Top of the Pops

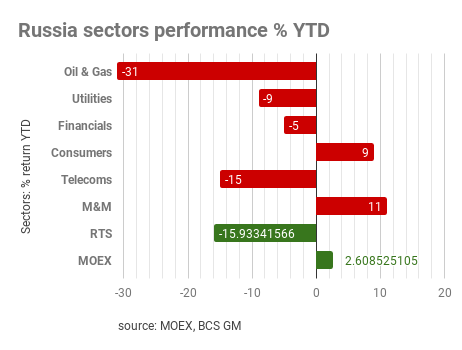

The end of the year is providing a glimpse of relief for investors and Russia watchers happy to see the worst of the current crisis pass:

To be blunt, the optimism is somewhat misplaced. Even if oil recovers past $50 a barrel on bullishness, only to suddenly see a surge from the US as well as the impact of Venezuela now ignoring sanctions and selling to China. It’s down again as the market realizes vaccines aren’t going to arrive like the cavalry and fix it all. Equities’ strength will reflect the minimal gap between the key rate and inflation as well as Russians’ desperate to do anything to boost their incomes and/or savings. Long story short, these aren’t the seeds of a healthy economic recovery, though Russia fared better economically in 2-3Q than most expected.

What’s going on?

Yesterday, the government opted to delay making a final decision on support for oil & gas service companies until the end of the year. Seems that MinFin and MinEnergo are at loggerheads over how to provide support in the first place. MinEnergo is trying to get money out the door as fast as possible, and MinFin is handwringing over how much it costs while making the policy fight one about “mechanisms.” Reading between the lines, it seems that MinEnergo wants direct spending out of the budget, presumably arguing that the expansion in economic activity would generate considerable revenues to offset costs. MinFin seems to want to tightly cap any budget support and force companies to rely on credit rather than budget support since they prefer to ruin the private sector’s balance sheets and hope the Central Bank keeps it all together in the end. MinEnergo is probably in the right, though. Without direct support of some kind, default risks will keep rising and with them, stress on the banking sector.

So far, the Central Bank isn’t worried about corporate debt. The 3Q financial stability report interestingly included climate risks in its overview — looks like the CBR wants to keep pace with other central banks — but increasingly the systemic risks facing the Russian economy are linked to what its recovery looks like. Large corporates have seen their debts rise, but not yet to outrageously high levels:

Title: Dynamics of the non-financial sector’s debt burden

Blue = non-financial company debt (% of GDP) Purple = debt burden of the largest companies (debt/EBITDA)

On one hand, this is good news. It means that the country’s largest companies are, so far, weathering the shock relatively well, particularly since the key rate is a lot lower than it was in 2014-2015 so debt servicing costs are far more manageable. On the other hand, the CBR is really worried about potential inflationary and destabilizing factors from post-crisis booms, whether that be in housing, a sudden rush of cash into Russian equities, or other spikes in suppressed demand. There is no wave of earnings coming to Russian households and any boom in equities will likely reflect the key rate running just above inflation, but a surge in defaults from an anemic jobs and wages recovery could spillover. However, I’d be more worried about the new bill the CBR’s pushing to create a unified platform for banks to identify clients based on money laundering risk. Imagine that taking out the reserves of smaller banks desperate for business while banks struggle to maintain profits with falling rates…

Insurance markets are on track to grow 5-6% for the year despite declining incomes, the ultimate “bad news is good news” business play. By volume, Russia’s market isn’t that large — it’s expected to reach about 430 billion rubles ($5.66 billion). Sberbank’s grown its own insurance business by 12%. There were about 17 million active insurance plans at the end of September and last year, 1 million people were paid out from insurance. The real story here is that insurance companies don’t just collect premiums, they invest into interest-generating generating assets. The larger the insurance market, the more money is available to flow into domestic bonds, some equities, and more. It’s a sign that Russia is slowly creating a larger base demand and supply of capital for its financial markets even during a crisis. That’s a net positive for those arguing Russia can finance a lot more to grow its economy using resources in hand, as constrained as they continue to be for various reasons.

The Federal Anti-Monopoly Service (FAS) is now reviewing the costs of drugs on the country’s list for price-controlled medications. The cancer treatment drug Lomustin has seen its price rise 9 times to 37,000 rubles ($487.66) per pack while another cancer and arthritis drug Azatioprina has doubled in price to 380 rubles ($5) per pack. The limited price response to shortages leads to underinvestment in production. Keeping costs down is normal and necessary, let alone in a crisis environment, but there isn’t a clear mechanism to compensate firms for what are effectively state-mandated losses without some means of raising production levels. There are also complaints about the quality of other medications on the list, again unlikely to resolve with current profit margins. In effect, FAS is acting as price cop whenever a drug goes into deficit and adjusting prices accordingly instead of letting firms and pharmacies negotiate. There’s nothing wrong with protecting the general welfare, but there are better ways than this.

COVID Status Report

Infections spiked past 27,000 for one day as Moscow got considerably worse over the last 24 hours. The breakdown of the worst regions based on infection rates per 100,000 shows the extent of the problem:

Moscow and St. Petersburg are still in the top 10 — expected given their relative economic and demographic weight — but Altai is remote, not densely populated, and struggling terribly. Karelia would seem to be an extension of transmission from SPB. The Far East in Magadan and Arctic European north in Arkhangelsk, Murmansk, and Komi are bad, as is Kalmykiya at the edge of the North Caucasus. Yamal-Nenets is prime oil & natural gas country. Outside of the largest cities, capacity to prevent the spread is limited. The Duma only just passed a law formally defining remote work and relevant rules around it i.e. trying to make employers responsible for covering costs for internet or electricity and anti-virus software as needed and so on when in an emergency situation. Remote work will be possible for lots of city jobs. It’s the extractive industries, jobs in small locales where one infection risks everyone, and the like I’d worry about.

Glazyev half full

Sergei Glazyev has a reputation for kookery. He was an advisor to the president till last October when, presumably, someone wanted him and his jeremiads about spending vast sums to boost Russia to its full productive potential was gone. He’s someone supremely unconcerned with inflation with his eyes firmly set on targeting growth. In an op-ed for Vedomosti, he unleashed yet another broadside for relevance attacking the Central Bank for holding back Russia’s growth. His chief criticism goes back to the decision to let the ruble float and for the Central Bank to respond to the oil shock, sanctions, and capital outflow crisis by hiking the interest rate and keeping them too high (even today, in his estimation). He claims, without much evidence provided of course, that CBR policy has since cost the Russian economy about 25 trillion rubles ($329.3 billion), 10 trillion of which has been potential investment. I spaced out those gains in an ad hoc fashion, but with a rising share based on gut assumptions about the oil price, period of adjustment, etc. assuming a -4.5% GDP growth rate for 2020. I know it’s not methodologically rigorous but a loss of $329.3 billion over 6 years is should be big a breakthrough for the Russian economy:

If Glazyev’s contention that Russia is loaded with productive potential not being tapped because the cost of credit is too high is correct, he might want to explain why it is then that the gains implied by his estimate, while significant, still run into problems about the composition of growth, distribution of any rise in the national income, fact that Russian economic growth has quite a limited impact on oil prices — the most important business cycle driver — inflation, capital outflow, and more. The following adjustments are even more ad hoc since I had constant US$ ready to go, but not calculating 2014 is a bit more complicated given the shift in PPP and devaluation make it a noisy year statistically:

There’s a basic problem with Glazyev’s thesis: it’s unclear if what’s holding back Russian growth is more institutional or more a result of macroeconomic policymaking. In his scenario, Russian growth would be quite strong, but I don’t think it makes sense to assume that easier monetary policy leads to a boom for Russia’s domestic demand, particularly since doing so would be incompatible with the reserve de-dollarization drive. It’s difficult to imagine there wouldn’t be a significant rise in inflation due to the further devaluation of the ruble, rising costs of imported components, and the net welfare losses entailed by making less efficient investments in the short to medium-term in order to build new supply chains with limited help from western companies due to repetutational and sanctions risks. I agree building off of Glazyev’s view that a refusal to spend on productive investment has created problems: Russian households are forced to take out more debt, their own savings aren’t being used effectively to generate growth, and a lack of investment ends up dragging down wages and real incomes. Glazyev, however, wishes to see the Central Bank become a Soviet institution with the aim of maximizing capital investments. He basically wants to revive the planned economy via Central Bank mandate by creating a system of ultra-low rate facilities (1-3%) used en masse for long-term projects. I’m sympathetic to the approach, but focusing just on increasing the level of investment ended up wasting countless resources in the Soviet system because the maximization of capital investment is a different matter entirely from the maximization of the efficiency of capital investment. Glazyev’s proposal would be hamstrung by no-bid tenders and massive cost inflation, no matter how much he drones on about “taking responsibility” for national goals.

Consider the problem from another perspective: How can increases in investment translate into rising incomes and therefore rising demand? At present, only about 20% of Russian companies plan to raise wages this year due to the current crisis, per data from SuperJobs. The following is % of firms planning to raise wages per the categories, yes, no, and hard to answer in green, red, and gray respectively.

If growth were to rise in line with Glazyev’s estimates of losses since 2014, real incomes might have risen only assuming inflation would still be under control. I for one lean towards the view that Russia’s struggles with inflation are primarily about internal market imbalances between supply and demand generated by distances, market oligopolies, market slack due to peculiarities of Russian political economy, price controls, misallocation of budget resources, and more. The cost of imports is an inflationary channel when the currency weakens. Glazyev’s thinking would seem to leave things like direct, indirect, and informal price controls undisturbed, thus managing price increases at the cost of creating shortages that further capital investment with state aid would be needed to remedy. Inflationary increases past the 4-5% annual band clearly exhibit pressure on real incomes so while companies would scramble to keep pace, real costs would rise and it’s not unreasonable to think that the current experiment with the mortgage bubble might have played out in a different fashion.

His entire analysis hinges on the CBR using Russia’s currency reserves to stabilize the ruble, but that’s an impossibility in the new price environment for Russia’s primary exports. I actually think Glazyev isn’t as out there as many might think, even if his ideas are riddled with holes, but his own brand of stimulus is victim to the COVID shock and energy transition:

Converting the valuation is irrelevant. What matters here is the relative size of the surplus. The lower it is, the more stress on banks. The more stress on banks, the riskier a massive credit expansion of the kind Glazyev’s envisages becomes. What’s curious about his own take is that he doesn’t frame it in terms of the state taking on greater spending and debt burdens to sustain demand. You’d think that would be the more rational means of generating growth and raising incomes, especially since that debt could be issued domestically at present rates and not present a massive drag in terms of debt servicing costs. Glazyev’s at least onto something, but it’s far too Soviet and into protectionism and closed markets to change Russia for the better.

Last tango in Riyadh

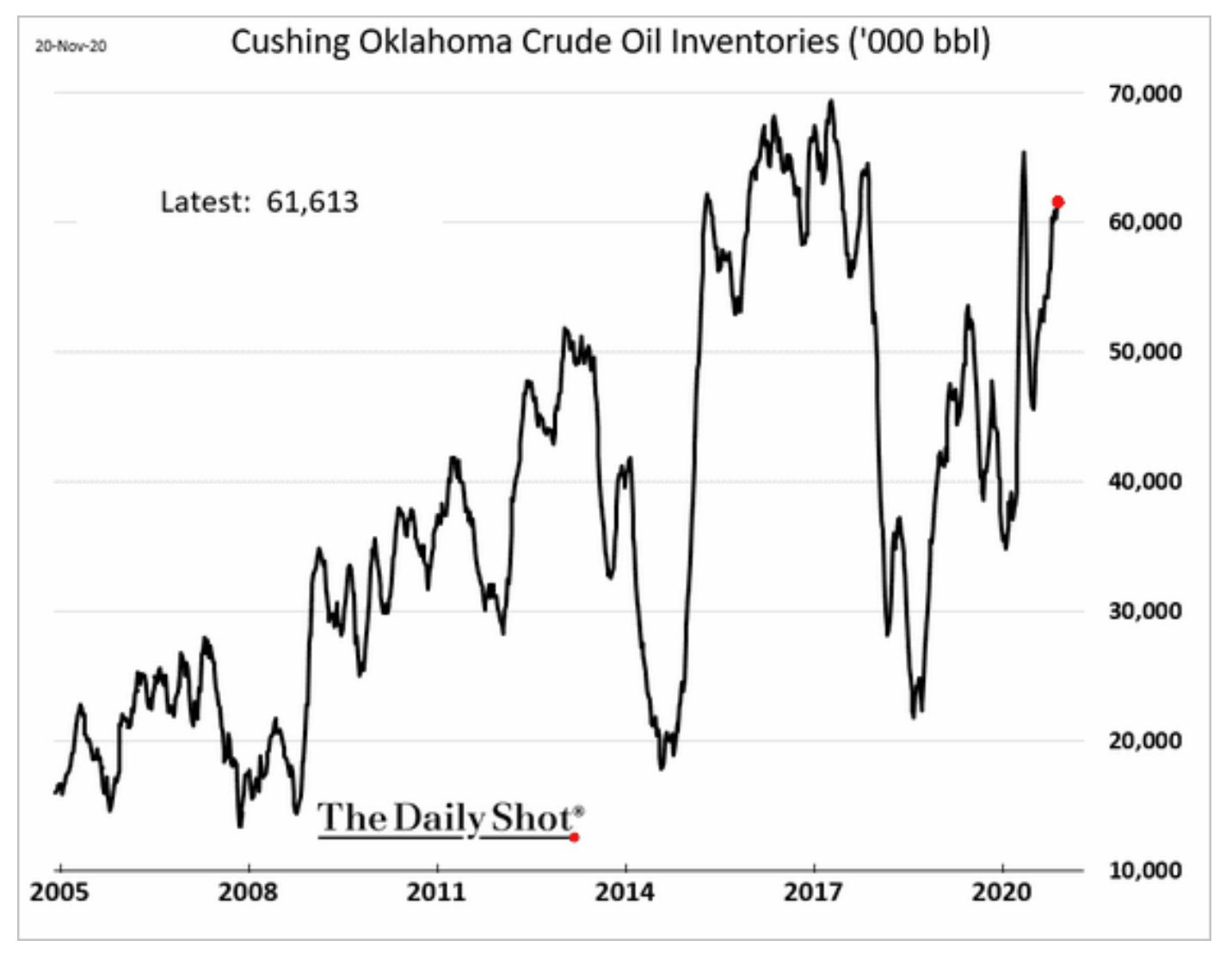

Oil markets are hanging in a holding pattern with the recent break upwards mostly a confidence mirage from a few good headlines. Consider how high stocks at Cushing in the US are looking now:

The current spike in COVID cases across the US might not subside till February-March based on the current trajectory, logistical delays delivering vaccines, and the immense hurdles facing the Biden administration trying to jumpstart their own national plan coming into office. Retail sales data out of China is looking more positive than a few months ago, which should be net positive for oil prices:

But even with better news on that front, it’s worrying that bond defaults in China are on the rise. We’ll leave Europe aside for now since I’ve beaten that horse to death lately. Defaults in the industrial sector bely a sense that China’s growth arc has to moderate against the size of its debt burden. As of now, the slack for demand and relative stability of supply for oil live little room for a significant risk premium.

However, a few news stories the last several weeks do suggest that while an outside shot, there is still time for the Trump administration and partners in the Middle East to do something stupid. First, Netanyahu’s not-so-secret trip to Saudi Arabia to meet with MbS when Pompeo was there. Then an Israeli announcement that the IDF should be prepared in case Iran retaliates against the US. Israel hit Iranian sites in southern Syria prompting call and response “come and take em’” diplomacy which then ended up with Israel demanding the UN Security Council take action against the Iranian presence in Syria because of reported border incidents with the Quds Force in Golan. The latest tanker incident in the Red Sea was the same type of pretext last time Trump came within 10 minutes of attacking Iranian soil. He backed off recently, and I don’t think it’s likely, but we’re not out of the woods and the market, as usual, has no idea how to read Washington or make sense of what its partners in the Middle East can force its hand doing.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).