hikes and choke off demand. By the end of the year, mortgage rates should rise from about 7.3% in annual terms to 9-9.5%. We can infer that the 9-9.5% band is considered “neutral.” That doesn’t really address the problem: the initial mortgage subsidy program was put in place without any increase in home construction. Housing deficits are driving up prices now more than the stimulus. The “early adopters” with lots of savings in hand and a desire for more space who work from home made their moves last year for the most part. Those borrowing now are just trying to improve their quality of life that little bit they can manage. Debit card overdrafts are up 340% year-on-year, 34.4% of Russians owe banks 80% of their earnings, and Russians are spending about 12% of their earnings aggregated nationally to service debts. A “neutral” rates policy provides MinFin a buffer because of exaggerated fears of deficits and reining in the cost of servicing debts (that theoretically are inflating away anyway?) while hurting the most indebted, leveraged, or else impoverished because it comes in parallel with renewed fiscal consolidation. In other words, Nabiullina’s claims that normalization won’t hurt economic growth aren’t strictly wrong, but carry uneven consequences because of monetary policy’s interaction with fiscal policy and a general misreading of the last 4-5 years that serves political purposes:

Inflation fell because credit conditions were overly tough and destroyed demand as real incomes fell amid fiscal consolidation and a decline in the relative level of support for pensioners and other groups as well as business investment. Siluanov’s SPIEF comments about future tax increases also stood out to me. He criticized the “leftism” of public spending in developed and developing countries on social programs that former economy minister Maxim Oreshkin pointed to at a panel:

“I completely agree with what Maxim Stanislavovich said about the world trend of 'leftism’ in expenditures. We’ll assume that these are the childish diseases the classics talk about. [We’ve] got to get over them. We of course need to ramp up spending on infrastructure, these are the expenditures that have an effect on the growth of the economy.”

There’s something perverse in the logic presented given the economic context in Russia and, perhaps more interestingly, the attack on economic “leftism.” The Duma just rejected the first reading of a bill that would provide 2,900 rubles monthly on what would seem to be debit cards to anyone living more than 25% below the poverty line nationally. It’s a relatively inexpensive policy that would go a long way towards easing the worst of the current effects of inflation, inflation whose price increase effects won’t vanish once it subsides. Food will remain more expensive in relative terms without any increase in incomes as fiscal consolidation resumes. The only way one can square Siluanov and Oreshkin’s assertions with the reality observed in developed countries, at least, is to accept their own supposition that COVID was a supply-side shock and that the Russian economy is now overheating. It’s oddly reminiscent of 2010-2011 when the early signs of recovery in the US triggered an inflationary scare that proved to be absurd. When you experience a large decline in output followed by a rapid resurgence in output, inflation rises in the short-term. That short-term inflation eases so long as demand is strong enough so that businesses feel confident that they can invest to meet future demand, thus easing bottlenecks. Russia’s relative output decline was also muted by its over-dependence on export sectors and weak domestic demand. If these basic spending measures intended to reduce poverty, increase the purchasing power of Russian households, and actually support businesses as well are out of bounds, where’s the big increase in infrastructure spending that isn’t just 2018 plans that have been whittled down and kicked back to 2030 targets?

Siluanov’s now shifting around money to offer some relief — MinFin is going to reduce its currency purchases to redirect reserves to infrastructure (about 400 billion rubles or $5.5 billion). That’s indicative of the positive effect of commodity price recovery and increases. The current account is in better shape so there’s less need to stabilize the ruble against fluctuations. But from 2017-2020, at least 3 trillion rubles (now $41 billion) in budget money went unspent and was parked aside by MinFin at the end of the fiscal year for perspective. Which projects benefit? No idea. It’s worth noting that the social and governmental components of state spending have slowly risen as a % of the budget since the start of 2013, though on a very slight and incremental path. The following is the federal budget, not the consolidated budget which I tend to use more often since it better captures ‘end’ spending accounting for everything:

Over half of the budget is now spent on social and governmental purposes, a figure that should rise with continued aging and the low number of people employed vs. retired. We can also see non-oil & gas revenues steadily rise, but that’s also a problem for the economy. Higher consumption taxes amid real income decline worsen losses for households and higher corporate tax burdens, something that seems inevitable given Siluanov’s concerns and the presidential administration/Mishustin’s approach to inflation, are likelier to negatively affect investment in Russia than on a developed market like the US. Normally higher corporate rates have little effect on business investment so long as the economy in question doesn’t face demand constraints. In the US, for instance, access and the cost of credit can sustain investment no matter the tax rate on profits — if I recall correctly, Apple could borrow at something like 0.6% last June during the depths of the US demand crash as an example. Russia’s a far different situation because of how poor domestic demand has been and the incentive to a) focus on exports for resources b) realize profits through cost-cutting and catering to consumers who want to spend less c) earn off of “catchup” deployments of e-commerce etc. d) fight for subsidies, regulatory rents, monopolies or oligopolies and the like. Sources of funding for investment point to the problem, as I’ve pointed to before:

Siluanov’s complaints about “leftism” — a bit bizarre given that aging societies should expect to see rising social spending levels and face deflationary pressures to growth that contradict his inflation assumptions — point to a shift in fiscal policy intended to reduce demand. The likeliest means of doing so at present politically would be an increase in taxes on big businesses since people won’t stomach higher consumption taxes or income taxes, lightly soaking the rich only gets you so far in Russia because of how terribly unequal the wealth and income distribution has become and how (relatively) untouchable the richest are politically, and the regime is now out to get “greedy” businesses. However, business investment is increasingly self-funded and monetary policy normalization means increasing the cost of credit and further strengthening the power of state or state-adjacent banks more able to offer credit on more attractive terms to the biggest borrowers. Any increase in taxes on business profits amid chronic shortages of demand, high uncertainty, and now rising inflation is risky and won’t increase the scale of the productive investments Siluanov would apparently prefer to spend state money on.

If higher inflation is here to stay for the longer-haul, it’s unclear why Russia’s economic policy response is to essentially talk about further demand destruction given the level of uncertainty and these dynamics. Oreshkin and Siluanov are complaining about “leftism” because Russia’s going to face higher inflation levels now that the US and EU are likelier to run their economies hotter for longer, an admission that the ‘successful’ effort to beat inflation post-Crimea wasn’t just a result of imposing pain on Russian households for the sake of the state, but also a structural interdependence on the deflationary neoliberal paradigm that had governed western economic policymaking for decades to manage the Russian economy. China was growing fast and consuming more of Russia’s primary exports every year so higher inflation levels meant less for Russian macro. The decision to completely drop the dollar from all National Welfare Fund holdings — Euros will reach 40% and the yuan another 30% — reflects these anxieties about US dollar debasement. But what Moscow sees as debasement is actually the global provision of liquidity coming out of a crisis. The US dollar has been strengthened internationally by both the Global Financial Crisis and Covid Crisis, neither of which were outcomes it had hoped for. But China’s current account, exchange rate, and currency holdings are USD dominated and the Eurozone is integrated into a transatlantic financial system still running through New York and London that’s now dominated by US investment banks (with growing challengers in the longer-term in China). Russian macro is operating as if the economy is in a bubble and the OECD and the IMF, long a supporter of deflationary policymaking in Russia, are wrong.

There are undoubtedly mistakes that have been made, are being made, and will be made with the shift in developed market thinking, but inflationary and macro regime changes globally have contributed to economic crisis in Russia’s past. The Great Inflation and profusion of petrodollars played a starring role in late Soviet macroeconomic (mis)management. Former PM Dmitry Medvedev’s interview yesterday with Kommersant led to some sad recollections of late Soviet political life as a reference point for today and Siluanov and Oreshkin’s comments track with past quotes from Siluanov, Kudrin, and others about how reckless fiscal, monetary, and economic policy destroyed the Soviet Union. I don’t think anyone’s assuming it’s the 80s all over again in Russia, but something’s going on as global economic governance changes in ways that challenge the regime’s ability to insulate the economy from the fallout.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).