Top of the Pops

There’s one major positive so far for Russia’s economic recovery — it’s way faster than from the 2008-2009 crisis. Industrial output is already above its levels from the start of the crisis, though that should be interrogated a bit. Despite the relative deterioration of household finances, industrial output has driven the recent ‘surge’ and inflationary pressures in the Russian economy. Output for May was 2.9% higher than it’s 2019 levels:

The speed of the recovery, however, is mostly a function of what other states spent on stimulus. A huge part of the reason the output recovery was so terrible after the 2008-2009 crisis was the failure of the Eurozone economies, led by Germany, to actually stimulate any growth. That failure coupled with the ripple effects of the mortgage bubble implosion that ripped into the transatlantic financial system, stanched by the US Federal Reserve, became the EU’s sovereign debt crisis and a decade of lost growth. Russia had only reached prior output levels just as that crisis hit having spent much of its oil wealth to save the economy without stimulating more diversified growth. Output has surged much faster this time, and Russians’ incomes have fallen but not faced the same type of crisis — the borrowing expansion amid lower rates has alleviated some of the pain. The commodity price upwards cycle ended in 2008-2009, and it started this time alongside the crisis. The effect is that poverty levels are rising along with inflation in ways not totally clear from the accounting gimmicks for incomes the government’s used to hide the extent of its policy failures. If supply/demand balances are so brittle in Russia that a surge of capacity 2.9% above May 2019 levels risks serious inflation based on the Central Bank’s logic, then the economy is never going to be allowed to grow much again. You need to spend more to sustain demand, and also sustain further fiscal spending as revenues rise in response. It’s great to see output bounce back this much faster. Now comes the hard part of managing the recovery effectively, a task to which the current political consensus is uniquely unsuited.

What’s going on?

Novatek is currently negotiating with Japanese firm Mitsui to partner in building an ammonia plant at the port of Sabetta on the Yamal peninsula with an export capacity of 2.2 million tons annually. Analysts estimate it’d cost about $2.2-2.4 billion to build. The idea is to deploy carbon capture technology and to utilize it in production, a handy way of burnishing Novatek’s green cred. Mitsui would have an equity stake and buy the off take from the plant’s production. What’s most important here is that the ammonia plant is intended to make use of CO2 from the methane released during the production of “blue” hydrogen, a new angle to the Arctic-2 LNG project Novatek is leading with Total (and in which a Japanese consortium including Mitsui owns 10%). Here’s why. These projects aren’t necessarily sanctioned or else as closely scrutinized by OFAC and European authorities and they allow Novatek in particular to get a step ahead of Rosneft, Gazprom, and Lukoil creating value-added synergies from its output that take advantage of the momentum on the ‘green’ market picks up. By combining ammonia, hydrogen, and apparently methanol production, they can show western corporates they’re more competent than their SOE competitors in Russia, have a great relationship with the state, and want to build ‘green’ assets. Mikhelson’s putting up Ws on the board while Rosneft and the rest are far more cumbersome thus far in their response to the market’s entreaties to get moving. These points of contact with foreign firms are hugely important for personal politicking and future policy — the Duma has finally launched a working group tasked with sorting out how to provide policy support for Paris Agreement targets, toothless for now but the basis for more expansive policy in the future. Novatek is positioning itself well.

According to Raiffeisen bank, consumer credit (accounting for savings) began to have a net positive effect on consumer demand in 1Q this year. But the scale of the positive effect on end demand in comparison to the volumes of borrowing and decline in real incomes suggests lots of underlying financial fragility for households and borrowers. The following are % dynamics on a quarterly basis:

Light Blue = credit contribution to demand (sans savings) Dark Blue = real disposable income contribution to demand Orange = end household demand, %

11.9% of Russians’ incomes are now going to service debts, an historic high. As we can see from the chart, what’s concerning is that real disposable incomes had a smaller negative effect on demand in 4Q 2020 than 1Q this year. We should see demand data for 2Q tick into positive growth if things are going well. They aren’t, though. 1Q still saw a net contraction of demand and we don’t have any reason to believe real wages are keeping pace with price or debt increases. Russians may be spending 11.9% of their income to service debts, but they owe the equivalent of 36% of their incomes in debt in total without any real fiscal stimulus in sight. Moscow’s policy response seems likelier and likelier to have robbed the country of income and demand growth once again.

Dmitry Mazepina, owner of Uralkhim and Uralkaliy, is doing his part for Russia’s agricultural sector by freezing prices for potassium chloride and ammonium nitrate. Prices for these fertilizers have risen 15-25% since the start of the year, triggering ongoing debates about the efficacy of export duties on agricultural products to redirect more production to domestic retailers and consumers. Mazepina’s price freeze uses May prices as its reference point. He and his board appear to have reached this decision after consulting with MinPromTorg. The two firms produced 1.1 million tons of fertilizer for January-May, 10% higher than 2020 — the firm’s committed to maintaining 2020 production levels this year. Setting aside the economic logic of the decision — it’s not great — we can see efforts like this as the next step of the current wave of mobilization and political entrepreneurship intended to curry favor with the government and presidential administration/Putin. Since forging some kind of policy consensus and securing additional spending are so difficult, the end result is a chaotic patchwork of companies and CEOs now faced with the prospect of doing their “patriotic” duties to take a hit for the regime’s bottomline. Though it’s quiet for now, we’re finally seeing murmurs about the degree to which elites aren’t happy with the state of affairs or else analysts identifying that elites have to push back to prevent worse from happening. But that seems unlikely at this point. The more businesses go along to get along, inevitably distorting and undermining the economic logic the regime seems to think holds together, the less resistance the political entrepreneurs will face unless they step on each other’s toes. These attempts to control prices are idiotic — export duties have potentially cost Uralkhim $3.5 billion in special investment contracts because foreign investors can’t predict the policy environment determining project financials. The investment environment for one of Russia’s most successful sectors is now a mess.

Russia entered the top-5 of the world’s 50 largest economies in terms of wealth losses during the pandemic based on a Goldman Sachs wealth survey (writeup includes the pdf link). Russian households controlled a cumulative $3.038 trillion in wealth — 0.74% of global wealth when Russia accounts for 3.2% of the global economy in PPP terms. That wealth fell by $338 billion, a figure only topped by wealth losses in India and Brazil. To clarify, that’s a net 11.1% decline in wealth held by Russian households in a crisis where central bank interventions saved securities like stocks, housing prices, and related stores of wealth. This decline in wealth will not have had any appreciable impact on Russia’s billionaire and multimillionaire class for the obvious reason that they probably hold most of their wealth in securities and/or assets abroad or in property in Russia that won’t have lost value. The figure Goldman came up with reflects the crisis of the Russian political and economic system since 2013 — it no longer creates enough wealth for those not part of its narrow rentier class. Most of these wealth declines for households will affect their ability to borrow since they assets they can secure credit with have fallen in value and their incomes have come under pressure. If you owned property, you’re probably fine right now. If you didn’t, you lost out bigly. External rents via export sectors can’t fix this problem, and to be honest, it is far more about institutions than the structure of the economy. But only if Russia rediscovers its fiscal muscle can it create conditions to support the evolution of new institutional arrangements that even slightly more equitably distribute wealth. Even then, political obstacles including succession politics and the increasingly horizontal and dispersed raiding of assets and use of repressive measures suggest things are probably going to get worse barring a growth breakthrough.

COVID Status Report

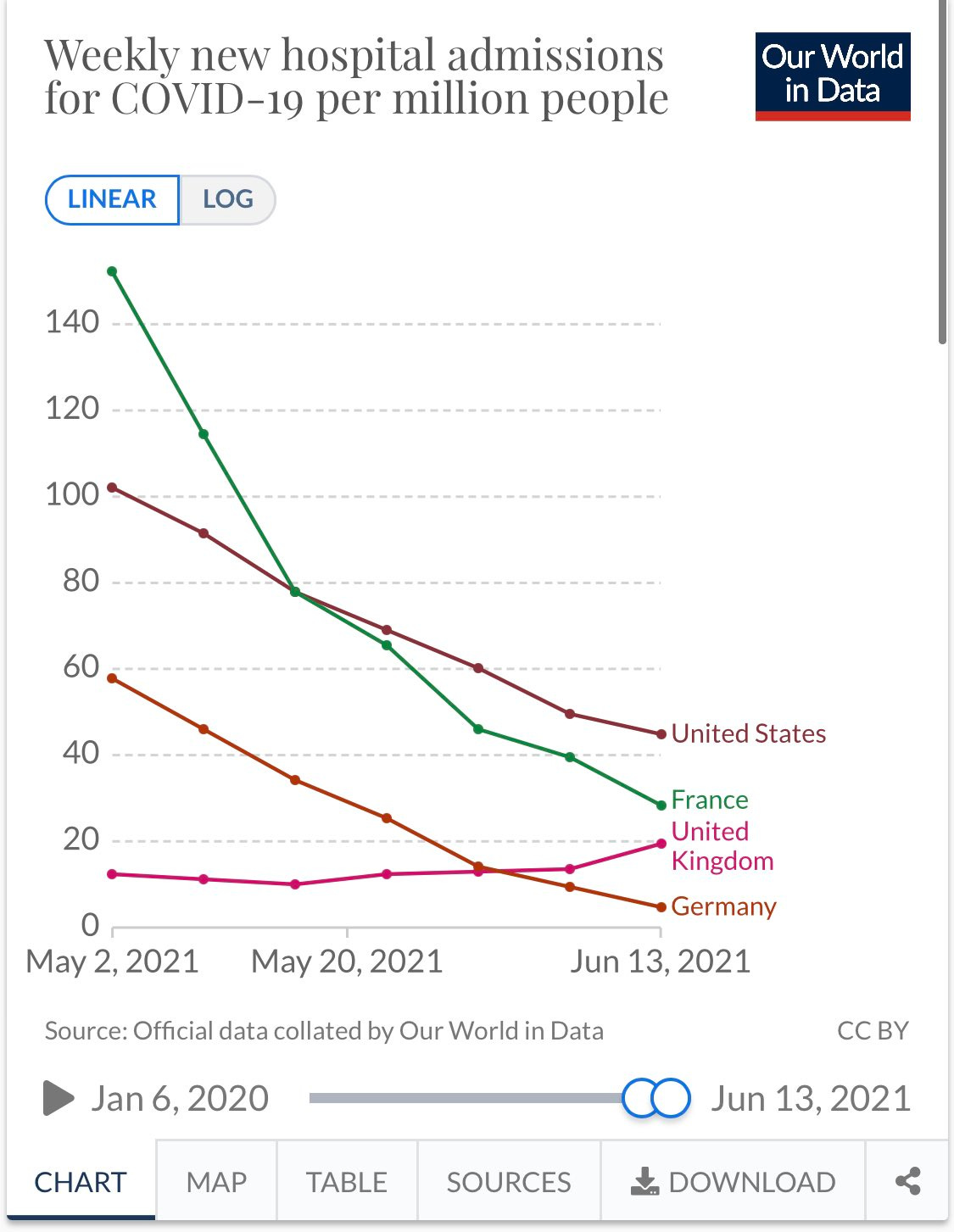

20,182 new cases and 568 deaths were recorded for the last day. Numbers keep surging upwards as Moscow, the Moscow burbs, and St. Petersburg account for over half of all cases. In three weeks, the positive case rate in Moscow has basically doubled and a fair bit of the increase is probably because of rising demand for tests as people realize the new wave is getting out of hand. Thus far, the story is clearly about the decision to trust in herd immunity as a result of having gotten sick before rather than vaccinations. We can see in the UK where most restrictions have been lifted that despite the rapid rise in new cases from the Delta (Indian) variant, the hospitalization rates are still quite low:

That doesn’t mean there aren’t serious concerns — long-term effects for younger patients are incredibly worrisome. Also worth noting that the British government is about to make another vaccination announcement, so they’re probably dropping the 1 shot strategy to accelerate full vaccinations. Good news in Russia is that Rospotrebnadzor has seen a surge of interest in vaccinations, as much as a 4-9 fold increase across the regions in signups for shots. For context to the level of urgency, no one from the 387 patients in intensive care at Moscow’s Kommunarka hospital are vaccinated. Denis Protsenko from Kommunarka is concerned that the current wave will exceed the winter peak because of the public’s exhaustion with anti-COVID measures, the authorities’ till now relaxed attitudes, and similar roadblocks to mobilizing a public health response effectively. Excess mortality data is going to be incredibly grim when this is over, enough to really have a macroeconomic effect. That’s insane and a testament to the authorities’ indifference to saving lives until it’s absolutely necessary to act.

Game, Reset, Match

The latest initiative from Berlin and Paris to invite Putin to a summit with the EU in an attempt to ‘reset’ the EU-Russia relationship, the first such meeting since the annexation of Crimea should it happen, isn’t going down well. Eastern European EU members are furious they weren’t consulted, it’s unclear what sort of ‘strategic autonomy’ Macron and Merkel believe is achievable, and it seems to be an affective response to the Biden-Putin summit. Now that the US has at least appeared to regain the appearance of more staid, balanced leadership managing the relationship with Moscow, the EU has to get in the game to protect its political interests and those of its exporters and industries (as usual). So what’s really on the table?

Energy security remains perhaps the single most important economic and political issue on the table in the relationship, one that has to be managed and will be affected by the EU’s expanding decarbonization agenda:

The return of high gas prices is being spun by some as a sign of Gazprom consciously ‘starving’ the market to jack up prices. That’s not really the case. To simplify the numerous points made by Laurent Ruseckas in this fantastic thread on Gazprom’s export capacity, Gazprom’s incentive to sell more via Ukraine is hampered by the offer of pipeline capacity on a contractual basis that’s interruptible — it’s not guaranteed — and costs as much as guaranteed capacity. These high prices aren’t a result of political gamesmanship so much as the structural consequences of the politicization of Ukrainian natural gas transit and problems managing natural gas use and demand while ostensibly trying to decarbonize energy production and consumption without a large expansion of nuclear power. There is of course a political component insofar as the unimpeded use of Nord Stream 2’s full capacity would obviate some of these problems, but everyone knows that projects can simultaneously have economic and political bases.

The energy agenda is no longer just about natural gas (or to a much lesser extent oil or nuclear). For instance, it’s now dawning on many that the challenges of long-distance transmission coupled with supply fluctuations given the interruptibility of renewable sources of energy is going to incentivize the relocation of production for industries like steel closer to renewable sources of power, backed up of course with some sort of base load. In practical terms, that gives economies that are able to quickly scale up green energy sources while managing the base load challenge an industrial edge for future capacity investments, and will dramatically weaken the attractiveness of relocating production to Russia to export into the EU once domestic carbon prices are externalized in some fashion and investor preferences continue to evolve. German power outfit Uniper is looking at selling its Russian assets to Inter RAO to cut its emissions. The contours of the long-standing German-Russian industrial relationship are shifting a bit. Moscow’s lucky that it’s metallurgical sector is more exposed to foreign capital, partnerships, and regulatory norm. The Security Council is now highlighting the security rationale to ensure emissions reductions. Germany and Europe are going to trade with Russia no matter which regimes are in power. There needs to be a platform for EU-Russia dialogue on these matters at minimum since they’re so important to the regime’s political economy, to the economic interest groups on both sides that have held together the relationship with baling wire since 2014, and to climate change efforts. Climate change is a security challenge in a profound manner that most of the most ardent supporters of revolutionary action in the West never seem particularly concerned about. Europe, particularly with its colonialist fears of mass migration from future crises across the Maghreb, is well aware of the stakes even if it’s generally been geopolitically impotent as an actor.

Beyond energy and climate, there has to be more active communication to avoid security incidents. The ongoing media fight over what happened with the HMS Defender — the Kremlin’s now saying it was a planned provocation — is a case in point. Some sort of communication and trust-building is needed to minimize risks. There’s another benefit from the Biden summit that’s opened up space for Europe diplomatically. Washington is now leading on Ukraine knowing that Berlin and Paris, aside from limited interventions for gas transit and similar issues, are never going to be as proactive as they could be because of their priorities. Kyiv is entirely against the current initiative, but the overall picture is more complicated. The EU has made clear that the carbon border adjustment mechanism (CBAM) will not apply to Ukrainian exports because it has a free trade agreement with the bloc. Washington has played ‘bad cop’ by temporarily withholding lethal aid, but that’s mostly for show. The Pentagon just authorized an additional $150 million in military aid two weeks ago and the US Navy’s 6th fleet is prepping exercises with Ukraine in the Black Sea. The UK just signed an agreement to improve Ukraine’s naval capabilities. President Zelensky has to oppose any effort at talks with Moscow for domestic audiences. He’s not an idiot. Ukraine also has enough allies within the EU that its interests will be represented in meetings. Any renewed talks will take place in a far different context than under Trump.

For all of his faults, Biden has managed a crucial feat through diplomacy — Europe is now locked into its posture aligned with the US on Russia without the pretenses of being the adults managing Trump. Belarus has changed things. The united front of sanctions from the US, EU, and UK on Belarus have far-reaching consequences for its economy and the regime. In targeting potash, oil, oil products, tobacco, and the country’s financial sector, there’s no longer any room for Minsk to play capitals against each other. Russia cut off the Naftan refinery from oil supplies after the US levied sanctions, denying Lukashenko’s regime the earnings from its exports. A regime as centralized and vertically organized as Lukashenko’s is not going to reverse course. As the sanctions noose tightens, the more Moscow will have to pay to keep the Belarusian state together and more opportunistically Beijing can decide when to offer money with strings. That’s almost certainly not on the table with any EU-Russia dialogue. Rather what’s likelier is a continuation of the door Biden opened at Geneva — they need to talk with Moscow about setting some sort of lines around cyber attacks, the political entrepreneurship of Russia’s security services, and their expectations about what has to happen in order to treat Russia as a great power. It may be dressed up as an independent initiative and there are points of disagreement with US policy, but Europe is playing the part of follower dutifully. Any progress it can make stabilizing the political relationship is good for European security and also good for the US defense posture globally.

Reset is a poor term to describe what’s happening. Establishing a baseline is probably more accurate. And just as what’s happening in US domestic economic policy backgrounded Biden’s talks, the same is happening with Europe. As a question of macro, the Euro is overvalued at the moment:

Why does that matter? It reflects the fact that EU members, especially in the Eurozone, are spending far too little to stimulate their economies. Doing so would lift consumption, and therefore raise imports and reduce the trade weighted value of the Euro. Russia’s strategic diversification of its export and import markets towards China and Asia has reduced the effect of European stimulus on its economic fortunes, but Europe’s dream of building green national champions and a much stronger corporate environment needs more stimulus. If that materializes, then future EU-Russia summits may produce far more productive discussions to partner on the energy transition because Russian corporates will see more opportunities to export into Europe or else partner to import the standards and technical capabilities being fostered in Europe. That’s a ways off. Still important to think of these summits in terms beyond the ‘low-hanging’ fruit of confidence-building and security talks. They represent chances for domestic interest groups and economic lobbies to try and get a hearing from their respective governments in advance and put their interests on the agenda.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).