Top of the Pops

In the waning days before the election, the Trump administration is doing a great deal to further lock in its trajectory for US-China relations. The State Department has authorized a potential $2.4 billion sale of Harpoon anti-ship missile systems to Taiwan and just signed a Basic Exchange and Cooperation Agreement (BECA) with the Indian government to formally deepen defense ties. China’s transition to a registration system for IPOs rather than one requiring regulatory approval has triggered a new wave of them as investors flee to certainty, assuming that China’s economic performance is sign of more growth to come. They’ll be in for a nasty shock when they realize just how much debt is now needed to generate a single % point of growth in the Chinese economy and how weak external demand looks…

What’s going on?

The government is now working out how much regional debt to forgive for credits offered to realize investment projects. As of now, the idea is to calculate debt forgiveness based off of expected federal tax revenues for the last budget year and then mandate that the amounts forgiven be used to invest into infrastructure that would support said investment projects. MinFin is demanding that special legal vehicles be created for the realization of new projects under the scheme “to simplify accounting,” but anyone who knows the vagaries of the Russian legal system knows that in practice, that would create another legal rent that will privilege whoever has the best access to administrative resources in a region. Mishustin’s warning that by 2025, infrastructure investment will fall short of Russia’s needs by $124 billion, and that gap will only grow. At least there’s an impetus to get money sunk into projects.

Business investment’s recovery is in question given the overall economic climate, and the Duma’s Center for Macroeconomic Analysis and Short-term Forecasting breakdown shows that recoveries are uneven:

Title: Dynamics of the Component Index of Investment Activity, seasonally-adjusted

Purple = Manufacture of machines and appliances for the domestic market Beige/Green = Supply (production + net imports) of construction materials Blue = Import of machines and appliances

Domestic manufacturing is slightly up thanks to a weaker ruble and the fall in foreign currency earnings from exports. But the underlying supply and demand dynamics don’t hint at better news in 4Q. September stats had investment down 4.2% in year-on-year terms and down 7.6% in 2Q per data from Rosstat (there are delays in the data release it seems). My question is how is this possible? Most likely, the answer is simple: investment has been so weak outside of extractives that there wasn’t as much to fall, bigger companies are propping it up, and the investment climate broadly was pretty grim last year too.

Payments using QR-codes using the Faster Payments System rose 214% between September and October per the Central Bank. Seems that Russians like the ease of payment and minimal transfer costs regardless of which banks hold their accounts. The system is doing its job - lowering transaction costs and improving financial services in a manner that supports consumers. It’s a rare unmitigated success story, and one that undoubtedly will help lift consumption in the aggregate in the coming years by improving financial inclusion.

The State Council is now laying out its plan as the formal institutional go-between for the federal center and regional governments coordinating policies to achieve that National Goals for 2030 into a unified national policy plan. It’s notable that they intend to try and soften MinFin’s demands on regional budgets and spending oversight while business is eager to see the moratorium on some regulatory inspections extended through 2021 as well as subsidized SME loans expanded. Given the council’s new and only just been legally stood up this year, the fact that it’s oversight powers are being expanded to include federal norms, regulatory acts, anything that touches on budget revenues suggests that it’s a more serious option for a potential post-Putin managed transition scenario (but little point in reading the tealeaves further than that at this point).

COVID Status Report

Russia confirmed a record 320 deaths from COVID-19 for October 26 and 17,347 new confirmed cases. The real story is that the numbers are not being driven by Moscow and its wide array of commuter towns. The following shows total number of cases since March in a time series:

Black = Moscow Red = Russia Blue = Russia w/o Moscow

Though Moscow’s measures may have a positive impact on the caseload, the aggregate increase is now a story about regions that often have fewer jobs that can be done remotely and nowhere near the same capacity to manage and enforce lockdown procedures as in Moscow. It’s also clearly a risk for the stability of the regime’s political cadres in the regions if people aren’t careful. Yesterday, Duma speaker Vyacheslav Volodin briefed Putin that 38 Duma deputies have been infected, 1 was in critical condition and care, and 1 had died. The governors of Irkutsk and Kemerovo oblasts reportedly are infected and recovering at home, though they feel fine for now. Failures of public policy can become serious personnel problems quickly if this wave isn’t brought under better control soon. Just ask the health minister from Rostov oblast Tatiana Bykovskaya who was forced to resign after a scandal involved botched treatment for 13 patients infected with COVID who died. Russian leaders aren’t the healthiest bunch at the best of times. Rospotrebnadzor has instituted a nationwide mask-wearing regime this morning for places of mass gatherings and heavy foot traffic. Hopefully it helps.

Que Dollar-es

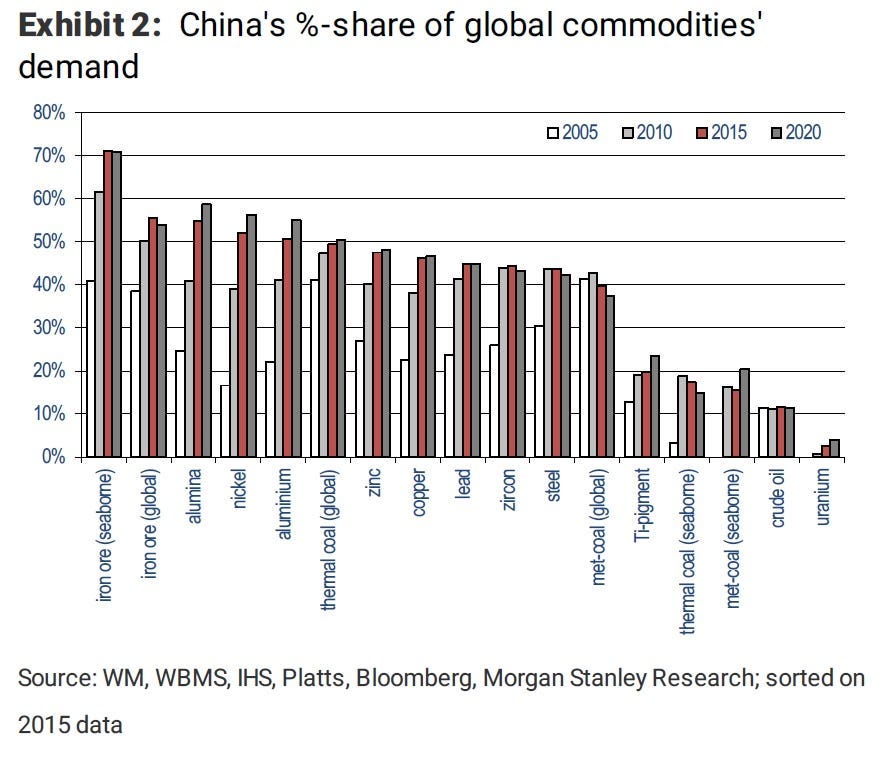

Looks like some in Moscow are are hoping to take the next step working out their de-dollarization strategy between China and the Eurasian Economic Union in a quixotic attempt to reduce their exposure to US sanctions and financial power, exchange rate volatility, and to divide Europe from the US. On its face, it’d be a big development and a risk for US economic power, but it’s clearly a political puff piece aimed at pleasing an audience. Still, it’s worth taking a dive in given that China accounts for about a third of global commodities demand.

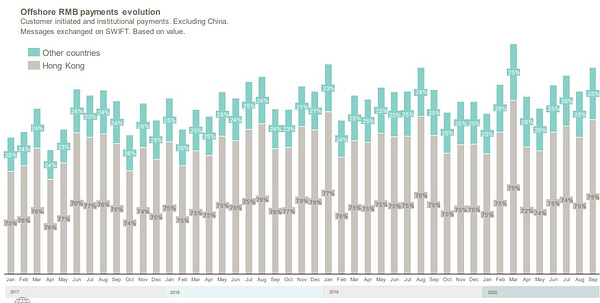

First, let’s note just how few foreign businesses want to use the RMB in their own transactions. The RMB came in 5th among world currencies for use in international transactions for August at a whopping 1.97%, actually near a 1% decrease from 5 years ago:

Until there’s true capital control liberalization in China and evidence that the PBoC really wants to let the currency float, the mix of lower levels of currency liquidity and politicization of the exchange rate, while offering some stability, isn’t going to be a draw. The argument mentioned in the piece - that de-dollarizing would somehow reduce exchange volatility exposure - is nonsensical. What they’re really saying is that China’s exchange rate is politically determined and heavily managed, but the management of the exchange rate would become impossible if the RMB were to truly internationalize and the US dollar is relatively steady when it enters periods of appreciation or depreciation against other leading currencies. Most importantly, the economic factors and policy inputs driving the value of dollar are accessible and pretty much transparent. Given investors have dropped their interest in Russian sovereign debt, it’s hard to imagine someone in a boardroom anywhere in Europe thinking “damn, if only we’d held more in rubles.”

Currency internationalization and commodities markets are deeply intertwined. The dollar’s increased prominence after the collapse of Bretton Woods in 1971-73 was aided greatly by the Saudi agreement to invoice oil exports in US dollars in 1974 and the internationalization of Arab banks managing currency transfers between foreign national currencies into dollars, which would then be recycled through imports of USD-denominated arms, purchases of US treasury bills, foreign investments, sit in foreign banks, and in many cases help manage a fixed exchange rate pegged to the dollar. Until the shale revolution, the US was the world’s leading oil importer, which obviously reinforced the use of the dollar for invoicing. One would expect that shifts in commodity prices and currency invoicing could, in theory, shift the balance of the internationalization of currencies. This is a projection used in a Business Insider piece from 2017 since I had trouble finding a quick hit on China’s net share of commodity demand for the world’s biggest commodities, but this gives you a good visual sense of its pull on the market:

The US dollar’s draw, however, is secure because of its liquidity and the confidence that the Federal Reserve has built up with businesses, investors, and markets as a lender of last resort. This year, foreign issuers have issued over $1.2 trillion in dollar-denominated debt. Russia’s not even willing to take a bigger risk issuing its own sovereign debts. Any increase in ruble-use is likely to be driven by country’s dependent on commodities in Central Asia looking for a deeper financial market nearby with a currency that tracks similarly in exchange. But every change in currency invoicing for commodities is bound to then lead to new transactions costs and currency risks for banks, businesses, and consumers. From the World bank on the contribution of permanent and temporary shocks vs. business cycles and medium-term investment cycles to commodity price variations:

It’s not that clear given the image came out a bit too small, but the larger takeaway is that permanent shocks can have a huge long-run impact on price variation (ostensibly creating greater price stability). Interestingly, crude oil is more affected by such a situation than natural gas per the World Bank study. But nickel, platinum, urea, zinc, and natural rubber all come closer to natural gas than crude oil in terms of the structure of what creates price variation. Price variations always interplay with exchange rates, which it should be noted that Goldman Sachs thinks is looking like a bull commodities market for 2021 thanks to inflation fears (not sure what kind of inflation they have in mind…) and a weaker US dollar given the Fed’s massive monetary easing. I’m less convinced than the guys who get paid to handle the transactions they’re promising will materialize, but hey, that’s just me.

The structure of push-pull factors for a bull market seem to be changing in real time due to real resource constraints, unexpected shifts in consumer preferences, and more. Massive expansions of mining investment are needed - Wood Mackenzie estimates that $1 trillion will be needed for metals production by 2035. I think they’re selling it short, and don’t have anyway of knowing just how crazy this market could look in a few years time, but that’s a good snapshot, and also worth noting that it’s a much, much smaller total than you’d see for oil & gas investment forecasts. If de-shoring production chains from China becomes more of a business reality for firms trying to relocate their export capacity - most businesses aren’t going to give up on trying to sell end products to Chinese consumers - there could be even less space for the RMB to feasibly challenge dollar dominance as production dependent on commodities becomes less concentrated on the Chinese market and its relative share of commodity demand declines, leading to a greater heterogeneity of producing markets and national currencies. It’s also going to face some new ‘permanent shocks’ that are only now becoming apparent. Automation could well end up being the next frontier for commodity input costs, but that’s for another day.

Talking up de-dollarization is a sign that the domestic markets that should be promoting ruble or national currency use aren’t looking so hot for business. The EAEU portfolio in Moscow is a mess ever since Anton Siluanov took it from Igor Shuvalov. Don’t expect any breakthroughs any time soon.

C2 It

Looks like Rosneft’s cutting its max production outlook for Vostok Oil from 100 million tons annually to 50 million tons annually (about 1 million barrels per day) in a clear sign that they’ve oversold the field’s reserve potential and have to signal intent to work within OPEC+ parameters potentially for years and years. Still, it’s an insanely big undertaking and one that conceivably could replace the aged production base in Western Siberia. But if the tax breaks development entails exceed those for depleted fields, it’s just going to end up hurting revenues and lead to another showdown at high noon with MinFin looking to increase the tax burden while cross-subsidizing investments into the Northern Sea Route - Rosneft wants 30 million tons of oil annually to transit the route once the field reaches peak production.

There’s a new push on from MinPrirody to rework its geological exploration strategy to handle mine depletions and greenfield investments. The sector is convinced there’s about to be a bunch of budget money wasted without helping anyone. Neither of these two stories is much a surprise. But they’re a matter of great concern when unpacking the geography of investment into commodities production globally. Take oil. Per IEA estimates, net investment into oil production is still significant, particularly since more of this money is going into efficiency improvements even if cost cutting opportunities are more limited than in 2015-2016:

Russia’s higher net costs are managed with a weaker exchange rate and preferential access to credit, but the new priority commodities in the metals/mining sector, like oil & gas, are affected by seam quality, distance to market, and more. Lower fuel costs for transport also reduce the relative price differential spread on a netback basis for any importer. Russia’s been pretty bad at managing geological exploration for a very long time, constantly going back and forth between trying to get companies to foot the bill and the state to do more. That’s going to matter a great deal more in the next decade with an uncertain demand outlook for oil and rising metals and mineral demand.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).