Top of the Pops

Even finanz.ru has come around to implicitly comparing the price control arrangements now taking root to the late Soviet economic crisis. The latest announcement is that the price control agreement fixing prices for sugar and sunflower oil cut by MinSel’khoz with producers will be extended — through May at minimum for sugar and until October at minimum for sunflower oil. What’s telling in the opening of the piece I’ve linked is its invocation of the 2014 pension adjustment. In 2014, pension contributions were frozen as a crisis measure, but 7 years on, they haven’t been unfrozen. In the Russian economy today, there is arguably nothing more permanent than a temporary crisis measure. What’s most striking about the latest price control update is that MinEkonomiki, the Central Bank, MinPromTorg, the Audit Chamber, and retailers are all opposed to the measure. It goes to show the degree to which economic policy has been politicized and is no longer left to the technocrats. At the same time, much hay is being made of the fact that the 2020 budget was the largest in real terms in Russia’s post-Soviet history, only beaten in % GDP terms by the response to the 2008-2009 financial crisis. The top shows expenditures as % of GDP and the bottom the net expenditures in trillions of rubles in nominal terms:

The effects of spending and ‘imperviousness’ of the Russian economy this go round to as severe a shock might be explained not only by reliance on export sectors, but also that by some estimates, as much as half of employment is directly or indirectly linked to the budget, official roles, and state-owned enterprises. If the budget and state dictate that large a share of employment, then economic policy can’t help but be heavily politicized. Future growth becomes a tenuous balancing act between tax receipts and spending levels until the investment climate materially improves. A more useful distinction in this regard lies in what is actually politicized, however — employment levels, fixed-income support, and social transfers are all useful electoral levers whereas spending levels for investment matter more for business elite constituencies. The greatest degree of independence has always been given to the institutions responsible for macroeconomic and budget policy, namely the Central Bank and MinFin. The problem is that the latter two can only address the inflationary crisis using politically prescribed tools that impose pain: rate hikes and a reduction of spending since spending is believed to feed inflation. Both make the problem of standards of living worse. And it’s remarkable to now see that most of the institutions in Moscow concerned with more microeconomic governance or else non-ag or energy sectoral management are opposed to price controls because they’re inefficient, wasteful, and end up harming productive investment whereas the Kremlin wants to quash inflation in line with the orthodoxy of the Central Bank and MinFin in order to head off a pricing crisis for the elections. This mismatch isn’t entirely new, but the degree to which policies intended to address inflation are explicitly political and lack a clear economic logic highlights that Russia’s ‘sound macroeconomic management’ has been somewhat mythologized. It’s actually producing and reproducing microeconomic crises and hindering their resolution, even accepting the limitations of Russia’s institutional capacity to effectively govern itself, rather than the more traditional view of terrible microeconomic management against great macroeconomic management. The longer the macroeconomic orthodoxy holds sway, the more political pressure is heaped on supply side/price control measures that aren’t working. The more they don’t work, the more the regime will have to double down on them and expand the budget’s role in dictating job creation, salaries/wages, and growth.

What’s going on?

OFZs are feeling the pain from rising inflation with a bit of renewed sanctions risks thrown in. 8-year maturities now offer yields above 7%, 18-year maturities have hit 7.28% as have 10-year maturities, and 7-year maturities are up to 6.92%. Inflation’s making it more expensive for the state to borrow, a problem that isn’t existential by any stretch but inevitably provides ammunition to the inflation and budget hawks in Moscow to pursue more tightening measures that will weaken recovery. It’s the first time in 3 years Russian sovereign bonds have fallen in value for 4 straight months, naturally offset by the higher yields. The market’s signaling expectations of a significant tightening of monetary policy from the Central Bank and quick one at that. The yields for mid to long-term OFZ issuances are still attractive, though, so it’s really the short-run that’s taking the hit. Unfortunately, it’s the short run that matters at the moment. Though Putin declared the recession was ending about a week ago, MinEkonomiki’s data shows the recession had actually deepened — February’s industrial output figures were further off their 2020 levels (-3.1%) than January (-2.2%) and retail sales and even food were down for February slightly vs. January. Spending levels are down 25% year-on-year even with the supposedly hefty and effective state response last year. Kremlin policies worsened the cost by creating macroeconomic conditions whereby higher inflation accompanies low to nil growth. Higher inflation in a growing economy can much more easily be politically managed than higher inflation in a stagnant one. The Audit Chamber’s adding to the chorus of concern criticizing the fact that now 33.5% of all sovereign bonds have floating rates, a fair bit above the 25% limit traditionally maintained by Russian policymakers. That seems a bit silly to me, but it does go to show that everyone’s rattled at the moment.

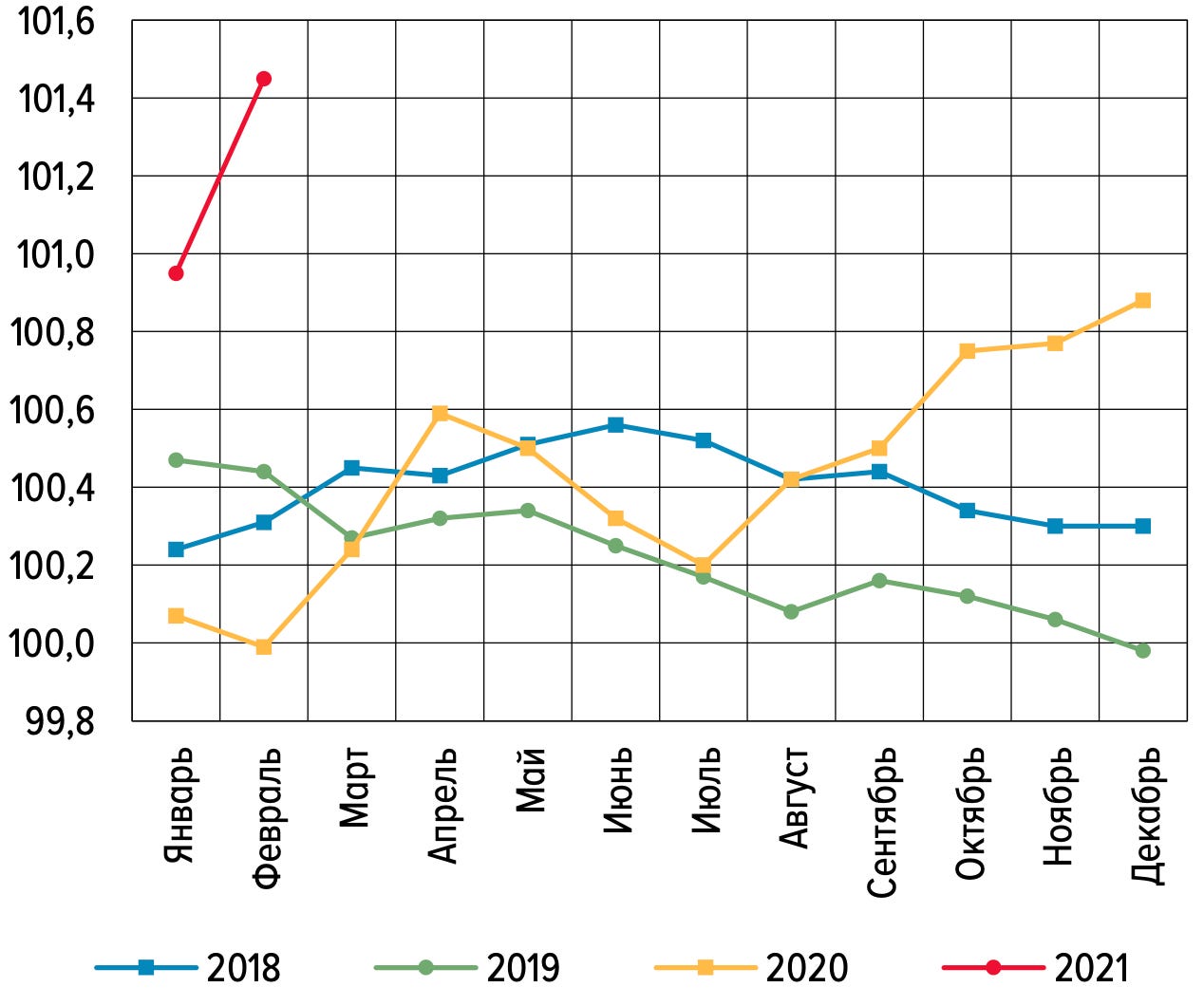

The construction sector — crucial to last year’s performance, for employment, and now recovery helping to ease the housing bubble — is now beginning to renegotiate its state contracts because of rising material prices. The current target is to demand greater payment if project costs rise more than 5%. Rising costs for metal alone could cost the sector 42 billion rubles ($556 million) this year per MinStroi. The CBR’s month-on-month inflation review through February shows just how much inflation picked up starting in September :

MinStroi is now proposing a legal mechanism that makes the final costs for agreed contracts more flexible in response to price level changes, but has no impact on the agreed time of completion for any project and won’t lead to a price increase above 30% for the state. The sector had previously lobbied for a mechanism to adjust contract values upwards when construction materials rise more than 15% over three months’ time, a way to softball the state while recouping major expenses from a sustained price rise. Construction metal prices rose a whopping 94% between November and January. This is a huge issue for the sector’s margins. As of now, the state’s allocating 846 billion rubles ($11.2 billion) for capital investment into construction, a figure that undoubtedly will have to rise given broader inflation on top of sector-specific price increases. But even a flexible pricing mechanism is a terrible instrument to address the problem in practice since builders usually buy materials as needed during a project, not all at the outset. The more the sector relies on state contracts, the more pressure there is to stockpile materials. The more pressure to stockpile, the greater the upwards pressure on prices.

The property market finally shows signs of cooling off as rates are rising for borrowers despite the continuation of the mortgage subsidy program. The volume of borrowing in December vs. January shows a huge decline, reflecting emerging deficits for new-builds as well as the poor state of the consumer economy and recovery expectations. The following shows subsidized mortgage issuances billions of rubles:

The expectation from estate agents and the market is that by H2, Russians will turn their attention away from buying new builds to buying up whatever owners are putting on the market or else those who can opt for second homes over first-time buyers. Even if the subsidy program is pared back, continued mortgage market growth in the realm of 15% seems likely. The pricing surge for housing may abate, but the trouble now is that no one will want housing prices to fall once they’ve bought, nor is the supply of housing such that one would forecast decline at the national level. Post-crisis, fewer Russians will be in good financial position to buy into the market without subsidy support since the price increases stick while real incomes are still falling. However, a fall could end up coming later in 2023 according to Gennady Salych of Freedom Finance. This would “burst” the mini-bubble since 2018-2019. It’d also reduce the value of what a bunch of people just bought, making them poorer on their balance sheets. Yet another political problem of political economy to ponder for the regime.

MinEnergo is doing some damage control rolling out Pavel Sorokin to explain to the public that while oil prices have fallen, benzine prices aren’t following suit because of the difficulties of pricing on a market with so much volatility. In an interview with RBK, Sorokin noted that policy should aim to create ‘predictable’ prices for consumers, which is a funny way of admitting that the domestic market is heavily influenced by regulatory structures and decisions that weaken the pricing link between external oil prices and domestic product prices. Sorokin straight up references a planning mechanism in his first answer — MinEnergo told refiners to increase their utilization rates and produce more benzine, and lo and behold, benzine supplies in February rose by over a third. What’s more, refiners had to sign agreements in coordination with the ministry to lay out modernization plans. The irony here is that the traditional use of subsidy measures for fuel alongside support measures for products exports in the form of lower tax rates, since adjusted as part of the oil tax maneuver tentatively begun in 2015, ended up costing the Russian economy billions annually without properly incentivizing modernization. What’s interesting now is that Mishustin’s arguing that the more recent damping mechanism intended to offset price changes for refiners to maintain price stability is now leading to an annualized 15% increase in fuel, much higher than topline inflation and obviously a political problem for Moscow. MinEnergo is adamant about maintaining the current system. Some controls are always needed, but the regulatory approach has created a persistent political problem for the Kremlin: product prices don’t seem to fall much when oil does.

COVID Status Report

New cases came in at 8,457 with deaths reported at 427. The decline was largely observed in Moscow, not the regions/St. Petersburg. TASS put out a release quoting Fyodor Lisitsyn of the Gamelei Center saying that a third wave by the end of April lasting at least 1-2 month is possible based on the Operational Staff data. If that’s the case, one wonders what exactly is the underlying trend or change noted here, unless he’s just referring to the plateau for decline:

Red = Russia Blue = Russia w/o Moscow Black = Moscow

There are few significant restrictions in place at this point and hospitals across the country have reduced their COVID-specific treatment capacity, coordinated with local and regional authorities and MinZdrav in hopes of returning the medical system to more normal operations. As Jake Cordell notes:

The state has failed catastrophically at containing the virus and addressing the public health risks. It’s gotten lucky that so few Russians seem particularly bothered about it. The longer the vaccine rollout takes, the longer the risk remains that recovery later this year will be interrupted by yet another wave of infections.

Me, Myself, and Kornai

Kommersant reports that investors in Russia’s port infrastructure still aren’t happy with the draft bill from MinTrans laying out ‘responsibility’ for investments. The bill came about as a result of government concern last year — it turned out that investors were being given land with assurances that they’d build relevant infrastructure and failing to do so. One wonders why given how terrible the economy has been . . . The resulting proposal, in the eyes of business, places far too much ‘responsibility’ on investors and not enough on the state. For every deal per MinTrans’ effort, investors have to agree to an investment declaration with Rossmorrechflot, the Federal agency for sea and river transport, that includes guarantees within certain parameters that investments into infrastructure will go ahead. The state’s trying to saddle business with risks when business, already investing at structurally low levels, want the state to bear more of it in order to entice them to invest. The ongoing lobbying battle is indicative of the political economy of ‘Late Putinism’ accelerated significantly by Crimea, the western sanctions regime, and response to the oil shock. It harkens back to Janos Kornai’s description of socialist planned economies as resource-constrained economies of shortage.

First off, Kornai establishes three types of constraints that affect production and shortage in a system intended to maintain full employment at all times:

Resource constraints — you can’t produce more if you lack the material inputs

Demand constraints — you can’t sell more than is demanded by buyers at given prices

Budget constraints — firm expenses can’t exceed its supply of money/financing and earnings

These types of shortage-inducing constraints, all different in nature with varying degrees of intensity and applicability, are set against two classically-defined types of economies. A classically capitalist economy is a demand-constrained system since demand provides the effective constraint on investment into production and therefore production increases. A lack of demand means production doesn’t rise. This was no longer the case by the time Kornai was writing in the mid-70s given the neoclassical reinterpretation and ‘hollowing’ out of the insights provided by Keynes or else more diehard, traditional Keynesians identified ways to increase effective demand during times of crisis or, ideally, to come closer to managing investment in line with demand for the greater social good. A socialist economy in Kornai’s typology is a resource-constrained system since demand is not limited by financial scarcity, but rather by physical constraints on resources. Wages and prices are fixed without too much concern for production costs, hence the constraints on demand lie more with how much can be produced. Whereas inflation might register as price increases between sectors consuming similar material inputs or experiencing a shift in effective demand for their production, inflation in a socialist planned system would show up as shortage as sectors would compete for physical resources and budget resources with any ‘victors’ creating necessary spillover into other sectors’ ability to produce. Even if resources were 100% utilized, the question of who gets what and the political power of different sectors, institutions, and individuals to convince budgeters and planners to give them what they want creates shortage somewhere, whether by a lack of an input for one industry or else a change among consumers substituting a good that’s otherwise short with another and creating new demand pressures on planners and firms.

One of Kornai’s central insights following from these brief observations was that firms faced a soft budget constraint rather than a hard one. The state would not let them fail and they could always ask for more resources. Unemployment and any slack in resource utilization were anathema. Firms weren’t allowed to fail. There was therefore little risk on capital deployed and a firm’s demand for resources didn’t respond to prices since its income didn’t determine its solvency or even its ability to procure resources. Of course, when resources failed to materialize and resources were scarce — the state faced a much harder budget constraint for its spending, even with the capacity to borrow — the result was that firms facing a soft constraint individually are competing over a finite pool of resources, which then reinforces incentives to hoard resources or else alter buying and selling between firms. In effect, the state and its budgetary resources become an ‘insurer’ for the risks taken by firms with little incentive to improve the efficiency of spending and so on. The state de-risked firm-level activity until it could no longer cover all of the liabilities it had accrued doing so.

Russia today has a mixed system in its economy, with the institutional forms of markets frequently blended with updated versions of Soviet institutional arrangements, price controls or tariff agreements, and informal mechanisms intended to provide some level of flexibility since the political-economic system is designed — within reason — to maintain as full employment as possible while also fighting inflation (now experienced through price increases), avoiding over-heating the economy’s productive capacity, and ensuring the stability of fixed-income social transfers for those in need for political purposes while adopting austerity measures to ensure investors trust the sovereign. Under this ‘macro’ layer lies a disastrous investment climate and, in a literal sense, demand-constrained system. Real incomes keep falling and the main driver of income increases from 1999-2013 — oil prices — no longer provide the same benefits because of structural stagnation, the lack of faith businesses have that their investments are safe and future demand will be there, as well as policies adopted to reduce the ruble’s exposure to the oil price. The result of stagnation amid the poor institutional environment is that the state is required to ‘de-risk’ business investments since demand is constrained by the state’s macroeconomic policies. In place of the potential for ‘infinite’ demand in a socialist planned system alongside finite resources, Russia now has increasingly finite demand with increasingly finite resources because of the way that state resources are and aren’t spent. The worse effective demand is across the real economy and opportunities for growth limited to select export sectors or consumer sectors, the worse this ‘de-risking’ dynamic becomes.

In a ‘normal’ economy flows to firms/investors in expectation of future profits and firms' spending is then financed by profits. Firms in Russia most certainly operate by this logic in plenty of cases, but the imposition of limits on profits via price fixes or agreements doubles the gut punch from falling income levels since households have received little income support since stagnation set in using state funds. The ‘de-risking’ applies to firms, not consumers. Since the budget drives so much economic activity and employment and the economy is trapped in stagnation, the nature of business risk and business credit cycles differ somewhat from a ‘normal’ economy. When booms happen, you expect borrowers and lenders to slowly take on greater levels of risk in response to rising levels of optimism and, eventually, mania about growth. This then corrects hard the other way when a recession, particularly a deep one, hits and can trap an economy in the doldrums by dragging down effective demand through the interaction of debt and the value of financial assets with the availability of credit needed to push demand higher and, ideally, restore wage and real income growth and effective demand along with them.

In the Russian economy today, there is no boom-bust business and credit cycle because of structural stagnation. The state needs investors and businesses to make riskier investments without any corresponding boom or enthusiasm in order to generate even mild levels of growth. Every attempt to increase the ‘hardness’ of the budget constraint facing firms by increasing their risk exposure when committing capital reduces their appetite for investment because of weak demand and the narrow basket of exports Russia’s competitive for when selling abroad. Attempts to attract more private capital are an exercise in negotiating this political push-pull over and over again. The growth of agricultural machine exports is a great example of this — only sectors that are effectively ‘de-risked’ and shielded from competition, which would impose harsher penalties for poor budget constraints at the firm level have succeeded in showing growth. Even then, it’s had limited positive effect across the broader economy. But the less the state is willing to spend from the budget via its current policy stance, including its war on inflation, the riskier private sector investments appear to be because of how that filters through households. The state’s best bet to avoid budget and geopolitical risks is to force the private sector to do the borrowing instead, worsening the budget constraint for firm investment without effective demand. The statists refusal to use the state here has crippled the regime’s policymaking capacity.

Kornai’s stylized description does a better job of capturing the problems now facing the Russian economy than most others I’ve come across, probably because he well understood the political realities behind economic policy in socialist regimes. His insights help us understand what’s happening now. We’re seeing the logical ‘end game’ for the current political-economic system. Not a rapid collapse, rather a steady escalation of the impositions on the state to ‘de-risk’ economic activity in a manner it cannot sustain without a dramatic shift in its fiscal and monetary policy stances, both of which are hostage to geopolitical imperatives. The Soviet Union went bankrupt slowly, and then all at once because it couldn’t manage this balancing act internally and lost a great deal of foreign currency earnings used to sustain a domestic debt expansion. Russia’s better situated to handle that last bit today, even when oil prices are lower. But the costs of inaction, institutional corruption, and inertia are far higher when external rents no longer provide growth. Another COVID wave is the last thing the country’s battered economy needs.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).