Top of the Pops

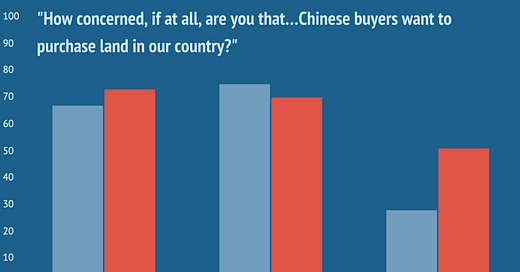

Unsurprisingly, the more China invests in a country in Central Asia, the less the population seems to like them, per polling covered by Eurasianet yesterday. The biggest tell is the fear of land acquisitions by China, a fear shared by many Russian living in the Far East and Eastern Siberia. The decline in Kyrgyzstan likelier reflects a shift to focus on concerns about owing China debt:

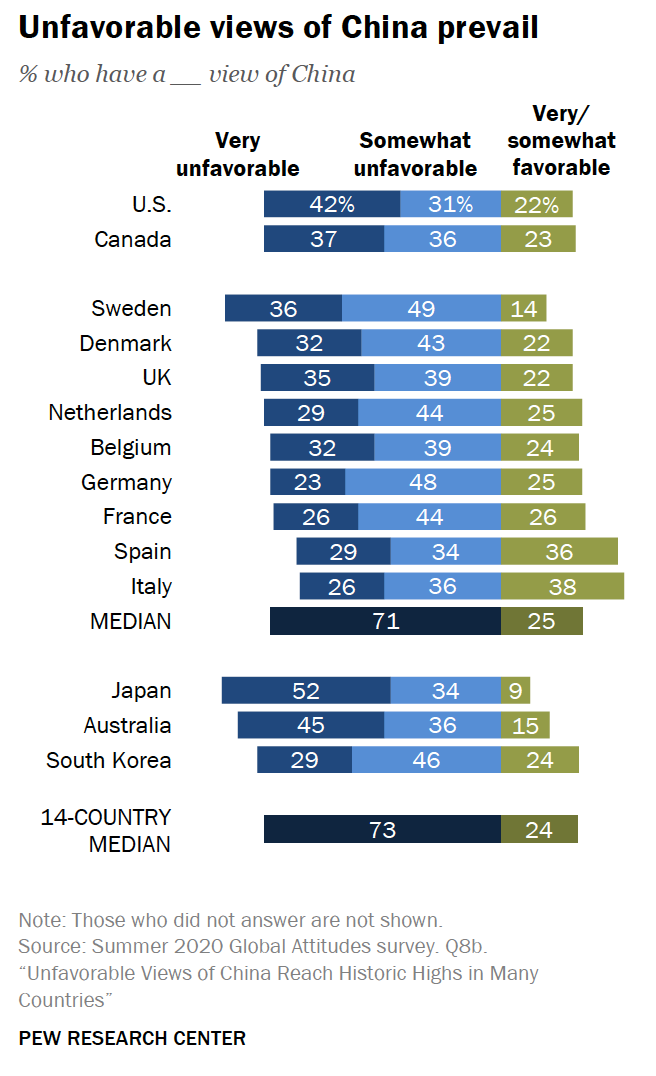

Though the nature of the fears may differ, it’s interesting to see this trend play out where China ostensibly has had a net positive economic effect on the region, at least in growth terms against declining trust in China across developed economies. From Pew:

In case it hasn’t become obvious, China sucks at soft power, and struggles to leverage its economic leverage into anything approaching the more durable, if by no means “trusting,” relationship that Russia enjoys, thanks largely to immigration and elite networks. That’s going to be a key dynamic to track in Kyrgyzstan, Kazakhstan, and Uzbekistan the next few years, particularly for Tashkent as it courts western investment.

What’s going on?

PM Mishustin has flexed his muscles a bit and dismissed deputy minister Alexei Volin from the Ministry of Digital Development. Volin was responsible for the media and internet, essentially point for figuring out how the state could transition its dominant control over television outlets to content streamed online, online channels, and to similarly develop regional governments’ own information ecosystems. Bella Cherkesova has replaced him. She built her political rep working on the 2012 Olympic media campaign and PR for the Kerch Strait Bridge.

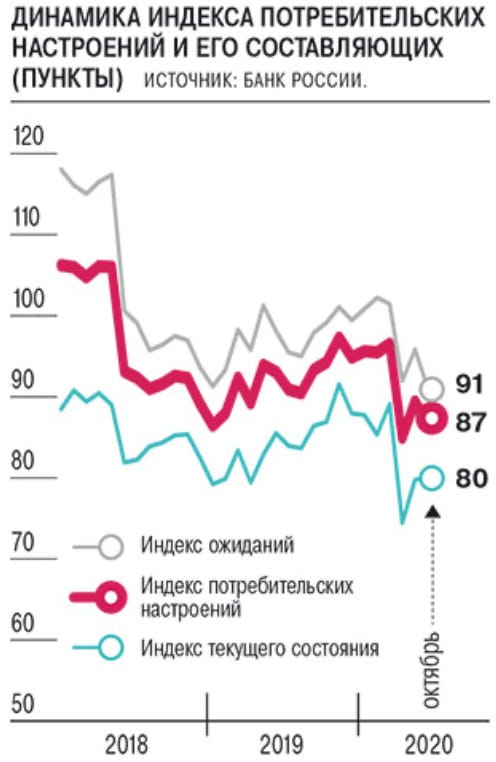

Consumer expectations are taking a turn for the worse, with the October release from the Bank of Russia showing rising inflation expectations - 9.7% for the next year as of September:

Title: Dynamics of consumer sentiment and its components

Grey = index of expectations Red = index of consumer sentiment Cyan = index of current conditions

60% of polled respondents said that the worst of the economic crisis lies ahead. That should be a massive red flag for policymakers.

Rostec announced a $2 billion export deal for 68 Mi-171 helicopters, 18 Mi-171Sh military transport helicopters, 14 Mi-171s with VK-2500 engines, and 21 Ansat choppers. The sales fulfill obligations from a contract signed in November, 2018, but the timing is auspicious. The US State Department has authorized a $1.8 billion sale of weapons systems to Taiwan, which has obviously rankled Beijing. Never mind that Russia’s stuck selling higher and higher tech systems and watching China steal its IP, Washington post-election is likely to freak out over ever little deal with China no matter how obvious or messy the results look.

Russia’s steel manufacturers are having an alright year, despite net national declines in production volumes thanks to commodity prices. Price rises for steel of 5-10% and lower coal prices led to a significant improvement for financial performance indicators for July-September. Dividend payouts are looking good. Severstal is planning on paying out 37.34 rubles per share, MMK is paying out 2.39 rubles per share, and NLMK is paying out 6.43 rubles.

COVID Status Update

Things keep getting worse. Yesterday’s daily caseload hit 17,340:

Red = new registered cases Black = deaths

Important stuff:

Second inset from right = elderly residents suggested to self-isolate in Moscow

Last inset = Some officeworkers in Moscow sent into remote-working

Yaroslav Nilov is leading the charge in the Duma to offer a bill that would finance the public procurement of masks and gloves to enable full compliance with suggested medical guidelines. Yesterday’s talk with Putin is being paralleled by Dum efforts to head off lockdowns with this approach. First deputy prime minister Andrei Belousov’s speech yesterday tipped off that the Kremlin’s committed to using regulatory support and liquidity support for small businesses rather than direct spending such as income support like that attempted earlier this year during the 2nd wave of the virus. No big national lockdown or restrictions are coming and experts note that the government is not releasing complete data for hospitalization usage rates and the rate of infection. In short, they’re ensuring further declines of public confidence in any health response and in the business environment.

Submerging Market Blues

The pullback of Russian income support schemes has now shown up in the data for real incomes. Thanks to Ben Aris for pulling the Rosstat data together:

Real incomes are trending back down 5% for September. Savings, if they have any, are running out and borrowing can’t make up the difference without adequate earnings. Add to this the complete disregard for trying to contain the spread of COVID during the current wave and you have a deepening shock built on a likely collapse of confidence, massive rise in savings rates, and dwindling spending power to sustain Russia’s halting attempts to substitute imports of foreign goods and services with domestic equivalents. Normally, declining incomes would allow a currency - in this case the ruble - to adjust by increasing Russia’s current account surplus since it’s still exporting large volumes of resource commodities invoiced in foreign currencies in demand. The adjustment would, in the end, help make imports more affordable. That’s not quite what’s happening as the ruble’s stuck lower than it was pre-shock and goods imports - the stuff that Russians would normally consume - seem relatively unaffected so far:

But the collapse in service imports is actually a huge problem for Russia’s services sector, one that’s likely highly correlated to contractions in output for oil & gas, and going to drag on goods imports as the second COVID wave spreads. From Rosstat via Kommersant:

Title: Change in output in different sectors before and after the change in methodology (Jan.-Aug. 2020), % year-on-year

Purple = before Orange = after

As you can see, Rosstat has magicked consumer goods sectors into positive territory, which, while a bit specious, at least matches figures showing the recovery of goods imports. Services imports, however, are heavily reliant on extractive companies hiring consultants, paying foreign service providers, etc. and those imports have knock-on effects for what are often higher-wage, high value-added jobs in Russia. Think finance, Russia’s own consulting space, the types of white-collar jobs that help cities, led by Moscow, soak up human capital and deepen regional inequality. Now that Putin has publicly allowed for the possibility of continuing the current level of OPEC+ cuts for longer rather than pursuing the easing path previously assumed for January, oil & gas will remain depressed in relative terms. Other extractives will not, and may well draw interest. But something’s got to give if Russia doesn’t pursue more expansive fiscal stimulus. Based on IMF estimates, Russia’s total fiscal intervention as a % of GDP barely beats that of Saudi Arabia despite Russia’s significantly larger economic and fiscal revenue base. It also trails the emerging market average:

So real incomes decline 5% in just one month between August and September and say that normally correlates to a similar decline in goods imports since a lot of them are consumer goods (technical equipment, things like that aren’t so it’s a very imperfect comparison but worth considering). Using January as a reference (a little lower due to seasonality, probably closer to where goods imports should be now than March when it peaked 1Q), a 5% decline in goods imports would be worth around $850-900 million a month at the current USD exchange rate per CBR balance of payments stats. Multiply that across a year, you get between $10.2 billion and $10.8 billion - a range of about 780 billion rubles to 825 billion rubles. That’s equivalent to a single bond issuance by Rosneft and less than half of MinFin’s planned OFZ issuance for 4Q which, spoiler alert, people are snapping up because they trust the Russian government to repay its debts.

It’s easily within Russia’s fiscal capacity to provide support at that level for the duration of the crisis. Instead, the hope is that non-extractive sectors with much higher rates of SME formation and market share are going to survive without anything beyond credit expansion while thousands more each week get sick. I’ve made the point before that this is a big gamble. It’s also shockingly irresponsible macroeconomic policy given how uneven global recovery is going to look like and undoubtedly going to drag down growth in Central Asia at precisely the moment that China’s current account surplus is growing and posing a deflationary risk for the rest of Russia’s key trade partners. China’s expansion of rail volumes to Europe via Russia has thus far failed to materialize into higher flows of imports from Europe and that’s unlikely to change with its current policy path. I’ve written elsewhere that China’s pull on commodity demand and prices bailed Russia out over the summer. Failing to prop up domestic demand is now coming home to roost. I’d expect the drop for September to October to be similar, if not worse.

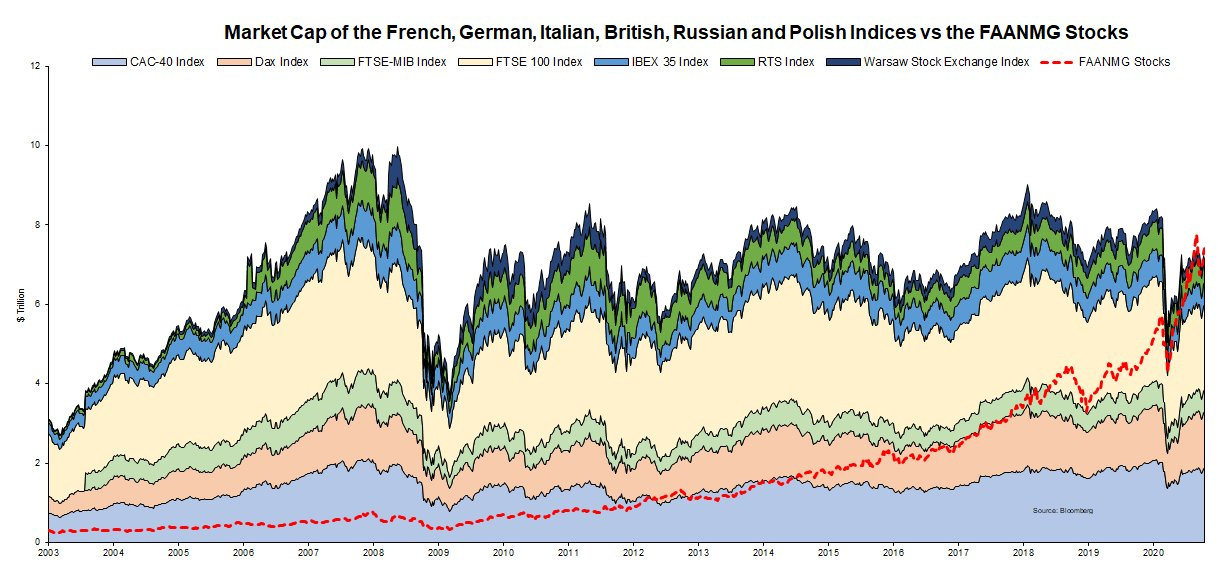

Russian economists may be making a big deal about deglobalization and related trends undoing the various modeling shibboleths taken for granted pre-virus. They note tech as well. That’s where I think the real trouble ahead lies since technological innovation is going to lead to job displacement in developed economies, create space to onshore manufacturing without worrying about comparative labor costs, and by extension, spoil Russia’s reliance on its current account surplus to serve the state at all costs. Take this chart from Vincent Deluard to note how, in equity terms, tech is the hamburger that is eating the world:

A single tech company from FAANMG - Facebook, Amazon, Apple, Netflix, Micrsoft, and Google (Alphabet) - has a greater equity valuation than the entire RTS index in Moscow and collectively, they’re worth more in equity than the indices of Europe’s seven largest economies combined. Right or wrong, and I think rightly though with some caveats to get into later, the market is placing the highest equity value on the companies that often pose the greatest risk to SMEs, labor’s bargaining power, and the polarization of productivity between white collar office managers and the grunts below as middle management and mid-tier jobs generally are squeezed out of existence. That dynamic is about to take off globally and play havoc with labor productivity and consumer demand, which is going to do a number on Russia’s model of suboptimal productivity in exchange for political stability via employment. One of the only ways to escape that cul de sac is to invest as much as possible into infrastructure and human capital and provide spending power during the current crisis, but it poses huge political risks for the Kremlin. Opining about the collapse of the regime is a mug’s game. But the rules of the economic game are changing fast. The failure to spend today is going to cost an arm and a leg in a year and everything from the neck down eventually if there isn’t some sort of new economic model that arises.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).