What’s going on?

Sources near the Kremlin reported to Kommersant that there’s no plan to move up the next Duma elections earlier than next September. Avoiding the appearance of rocking the boat and creating openings for political competition in the middle of a crisis is understandingly a no-go. Back in spring, many were pushing to hold them in September 2020, but Gennady Zyuganov of the KPRF was reportedly against it. Without consensus, it wasn’t tenable and that remains the case.

Federation Council Speaker Valentina Matvienko is pushing forward a shade of Bidenomics in Moscow, calling for corporate tax breaks if companies actually invest into the creation of new jobs, development, and infrastructure in Russia proper and seeking to increase the costs of parking money into offshore accounts to then be repatriated via dividend payments. Lacking a lever to ensure that more state money is invested and that it’s invested well, it’s probably one of the few decent suggestions to see some low-level progress in the coming years. It builds on a push from MinFin to improve the legal system administering holdings in Russia to return more capital from abroad currently escaping taxation and reduce openings in the tax code to dodge payment.

A report commissioned from Minchenko Consulting puts 7 governors at risk for replacement come campaign season. The list includes: Shol’ban Kara-ool (Tuva), Valentin Konovalov (Khakasia), Sergei Morozov (Ulyanovskaya oblast), Vyacheslav Bitarov (North Ossetia), Rashid Temrezov (Karachaevo-Cherkassia), Vladimir Vassiliev (Dagestan), and Vladimir Sipyagin (Vladimirskaya oblast). Notably, the 7 represent a decrease in at-risk governorships given a conservative shift in policy from the Kremlin, presumably given the constitutional reforms, virus and related crises, and need to preserve continuity this year.

Sobyanin’s mayoral team in Moscow is now considering a return to strict lockdown measures if infection rates don’t improve within 2 weeks time, including the need to document permission to be out and about. The announcement flies in the face of Putin’s own nudging of regional governors to avoid stringent measures, but it seems that Moscow rules don’t apply everywhere. New Rosstat data shows that over 30,000 Russians have died of COVID or related causes since the beginning of the pandemic, a roughly 5.9% increase in the death rate year-on-year. The trouble’s captured in two graphs.

Tip of the hat to Iikka Korhonen for PMIs:

From Vedomosti on foot traffic at shopping centers:

Measure: % change year-on-year Orange = Moscow Red = St. Petersburg Blue = Russia

Services are bound to take another dive as Russians begin to worry more about exposure and a strict lockdown at this moment that spreads outside Moscow will cost a fortune. Again, despite the litany of external factors affecting the ruble and macroeconomic stability, doing a better job of supporting demand and managing the virus remains the single most important key to recovery, especially in order to better rebalance the economy structurally. Without that, any talk about changing tax regimes or more to encourage investment is largely a moot point.

2020 Revision

Big Oil entered this year in a less than ideal, but at least stable position. The collapse in demand, the oil price, and the more recent pivot from majors like BP, Shell, and Total to become “Big Energy” in place of Big Oil have sent investors running for higher ground before the ice caps melt. This chart from Reuters tells the tale:

Oil majors have massively underperformed the FTSE 100 in London, an exchange that now effectively trades like an emerging market. Brexit has investors spooked that it’s a value trap. But a breakdown of sectoral performance within FTSE hints at the financial impacts at the sector level for equities: FTSE 100 energy stocks average -44.19% losses YTD (as of Sunday) whereas basic materials averaged 10.12%, even beating out the three tech firms listed in the grouping which clock in at a gain of 6.39%. What’s odd this year is that, given the increasingly emerging market behavior of the FTSE with the unvarnished incompetence of Whitehall’s negotiating strategy, the FTSE has actually been most highly correlated with the MSCI Price Index in Russia: a whopping 0.83 correlation in fact. Forgive the grainy quality, I couldn’t do much to enhance the graph that Yahoo Finance posted, but the picture is striking:

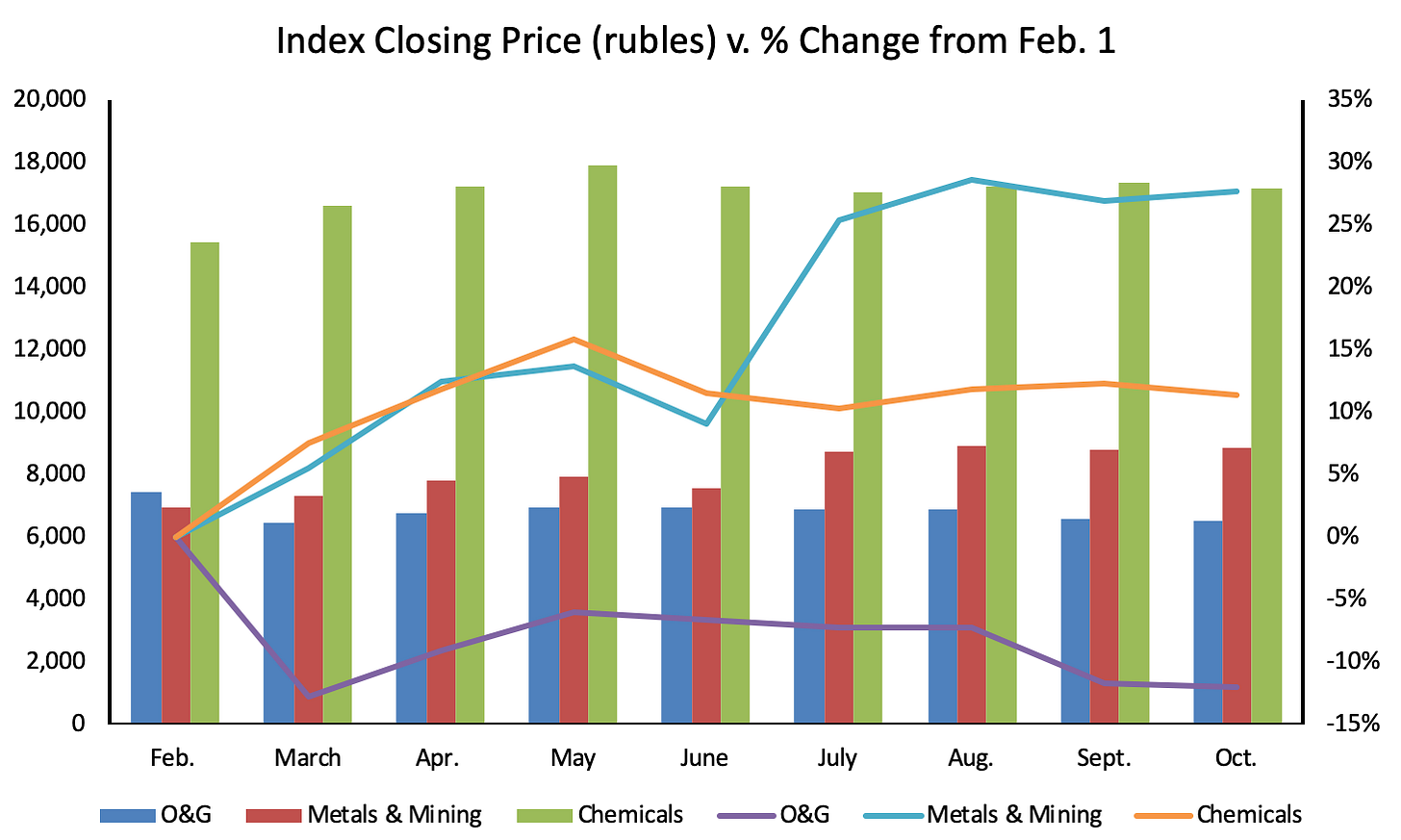

I thought to check the performance of the O&G index on the MOEX specifically just to get a snapshot of how equity value is holding up - and crucially how different types of stimulus in Russia and abroad would be affecting trading valuations at a time of great uncertainty. I grabbed this from the MOEX sector breakdowns linked here. The closing price refers to the 1st of each month:

Keep in mind that MOEX indices are relatively limited in scope, but still worth a peek. Despite taking a hit, oil & gas stocks have, on the whole, massively beaten the types of declines we’re seeing with the oil majors now embarking on shifts destined to destroy underlying equity and requiring mass sell-offs of assets. That would be readily explained by both investor expectations and the nature of Russia’s stimulus for the sector: everyone knows Russian firms aren’t going to diversify, hence the equity sunk into upstream and downstream assets is, in relative terms, more safe for return on capital and, crucially, the Russian government has made sure to use stimulus measures to support the oil & gas services sector. When companies create value via public procurements, shell companies that provide services for them but allow them to lower their tax burden, and so on, the market devastation is somewhat eased. It also suggests that the stock price drops for IOCs are more about a loss of faith due to an environment where safe returns are generally scarce given the low yields on bonds as any economic modeling on returns. At the project level, yes, the pivot is a lot of short-term pain. The cost structure of renewables projects is quite different, and there’s room to build a solid base of steady returns less exposed to commodity price swings, even if they aren’t as high as what O&G has come to expect. Turning a tanker is never a fast-run thing and COVID has shown just how limited conceptions of economic value that are too short-termist can be in a pinch.

As expected, MOEX chemicals firms performed better - earnings on margins generally improve with oil price declines, some of the industry serves metals firms, and production for export has been less affected than crude or refined fuels. Metals & mining equity is riding high thanks to China’s stimulus plans earlier this year, boosting demand and prices. Given that the Russian business cycle is so exposed to fluctuations in commodities prices, particularly oil, and the expected low rate of growth for the longer-term in Europe barring some massive structural shift - actually liking non-white immigrants, an increase in birthrates, evidence of meaningful technological innovation that encourages the creation of large firms that can compete with those in the US and China - China’s economic policies, and banking sector, are likely to have the biggest external impact on a lot of Russian equity in the years to come. That’s not news, but the degree to which it will matter so long as innovative firms like Sber or Yandex struggle with Western markets is striking and, it seems, growing.

Thems the Break-evens

According to Goldman Sachs, the Saudi finance ministry has pegged the budget through 2023 to an assumed oil price of $50 per barrel. That’s slightly more conservative than the tune MinEnergo called a month ago, looking at $55 a barrel next year thanks to mass vaccinations. Other accounts from the last month trend in the range of the EIA’s $49 a barrel for a current price target in the near to medium-term to $60 from oil bulls at Bank of America. Everyone’s running deficits, which means issuing debt. But there are warning signs that MinFin is falling short of its debt issuance target. VTimes pulls these two graphs to capture the changing structure and share of OFZs

Title: Structure of Holders of OFZ, June 2020, trln rubles - note that data on households holding them was only available for 2018-2019

Red = banks Light Blue = non-residents Blue = financial companies Green = households Gray line = total

Title: Share for Ruble-denominated, Government vs. Corporate Debt Obligations - excluding the Bank of Russia

Red = state debt Blue = non-financial sector debt

Given the state’s rising share of ruble-denominated debts, the pressure is on to calm investors by ensuring a strong national balance sheet and project calm. MinFin needs more people buying debt to help pull it off. Foreign investors probably aren’t going to jump in unless there’s a change in the sanctions environment and, I believe more importantly, Russia’s growth as an emerging market when emerging markets are struggling. The geopolitical risk angle to both the ruble and declining non-resident share of OFZ purchases is relevant, but not compelling to me for a basic reason: all the juicy targets are already sanctioned, and no one at the US Treasury wants to sanction Russian debt beyond US banks participation with all of the crises going on at once right now. I could be wrong about the level of uncertainty regarding US policy, but the narrative has shifted rather decisively in Washington towards China on most topics. That’s not to say it’s irrelevant for “hot money” flows of investors looking for short-term gains, but long-term bond issuances seen as a hedge with a much more attractive coupon rate should be a no-brainer given Russia’s fiscal stability. That it isn’t suggests that the growth story is the thing to watch.

Moving on, getting more Russians to buy debt is a possibility, but runs counter to intentions to raise the tax burden on the non-resource sector of the economy, which will likely depress wage growth and job creation. You need both to make sure people have savings to invest after a massive shock creating mass job losses and constraining demand. Think of it this way - a real economy demand shock can create a supply shock for private savings. That leaves the instruments the Central Bank has created to respond to the crisis, but it’s been admitted that there aren’t enough domestic sources of capital at present to meet the bond purchasing target.

The break-even oil price for the budget isn’t really at issue. MinFin as already decided to raise taxes to reduce resource rents’ share of federal revenues by a considerable amount. What’s more interesting is that, in so doing, MinFin is likely to hurt economic growth when growth (also built off of better handling the virus) is actually what would make it easier to convince foreign investors to buy OFZ. As noted in the previous column, China is increasingly dictating the shape of that growth in different ways, and one suspects MinFin might want to try and get Chinese investors to buy debt as well. But the structural dynamic of China’s economy and current recovery is going to weigh heavily on oil price budget break-evens globally, as well as on Moscow’s options attracting capital from abroad at a time when Western investors are skittish.

There’s a crazy amount of cash sitting around unused in China, whether from job losses imposing higher savings, lower wages, or else a lack of consumer confidence compared to the recovery of manufacturing and exports. Not only does that dent demand for commodities (and therefore prices), but it starves other markets of potential capital flows via spending, lending, securitization, and broader demand that could help manage deficits and imbalances. Russia lacks domestic resources to finance its budgetary program largely by choice - its geopolitical ambitions, domestic economic program, and macroeconomic orthodoxy. Even when it comes to finance, it seems that external partners are needed. Funny how multipolarity bites.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).