Top of the Pops

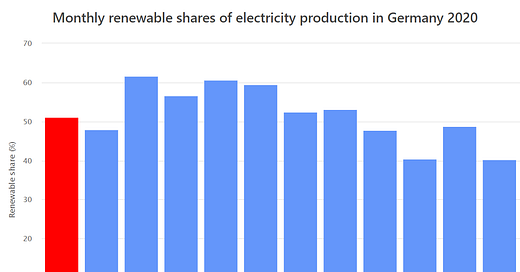

Missed the last few days, Germany’s energy regulator has ruled that 4,788 MW of hard coal-fired plant capacity will be taken off the energy market as of January 1, 2021. Energy output already under contract can continue past that date, but no new orders taken while the operators have till March to appeal the decision. The current policy path requires that hard coal plant closures require financial offsets for losses, but that requirement will end in 2027. The European Commission only ruled last week that the relevant offset mechanism did not violate EU state aid rules. The precedent is undoubtedly going to come up in future UK-EU talks no matter what happens next in terms of a Brexit ‘deal or no deal’ scenario. Germany’s share of renewable energy continues to rise and is above 50% for the year-to-date:

Without nuclear, coal decommissioning is a net benefit for Gazprom when it comes to market share. Nord Stream 2 is undoubtedly going to be completed, the question is simply how much longer the process is dragged out. Though Gazprom has lost its pricing power on European markets, it’s going to be a net beneficiary of early transition plans on a volume basis (I expect). The question is how much will electricity in Germany cost in the future. The government just scrapped the renewable energy fee levied on power prices for hydrogen to try and accelerate investment. Russia has a better shot of working with hydrogen given existing investments and infrastructure, and the next test for Gazprom in Europe is going to be whether it can take part or if protectionist EU initiatives to build up domestic supply undermine the business case for Russia as an exporter.

What’s going on?

Uralchem bought a controlling share of Uralalkali yesterday for $2 billion. The acquisition is a significant play to consolidate a larger market position for the production of potash fertilizer and other refined petrochemical products. The timing makes sense too. Uralchem had access to (relatively) cheap credit via Sber and wanted to build up its lead as Russia’s leading producer for ammonium nitrate. It’s worth following the aftermath of this deal further. Uralchem’s been targeting market growth in Africa in recent years and the downstream segments of the agricultural sector make use of easy-access feedstock from Russia’s oilfields to provide exports paid for in foreign currencies. I’m not sure which banks are financing trade, in this case, but I’m curious to see what comes up. There isn’t a big takeaway here save one thing: agricultural demand for products never took a massive COVID dive and will keep growing regardless of the energy transition until we find petroleum substitutes.

Russia’s young graduates and specialists entering or navigating the workforce want a fairer shake than employers are offering as Russian firms now face more pressure to offer flexibility to work from home. The gaps in wage expectations for “what’s fair” are damning:

Title: Optimal Wages According to Specialists and Employers, % polled

Beige = employer Orange-Red = specialist

Younger specialists want more money and more flexibility. Labor has bargaining power in Russia, but it’s concentrated in politically-sensitive industries or public functions (think transport, namely the railways and ports). But future economic growth is going to create more flexible work arrangements and after years of income stagnation/decline and a state-backed massive mortgage stimulus, it makes a lot of sense that people want to be paid more. COVID isn’t going to create mass strike activity or boost labor unions among newer professions, but this disconnect is going to (eventually) create more upward inflation pressure and push back against what is, in practice, state policy to allow wage stagnation while slowly increasing the relative benefits and wages of state employees with a lot of bargaining power.

Analysis from FinExpertiza for 3Q shows that the population’s average incomes rose in 61 of 85 regions compared to 2Q thanks to COVID support measures and social benefits. In Krasnodar region, incomes rose 51.8% off of 2Q lows. That figure was 30.6% in Dagestan. There isn’t a clear order to which regions show the best results, from what I can tell. What concerns me, however, is that said support measures are slowly being pulled away and consumer confidence and expectations as well as the outlook for services in Russia at the moment are quite weak. The analysis found that wages only accounted for 57.1% of people’s incomes, with another 10.1% coming from shadow entrepreneurship. If austerity continues to be the modus operandi in Moscow, social transfers’ rising share of income is proof of stagnation and economic policy failure, not the strength of the safety net. Some estimates suggest incomes will only recover from this year’s losses by 2022, which to me seems possible because of room for rising incomes derived from property and financial assets, but it’s hard to see wage growth strong with demand continually weak and inflation, low for now, but threatening to rise again.

MinTrans has decided that regional governments should be allowed to regulate taxi rates independently, a decision that has drawn immediate criticism from the Federal Anti-Monopoly Service. Current law stipulates regional governments are not empowered to set tariff rates for haulage (think freight but also taxis), but an amendment does allow for the establishment of minimum rates for light-vehicle taxis. Right now, price rates are largely dictated by aggregators’ algorithms that factor in demand, availability of cars, etc. but if the end cost from the algorithm doesn’t align with the operator taking part in the program organized by the aggregator, then the operator can refuse the ride. Taxi services led by Yandex.Taxi are lobbying against any regulations because it’s costing them business (and by extension constraining supply). Once again, a federal regulatory regime meant to alleviate regional differences is undermining the profitability of service-providers.

COVID Status Report

Welp. Daily cases broke 28,000 for the first time against 554 recorded deaths with a big uptick in Moscow compared to a resumption of the prior trend for the regions (I guess I was too optimistic!). Yesterday, Sergei Melikov — head of Dagestan — became the 23rd governor to come down with COVID and was hospitalized accordingly. I’m wondering what’s causing the erratic changes in Moscow specifically since, while common enough for anyone to see who, like me, has lived and died by infection levels locally due to some bureaucratic nonsense, it’s remarkable it doesn’t show up in the regional data in the aggregate in ways I’ve seen nationally in the UK:

Black = Moscow Red = Russia Blue = Russia w/o Moscow

Some of this is undoubtedly due to testing capacity and the BS with the data that the Operational Staff clearly leans on. To me, it backgrounds the urgency with which Putin ordered mass vaccinations to start by the end of next week. 2 million doses are reportedly available and, as he informed Tatiana Golikova, they’ll start with teachers and doctors. Vaccines will be free for Russian citizens and exported at an expected cost of $10 or less per dose. Take that America! Mishustin’s given Rospotrebnadzor, the Ministry of Justice, and MinZdrav a week to work out the legal guidelines, procedures, and rules to supply vaccines to the regions. It’s “damn the torpedoes” time since no one in government wants to think about another spending spree for the economy at this point.

It’s Always About Regime Change

Coming across the BlackRock Investment Institute’s September note on inflation risks for investors on Twitter got me thinking. Their concerns can be summarized as follows:

Higher global production costs are likely to ensue from “deglobalization,” specific supply shocks COVID has created, and the restructuring of supply chains

Central banks, responding to a decade of weak to non-existent inflation despite monetary expansions, are shifting towards frameworks aiming to overshoot inflation targets

These two trends create significant risks that central banks will lose any nominal anchor — a specific, policy-driven or policy-responding variable and/or device such as the interest rate or quantitative measures for the amount of easing done — that can be used to guide inflation expectations, triggering much greater potential for inflation.

What’s most interesting and relevant from the get-go is BlackRock’s breakdown of the ‘global share’ of inflationary factors for goods and services and headline inflation vs. core inflation i.e. the total amount of inflation in an economy compared to inflationary measures that typically exclude food and energy:

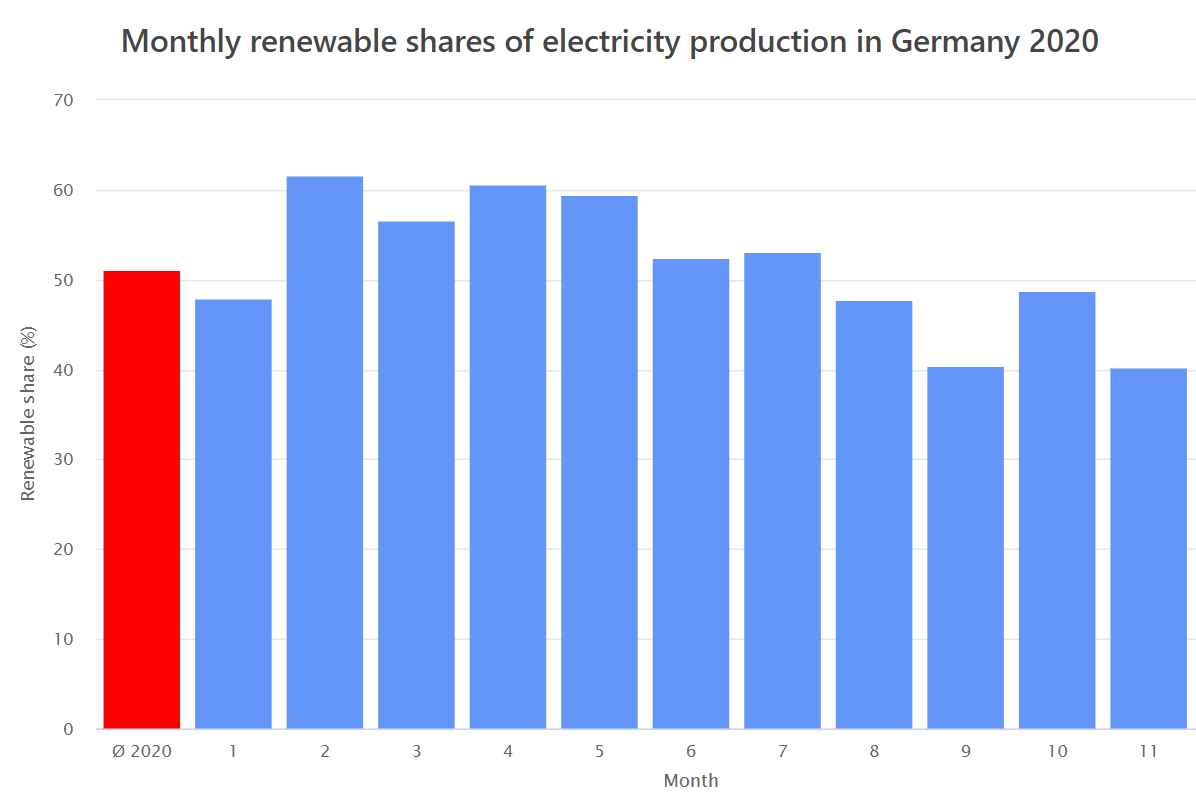

I take some issue with the assumptions underlying COVID as a “deglobalizing shock,” but not cause I disagree with the premise that leading developed economies in Europe, Oceania, and North America are about to embark on a policy course intended to foster a realignment of supply chains and production. The questions are rather “is it deglobalization or deeper regionalization?” and “how successful can one be deglobalizing?” This view of deglobalization as a major driver of inflation due to rising production costs is essentially predicated on a somewhat antiquated view of the economic drivers behind globalization: cost and price competitiveness. Financial flows dictate most of the structure of international trade. Take Japan’s expansion of supply chains into China and Southeast Asia back in the 80s. That was driven by US political pressures to reduce the United States’ bilateral trade deficit with Japan, so Japanese manufacturers realized they could simply source from other economies and make the political problem someone else’s. Trade deficits and surpluses are ultimately about financial flows — being a net borrower or net lender, consuming more than or less than one produces domestically, and other relevant factors such as currency strength.

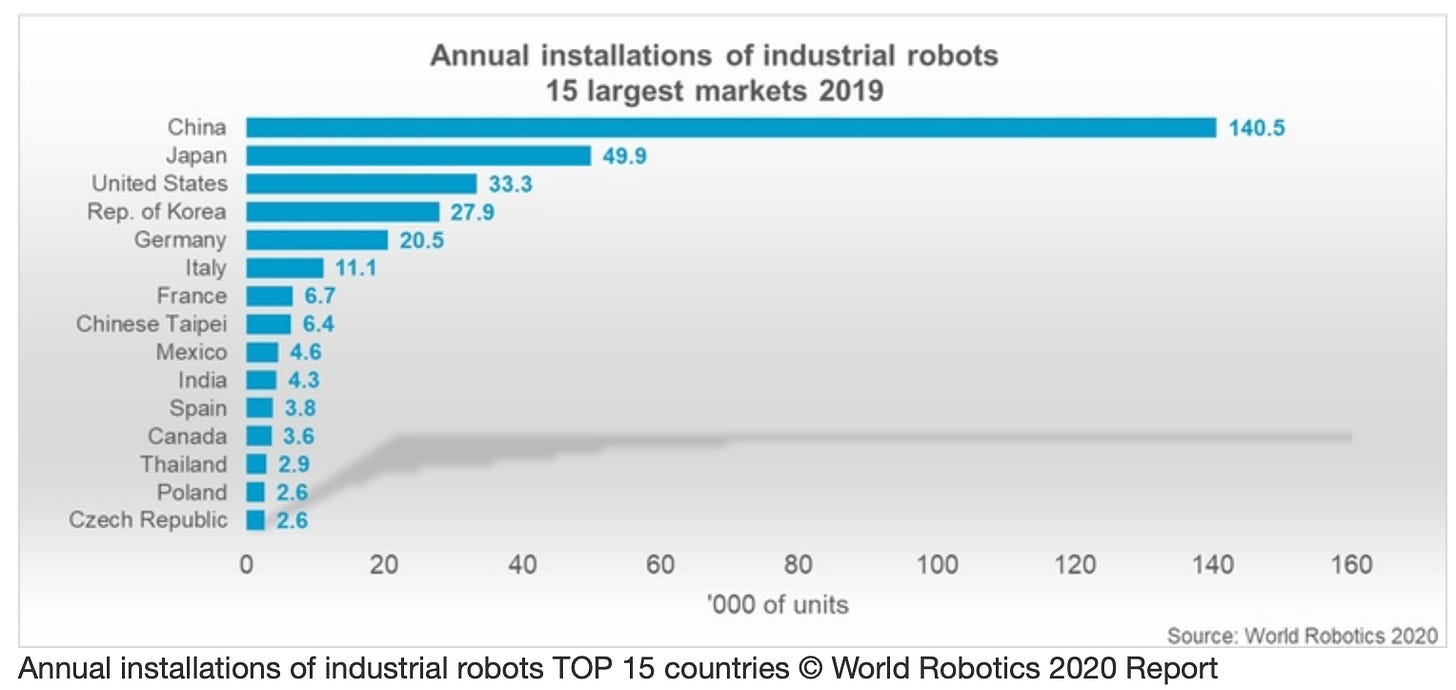

Deglobalization is really about diversifying production away from China, which now has massive built-in advantages from network effects. But in cost terms, that actually makes sense. Analysis from then Sberbank in 2016 found that Russia’s average wages were lower than those in China, and rising wages for Chinese labor make Vietnam, ASEAN, and other parts of Asia more attractive for manufacturers looking to export intermediate components too. But since most newer investment into China’s manufacturing is to meet its domestic demand, “deglobalization” is as much about making intermediate parts elsewhere to export to China as to it is to re-shore production. The declining global share of inflationary pressure makes sense, though. Global trade growth has slowed since 2008 and China’s done a poor job of handling its transition from export-dependent economy to full-blown consumer economy, even with its successes. This turned out messier than I wanted so forgive the jankiness of the two y-axes and non-aligned x-axes. Rhs is GDP growth and lhs is Trade % of GDP:

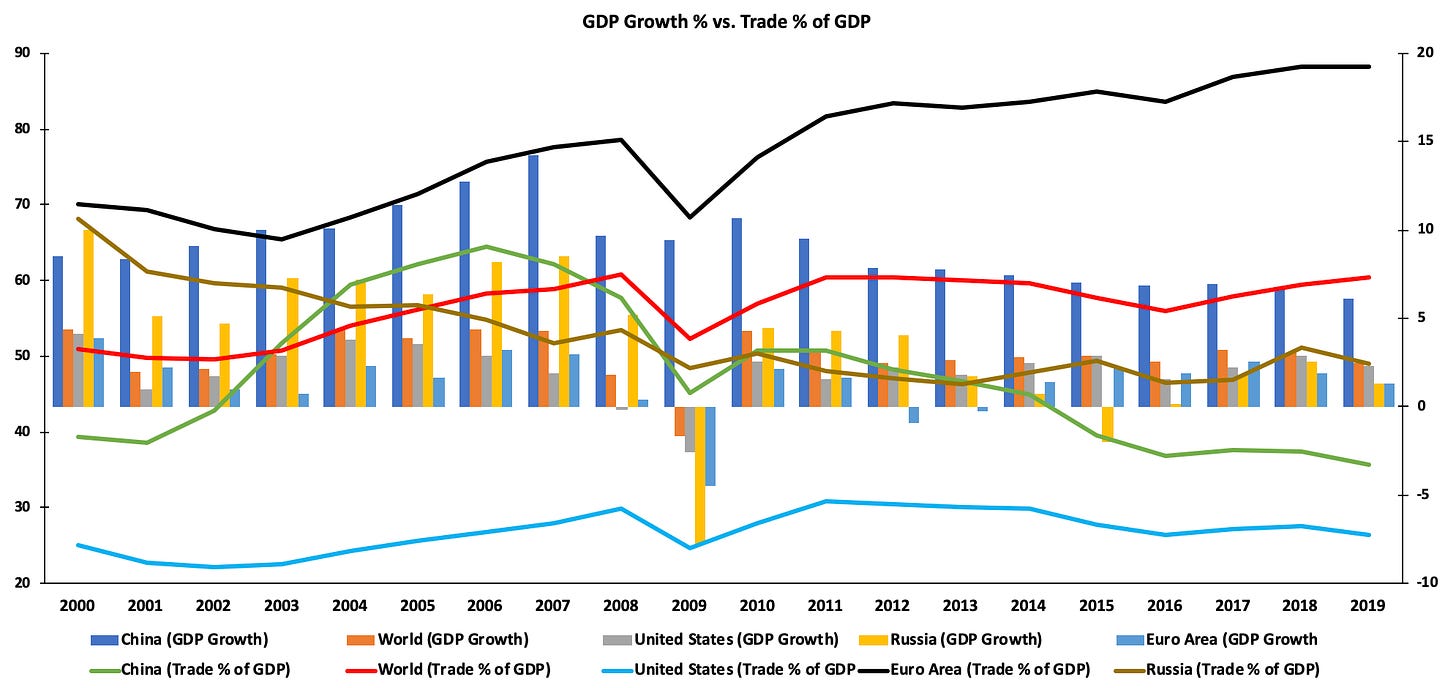

You can see the Euro area’s trade % of GDP rise thanks to austerity and a growing dependence on exports to the Chinese market. At the world level, it stays relatively constant despite the growth slowdown for trade post-2008. It declines considerably for China and was declining last year for the US as well. The point I’m trying to make is not that this research note is wrong about inflation risks for production, but rather that I’m not sure the mechanism by which that happens is going to be driven primarily by moving production to high-cost areas. Trade inefficiencies, yes, but let’s not forget that the Asia-Pacific accounted for 2/3rds of global manufacturing robot installations last year led by China:

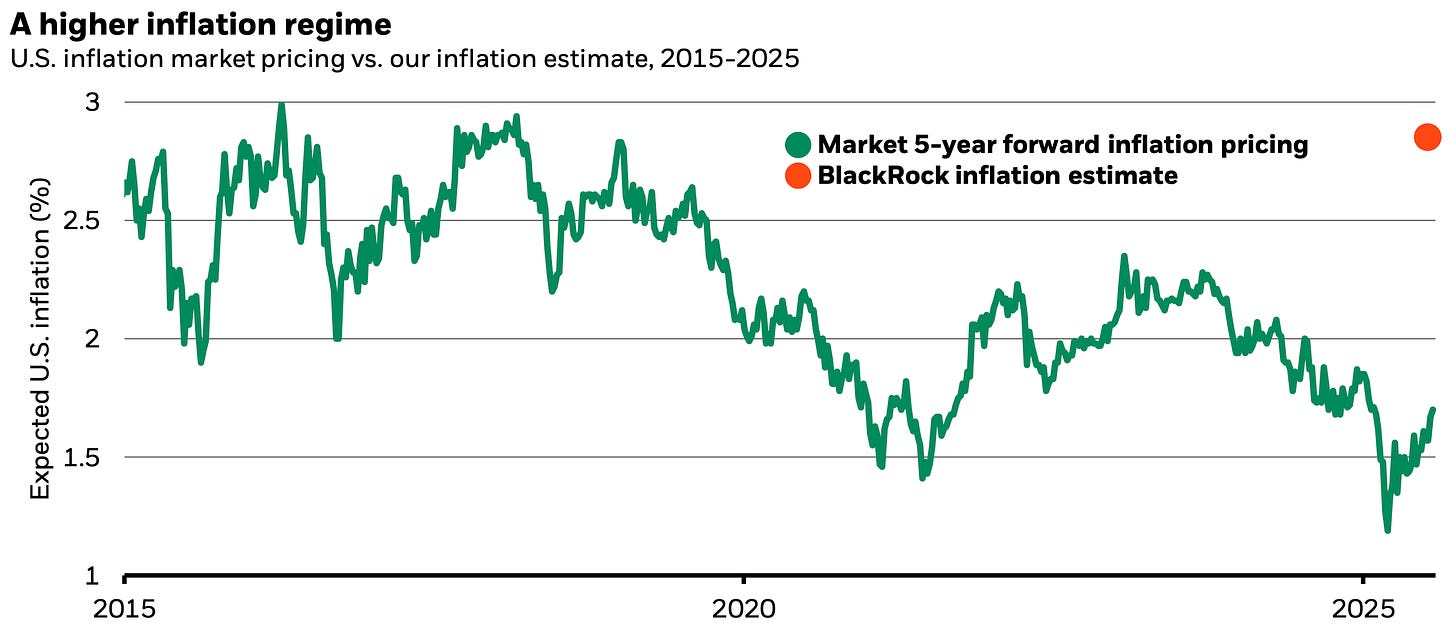

Automation may well create jobs on net, but it’s a deflationary factor for production costs, especially when you have as large a manufacturing base and relevant network effects as China does. These shifts in supply chains, if they do trigger higher inflation, are going to force firms to invest more into cost-cutting and efficiency at precisely the moment when automation is taking off for a lot of industrial manufacturers. I won’t dive into BlackRock’s points about central banks because I think they’re right in their inferences and concerns. Their implied inflation forecast is worth taking a quick look too:

Breaking out of the 1.5-2% bound, you’d think that there’d be more upward pressure on interest rates but let’s not dive deep into central banking here since I’d need at least another 5 coffees to even start to pull together anything worthwhile. Note that they also talk about market concentration and pricing power, which I think is spot on and going to be a problem for a lot of consumer goods, but again, not my prime concern. Let’s assume that their implicit assumption about relative costs of production is going to be a proper driver for inflation. Why didn’t they mention the energy transition?

The last “energy shock” came with a quadrupling of oil prices in 1973, when inflation was already running high after the collapse of Bretton Woods. This one is coming after a period of sustained oil price deflation thanks to the impact of monetary policies and Wall Street speculators. Interruptions in investment cycles and production cycles from economic shocks can lead to bursts of inflation that will settle but still sting. Right now, for example, container rates to and from China are rising from an apparent shortage of containers, no doubt worsened by China’s supply side rebound this year. That feeds into importer and distributor costs quickly if they rise significantly enough. Similarly, any rebound in oil prices is going to make marine fuels more expensive. However, the real “shock” for the energy transition is how much it’s going to superheat demand for metals and minerals as well as the complicated price dynamics that renewable energy grids create if they don’t maintain large nuclear power generating capacity. Natural gas is the go-to backup fuel, but if you crimp demand with an extremely aggressive green energy agenda, you face a paradoxical situation where natural gas itself might be quite cheap, but operators have to charge higher and higher rates to make up for the fact that they’re not utilizing enough of their own power generating capacity to break even on operational costs. That’s not counting the regulatory difficulties of effectively privileging the sale of certain types of power generation over others, rising input costs for construction, and so on.

The only way around it is to create a bunch of redundant backup capacity from different sources and improve battery tech. Doing so costs money. A lot of it. And over-capacity always creates stranded assets unless there’s policy intervention, so you’re then looking at an energy market that risks creating equity and asset bubbles constantly in need of stabilization. If manufacturing automation continues apace, that’s going to coincide with higher power demand. Any production re-shored to developed economies is going to cost more on the power side cause of energy policies aimed at accelerating the adoption of green energy sources, which is going to run up inflation. The unstated reality of the energy transition is that commodity inputs that aren’t oil & gas are going to skyrocket in price if optimistic adoption and investment scenarios play out and there’s a fundamental mismatch between investment horizons, expected earnings, and inflation expectations if you’re trying to build back better and greener. Green investments are, by their nature, best suited to a lower-inflation regime since they operate like utilities and closer to fixed-income financial assets than a pure commodity play that swings cyclically on price, equity value, profits, and dividends. It’s ironic that so many proponents of modern monetary theory and full employment don’t seem concerned about the very real inflationary pressures that energy historically exerts on the economy, and will do again for an indeterminate period of time as things change. Running the economy hot is going to undermine the base assumptions many investors are making as to why green returns are so attractive unless prices (and profits) rise significantly, undermining consumers whose wages have been stagnant for decades and for whom real incomes have only risen if they own financial assets. Unless congress, for instance, takes action to raise incomes and lower healthcare costs, a higher inflation regime by default, nudged along by rising energy costs and shifting production costs, is going to hurt the working poor.

That’s a lot of jabbering before getting to Russia. The reason this “de-globalization” and inflation narrative matters so much for understanding Russia’s place post-COVID lies in the way that inflationary impacts of energy transition, trade, and central bank/macroeconomic policies are going to significantly strain its ability to contain inflation and manage growth domestically with its current economic structures in place. In the world of Bretton Woods, the United States exported its inflation because it maintained the dollar peg to gold (and obviously couldn't adjust its currency as a result). A spike in monetary inflation in the US economy would be transmitted to trade partners who could suddenly import more for less money. There are still inflationary and deflationary links to the US$ when it comes to most oil importers and even if some exports are denominated in Euros, the value of the US$ and its relationship to the Euro matter a great deal to Russian corporates trying to raise financing abroad or sell imported goods to Russian customers. What I’m more curious about is what Russian macroeconomic policies look like in relation to western peers and China. High interest rates have historically been used to stanch capital outflows, which coincidentally tend to rise with oil prices and corporate earnings in Russia. If the oil price isn’t the right predictor anymore and corporate earnings are flat because of domestic demand constraints, capital outflows anyway. And with it, the hunt for yield denominated in currencies or on markets that have lower annual inflation rates than Russia. Even if the near 3% rate BlackRock forecasts for the US comes true, that’ll entail running the US economy closer to full capacity and probably be correlated with more growth since I’m a bit skeptical of a wholesale ‘re-shoring’ initiative getting off the ground so long as the US dollar plays the role of the world’s reserve currency, though that growth might not be evenly distributed across class based on the last 30 years.

There’s no way I can think of achieving a full energy transition without going full bore raising investment and spending levels with easy money and aggressive fiscal policy stimulus in the OECD. But doing so is going to change the basis for Russian policymakers’ trying to keep their own system together while minimizing the spillover from the world’s real economic power centers into its own policymaking. That may well be why its returning to a proto-gold standard, not in full, but in part. Grigoriy Yavlinsky has written a fair bit on how Russia’s economic position in the global economy — a peripheral economy dependent on its industrial centers lacking competitiveness and a deep level of global integration into supply chains — has configured its domestic politics to bend towards authoritarianism by default. If the current account squeeze is tight enough and Russia can’t attract more industry on the basis of favorable comparative costs compared to countries like China, even its status as a relatively powerful, but ultimately peripheral economic player is going to fade. A higher inflation regime is a harbinger that our construct of investment value in a portfolio over longer-periods of time, of how people living off of fixed-incomes and those more active speculating on asset values and so on is going to be changed considerably. It also means Russia’s in trouble. Rising net external demand used to mean rising oil demand, which filtered into Russia’s domestic spending and its population’s incomes. That’s no longer the case, especially if the gloomier takes on re-shoring production come to pass. The costs of failing to modernize are rising fast, and I’m very skeptical that the rents to be generated by the industries Russia will pivot to such as hydrogen are going to be adequate to keep pace with where the evolving economic consensus in developed economies is headed.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).