Top of the Pops

A little tidbit on electric vehicle adoption. Apparently the number of charging stations in Germany increased by 10% in just three months’ time, now at just under 40,000 in total nationally. Volvo has committed to go all electric for its production lines by 2030. It’s getting easier and easier to make the business case in Europe, China, and yes, even the US. Still, we shouldn’t forget just how steep the adoption curve has to be — and that events in Texas, for instance, would be all the more catastrophic if the power grid went down and almost all vehicles relied on electricity. This for the US market from a great CSIS read on renewable energy supply chains and the ground the US has to make up to compete:

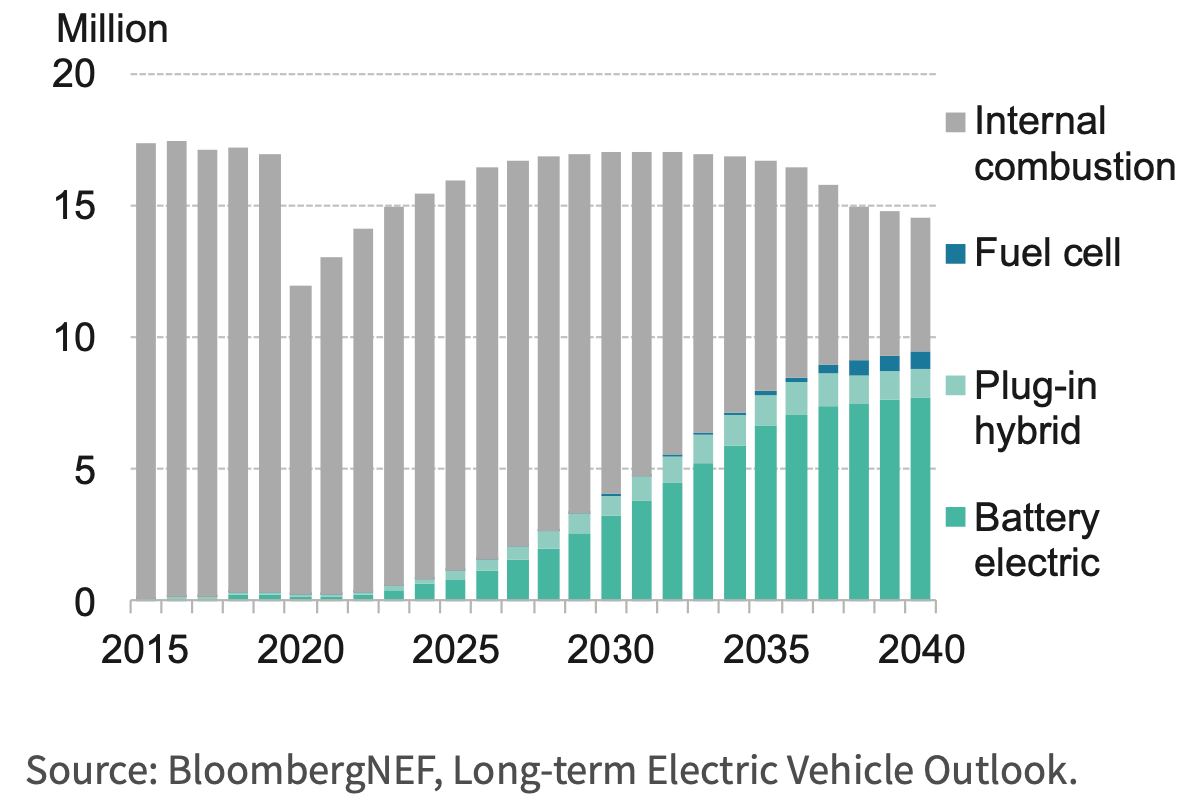

This is another handy tidbit from the Bloomberg factbook review of the state of play in green energy and the fight to lower emissions:

There’s still a great deal of work to be done and mandating a target is worlds removed from actually being able to realize it, let alone parse out what different states and companies mean by net zero. In practical terms, some economic activity has to become carbon negative and fast to prevent runaway effects from climate change accelerating drastically. But none of this supports the broader position now obviously taken by the Russian government than transition isn’t a threat to the hydrocarbon business model. Putin himself blamed frozen wind turbines for what happened in Texas instead of the entire grid not built for such weather. Moscow’s about to face a hell of a time greenwashing for western audiences, voters demanding cleaner air and better waste management, and investors.

What’s going on?

2021 has kicked off with record growth in consumer loans in Russia, something that should be a red flag though borrowing costs are (relatively) low. Consider the comparison of borrowing levels in blns rubles every January from the last five years:

During a demand shock and crisis like COVID, savings go up for households since they’re consuming less and, in the case of Russian policy, some payments that couldn’t be made were suspended via moratoria. But those moratoria are been peeled back as reopening has taken priority at the same time that real incomes once again fell for the year and price inflation for the basic goods poorer consumers can afford have been rising alongside housing prices and, soon, cars more noticeably as well due to chip shortages. So if consumer credit keeps rising and we still aren’t yet seeing a particularly strong consumer recovery, a lot of these are loans that are either covering existing costs or else what I think of as “treadmill loans” — people are borrowing to be able to keep running in place where they were in terms of their quality of life pre-COVID. If this trend continues into 2-3Q, then any Central Bank move at the end of the year to raise the cost of credit — admittedly key rates have a much more indirect effect on consumer borrowing, but spreads still matter — will have that much more adverse an effect on the roughly half of the country that’s seen some sort of financial impact on earnings from COVID.

S&P data shows that the volume of commercial debt owed by EMEA governments in 2020 fell by $100 billion, re-emphasizing the dominant role that sovereign debt issuances have played in getting economies through the crisis period. It’s crazy to see from the graphic they worked up that Israel — a nation of about 9 million whose economy is, in nominal dollar terms, less than a quarter the size of Russia’s — holds more from commercial banks than the rest included:

Title: Volume of countries’ government’s commercial debts, US$ bln

Red = Russia Light Blue = Egypt Black = Israel Dark Green = Poland Gold(ish) = Turkey

At the regional level, commercial banks hold debt worth the equivalent of about 40% of GDP. In Russia’s case, at least, the vast majority of that debt expansion was driven by domestic banks lending with their own interest rates correspondingly lowered by the Central Bank’s key rate cuts to reduce the cost of interbank lending thus reducing the cost of credit. The irony is that austerity and lower inflation make debt service repayments more painful because the gross national income grows more slowly and the value of what’s borrowed doesn’t inflate away as fast — there’s very little risk of financial trouble for the Russian state since it’s domestic banks it owes who are lending based on costs and spreads largely determined by policy choices (with the caveat that there is a potentially greater political risk for the ruble or OFZs if Moscow suddenly spent way more). Russia spent less than 6% of GNI on debt servicing pre-COVID, a figure that is likely to be higher for 2020-2021 despite the lower key rate because of economic contraction and failure to stimulate growth. It’s a self-perpetuating cycle that occurs by choice, the kind that would make any old Republican or Tory treasurer looking for excuses to cut benefits proud.

Mikhail Mishustin visited the Altai region as local industries pleaded their case that the federal government shouldn’t lift subsidies for producer costs for agricultural equipment as well as lengthen the window for relevant localization requirements for production in Russia back to the original 3 years from 1 year. As has so often been the case, promises to localize production in 2018 within 3 years ran ahead of reality. Don’t get me wrong, I love a good grip and grin session showing the regions some love from Moscow, but the technical details about policy set by MinPromTorg aren’t really that relevant to why the story matters. The trouble is the relationship between subsidies, austerity, and Russia’s approach to industrial policy. Because so many of these types of industrial plants benefit either from direct subsidy support, some form of subsidy support for credit or buyers, or else privileged access to contracts associated or, at minimum, correlated with state procurement programs means that when a recessionary shock hits, those subsidies (and budget spending) are a crucial lifeline keeping the industry afloat while also generally reducing its competitiveness since the vast majority of Russian manufacturing production at these plants isn’t for export. When it is, it’s within the CIS or EAEU most often. But since Russia keeps pursuing fiscal consolidation and weakening domestic demand, these companies don’t grow as much as they could, doubling the importance of said subsidies while inefficiently pursuing the localization of production. This dissonance created by supply-side policies and austerity alongside attempts at active industrial policy and ‘picking winners’ can really only get worse. Even if production is localized, demand will remain weak. The state’s role is more likely to expand than not.

This VTimes long read on the state of consumer finances and attitudes in Russia is damning and a much better leading indicator about the public mood than most of the political polling, which inevitably ends in tears given how hard it is to build a solid case from it without a great deal of contingent inference. Only 32% of respondents are expecting their material circumstances to improve and the overall picture is caught with the title: people are buying in bulk, shopping less often, and stretching their money farther. There is almost no corresponding evidence in the real economy that any increase in savings suggests better household balance sheets for a sustained consumer recovery. It makes perfect sense given the structure of stimulus programs, but it’s stark that less than a third of the country now expects their financial situation to improve. Banks are talking up how creditworthy their borrowers are despite poor economic indicators, which isn’t exactly a great show of confidence considering what’s happening to consumers. There isn’t a financial bubble building that threatens the entire banking sector by any stretch, but there are clearly a bunch of related borrowing bubbles partially driven by state policy from last year that will begin to undercut recovery sooner rather than later if incomes don’t rise. The longer the Kremlin waits to pass a spending bill offering income support, the more of that income support will actually just be a backdoor bailout for banks exposed to risky loans as consumers immediately pay down debts instead of increasing consumption if their incomes are stagnant and debt servicing costs increasing. It’s a policy mess mostly of the Kremlin and government’s own making.

COVID Status Report

Cases hung at 10,535 with reported deaths at 452. Things keep improving incrementally with the massive question marks that poor vaccine take-up leave us. SberIndex data shows that February saw the beginning of a return to normal consumer expenditure on things like home repairs (and remodeling) and other consumption habits since monthly spending was up 2.6% year-on-year, the highest mark for any month since the pandemic started. As noted above, this surge in spending doesn’t reflect confidence in incomes, though, and is probably highly stratified between those least affected financially and most affected financially. Contract services rose 23.9% which is the biggest tell that reopening i.e. a normalization of behavior has begun in earnest. MinSel’khoz is officially promising state support to egg and chicken producers to compensate them for not raising prices, which sort of contradicts the happy-go-lucky narrative that spending is returning to normal. It should also be noted that price inflation for basic goods has been significant in that year and volumes of spending, inflation adjusted, are probably not showing much growth from last February. What’s also interesting is that those piling into retail investment with at least a year’s experience investing now are far more optimistic about the state of the economy than most Russians according to Levada. Descending order: things will improve, no change, things will get worse, hard to answer:

Blue = Investors Red = Russia

It’s chicken or egg as to why the optimism, but it shows a growing disconnect between those whose wealth is tied up in equities frequently benefiting from economic distortions that are net negative for national welfare vs. those who don’t get or trust stocks.

Clash of the Titans

For all the love showered on state-centric narratives, it’s corporations, their ability to marshal resources, to meet energy transition targets, to monetize decarbonization or negative emissions schemes, and avoid too significant losses in profits as costs rise for key material inputs and labor that will do the heavy lifting until states realize they have to spend way more than they bargained for, tax more externalities, and get far more creative with industrial policies to make headway fast. Tesla has long been at turns adored and scorned because of the behavior of its CEO Elon Musk who manages to rocket from relatively sage predictor of tech applications to the guy with the dumbest takes online or proposing absurdly inefficient, rent-seeking ideas on a regular basis. Now that the energy transition and EV adoption are picking up pace, the real test is here: the more traditional auto manufacturers pivot into EVs with decades of experience running companies that actually generate profits passed on to shareholders, the worse Tesla’s business model in the auto sector becomes by comparison. After all, owning Tesla stock is a purely speculative play on what one hopes it will do in the next 5 years and has nothing to do with what it’s earning today, nor does it pay a dividend. Consider the recovery of Volkswagen’s equity values as it’s pivoted into the EV space, with one analyst even predicting its sales would overtake Tesla’s by 2025. I can’t interrogate that claim, but know that all it takes is a few well-placed bulls on a stock to change a narrative and suddenly open the equity floodgates:

The infamy of dieselgate — a 7 year saga with the US Environmental Protection Agency calling BS on emissions standards that concluded in 2015 — laid the groundwork for a potential corporate resurrection as best practices evolved and now it has the chance to at least appear to go green. The more companies see these benefits, the harder Tesla’s value-add sell is, especially as regulations evolve to prevent any one company from selling consumers or building charging stations that aren’t compatible with other vehicles, reducing the potential for market capture and freeing up consumers to more easily switch between models and firms. GM has similarly seen equity gains come as the market’s stabilized and it’s rolled out its own EV timeline:

These are just two examples, but they’re key to consider because neither Volkswagen nor GM immediately make you think “innovation” or “tech” despite the fact that it’s the manufacturing, materials, and construction firms, including outfits like Honeywell or Siemens that are going to actually drive the transition in a lot of business contexts. Unlike tech firms, they have to show strong profits and aren’t just equity bubbles built on potential, declaring losses while expanding into everything regardless of actual core competencies, or else rent-seeking and monopoly/monopsony business models. It’s the old-school firms with R&D divisions and older business models building the world being made possible by technical breakthroughs, or else enabled and pushed by some tech doing that. Firms like Tesla will have to grow up fast as first-mover advantages fade.

What I find funny in Russia’s case regarding this corporate tug of war is that on MOEX, its own innovation index — normally where you’d put a mix of firms weighted towards tech but including these manufacturers/materials/construction firms with lots of R&D as well as pharma/biotech in other contexts — is basically all pharmaceutical and biotech with one financial services firm — QIWI — one headhunting firm — the imaginatively branded HeadHunter Group — and then the United Aircraft Corporation repping the defense sector and living mostly off of the budget. I should have known this, but never bothered to look. And on top of that, it’s performance over the last decade is miserable:

The reason performance is so poor for MOEX over this time has much less to do with the ‘human capital’ available in the form of well-trained researchers or innovative thinkers and is instead a result of the institutional failures of the Russian political and economic system. Look at the Rosstat data on firm demographics i.e. types of firms:

The science category (ostensibly innovative) probably includes a fair bit of services jobs that produce no tangible innovation benefit, but has only risen because the total number of firms in Russia registered with Rosstat has declined by at least 9% 3 years in a row (COVID had no impact on net figures). The spike in dying firms was eased last year with crisis measures, but you can see that less than 2% of firms are considered fast growing or high growth potential and we know that investment into R&D as % GDP is around 1% total, a little over half of which is privately funded. There’s a lot less room for the types of corporate synergies (I know, I hate myself for that) between sectors because the corporate landscape in Russia is most conducive to create giants who capture rents with state help, if not direct ownership. Ironically, that’s often the tech business model in the West, but it fits into a much broader ecosystem of innovation at the corporate level that draws investor interest in innovation, can more easily raise capital, can better commercialize technological or material developments, and most importantly enjoys strong demand to serve on home markets.

I know I hammer this point home ad nauseam as a proto-Keynesian, but the fear of inflation and strict adherence to supply side theories of the economy coupled with what I would describe as ‘Command Capitalism’ — the state may own the commanding heights, but actual control is fair more fluid and also dependent on informal relationships outside ‘the state’ — seriously hinders the potential for indigenous innovation. When it does happen, it’s often linked to the ability of a firm like Sber — majority state-owned — to scale and deploy something quickly without much competition. The last point to raise here without going into detail since I’d have to do a lot more legwork, these corporations aren’t just producing things or researching etc. They earn vast sums of money off of portfolio income — dividends, owning financial instruments, equity in other ventures — which means that they’re effectively imbued with aspects of the role of a financial institution in certain contexts, including lending to small firms/acquiring equity in said firms for promising IP developed elsewhere. In Russia, the biggest firms closest to the state are just as likely to be asked to cough up foreign currency earnings to plug banking sector holes or the budget when needed rather and face massive reputational risk scrutiny over deals and direct sanctions in some cases. Lacking an adequately diversified and competitive private sector built around its defense industry, Russia is stuck playing catch up as always. Corporations reflect the national systems in which they arose. Rentier command capitalism taxes innovation at a punishing rate in practice.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).