Top of the Pops

A brief note. My Twitter is still locked, and while I’ve considered opening a new account, I have heard that they’re at least looking at my appeal. The next few days, I doubt I’ll be online too much, but if you could share this with anyone you think might be interested and on Twitter etc., I’d really appreciate the help!

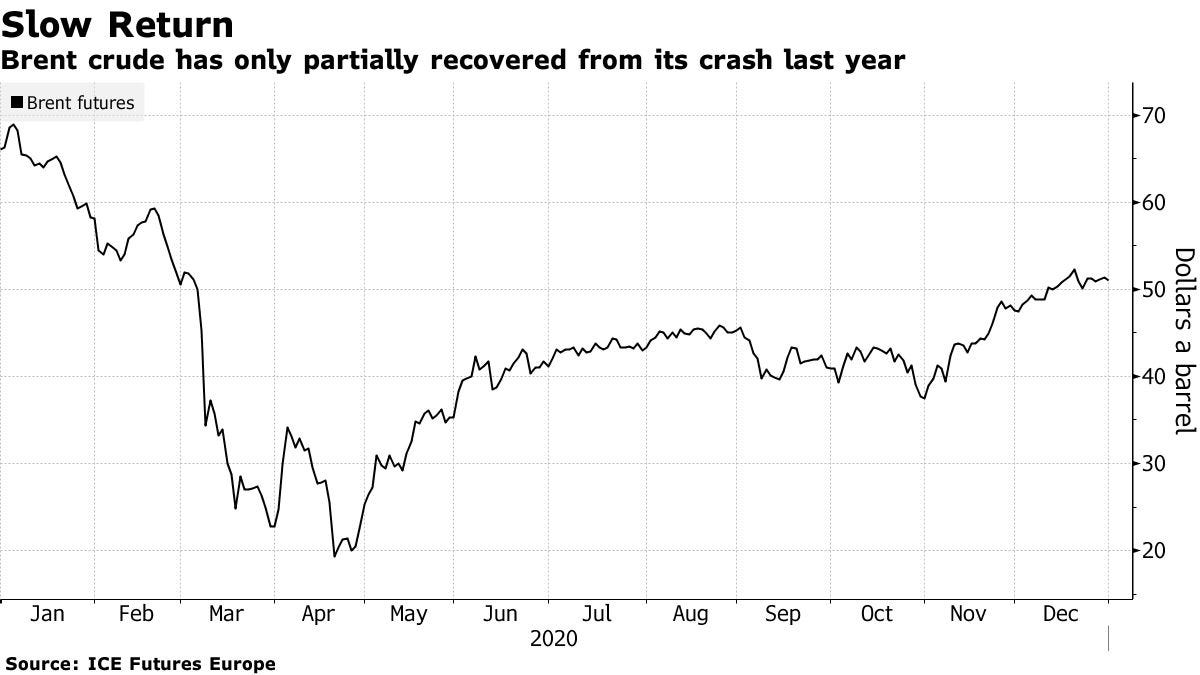

Oil’s finally back to pre-COVID price levels, with Brent now above $50 a barrel and many expecting a small price correction towards $49 and then $47 a barrel. The narrative of recovering to pre-crisis price levels isn’t really the story. Even OPEC has been forced to fully acknowledge that the nature of last year’s demand destruction is massive and overhangs any recovery:

Price ticks upwards inevitably breed some recovery of drilling for shale as well as tentative interest for new investments elsewhere. The Dallas Fed’s energy survey of business activity ticked into positive territory from a -6.6 rating in 3Q to a positive 18.5 in 4Q. As usual, shale can’t live up to its promise but is much harder to kill than OPEC+ would like. For now, the market appears to be pricing in a continuation of the current cut levels among OPEC+ despite the UAE’s game of chicken as it seeks to expand its output and market clout while Iranian output suffers from sanctions. I’m still waiting for word on of a Russian-Saudi roadmap for future partnership. Novak, from his post in the cabinet, is clearly the de facto ‘curator’ handling the economic relationship, which signals the political reality that Russia isn’t off of the oil needle by any stretch, no matter how they spin the rise of non-oil & gas revenues. This is a matter of necessity, and one that Putin is ill-suited to get a good grip on since attempts to politicize the market always blowback eventually and Russia’s leverage is best realized by achieving substantive growth driven by diversification. I can’t imagine that cuts will be eased more quickly now, especially with the newer COVID variant becoming a serious concern for recovery.

As an aside, it was great to see Kommersant poke holes in Mishustin’s price control plan for inflation. Seems that everyone realizes it’ll likely end up hurting consumers in the end at the same time it hurts business. Everyone feels the pain, only the state appears to gain.

What’s going on?

The government failed to spend 1 trillion rubles ($13.65 billion) for the 2020 fiscal year due to a mix of incomplete procurements, tricks aiming to top up the reserve fund, security service outlays that went unspent, and money withheld from regional transfers. What’s remarkable about these occurrences in Russia is that any withheld spending just worsens the economic pain of the pandemic borne by the public, and therefore imposes not only a net drag on growth coming into 2021, but also allows Siluanov and the Ministry of Finance to get creative burying budget cuts, shifts in outlays, and showing the Kremlin that there’s no risk of external borrowing threatening the country’s economic sovereignty. Money unspent isn’t a uniquely Russian phenomenon. It happens all the time in governments where ministries change hands, priorities shift, and elections interrupt longer-term budget plans. But refusing to spend the additional money on anti-crisis measures just prolongs the pain and worsens the current imbalances in Russia’s long crawl back to stagnant growth.

The Central Bank is telling firms and apps trading securities to inexperienced investors (think the Robinhood set and related outlets) to limit their ability to purchase foreigns securities that don’t meet the Bank’s regulatory criteria (intended to protect said investors) by the end of March. The overall legislative framework in the works would leave those selling these securities on the hook for returns worth 2/3 of the Central Bank’s key rate should these investors fail to realize a profit or take losses after being given unreliable or partial information or else providing them information that would require “special knowledge” of the market to understand. This isn’t really about saving investors, though. It’s about keeping money in banks. There’s been an over 20% increase in the amount of cash in circulation in the last year and with the key rate actually trailing inflation for 2020 (4.25% vs. 4.9%), there’s not much holding Russians’ money in banks. The following shows cumulative change from Jan. 2019:

The last time a spike that big was observed was 2010, just before the oil price recovery and global growth recovery bailed out the Russian economy. There’s no reason to expect the same synchronicity this time, and easier money isn’t going anywhere, especially if Mishustin and Siluanov want to limit any increase in servicing costs on existing debt given that there had to be borrowing to cover budget deficits (though at a lower interest rate than in the past).

Rosstat data shows that, excluding seasonal factors, business confidence has largely returned to pre-COVID levels from the end of 2019. There’s just one problem. Businesses weren’t exactly happy at the end of 2019 given the flood of news in 2H showing the economy was slowing down before COVID hit:

Title: Index of Organizations’ Business Confidence (excl. seasonal factors)

Red = resource extraction Green = value-added production

In other words, the recovery to “pre-crisis” levels meriting a headline in Kommersant are still net negative. The extractive sector leads industrials by a huge margin — Wall Street and other banking sectors see a commodity bull market running for awhile and Brent crude has held on above $50 a barrel despite the coming easing for cuts. But industrials are still in pretty down territory, and significantly down compared to their brief high point late 2Q in 2019. The term “pre-crisis” is becoming a useless signifier for comparisons. Too many are stacked on top of each other, unclearly defined, and systemic in nature. These indicators show the country’s extractive firms, still led by oil & gas, becoming positively confident while the rest struggle. It’s Russia’s version of China’s supply side/demand side recovery gap from 2-3Q that closed in 4Q but still worsened the underlying structural problems facing the Chinese recovery. Russia risks yet again seeing its relative dependence on extraction rise as earnings climb thanks to higher prices on metals & minerals, as well as any sustained oil price recovery (though I’m more skeptical about the latter, $50 a barrel seems like a reasonable reference point for now).

Though a touch histrionic in tone, Roman Bevzenko’s op-ed for VTimes about the degradation of Russia’s jurisprudence thanks to last year’s constitutional gamesmanship points to an important pressure point in the coming few years for the economic and political system. The issue has less to do with limiting the space for political demonstrations, protests, and speech or specific illegalities such as the unconstitutional expansion of the voting window for the nullification referendum to a week in many precincts instead of 3 days. Rather it’s about the way in which the constitution had to be bent in order to give Putin the maximum leeway to choose how he handles succession and his political options. Russia’s courts do actually work in plenty of civil cases — criminal cases are another matter entirely and a disaster — but often strike a tenuous balance delivering what are at least semi-acceptable services for the public some of the time while still protecting the political interests of the powerful and well-connected. The more recent turn in Russia’s legal system has created a dividing line: courts, judges, and academics who have thrown in with the regime’s logic and those fighting to carve out more judicial independence on key policy areas (such as the bankruptcy law reforms from last year). That split is going to further fray the business climate and reduce the regime’s ability to absorb dissent. It also raises big questions about what happens the day after Putin leaves power or dies if judicial institutions continue to rip up assumptions held in the constitution.

COVID Status Report

New cases are finally dropping with better news from the regions dovetailing with continued improvement in Moscow. The last 24 hours saw 23,351 new cases and 482 deaths:

Black = Moscow Red = Russia Blue = Russia w/o Moscow

But there’s a catch. The caseload in St. Petersburg has overtaken that of Moscow, undoubtedly a result of the massive amount of financial and medical resources concentrated in the capital vs. other leading cities. The current fear in St. Petersburg is also one to watch across the country. Hospitalizations dropped by 30% during the New Year’s holiday, but much of that was people preferring to stay home instead of risking a hospital visit. That’s also very likely at play with the caseload figures from the New Year. It may take a few weeks to see just how much the current decline trajectory sticks, and whether or not non-Moscow metro centers may be experiencing a significant 3rd wave even amidst a national decline in total cases. On a foreign policy note, Moscow’s making sure to offer up vaccines to Ukraine in order to keep health coordination “out of the political sphere.” Watch that rollout closely.

The Hour One Problem

The Iranian announcement that it’s resumed uranium enrichment at Fordow to produce 20% enriched uranium and the IRGC’s reported seizure of a South Korean tanker are the latest evidence that the Trump administration’s strategy of bluffing has worked, if not as advertised. Re-entering the Iran deal was a signature talking point for Joe Biden, one of the few (relative) specifics he offered when it came to matters of foreign policy but, as with most of his rhetoric, he consciously left out any statements as to how it could be achieved and his own aides are receptive to trying to negotiate a broader agreement than the original one intended. This is an interesting moment for Russian foreign policy in the Middle East, and one that I think reveals just how short-sighted throwing in behind Trump was, not only for domestic political reasons in the US, but also for Russia’s relative position as a power.

On the whole, the consensus seems to be inertia is carrying Russian policy forward, even if the respondents to the linked Moscow Times roundup don’t frame it that way. Inertia in this case most readily refers to foregoing any hope of improving relations with Washington, being stuck with China post-pandemic, and trying to realize some sort of longer-term gain from the various tactical moves and improvised attempts to please the boss across Africa and Latin America. Biden’s two most visible foreign policy priorities — climate change and Iran — are going to pose massive risks for Moscow no matter what it does this year. The two are inseparable in many respects because of how the structural effect of the shale revolution and attempted Obama pivot in foreign policy has been accelerated by COVID-19’s demand destruction and public calls for a much faster energy transition.

The Trump administration did virtually everything conceivable to tie the next administration and congress’ hands when it came to policy in the Middle East, aligning fully with the revealed policy preferences in Tel Aviv, Riyadh, and Abu Dhabi. One of the least understood aspects, at least from the news coverage, is the impact of arms sales. The last second push to close as many deals as possible with the UAE and Saudi Arabia before Biden’s inauguration is really about sending a large influx of US nationals who are needed to provide support, training, and maintenance for the delivered systems and management of inter-governmental procurement contracts to those countries, creating a larger security risk that has to be addressed in the event of any escalation of hostilities. They also follow the oil industry. 35,000 Americans live in Saudi Arabia, 50,000 live in the UAE, 4,600ish US citizens (not soldiers) live in Bahrain, 13,000 in Kuwait, and about 15,000 in Qatar. That doesn’t include the over 50,000 US troops that have been deployed to the region and thousands more from the sizable naval presence that rotates through, a total that swells yet more if you try and piece together the number of contractors working for US intelligence services and the military in places like Syria, Iraq, and Libya. All it takes is one incident that is linked to Iran by media outlets and targeted information leaks to put the White House under Biden in a tight spot with congress and the public. The entire strategy from US partners in the region is akin to hostage-taking and hoping that putting US citizens and troops in harm’s way while taking small, escalatory steps to encourage retribution will force US and Iranian action of some kind.

This gets interesting for Russia quickly. Saudi Arabia and the UAE have a vested interest in maximizing sanctions pressure on Iranian crude assuming a weaker oil demand recovery and structural decline. It denies Iran oil revenues, increases their market share, and creates a permanently antagonistic relationship while also sidelining Iran from having any relevant input for OPEC. That, in theory, benefits Russia politically since it’s the only producer other than Saudi large enough to have a gravitational effect on market sentiment through cut agreements. But it also means that as the oil rents diminish in relative and assumptions about oil demand change, the cost advantages of MENA output matter more to try and edge out any future non-OPEC output gains from post-COVID investment cycles. OPEC’s monthly report from December argues for a modest gain in non-OPEC output and shows that OPEC is still playing the vital swing producer role collectively:

OPEC alone can handle most of the slack in demand at this point, but the cuts have. become what seem to be a permanent reality of market management given cost deflation for shale and offshore oil. Russia’s left somewhat in the cold here. It’s future production entails higher recovery costs and the country’s business community doesn’t want to sell off the national oil wealth to foreign firms unless it finances strategic investments elsewhere. Further, Saudi Arabia has a competitive advantage over Russia when it comes to fuel substitution — solar and wind are relatively cheap and extremely reliable due to the climate, and Saudi efforts to expand into green hydrogen are aided by its continued access to European and US firms and tech without the same reputational risks or any sanctions regime. Producers in the region can expand their share of world exports by adapting to the energy transition, even potentially using partnerships with an incoming Biden administration to advance that reality as a means of currying favor promising to buy US green exports with petrodollar earnings.

On top of that, you have the reality that in security terms, Russia is stuck with Iran because of their presence and activity in Syria. There is no exit strategy for the US, which means that there are continued risks from operating in a space with so many competing interests and powers acting at cross-purposes. The Kurdish SDF are already lobbying in Washington to expand the US troop presence, which will be picked up by hawkish Republicans and Democrats like Bob Menendez, Chris Murphy, and Chuck Schumer as a negotiating point. The more Israel launches small-scale attacks on Iranian troops and prods for trouble in Syria and Lebanon, the more Al Qaeda affiliates being armed with Saudi, Emirati, Qatari and/or US and European support, the more pressure Turkey brings to bear on Kurdish positions and presses against Assad’s forces and Russian peacekeepers, it’s a massive powder keg that has not yet blown out of a mix of good luck and regional players’ reticence to pay the cost they hope the United States will bear. Just watch this from the 75th anniversary assembly. Netanyahu expressly tries to politicize the port explosion in Beirut to trigger fighting (skip to around the 6 minute mark if you don’t have time):

Russia’s ironically losing in the Middle East in two ways, even if it appears to have gained a secure role as a regional go-to power. First, Russian oil output is not as competitive as regional exporters’ in the long-run and any long-run demand decline that has to be managed — perversely strengthening OPEC’s hand — will require the ability to stomach periodic well shut-ins, low extraction costs, and spare capacity. Russia lacks all of these things, and will be similarly hit harder by carbon adjustments on oil exports when you factor in the viability of solar and wind power for much of the region (Iraq presents a particularly complicated case given security concerns).

Second, its economic need to play a role in oil market management for its budget and business cycle as well as domestic intermediate industrial demand can be compartmentalized in navigating the Saudi-Iran dynamic only so long as the effects and risks of Saudi, Israeli, Emirati, Turkish, etc. policy don’t come to a head. In other words, Russia has to play a larger role managing crises precisely because of its commitment to not picking any side. The Trump administration effectively locked in a cycle of potential escalation that Russia can’t manage. Russia’s successes still depend on the US being the adult in the room and not pulling the trigger. But not even Biden or a Department of Defense more hesitant to launch strikes can undo the structural dynamics at play since the very market management Russia needs had, by 2018, entailed corollary actions on the part of the US to try and squeeze Iranian output to pursue objectives concerning Iran, to benefit US oil producers, and to work with Saudi Arabia and Israel jointly to pursue their regional preferences. Backing Trump has forced Russia to keep deepening its diplomatic and, in many cases, security commitments across the region, disguising what is a careful balancing act fraying at the seams, now managing a greatly accelerated energy transition, as success and prestige. Biden’s first crisis could well be Iran. That’s terrible news for the Kremlin, no matter how comfortable it is committing to a permanently adversarial and antagonistic relationship with Washington and, increasingly, Europe.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).