D.R.E.A.M. (Dollar rules everything around me)

Russia's dollar dethroning dreams make no g*ddamn sense

Top of the Pops

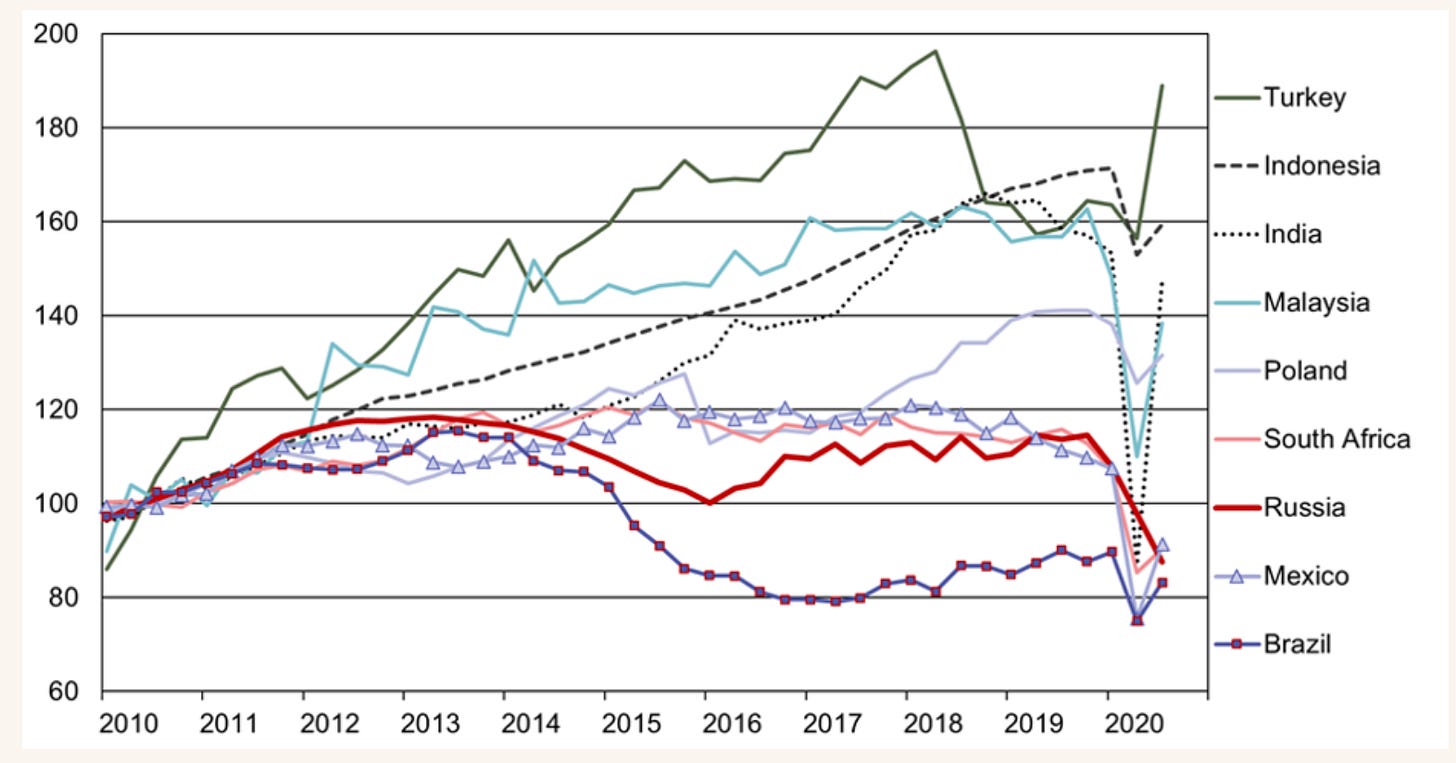

Russia’s got a fixed investment problem and it needs to sort it out fast. The following are fixed investments, not capital investments, but still show that fixed investments for buildings, machinery, etc. haven’t recovered since their 2012-2013 peak when oil was around $110 a barrel (closer to $120-130 a barrel today in inflation adjusted terms):

Comparing Russia to other countries directly is somewhat misleading, though this BOFIT chart fantastically depicts the overall trend with 2010 as the baseline. Russia’s investment needs are higher in relative terms because of its size — infrastructure is a mother. But the decline indicated in 2020 understates the problem when you look at its composition. Declines in private sector investment were partially offset by growth of SOE investments last year, a fairly naked ploy to massage economic figures and try to contain the damage without offering cash relief or other instruments deemed to high an inflation or currency risk. The oil sector alone still accounts for in the range of 50% of all capital investment in economy, a massive problem if more optimistic demand recovery scenarios don’t materialize. Last year’s figures show that state-owned firms accounted for 66% of all capital investments, an unsustainably high figure that is only likely to worsen given that SOEs enjoy privileged access to credit, benefit from the sovereign credit rating, and enjoy other forms of support. It’s hard to imagine that in a default deflationary fiscal and monetary regime, the state’s share of capital investment won’t increase further in the years to come, further linking investment levels to fiscal policy since monetary policy will likely entail a new round of “normalization” and slowly rising interest rates at a faster clip than in developed economies once the budget balances in 2022-2023.

What’s going on?

A new law that would better align the distribution of power between the federal center and regions to avoid regions being saddled with ‘duplicative’ financial burdens based on badly designed legislation creating revenue and spending requirements. This is the latest face of Mishustin’s optimization campaign to improve the efficacy of government, economic programs, and services. Two of the biggest proposed changes come for land management and licensing for resource extraction. The former would more likely end up being designed to offer more regional flexibility so as to better encourage the reclamation of new land and expand Russia’s agricultural production base. The latter, however, hints that the federal center may want to take away regional oversight functions for resource licensing that are duplicative, not only on efficacy grounds, but also to make it that much easier for companies and officials in Moscow to push through major investment initiatives without competing against local input. Officials hide behind the constitutional referendum and changes of last year to justify these changes, and some are surely needed. But you get the feeling that the center is really just trying to find a new system to manage power vertically at a time when the current one is groaning under the weight of its internal contradictions.

The Central Bank is continuing its fight against what it perceives to be overly risky financial instruments for unqualified and inexperienced investors, now moving to regulate the policies offered by insurers. In particular, the CBR is targeting life insurance policies that carry more complex investment characteristics that require an upfront, one-time premium payment or else deliver returns on the basis of the quality of the underlying assets used by the insurer. The All-Russian Union of Insurers has diplomatically put out that while people always recollect 100% of what they put in with taxes adjusted, consumer interests can be better protected. The market for these policies really needs to grow for Russia to maintain better sources of domestic “long money” for investment:

Title: Size of the life insurance market, blns rubles

The basic concern is that higher-yielding plans will confuse investors who don’t know how to distinguish savings instruments from investment ones. I’m still skeptical that’s really the fear. Domestic demand repression (and now the COVID crisis) drive up savings rates and the banking sector is more fragile with a reduced current account surplus. Russia’s failure to lift real incomes/earnings alongside high nominal wage increases and the lower key rate regime are driving Russians to seek out better returns so they can live decent lives. The CBR is trying to head off financial instability that is generated by its own economic orthodoxy and Russia’s fiscal, trade, and industrial policy approaches.

Kirill Rodionov delivers a warning to Russia: it may be worth waiting to increase oil output cause producers outside of the OPEC+ agreement are lifting output in response to higher oil prices. Libya’s been a serious problem, and the main driver of Saudi Arabia’s decision to take it on the chin in February; its output rose a combined 1.7 million barrels per day between September and the end of November. Norway has nudged its output up 17% to reach 1.3 million barrels per day. US output had recovered past 11 million after dipping down to 10.4 million in October as of December. In short, marginal and major producers elsewhere, aided by political agreements (Libya) and oil prices sticking north of $50 a barrel, are lifting output in response. Negotiating for production increases on Russia’s part only works so long as Saudi Arabia prefers an oil price over market share approach. The supply/demand balance remains weak and, undoubtedly, surprises are still in store for demand based on what US stimulus bill(s) end up accomplishing.

The sub-commission on customs tariffs and non-tariff regulations has officially hiked the export duty on wheat, rye, barley, and corn to €25 per ton after the export quota of 17.5 million tons is reached starting February 15. First off, I find it hilarious that Russia’s de-dollarization drive is so deep-seated, it raises revenues in Euros — a currency much stronger against the ruble than the dollar and with significant exchange rate risks due to European deflation (thanks German miserliness!) — increasingly exporting to countries that would have to use their own Euro reserves to reduce the friction generated for Russian firms if. they don’t transact in Euros abroad (unless they get their Euros from Russian banks now reliant on Rosneft’s oil exports to keep the supply steady). Second, the move will likely end up prolonging higher food price levels due to investment restraint, something interesting to consider now that the current economic situation appears to be encouraging consolidation in Russia’s fishing sector. A merger between NBAMR and Okeanrybflot will create Russia’s largest fishing firm by production quota. I need to dig in deeper to the latest M&A and investment activity, but it’s worth watching across sub-sectors of the food industry as broader attempts to control the price of food hurt profits and investment levels, thus further privileging larger companies more able to use leverage to expand through acquisitions. It’s been happening since 2014, but this shock may jumpstart a new wave in 2021-2022.

COVID Status Report

Cases stood at 24,715 and reported deaths reached 555. The current slight uptick doesn’t seem to quite add up per some of the other reporting out there, however. That’s not to say that cases are skyrocketing again, but we know that the official data is a bit sketchy:

Black = Moscow Red = Russia Blue = Russia w/o Moscow

Russian vaccination data could be overstating the total numbers (1.5 million) by a factor of 5 or more. Yesterday, Moscow mayor Sergei Sobyanin talked up the possibility of creating a system to allow those who are vaccinated or have a natural immunity from having gotten over COVID to be able to go about their lives freely, completely undermining the point of the vaccination campaign until herd immunity is truly reached. As many as 6% of Russians polled are still against getting vaccinated or else aren’t ready to be and the number ‘for’ it is only around 40%. Rospotrebnadzor is confident that the peak of the virus has passed, but the gamesmanship around the vaccine rollout and obsession with saving the economy over lives is going to cost both in 2021 unless the vaccination rates pick up very, very quickly (which could happen).

Hello, Dollar!

A deal struck between the Ecuadoran government led by Lenin Moreno and the United States’ International Development Finance Corporation (DFC) for a $3.5 billion loan on an 8-year maturity with a 2.48% interest rate is huge news for US-China competition. In exchange for helping Ecuador finance debt owed to China, the US won a key concession: Ecuador would exclude Chinese firms from its telecommunications systems. The deal could provide a template for more diplomatic initiatives during the Biiden administration as competition with China becomes the dominant theme for Washington’s geopolitical fussery. It also raises questions about that relationship between financial flows and commodity flows during bull markets.

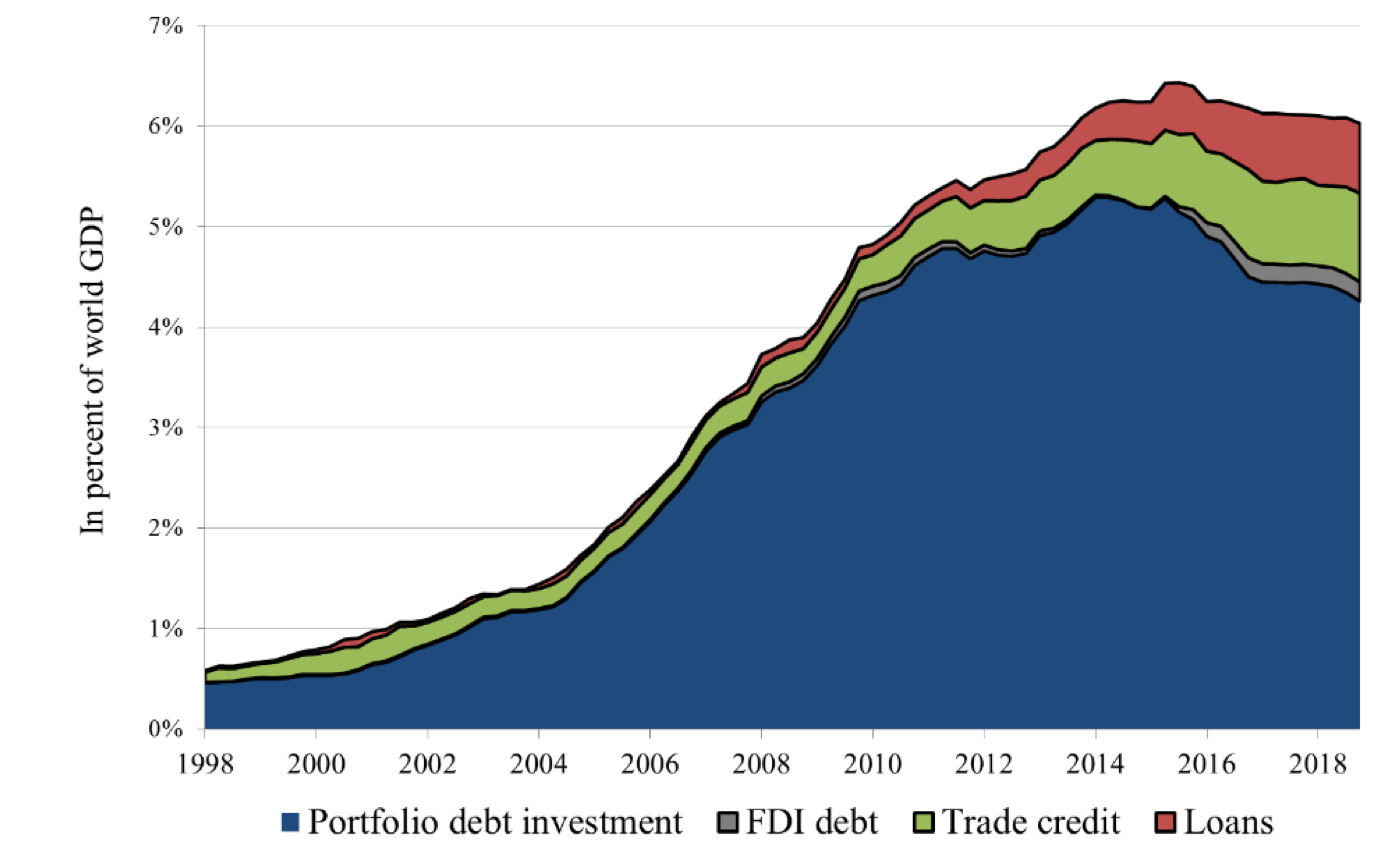

China’s become a massive net lender globally over the last 15 years. A 2019 study by researchers at the Kiel Institute for the World Economy discovered that reporting from the World Bank and other multilateral institutions massively understated China’s impact on global financial flows. The net debt claims China held in terms of trade credits, direct loans, FDI debt, and portfolio debt (think buying sovereign bonds) were worth 6% of world GDP by 2019:

Think of that. That’s over $5 trillion using current US$ prices. And an estimated 85% of what China lends abroad has been lent in US dollar, backed by the country’s immense currency reserves earned from its current account surplus. For all the talk of China opening up central bank swap lines with emerging markets and spreading its influence through financial statecraft, it’s still depending on the US dollar to do its work for it, as are those borrowing in dollars (and can use borrowing in dollars as a means of playing off both powers against each other). What drew my interest here is the role that the oil shock in 73’ had on internationalizing the dollar in the wake of the collapse of the Bretton Woods monetary system.

When oil prices skyrocketed, suddenly import-dependent countries — particularly those in Europe and Japan — desperately needed US dollars to settle accounts with Gulf exporters who were invoicing their exports in dollars, a legacy of both political agreements and the Anglo-American oil majors’ preference to price crude from the Persian Gulf in direct relation to crude prices at US ports in the Gulf of Mexico. This meant that very rapidly, there was an accumulation of dollar-denominated liabilities outside of the United States and outside of the US financial system and a growing number of US banks with swelling stacks of dollar-denominated assets underwriting foreign borrowing. Financial instability in the US could therefore ripple outward quite quickly, leading to what would have then been a recession that, on a numbers basis, threatened to rival the Great Depression should the worst scenarios come true. The Federal Reserve thus effectively became an international lender of last resort, the ultimate plumber for the international financial system, by 74’ with the help of an oil price shock and several domestic bank failures. Today, oil’s not the angle here. It’s metals & minerals.

A large volume of the dollar lending China does abroad goes to resource exporters. Financial terms frequently include claims on future revenues, physical volumes of production that secure the debt used to finance extraction, or else repayments at commercial rates that exceed those normally used in development finance by folks like the World Bank, Asian Development Bank, European Bank for Reconstruction and Development, etc. The problem today is that the expected increase in metal & mineral demand outstrips anything we saw with oil in the 70s and while they don’t entail the same level of financialization, there’s a lot of debt tied up in commodity prices and political fights to come. Consider the World Bank’s forecast for mineral intensity as a % of 2018 production:

None of these will be worth the same as oil because of the market cycle dynamics for waves of investment are different and they can’t produce the same types of revenues, though the energy transition will make demand less elastic. But just as oil exporters used rising prices and demand to renegotiate financial and ownership terms with western companies and banks in the 70s, the array of loans China has used to secure adequate resource supply for its export-led economic model will face renewed political pressures as the value of mining assets rise, countries want to keep more of that money for themselves to finance development, and, crucially here, the general exposure to dollar-denominated lending makes the US and not China the actual ‘lender of last resort’ in a crisis. Escalating competition is going to make the dollar an ever more important tool to address how these obsolescing bargains for resource wealth are made.

What’s funny, then, is that Russia’s de-dollarization drive is actually weakening its power to engage politically in these matters. Russia’s lending abilities are now more constrained since its current account surplus is derived primarily from oil & gas prices, but in trying to reduce the role of the dollar politically in its dealings with Europe and promoting trade settled in national currencies within the EAEU and Shanghai Cooperation Organization, Russia’s vision of an international financial and monetary infrastructure is nonsense. Unless there’s some form of internationally agreed currency unit such as the bancor proposed by Keynes used to mediate imbalanced capital and current accounts between countries by tending to drive them back towards equilibrium, there needs to be some form of national entity that can bear the costs of providing a public good such as a reserve currency. The most viable means by which some sort of evolution could take place is if China lent more in renminbi and imported more than it produces, both of which entail massive destabilization risks internationally. For one, China’s property market has become one of the globe’s most important stores of financial value and any disruption on the property market could be disastrous. The property market in China was worth over $52 trillion as of last year and while some adjustment has to be made for the size of the country, Chinese investment into property looks a lot more like the US before mortgages started going up in 2006-2007 than a healthy market:

One study — probably a bit exaggerated — found that a 20% decline in property values could yield a 5-10% decline in China’s GDP, as well as a massive spike in capital outflows as investors panic. Any slowdown in investment — a huge problem for an investment-led growth model — triggers a potential relative decline in property values. Those properties are undoubtedly securing debt and other financial instruments held by people that really, really hope they don’t devalue. In that event, China’s dollars become essential as a calming mechanism for international markets just as lending those dollars saves it the headache of the same types of risks of defaults abroad spilling over into domestically-denominated economic activity since the country’s dollar reserves are reliably massive. China’s dollar addiction is very hard to break politically, not just economically, because it shunts the costs of reserve currency dominance — higher unemployment, more extreme non-tradable services inflation, worsened inequality driven by domestic economic imbalances linked to dollar dominance (think of the appreciation of the US dollar between 1979 and 1985 and the decimation of many manufacturing jobs) — onto its competitor. Unemployment is a systemic political risk in China, just as it is in Russia.

The US, even saddled with those burdens, has the power to use dollar-denominated debt owed to China as a sort of cudgel to re-engage with the producer states that will play a more significant role in providing the materials needed for the energy transition. Russia, however, can’t replicate what China’s done because its foreign currency reserves are accumulated primarily through the two commodities most likely to see their relative value decline in the coming decades rather than manufacturing and value-added intermediate production like China. And the distribution of dollar (and Euro) earnings from commodity exports is going to evolve as copper, nickel, lithium, cobalt, and other metals & minerals become much more valuable and financial markets seek to do a better job hedging against price fluctuations the more those inputs affect inflation over, say, oil. If Russia wants the ruble to play a bigger role internationally, it has import more goods i.e. stop suppressing domestic demand and it has to lend more abroad i.e. risk foreign claims on ruble-denominated assets pushing unemployment higher domestically. Ecuador is a sign of the currency wars to come, currency wars that will affect and be affected by the flow of billions of dollars worth of increasingly vital metals & minerals.

The oil shock accelerated and strengthened the internationalization of the dollar as the world’s reserve currency. The current shock, depending on what inflationary pressures it brings, could have been an opening for China to further internationalize its own currency — and for Russia’s Joker-esque dream of currency chaos to reign supreme. I’m less certain that happens in a world where a US administration adequately realizes that China’s dollar lending has provided it an opening on a host of development issues in countries Washington has done terribly ignoring for decades now. Companies involved that are diversifying their revenues across geographies and currency zones are in for what could be a wild ride. When you come for King Dollar, you best not miss.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).