Top of the Pops

First a correction - in a rush yesterday, I mischaracterized word out on the Dixie, Bristol, and Krasnoe and Beloe merger. The merger took place last fall, but the piece was focused on its earnings/valuation this year. Apologies for the mistake, I rushed it.

Azerbaijan is throwing a hard elbow at Moscow, with president Aliyev’s aide Khikmet Gadzhiev explicitly stating that Baku does not believe Russian observers in Karabakh are necessary because of the territorial extent of its operations. Aliyev’s gamble is pretty clear: keep holding out to give Turkey room to demand a seat at the table. The more they hold out, the more they’ll want to drag Iran into talks for the simple reason that it reduces Moscow’s bargaining power and before you know it, Pashinyan’s warning that Nagorno-Karabakh is the new Syria has validity. No one will have the power to dictate conditions on the ground and the steady attrition paid in lives and economic fallout begins to take a heavier relative toll for Armenia without more expansive aid from Russia.

What’s going on?

TCS Group, the holding structure for Tinkoff Bank, has called off merger talks with Yandex with immediate effect. Yandex shares had risen 12% after the initial deal announcement to acquire the bank - worth an estimated $5.48 billion - and it seems likely the equity value on the market closing out 2020 for both firms will take a hit given limited growth prospects. The news comes just 3 days after word dropped that Sber CEO German Gref was going to leave Yandex’s board. There’s a fight on over the intersection of the new tech giants and the banking sector. Watch Sber’s next moves given it’d likely finance deals with other potential suitors, namely MTS and MTS Bank.

The IT-sector is pushing new tax breaks to accelerate the adoption of AI with MinFin, but the tax break target is technically individual specialists and not firms. The idea? Return the income taxes taken from salaries paid to firms employing IT-specialists, thus firms developing or implementing AI - the only ones eligible - could raise salaries. The change would affect about 495,000 people directly employed in the IT sector, but it makes no practical sense. Effectively, you have to create a new registration system, identify what AI actually is (and we all know that businesses will get creative with classifications), and add additional overhead for monitoring without accelerating adoption. Why publicly invest into R&D when you can create more bureaucracy to keep more people employed in a stagnant economy?

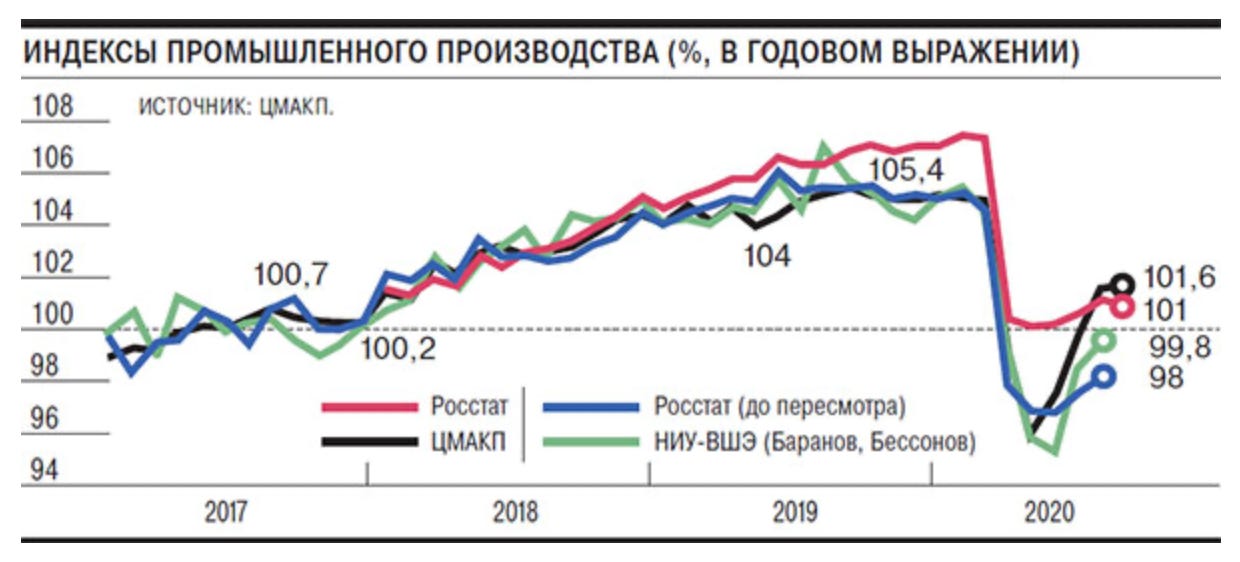

Competing data releases, highlighted by Rosstat’s latest update on industrial output as it changes methodology, all point to a new potential fall in industrial activity for small businesses going into 4Q:

Title: Industrial Production Indices (%, in annual terms)

Red = Rosstat Blue = Rosstat (before methodology change) Black = Center of Macroeconomic Analysis and Short-term Forecasting Green = Moscow HSE

Output is basically where it was at the start of 2017, and signs of recovery are weakening as lost incomes and the easing of demand backlogs take their toll. The unstated problem here is that OPEC+ cuts are a big drag on industrial output for smaller suppliers that sell into O&G supply chains. This is a failure of macroeconomic policy - saving energy service providers earlier in the year was vital, but the lack of support and stimulus into other kinds of demand is creating a long-run drag on the industrial businesses most affected by the downturn, especially since state-run or backed projects frequently don’t even communicate with SMEs about the status of their orders on time and generally cut their contracts first since they’re the least important politically for the asset owners and operators.

The Eurasian Commission has requested Russian telecoms operators to work out plans to lower roaming charges for EAEU member states on a 5-year roadmap to eliminate them entirely by 2025. The move makes good sense for Russia’s labor market given the large number of labor migrants from Kyrgyzstan and, crucially, non-member Tajikistan (which has a large migrant population coping with high mobile fees). The policy would also offer further incentives for Uzbekistan to deepen regulatory alignment with the EAEU, building on its current observer status. The Commission wants the Digital Ministry (MinTsifry) and Federal Anti-Monopoly. Service to provide data on operators’ roaming charges in member states. The fight over data and data access is going to be an interesting one for Eurasia’s halting (re)integration.

COVID Update

Graph: Number of confirmed cases of infection, darker = more cases

What’s interesting about this map? Where the highest infection totals are, and how they don’t necessarily line up with population density. If you look closely, the highest infection rates are taking place in the Kuban’ and southern Russia - the country’s agricultural breadbasket and key export earner - and in core Siberian oil and gas provinces like Yamal-Nenets, Khanti-Mansiyskiy, and Krasnoyarsk krai. Food producers have to go full tilt to meet demand, and any supply chain risks from infection are going to trigger inflation pressures elsewhere, especially since firms selling to both domestic and foreign markets are probably going to prioritize foreign currency earnings at the moment if they can. The oil and gas provinces are stuck since winter always lowers drilling activity and leads to turnarounds, but that also means a lot more people stuck in interior spaces begging for warmth. It’s not a crisis (yet), but these are going to be interesting trends to track (though winter is going to offer a reprieve for plenty of agricultural enterprises).

NatsGoaling for Columbine

National goals in Russia, like laws, are suggestions (until they’re ironclad coercive tools). The White House and Mishustin’s team are currently working through the final document and plan meant to create a unified administrative model to oversee the realization of said goals. This is an ongoing nightmare for anyone who’s job is on the line if they don’t deliver since the May Decrees from Putin’s inaugural in 2018. Putin’s decision to give Dmitry Medvedev the task of running the COVID response during the current spike from his perch on the National Security Council is basically him saying “bring out the gimp” in Tarantino fashion while Mishustin ducks and covers. Look at these TsIOM stats on public trust in leading political figures:

Title: Trust in politicians (sum of responses “total trust” or “generally trust”)

Purple = Putin Light Blue = Mishustin Red = Zhirinovsky Dark Red = Zyuganov Cyan = Smirnov Orange = Medvedev

The Russian public reportedly trusts Medvedev less than a guy who goes off on how the whole world will speak Russian (Zhirinovsky) in 20 years time. His trust ratings are less than half of those for Mishustin. Putin just tossed him a hot potato while the state fails to respond systematically to preserve Mishustin’s public rating. Dima’s a punch line to Seth McFarlane joke that never ends, but has political value precisely because is brand is toxic.

So with all the hubbub now on about a bill to improve the realization of national targets, the real question is what exactly are they in reality? Planning documents in Russia are often worth less than a Samovar in Tula: they’re basically toilet paper, the kind you find in a dirty train station stall at 3 am waiting for a transfer to Nowheresville while it’s -15 outside. It turns out the new bill is really much more about dividing political responsibilities and authority than anything else. The biggest takeaway from the latest story is that Mishustin is carving out a more formal organizational structure for how the White House actually administers implementation, thus taking the national goals from inchoate targets Putin once set out to save face publicly and promise a brighter future to a concrete lever to squeeze and reward people.

Mishustin’s rise confounded even the most die-hard Russianists when we first discovered he was the new PM. Even the best analyses amounted to a begrudging “well, he’s a technocrat” angle highlighting his success improving Russia’s tax collection and implementing tech. This looks more and more like a necessary process to establish his own political power base by giving him a means of enforcing discipline over the national goals, but one contingent on his own managerial performance as well while they use Medvedev and regional governors and figures to push away criticism over COVID-19. It’s notable that in mid-September, Mishustin was adamant that Moscow couldn’t just soak the oil companies for more tax revenues to fix its fiscal situation. He stood behind moves like increasing excise taxes on tobacco, raising taxes on the metals and mining sector, and engineering the appearance of striking a blow for equality by nominally raising taxes on the rich. As far as I can tell, he is comfortably slotting himself into a role as a future negotiator for the policies that are going to finance not just the national goals, but whatever state-led policies develop to try and stay competitive during the energy transition. He knows his tax, and he knows that every tax increase in Russia is negotiated by gatekeepers. Belousov has played point for metallurgy so far this term for Putin. I’m curious to see if the centralization of authority over the national goals ends up handing Mishustin a new means of inserting himself inside the decision curve at the presidential administration on key policy areas, including energy. With all that pressure, hopefully he still likes Mondays.

It’s Always Darkest Before It’s Totally Black

I stumbled across a rather damning data point for Russia’s COVID crisis response this morning: between March and June, 29% of Russians were forced to secure credit using Microfinance organizations. 20% of respondents from the survey cited said they were taking out loans more often than before. The hit to consumer spending was shown well by BOFIT’s weekly monitor from last week:

It’s a massive drop-off, which also highlights just how much GDP relies on external rather than domestic demand. A huge part of the problem comes down to lender expectations. Since income support was limited and the Kremlin is comfortable leaving the country’s reserve pile alone and not launching massive investment and intervention to create jobs, banks are understandably nervous. As The Bell highlighted today from an RBK report, it’s estimated that personal income losses for 2Q alone came out to 841 billion rubles ($10.8 billion). It’s no wonder that interest rates for consumer loans have not budged despite the Central Bank’s key rate cuts from 6% down to 4.25%. Incomes losses coupled with a lack of fiscal stimulus means banks are losing earnings while lower key rates put downward pressure on their earnings from the loans they can secure and make to large businesses.

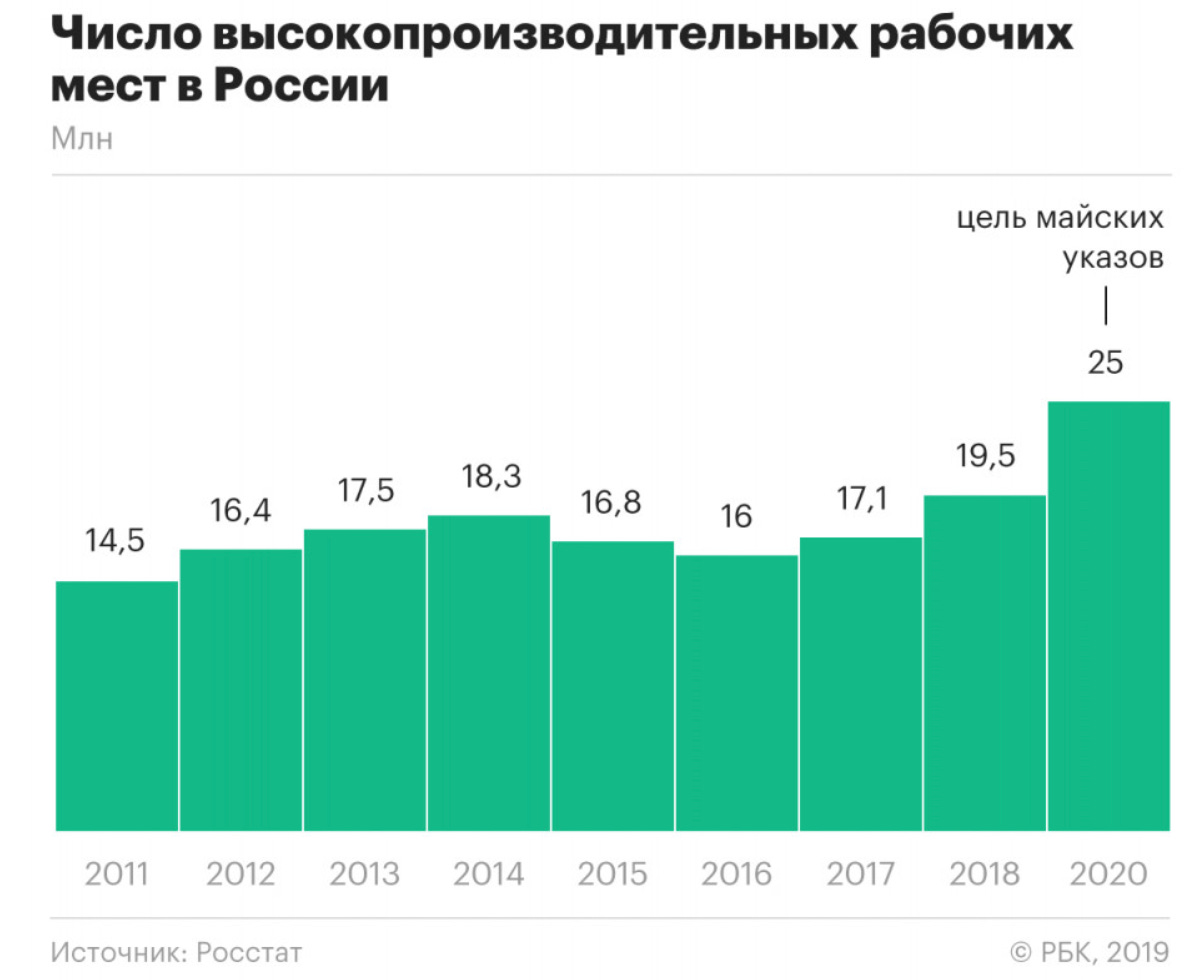

Back to the May Decrees I mentioned in the previous column, consider what Putin said Russia wanted to achieve in terms of “high-productivity” jobs - a necessary precondition if Moscow is serious about diversifying from hydrocarbon export and rent dependence:

Title: Number of high-productivity jobs in Russia, mln

Inset = Goal of the May Decrees

The decree was always ludicrous, but the irony of COVID is that all the job devastation created a window to spend reserves on investments that would support sectors likelier to achieve productivity gains. For extractive industries, high-productivity is about return on capital and number of laborers needed to achieve x amount of output. Russia’s focus on employment over productivity for the regime’s stability is counterproductive for increasing productivity in normal times. Now it’s like walking around carrying a dead cat. The refusal to shift the investment and stimulus approach creates a negative feedback loop for Russian banks. When oil prices crash or are low, credit expansion is riskier because foreign currency is always a pressure point for Russian corporates or consumers who don’t want to hold rubles. Income support enables further credit creation and demand for jobs that won’t be so exposed to the commodities cycle. But having failed that, the country’s resource-extraction firms end up sucking up more credit and resources without creating enough 2nd and 3rd order effect growth. The already exhausted economic model of 2014-2019 that came after the exhausted model from 2002-2013 has caught a third wind, and most Russians will suffer for it.

Alexei Kudrin is trying to use the Audit Chamber to show that the government’s forecasts for jobs and incomes are too optimistic. There’s little doubt Mishustin won’t listen. He’s busy managing up and down now, something Kudrin no longer seems to worry much about.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).