Top of the Pops

VTimes published commentary and background from Aleksandr Novak’s team in the cabinet explaining that the government is not worried about the energy transition because the demand for hydrocarbons may be falling, but will remain high. Though oil and/or gas demand might fall, the share of oil & gas used for refined petroleum and petrochemical products will rise much faster than energy demand and natural gas will remain the most important hydrocarbon fuel until 2040-2050. Energy efficiency improvements in Russia and economic diversification continue apace and they can use carbon sinks with forests to offset emissions. In short, it’s a remarkably denialist piece of commentary that, while strictly true in its initial claims, skips over all of the actual implications of these processes and willfully ignores that forest carbon offsets are, for the most part, a sham approach since the real need now is to reduce emissions, not simply offset them. Basically, there is no plan to contend with the changes afoot because even in a world of persistently high demand, the scale of investments needed to address incoming policy changes and failure to do so will render Russia’s competitive advantage that much less competitive.

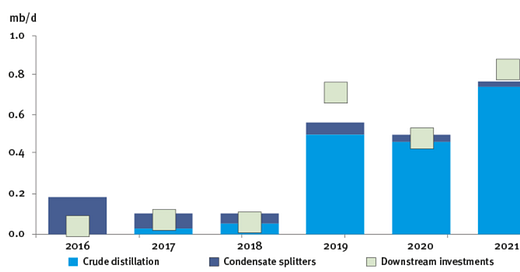

Take the refined products line. Russia’s own refining complex holds a very small share of the global market and China’s currently surging ahead of the US to become the largest refiner on the planet. The net effect is that while the US and EU cumulatively have more capacity, China will have the greatest effect on end use demand from its own policy changes domestically, and crucially, will be exporting products to the rest of the Asia-Pacific as privately-owned international oil companies inevitably shutter more capacity on markets entering demand decline and Middle Eastern national oil companies cut deals to buy into refining capacity to place their product while Russian firms are left behind. Russia’s oil companies have a terrible track record expanding their downstream presence in China and across Asia. Take OPEC’s investments into newer downstream capacity the last several years and they dwarf anything happening in Russia on a capacity basis aside from some refinery modernizations and a few specific natural gas petrochemical projects in the Far East, which while significant, face future marginal return problems as Chinese refining capacity of all stripes continues to grow and Russian demand will likely remain weak:

The future is not just a diminishing marginal rent to be gathered from the oil & gas sector — higher prices from underinvestment will simply accelerate decarbonization as enough technologies reach maturity, though their adoption will face plenty of hurdles. It’s also about the relative competitiveness of nationally-owned energy firms and private ones to adapt and lock in demand. Saudi Arabia in particular has been aggressively pursuing downstream capacity additions abroad to lock in demand for its own crude and collect more of the value-added marginal profit on growing markets. Russia’s got virtually no chance of bridging this gap, especially with its leading oil companies directly sanctioned or facing secondary sanctions risks. Novak’s team’s note to VTimes betrays a fundamental lack of imagination, and clear evidence that the regime is locked into a terrible pathway dependency with its bases of elite political support and approach to macroeconomic policy.

What’s going on?

Mishustin and the cabinet have confirmed plans for a third business support package, planning to extend 7.7 billion rubles ($103 million) of funding to continue existing schemes with a slight adjustment. The loan scheme for companies maintaining employment levels will be marked up from a flat 2% annual rate to a 3% rate, marginally increasing the debt burden for companies still struggling to recover. The program is aimed at small businesses or large firms that were worst hit i.e. tourism and similar services requiring face-to-face interactions and brick and mortar foot traffic. The size of the loans will depend on how many employees a company has but can’t exceed 500 million rubles ($6.7 million). The money allocated by the state is then used to pay banks the difference between the market rate and the state mandated rate for the loan, what is effectively a Soviet-era price subsidy schema repackaged as credit assurance. So really, the state is injecting that money as a subsidy to the banking sector in hopes that the lending and borrowing will be enough to keep things going without real spending commitments. It’s a far cry from what Boris Titov had been lobbying for and businesses have been quick to note the illogic of the approach: employment hinges on consumer demand, which this does relatively little to address, and businesses are still out of pocket for social insurance obligations for the employees they’re keeping on the books without adequate business. Russia’s support measures bear some similarities to European schemes intended to maintain employment rather than provide income support. In the same way, that means they’re hiding the true extent of economic scarring for jobs.

Based on the latest data release from the Gaidar Institute/Markit’s PMI, the uptick in the Russian manufacturing sector actually isn’t all it’s cracked up to be. Rather than resilient demand underpinning potential rises in production, it’s actually the emptying of stocks of finished products and intermediate inputs that’s driven partial recovery:

Title: Balance of stocks of finished industrial production by country — balance = % higher - % lower from respondents

Green = Italy Black = Germany Light Blue = France Red = Russia

As we can see, COVID actually was a shock for the industrial sector in Russia, not because production lines closed, but because back orders could be cleared for so long before real demand allowed space for recovery. Stocks are still around -10% off from balance and -20% vs. pre-COVID. That itself indicates a degree of over-production since most of these goods aren’t being exported and stocks are often balanced via procurements, though this pertains most to industries like rail logistics or any civilian production adjacent to the defense sector rather than things like light vehicles. Higher oil prices will boost industrial orders, but since macroeconomic policy has tried to decouple the exchange rate and other indicators from said prices, they’re unlikely to expand intermediate demand that significantly within the economy without a new stimulus bill boosting incomes later this year. Given the political climate, however, this seems likelier and likelier if the current campaign against Navalny’s staff and organized non-systemic opposition figures fails to calm the growing dissatisfaction with the idea that Putin remain in power past 2024.

MinEkonomiki has finally worked out the proposal for the Sakhalin cap and trade emissions system intended to act as a model for the application of such a system to the rest of the country. Given the region’s intense dependence on resource extraction and presence of foreign firms, it’s a logical place to introduce the system. Crucially, the proposal creates a voluntary market for trades instead of mandating specific reduction targets, which leaves plenty of questions as to how effective it’ll prove to be. The program also appears to be, in reality, another attempt at guiding demand for already subsidized sectors — Vyacheslav Alen’kov from the Sakhalin government notes that the program should boost gasification efforts, encourage the use of natural gas for road fuels, as well as help create demand for hydrogen-powered trains. So really, the hope is that any new regulatory framework would end up boosting Gazprom and efforts to promote domestic hydrogen, which are subject to cross-subsidies and more. It’s still a positive development and marks a huge incoming change for national economic and ecological governance, but it’s also worth remembering that Russia is 15 years late to the cap and trade game vs. Europe, and the policy conversation in the OECD has moved beyond such a system. Chubais’ warning that not imposing a carbon tax was a grave mistake will ring truer in time, I think, if this program works as it’s actually intended to — marginally reduce emissions while carbon sinks are used to greenwash policy and generate more forced demand for Gazprom and related firms’ goods and services.

MinSel’khoz has a new plan out to stabilize price for eggs — expand the limit for short-term subsidized borrowing from 1 billion to 1.5 billion rubles ($20.3 million), lengthen the maturity for subsidized credit for investment from 8 years to 12 years, and slowly increase the tariff rate on imports of incubated eggs from 0-5% as of Jan. 1 2022 increasing to 15% on Jan. 1 2023. The explosion of state-subsidized credit seems to be an interesting inversion of late Soviet policy i.e. the preference to subsidize production over prices and consumption is clearly seen as somehow being more sustainable by the economic groupthink around the Kremlin shaped by the Gorbachev years and 1998 default. There’s also a related proposal to subsidize the cost of production per kilogram until October 1. Essentially, the response to a domestic deficit of the product is to subsidize investment into production while slowly creating soft market protections so that domestic producers aren’t at risk of losing market share. You can’t really do both effectively on a long-term basis because the former decouples the investment cycle (slightly) from demand and doesn’t address systemic underinvestment that comes about from trying to restrain prices. In other words, the state is increasingly trying to separate the business investment cycle from external conditions for the sector, which is a recipe for the sector demanding more and more support without adequate productivity gains since Russia’s population isn’t growing. Any excess production has to be exported, but the protectionist measure will end up encouraging counter-measures in trade partners. Firms are now being asked to only raise prices by 10%. Price control politics continue on their absurd path.

COVID Status Report

New cases fell to 10,565 with reported deaths at 441. Valentina Matvienko is expressing confidence that Russians can go about planning their summer holidays without concern for the virus and its potential to disrupt plans. Psychologically, the pandemic is almost over as a political issue in terms of the public health considerations, at least based off political communications from Moscow. Tatiana Golikova put forward the social bloc’s view that herd immunity should effectively be achieved by August. One of the effects of the virus has obviously been a spike in the cost of medication, but it’s clearer now that there’s some evidence market leading pharmacies have managed to leverage their existing scale to grow slightly faster than the rest of the competition:

Left-Right: rank, distributor, volume (blns rubles), growth % (annual), market share (%)

4 of the 5 leading pharmacy chains grew at 15%+ year-on-year, which was greatly exceeded by smaller competitors in some cases but only one — Grand Kapital — is close to breaking the 6% market share barrier. If these growth rates continue relatively unchanged (allowing for some variation), then pharmacy ownership might slowly start tipping towards much greater levels of corporate concentration as the top 3 firms move closer to controlling 50% of the market. For now, it’s quite competitive and most leading firms only account for 0.5-2.5% of the market. But unless they can grow fast enough to catch up, the “big 3” and those closest behind may start pulling ahead thanks to the boost they can likely realize from scaling benefits that keep consumer costs slightly lower thanks to larger logistical networks, better relationships with pharmaceutical dealers, etc. given that competition enforcement in Russia is often a bit of a harrowing ordeal.

Swords into DOWshares

I stumbled across a meme early this morning that relates to past columns as well as the broader purpose and implicit or explicit argument behind a lot of the content in this newsletter — the trope of Russia’s “demographic doom” as it pertains to national security and so-called grand strategy thinking in Washington. As the contrarian and spoilsport I am at heart, I’m firm in my conviction that all sides of the debate are somewhat wrong (and occasionally right for the wrong reasons). Take this snippet from a middle ground 2018 Rand report comparing Russia and China in terms of the nature of their respective threats as a lede:

“Russia can be contained, employing updated versions of defense, deterrence, information operations, and alliance relationships that held the Soviet Union at bay for half a century. China cannot be contained.”

Take these two clips from Michael Kofman’s valuable counter-argument in WOTR regarding first the importance of quality over quantity for ‘demographic power’ and then the often assumed ‘guns or butter’ dilemma facing Russia:

“Statistics on human capital and productivity also tell a more positive story. The U.N. Human Development Index has continued to increase Russia’s rating, from .734 in 1990 to .824 in 2018. Meanwhile, the Organization for Economic Cooperation and Development shows the growth rate in Russian labor productivity as being much higher than that of the European Union. These are crude measures, but they indicate improvements in the quality versus just quantity of human capital in Russia.”

“So far, this prediction is not coming true. Russian resources are not particularly scarce, and it’s unclear what “geopolitical potential” has been bleeding away.

Finally, take the likes of Hal Brands who well represents the core type of thinking in much of the community of academic/wonk strategists in the Washington, D.C. metro area content with the long-term decline narrative. The following title from a Bloomberg column really says it all about the incoherence of what Russia symbolizes for D.C.:

“Obama called Russia a ‘regional power.’ Thanks to him and Trump, Putin has added a new region.”

All of these descriptors and approaches basically misstate the problems Russia is facing, what the nature of decline really looks like, and while acknowledging that things like cyber and nuclear weapons create very high strategic stakes (and problems) for any approach to ‘Russia’ in policy terms, none of these attitudes about Russia’s role in the international system ever seem particularly intent on scrutinizing what US (or western) interests actually are or the relative merits of what’s ‘gained’ geopolitically.

I’m particularly bothered by the deterministic approach to demography and Russian national power that takes de-contextualized measures of human capital as a proxy for improvement of ‘quality’ without addressing the growing level of dysfunction and disarray in Russia’s economic governance and non-military and security institutions. If you look closely, there’s a growing economic crisis linked to the defense sector’s continued over-sized share of GDP in spending terms amid what are unnecessarily stringent austerity measures in many cases. One has to read the business dailies.

Today, Vedomosti announced that the Optron-Stavropol’ aviation plant might shut down by April 1 due to a lack of orders. Last year, the plant scraped by on 94 million rubles ($1.27 million) of orders for engines and system components used by both the military and civilian aviation. Military orders accounted for roughly 95% of its portfolio and since 2016, the ownership have known that the plant would have to close after 2020 if it didn’t land enough civilian orders. This goes to a huge problem facing the broader defense sector as more and more productive capacity is, at least in principle per policy directives, directed towards dual-use production for both military and civilian consumers (though this has been intended to mean the creation of civilian subsidiaries rather than colocation of production for both at single factories or complexes). But civilian demand is weak at best thanks to austerity, which really means that defense companies are likelier to end up simultaneously taking up more market share since they’re effectively subsidized with guaranteed demand for military products (that they might markup in price) while creating loss-making or stagnant ventures that are less competitive, less efficient, and lower tech than western peer production. Attempts to expand civilian production at existing military plants make for terrible industrial policy if consumer demand is permanently constrained since it’s yet more import substitution increasing relative costs for consumers who have have not seen material improvements in spending power or else declines for most of a decade. Resources are scarce in Russia because of its own economic ideology and policy choices, not as a result of a declining population, but particularly because of a lack of aggregate demand.

Consider the systemic failure to adequately support innovation across the Russian economy including its defense sector:

Investment in capital assets (including IP) in Russia was 71% that of what it was in 1990 — I’m assuming this is compared to the Russian Republic within the USSR, but even if it’s the Soviet figure, it’s not unreasonable to expect that the Russian economy could, over 30 years, grow enough to match or exceed 1990 spending levels. In % GDP terms, investment fell over the course of the last decade hitting a lowly 15.6% last year. Science financing from the budget is under 0.5% of GDP now. The number of researchers employed across the economy has actually fallen over the last decade, which might show up as an improvement of human capital productivity, but is clearly a net drag when you have a workforce that’s diminished by 4 million in a decade and have every incentive to try and automate as much labor as possible as fast as possible to better preserve standards of living for pensioners and older Russians. Finally, patent issuances per 10,000 people were actually declining after 2015. So no, these human capital improvements, captured by aggregate measures at a high level, don’t capture the nature of decline since they correlate to net declines in real income and, for many, real wages over the last decade from 2008-2013 highs. In fact, they just represent the workforce doing more with fewer workers as the economy has stagnated without producing any growth. As a final aside, I’d add that the success of the expansion of military enrollment probably says as much about the lack of good jobs in the economy and fact that most net job creation by sector since 2014 has been lower-wage and offset by increases in freelancing as it does the success of recruitment efforts (not unlike the US, though recruitment drives generally struggle when manpower needs surge). The truest part of the argument that Kofman and similarly minded specialists make is that it’s quite difficult to register the ‘geopolitical losses’ that have stemmed from these economic and demographic factors. That’s where Brands and the notional obsession with ‘containment’ meet these underlying problems of political economy that those resistant to decline narratives seem to miss.

It’s impossible to separate the economic dimension from the security/affective dimension what Moscow ended up doing in Crimea and Donbas. The Eurasian Economic Union, I’d argue, was doomed from the start insofar as Russia refused to make itself the central “consumer pole” within it, instead preferring to pursue shared external trade policies with ad hoc harmonization and norm setting etc. between members, but it was unlikely to provide significant economic or geopolitical benefits without Ukraine’s membership. Take the industrial relationship (World Bank data) and employment in industry as % of the workforce:

Ukraine actually had a net underlying trend of manufacturing growth that would have only ever been possible to sustain selling to the Russian market, while the Russian decline reflects the weird mix of the effect of resource dependence and services growth that accompanied first the commodity boom and then stagnation with weak demand. The loss of Ukraine was the loss of the most important market in Eurasia for the purposes of more competitive integration — this integration would have also been subject to subsidized natural gas prices for Ukrainian industry. Though Crimea was ‘gained’, the following sanctions regime and efforts primarily by the Ukrainian military (and then western partners to increase their links via armaments and training) contained worse from happening as did the relative caution of Moscow when it felt it had achieved what it wanted to. Even if Ukraine ends up forever stuck in political crisis trapped in a halfway house just outside the EU, Russia lost a great deal. Syria and the Middle East, however, are the more interesting Rorschach test for what these analysts claim when it comes to Russia’s apparent ability to frustrate US policy.

Russia never replaced the US in the Middle East. The fact that the unilateral application of US sanctions on Iran in 2018 was cheered on by the Gulf and met no effective resistance from external powers is proof enough, never mind that net US troop deployments to the region actually increased under Trump. Russia’s intervention in Syria did not, in any appreciable way, disrupt or challenge US interests unless one assumes the premise that removing Assad from power and picking sides in the Syrian civil war was actually in the national interest uncritically. The US could always have contained ISIS and Al Qaeda in Iraq and allowed combatants in Syria and neighboring states to fight it out, nor was the supposed moderate opposition ever organized enough or violent enough to prove a viable force. In practical terms, American interests in the region are relatively secure with a limited footprint. Oil markets are fairly safe on the whole, and in the case of massive disruption, the US has the resources to mobilize quickly. Beyond that, stability isn’t exactly improved through the persistent use of force without substantial limits. Russia’s, however, require an expanded one.

Since 2015, there’s an obvious emergent political economy of Russian engagement across the Middle East that becomes all the more pressing, not just because of oil, but because of its self-imposed domestic resource scarcity. The expansion of Russian crude oil sales to China corresponds to increased trader activity lifting crude volumes from Iraqi Kurdistan and Libya to meet European customers’ contractual obligations. Further, Rosneft in particular acquired majority ownership of crude oil pipeline infrastructure out of Iraqi Kurdistan to Iraq as well as stakes of natural gas projects in Egypt and an oil products terminal in Lebanon while working with the Qatari wealth fund to sell off shares and raise budget money as an attempt to break “sanctions blockade” while also expanding Sechin’s role in executing/setting foreign policy. The sanctions make future investments in Iraqi projects particularly attractive since Trump denied Russian firms the ability to invest into Iranian projects on top of the residual mistrust between Iranian political elites and its oil sector with counterparts in Moscow over ownership of strategic resources. And on top of this, marginal increases in Russian wheat exports correspond to higher wheat import needs across the region as populations grow, making Black Sea exporters — Ukraine as well — more attractive for import needs. Since the agricultural sector is increasingly important to maintain the balance of Russia’s current account, which then finances its stagnant coalition of budget dependent industries and political elites and pensioners benefiting from deflationary policy, the region becomes more important for state-to-state contacts and sectoral investment constrained by weak domestic business activity. In the case of Syria, Russia had to act to avoid losing its only toehold for an Eastern Med base. In the case of Libya, Rosneft has reportedly been willing to invest into future production depending on conditions on the ground, all the more important given sanctions and the lack of attractive greenfield investments in Russia limited now primarily to Vostok Oil in the Arctic, which will end up costing the budget billions of dollars in foregone revenues. As in Syria, Libya was largely tangential to US interests and no one can meaningfully articulate what they are or why the US is needed when European nations are capable of acting on their own. All of this comes on top of the obvious reality that managing oil output with Saudi Arabia has become a necessity for Russia’s budget, macroeconomic policy, and stability.

So the argument about Russia thwarting American ambitions beyond its ‘region’ is quite flimsy on closer inspection. There is little substantive argument that Russia is willing, even if able, to do more and the United States can always just get smarter about its aims while the evolution of the oil market post global financial crisis and Russia’s turn towards economic sovereignty created substantial pressures beyond the considerations of power politics or basing access to be involved. But every security engagement entails a use of resources, even if limited in nature, and public support for deployments is an issue that the Russian political system has to manage differently than competitors like the US. For instance, as of last March, 39% of Russians supported current Russian policy in Syria with 43% saying they thought things were getting worse. It’s not an existential problem for Putin. But legitimate military action is a tougher sell if people are getting poorer. He can’t exhort them to go out and shop. Put another way, the expansion of Russia’s aggressive foreign policy moves and use of force reflects its economic weaknesses and decline and hasn’t proven it can really thwart the US as much as is often claimed. It can’t be ignored by any stretch. But the debate about ‘power projection’ — an overladen term stretched to mean whatever is convenient to an argument — is sorely lacking in nuance. Russia’s short-game is its long-game. That doesn’t speak well of Russia’s power prospects.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).