Top of the Pops

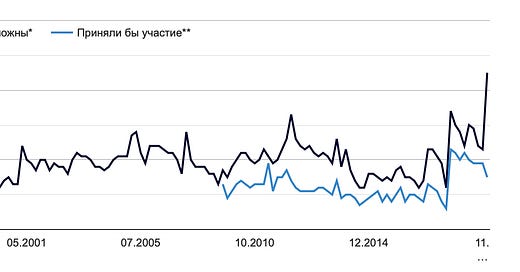

The Saturday arrests of municipal deputies and opposition figures, led by Ilya Yashin and former Ekaterinburg mayor Yevgeniy Roizman, gathering for a conference of “United Democrats” was just the latest escalation of the state’s expanding use of coercion and outright repression to quash all organized non-systemic opposition ahead of the September elections. In total, 193 deputies, members, and journalists were arrested at Ismailovo aptly located by the Partizanskaya metro station. Some of the journalists were allowed to leave later on. Roughly 140 people are being charged with administrative violations linked to the ‘activity of undesirable organizations.’ Moscow May Sergei Sobyanin’s office leaked that the FSB planned and launched the action, not the Moscow police. The gamble that the FSB and regime are taking is easy to discern. Levada polling shows Russians now think that protests with political demands are marginally more likely than protests with economic demands (dark blue), but January-February numbers already show more people stating they wouldn’t attend them (light blue):

The show of force is meant to ratchet up the paranoia about any gathering of opposition figures or those friendly to the opposition without a legal record or membership of an organization registered as a foreign agent and those already on watchlists. It doesn’t matter if everyone thinks protest is likely (or even called for) if they’re too afraid to leave the house and go to one. Levada’s overview of the state of civil activism in Russia from October highlights how risky this strategy is in the longer-term. 25-35 year olds have been ‘radicalized’ to the extent that they increasingly see that the regime isn’t delivering for them, while the youngest Russians just entering the workforce or still in school but working are likely to have been particularly hard hit by the pandemic’s effect on lower-end service sector jobs and household spending. The number of people saying they’ll vote for United Russia — note this is different than actively supporting them — has fallen to 42% with little evidence the downward trend will stop, especially with inflation still hitting households hard. The fate of elections in September is coming down to a massive gamble on the power of the state to use excessive, repressive force in advance of them while providing Putin space to offer a kind helping hand with a later spending bill. It’s effective at preventing outside challengers to systemic parties, but the nature of problems in the economy is such that we’re not far from seeing new forms of repressive measures to induce businesses to make things better. Coercion is becoming more normalized throughout the system, even if in the case of economic matters it doesn’t (yet) entail mass arrests and often comes with some sort of inducement like a tax break. ‘Who next?’ is the obvious question, but I’m more interested in Sobyanin’s decision to subtly distance himself from this latest mass arrest. It could well just be that he doesn’t want to be seen as cracking down on deputies with a long track record of locally organizing and some local support. But if local authorities elsewhere want to maintain credibility by not appearing to target independent municipal deputies or organizers, they’ll try to shovel the blame onto the FSB and the federal government. That eventually creates a new political headache for Moscow if locals begin to blame repression on the center explicitly while expecting to see more political independence reflecting their preferences at the local level.

What’s going on?

MinTsifry is planning to expand existing regulatory requirements for the inclusion of domestic software/production in smartphones to mandate that manufacturers download a domestically-produced search browser into all smartphones on the Russian market. Smart money’s on Yandex lobbying for the change to capture yet more market share and force Google to find new sources of revenue in Russia. The new proposal should be put to the government in April with the aim that by July 1, Russian consumers would have the option to use said Russian browser (clearly Yandex, but also Mail.ru) by default on their smartphones. What’s funny is that this was the actual aim of the existing regulatory framework, but it failed to account for the fact that producers could only tweak these settings when the phone was being activated, such that the user could immediately change them back or however they pleased. Yandex is deploying the Silicon Valley playbook and telling the press they want consumers to have choice while fighting to lock in their market share. It’s another manifestation of import substitution and efforts to indirectly subsidize Russian firms, but also something to watch given the state’s interest in expanding its ability to monitor digital communications and leverage data collection to head off social unrest in the regions.

A new report from the Higher School of Economics for the WHO shows a useful breakdown for what affected GDP growth during 2020. Whereas the 2008-2009 shock was a disaster for fixed capital assets, virtually all of the pain was felt by the population last year at a level not that dissimilar from 2015:

Title: Components of GDP in past crises, % Cyan = households Black = the state Orange = fixed capital assets and reserves

The hit to households pulled GDP down by 4.4% last year, while we can see that compared to prior crises, state spending did actually do more to lift GDP. What’s more striking is just how little state spending did for GDP isn past crises and the low base it’s working from, evidenced post-2015 by the relative increase in the salience of budget spending for the allocation of capital across sectors, whether that be procurements, direct investment planning, or other less direct means. The contraction of imports from the OPEC+ deal and oil price shock last year saw the greatest drop in exports since 1996 vs. 4.7% in 2009 while imports dropped 13.7%. The relative shock to households has clearly been massive compared to recent benchmark ‘crises’ and it’s evident that the additional social spending support package, buried for now, is unlikely to be large enough to offset losses without broader recovery in economic activity because of the extent of inflationary pressures. I’d say there is no plan B, but it’s not clear there’s a plan A at the moment.

One of the side effects of Russia’s export sector dependence driving its current recovery in place of any domestic spending plan or boost to consumer demand is that the rise in oil prices has triggered an increase in the outflow of capital from the private sector into foreign assets. The surplus in the balance payments, $6.8 billion in January, fell to $6.3 billion in February despite a 12.7% gain for Brent oil prices. The expectation was that the monthly surplus for February would show a $1 billion gain rather than a $500 million loss. The net flows of capital out of the country, however, are lower in relative terms for Jan.-Feb. 2021 than in 2020 — $12 billion total vs. $14.7 billion which has eased pressure on the ruble. The bigger takeaway is that while Putin harangues business to invest at home, he seems blissfully unaware that the relative volumes of money headed into foreign assets — crucial to offset a current account surplus — is as much a result of low domestic spending as anything else in Russia structurally. Foreign assets in practical terms are also attractive when they offer better returns in safer legal regimes that can’t be accessed by the state. The bump in outflow for February therefore signals a lack of investor faith in the domestic market and the strength of Russia’s economic recovery, which shouldn’t surprise anyone. Russian corporates prefer to sink money abroad cause the returns are better, especially with the US ripping into high-gear growth with a possible infrastructure bump on the way later in the year as well. It’s also a fitting dynamic given that most of the rise of values on the RTS reflects rising oil prices too, not sudden confidence in domestic growth. The Central Bank is watching this closely alongside fears that higher inflation will persist.

Russian banks have spotted a serious conflict of interest problem for the Central Banks “know your client” anti-money laundering initiative: the regulatory body proposed by the Central Bank would simultaneously oversee which businesses are placed into which risk categories while also monitoring and interfering in anti-money laundering policies at the bank level. It doesn’t take a master of the dark arts of Russian finance to recognize that things get very complicated for risk management when the body overseeing these financial risks becomes an active component in risk assessments for bank clients. Worse, the Central Bank would host the body receiving complaints about the process, in effect ‘overseeing itself.’ The National Financial Market Council is lobbying (again) after failed attempts to change the law when it passed through the Duma late last year, asserting their clients’ constitutional rights are threatened by the creation of what would effectively be a new legal mechanism deciding guilt without any check or balance. Further, the current law has a very broad definition of ‘doubtful operation’ that goes beyond money laundering. This might seem like a highly technical matter (and it is), but it matters a great deal how these legal instruments are elaborated and codified given the regime’s new need to find sources of capital for large spending programs it refuses to finance with deficit spending or else can’t as easily finance with new tax increases.

COVID Status Report

New cases came in at 9,487 with reported deaths at 404. Doctors are still fighting with public distrust of vaccines arguing that a renewed rise in cases come the fall can only be avoided by significantly increasing the take-up of the vaccine. Most of the COVID news for Russia, however, comes on the international front. The surge of inexplicable AstraZeneca skepticism across much of the EU has made way to broader talk that the bloc will negotiate with Russia over production of Sputnik-V building on the efforts of individual countries such as Hungary and Italy. The word comes just 2 days after the US, Japan, Australia, and India — the security and economic grouping known as the “Quad” — announced an ambitious plan to produce 1 billion doses in India by 2022 backed primarily by American and Japanese capital and pharmaceutical firms. Russia’s certainly maneuvered adroitly to offer help to other nations in need where possible, but it remains to be seen if it can match the productive capabilities of the US and other western nations once they get their footing. For instance, if vaccine skepticism was as big a problem in the US as in Russia, then a huge number of vaccines would be available for export under the right logistical conditions. The new timeline to offer vaccines to all American adults by May 1 will accelerate pressures on Russia’s vaccine diplomacy, especially the longer Russia’s domestic failures on that front weigh on economic recovery and the political climate for the September elections.

Hostage to Rate

It looks increasingly to be the case that the Central Bank will have to hike rates sooner rather than later, and perhaps by more than expected in order to get the current inflationary surge under control. The comparison of CPI for food vs. topline CPI from bne intellinews tells most of the story:

Given that Russians spend, on average, around 30% of their income on food, the current trend actually goes back all to November 2018 when oil prices spiked upwards of $80 a barrel and has persisted since, save during the initial oil price crash after COVID hit China. That’s worth unpacking, but for another time. The simplest, most direct tool the Central Bank has available to kill inflation is to make the cost of borrowing more expensive and, therefore, pull money and activity out of the economy. Doing so in the middle of a recovery from last year’s slump while oil prices remain higher, there’s very little evidence of a consumer recovery, and it falls to the government to talk about a new investment cycle without effective demand would choke off growth and worsen the losses seen from last year. Oil prices pass through into core inflation more strongly than in many developed economies since it’s such a large part of GDP, domestic intermediate demand, export earnings/bank sector stability, and the energy sector still buys large volumes of foreign service and goods imports whose pricing reflects market tightness. If we buy the bull market oil price case (I don’t for long, at least), then the better way to manage that aspect of inflation is to break OPEC+ cuts the moment it seems demand is recovering. That can’t happen for awhile ahead, so there will be persistently higher inflationary pass-through without as much domestic industrial demand cause of output cuts. What worries me more is the consumer recovery and the structure of the economy given current inflationary pressures.

Take the following % sectoral breakdown of GDP from the Higher School of Economics covering 2011-2019 so we can see the pre-crisis years and effects of post-Crimea sanctions and the oil shock of 2014-2016 on a longer time table regarding state policy:

Grey = agriculture, forestry, fishing etc. Yellow = resource extraction Blue = value-added production Magenta = construction Darker Red = knowledge-intensive services Clear = other services Purple = high-tech production share of GDP

Pre-COVID, extraction’s share of GDP was rising and the marginal gains for value-added production largely correspond to investments into refining capacity for natural gas and petrochemicals as well as modernization efforts at oil refineries. Despite some marginal improvements for diversification, the reality is that the economy entered COVID more dependent on extraction for GDP than in 2014-2015. Why? Simple. Austerity policies killed growth in other sectors such that extraction grew faster in relative terms than the rest of economy after the initial recession and devaluation shock, the latter of which should have theoretically allowed for more opportunities to localize production and export manufactured goods. That can actually strengthen the inflationary pass-through effect not just from oil, but from metals, minerals, and precious metals extraction as well as agriculture (as we’v seen) as commodity prices rise. It’s important to keep in mind that inflation isn’t a universal, unitary phenomenon, rather coming from different types of market imbalances. I’ll come back to this point in a moment.

The outlook gets worse factoring in economic complexity ratings and Russia’s share of global trade. The following is from the same report:

Shaded Blue = export of goods/services, % world Red = tech-intensive exports requiring highly qualified labor, % world Yellow = tech-intensive exports requiring mid-level qualified labor, % world Blue Bubbles = Russia ranking economic complexity

The economic remained less complex in relative terms globally than it was in 2006 as of 2018, a ranking that may have moved up slightly but not changed significantly. The problem here is that Russia’s exporting sectors where it finds its competitive advantages are often vectors for inflation and it could best address topline inflation by more successfully developing other sectors. This is particularly true for wheat and other grains, whose price increases are contributing significantly to food CPI right now. The problem with the rate hike approach to solving the problem of inflation is really that it’s intended to destroy demand to reduce the demand for money now driving inflation. It would begin do so with a likely small, .25% rate hike in April so as to “anchor” inflation expectations and stop them from becoming a self-fulfilling prophecy i.e. companies keep raising consumer prices because of the expectation that costs will keep rising. Unfortunately, monetary policy can only do so much to fix the problems now concentrated in food prices. It’s ultimately better suited for other types of consumption, such as housing where the cost of credit has a significant impact on consumer demand. Take the housing price increase between spring 2019 and year end 2020 for Omsk, the regional leader for housing price inflation coming into 2021:

That’s a 37.8% increase between April 2019 and this February while we know that real incomes have net declined over the period. The surge in prices is obviously linked to state-subsidized borrowing, which even marginal increases in the key rate can affect by increasing costs for other forms of credit and discouraging people now taking risks and buying from borrowing per the existing program. Doing so, even slowly, will begin to harm the construction sector, which accounts for 5-6% of GDP, and spillover into related types of product consumption like car sales where consumers often borrow to buy. The volume of overdue consumer credits surged 23.5% last year. I wager you’d see a much larger pullback for those types of consumption and fast since the rate hike doesn’t just anchor inflation expectations, but can also expose the pitfalls of risky lending and accelerate a tightening of credit conditions depending on how bad the consumer economy is — I admit it’s quite difficult to know because of how Rosstat constantly changes methodology and the large share of the population who’ve done fine by the existing support measures.

Food is a different animal. Everyone has to eat. Demand for basic staples isn't dependent on access to credit since they aren’t a luxury or something you can defer till you feel more financial confident. The implicit assumption among Russian policymakers is always that inflation is primarily a monetary phenomenon and one that can be managed on the supply side — I’d argue a logical consequence of the explosive inflation witnessed on black markets at the end of the Soviet Union’s existence and in the informal sector in the 90s when the state’s capacity to effect monetary policy was often quite limited. It may well remain the case that the informal sector in the Russian economy adds a great deal of ‘inflationary drag’ i.e. parallel markets, often broken in some manner, that drive up prices and affect inflation in the formal sector. But when it comes to food prices, a rate hike does nothing to help the problem because it’s ultimately a supply/demand balance issue, and one that along with Russia’s other leading export sectors, is heavily affected by global price trends that also reflect the balance of investment into production over longer cycles. A rate hike tamps down demand elsewhere in the economy, sure, but it’s just as liable to weaken employment and wage gains at the margins, particularly for the sizable population that freelances full or part-time.

The end of all this is to say that there’s little reason to expect a rate hike to help with food price inflation since price controls have become the go-to policy instrument. Price controls generally lead to underinvestment into productive capacity thereby creating shortfalls and product deficits and worsening inflation. The Central Bank’s success reining in inflation across the Russian economy has had very little to do with its competent management and mostly to do with the deflationary effect of stagnation and falling incomes. The shortfall of aggregate demand in the economy pressures prices downwards, making the monetary policy aim of 4% inflation more manageable. But there is no lack of demand for food and the market management response from the government is likelier to make it worse than better. While the US and developed economies look forward to holding rates down indefinitely so that recovery can get underway, Russia risks weakening its already tepid recovery by raising rates to insulate itself from the price effects of a global commodity price cycle. Every time this happens, the relative salience of the extractive sector only grows, then worsening the pass-through effect of commodity price levels on levels of investment and intermediate demand into other sectors of the economy.

This dynamic is one of the reasons I’m so skeptical that Russia could conceivably benefit from global warming, particularly for its agriculture. The argument often goes that the expansion of arable land is a net boon for Russia as it can competitively produce more and export more, thus enriching itself. What these assumptions ignore is that losses of arable land elsewhere and stress on food supplies would inevitably create more inflationary pressure globally, and feedback into the Russian economy which, as we’re seeing, has proven incapable of addressing higher levels of price inflation for basic foodstuffs and related commodities in a broadly deflationary demand environment because its pursuit of stability generates persistent instability, stagnation, and falling investment levels and incomes. 2020 saw asset owners make out much better than households and individuals still renting and without too much in the way savings. Nothing’s been done to address this gap during the recovery, and all signs point to an anti-inflation monetary policy response that will harm the real economy’s recovery because of the quixotically spendthrift fiscal policy approach the government and presidential administration have taken. We won’t know what the Central Bank is thinking till April, but the first hike, even if minor, should reveal the underlying fragility of the recovery — and the gross miscalculation I believe the Kremlin has made about its ability to manage the economy to deliver results for September.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).