Top of the Pops

Ceasefires aren’t holding in Nagorno-Karabakh and it seems that Baku is willing to keep pressing its advantages so long as Russia can’t commit to positioning troops in harm’s way.

The dust hasn’t yet settled in Kyrgyzstan as Japarov appears to have seized all of the commanding heights of political power in the country. Now both prime minister and interim president, Japarov is promising elections. I’d watch them closely.

What’s going on?

Market observers have seen an increase in Russians’ interest to buy property — mainly new-build apartments — as an investment during the COVID-19 crisis. The basic thinking is that with the key rate cut to 4.25%, Russian’s are effectively realizing returns of .25% or less on bank deposits given inflation and, with favorable mortgage rates subsidized by state policy, are hoping to get better returns on property. There’s just one problem: the country’s heading for a jobs and earnings recession based on the current second wave of infections and decision not to meaningfully expand or extend support for businesses and individuals.

A new reform to the Constitutional Court is set to make decision-making process of the nations highest court considerably less transparent. Dissenting opinions will not be published and judges will not be allowed to publicly criticize the court, a change that will further strip away judicial independence. More importantly, now that the president has a constitutional prerogative to dismiss judges per this year’s constitutional amendments, this move is meant to further centralize authority to ensure judicial outcomes for salient cases and disputes between interest groups.

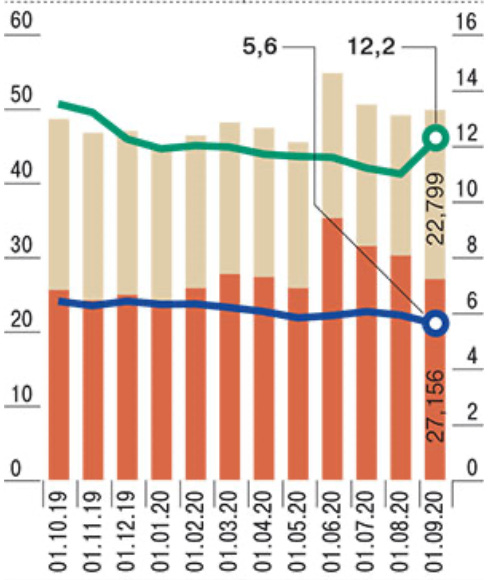

The budget deficit hit 1.778 trillion rubles ($22.8 billion) for the year in September, a significant decline from 2019’s budget surplus for the January-September period of 2.99 trillion rubles ($38.4 billion). That the current deficit has only reached that figure so far goes to show just how conservative the economic support packages and stimulus support plans are:

Title: Fulfillment of Budget Obligations Jan.-Sept. 2015-2020, trln rubles

Beige = revenues Orange = expenditures

The current budget plan for 2021-2023 calls for decreasing social spending’s share of budget expenditures slightly, from a peak of 4.8% next year (a small rise from 4.7% in 2020 due to overall budget cuts) to settle at 4.5% by 2023. Safe to say no one making decisions seems to care too much about the structural effects of the current crisis on social welfare.

The ex-mayor of Norilsk - Rinat Akhmetchin - has been sentenced to 6 months of correctional labor in respond to his failure to ensure proper oversight and environmental damages caused by the large diesel spill in late May. Given that a bunch of the staff of Kamchatka’s regional government was forced out within a week of the incident in Avacha Bay, it’s worth following similar cases in the next year. The waste collection (and treatment) protests helped make ecological concerns a sticking point for the regime’s legitimacy, one they’ll need to more pro-actively manage going forward.

COVID Status Report

Russia saw a single-day infection increase record for Sunday, registering 15,982 new infections. Consider the regional map heat map again:

Number of confirmed cases, increasing left to right:

The Arctic is what sticks out, particularly Murmansk and Archangel’sk. Now that winter is coming, more people are going to be sticking indoors and, without serious support measures, that’s going to end up leading to higher infection rates. Moscow mayor Sergei Sobyanin is doing his best to keep things under control without committing to a total lockdown. I’d watch carefully to see if the caseload is still rising by November because of the nature of existing support packages.

Casino Royale

It looks like small and medium-sized businesses are in deepening trouble. The amount of debt that SMEs are past due on is steadily rising, a trend that became noticeable in July-August and likely further along now since the most recent data available is from August. The following chart from Kommersant shows the August uptick for SME debts past due:

Left Axis: Number of debtors with debt past due, 000s

Beige = legal entities and individual entrepreneurs Orange = SMEs

Right Axis = % of delayed debt vs. total debt held

Green = SMEs Blue = legal entities and individual entrepreneurs

The uptick represents a two-fold problem. The stabilization of GDP has done nothing to lift real incomes and future real income growth looks weaker than GDP growth. Without income support, SMEs clustered in the service sector or else not surviving off of state procurements and large firm contracts are in serious trouble. The other is that state support subsidizing loans — a policy that deputy prime minister Andre Belousov wants to continue into next year with annual rates capped at 7% against the 8.5% subsidized rate as of late September — requires consumers to work. Unsubsidized rates for SME borrowing stood at 10%, so the current subsidy scheme is really a pittance in practical terms if your customers aren’t coming back. More broadly, the percentage of debtors past due on some of their debts in Russia due to financial difficulties rose from 55% to 70% according to the National Association of Professional Collectors’ Agencies. Per Vedomosti, the volume of SME borrowing was up 10.4% in August:

Title: Volume of Credit Extended to SMEs in 2020, bln rubles (by month, Jan-August)

Higher borrowing doesn’t correspond to demand at the moment. As of late September, consumer demand was down around 6.7% year-on-year, with the average Russian spending 4,000 rubles less for January-July and the median Russian spending 2,600 rubles less. In other words, the hit to incomes in Russia’s leading metro areas was worse in relative terms because of the higher proportion of service jobs more strongly affected by COVID. SME ombudsman Anastasia Tatulova is arguing that 2019 taxes should be returned to SMEs and cash support offered for those supporting remote working jobs. That’s not happening. And the relevant national project for SMEs is now calling for there to 25 million SME jobs in Russia by the end of 2030.

Yet there’s little evidence anyone has bothered to grapple with the basic problem: the only competitive sector for SME growth is in services, like bars, restaurants, anything selling “an experience”, and so on. People need to be spending now, if not in person (though no Russian official seems willing to order a strict lockdown again), then online. Even before COVID hit, there was a slowdown in the growth of consumer credit in Russia:

Title: Dynamics of Consumer Borrowing

Cyan = volume of consumer borrowing, bln rubles Red line = growth rate for the previous 6 months

An expected return to a 5-10% growth rate in consumer borrowing is simply not sustainable without income support, at least not without massive credit risk. Let’s go back to today’s story about Russians looking at property investments. This chart shows the average cost for new-builds in Moscow in 000s of rubles per square meter:

In the middle of a massive economic crisis when unemployment is being underreported, lost or held wages are on the rise, total spends are down, and commercial real estate is struggling with SMEs increasingly unable to pay off their loans on time, residential real estate prices in Moscow seem relatively unfazed. This is an unmistakeable sign that inequality is rising and that, lacking other options, more people are turning to bets to afford their lifestyles or else exploit the mortgage subsidies while they still can. People are cashing in their chips, but no one’s leaving the casino. Moscow’s policy response to the crisis is basically to inflate debt bubbles without addressing the crisis of real incomes. That’s a hell of a gamble.

Vostok Images

On Friday, Rosneft’s board announced it will be placing 800 billion rubles ($10.3 billion) of bonds out on the market. Rosneft has outstanding debts worth a combined $54.8 billion, and a little less than half of that is denominated in rubles. The last time Rosneft made this big an announcement for ruble bonds back on December 15, 2014, the ruble devalued over 10% against the dollar the next day. The reasons are straightforward enough: the massive infusion of rubles to banks after passing through Rosneft’s subsidiaries encourages them to buy foreign currency to earn stronger returns quickly given ruble volatility and economic weakness and Rosneft’s gravitational pull on Russia’s foreign currency earnings can spook other parts of the market, driving a self-fulfilling prophecy of speculation and attempts to hedge against ruble currency risks.

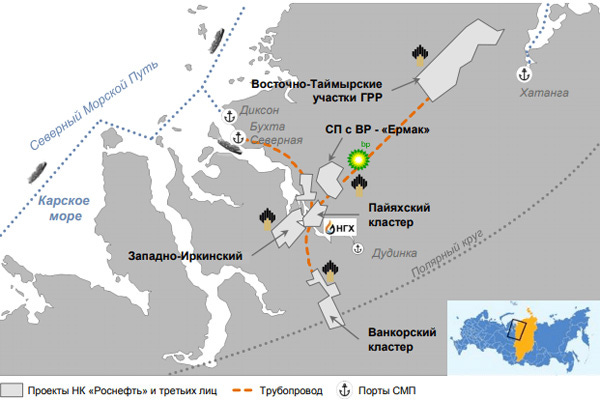

The situation now isn’t the same as 2014, not least because the country’s had nearly 6 years to adjust psychologically to a floating exchange rate. What’s more important to ask is what exactly does Rosneft plan to spend that money on? My assumption is they’re planning on going ahead with Vostok Oil, which is a risky proposition and a fascinating case of the complete decay of the Kremlin’s ability to decide domestic policies:

The upper left marks the Kara Sea and the blue line is the Northern Sea Route. The clusters all build off of Rosneft’s current fields at Vankor intersected by the grey dotted line — the Arctic Circle. The capital expenditures needed to build all the relevant infrastructure are huge and the issuance is likely part of a bigger game of chicken to make sure Moscow subsidizes the project to Igor Sechin’s liking. For context on Rosneft’s offering, MinFin is placing 2 trillion rubles’ worth of OFZs on the market for the entirety of 4Q. Rosneft’s single issuance is 40% of Russia’s targeted sovereign debt issuance for 3 months of a fiscal year. The issuance is going to distort demand, even if it’s unlikely to affect MinFin’s planning in the end. That’s bad news for the ruble if it’s residents buying Rosneft and non-residents and foreign currency inflows don’t pick up to help manage ruble volatility.

If the bond issuance is a leading indicator, it’s bad news that OPEC+ is now realizing that 2nd and 3rd waves of infection could lead to an oil surplus in 2021. Rosneft is bad at making moves in the downstream and while it’s possible that a considerable chunk of the issuance is going into existing fields (and a backdoor stimulus for oil and gas service providers), you don’t make a splash that big unless you want to increase production (which Sechin always does). Ongoing talks over tax breaks for Vostok Oil being finalized point to the extent that MinEnergo can’t rein in the oil sector without a full court press if need be. So long as Russian oil firms are divided in their interests and motives, Rosneft can leverage its massive heft to keep poking at OPEC+. This is a longer-term pressure — it takes awhile to get going on projects in the Arctic and the final terms for tax breaks aren’t agreed yet — but this confirms my fears about 2021. Putin may not be able to hold OPEC+ together. He already blinked in March and April, and even MinEnergo is adamant that Russia will keep easing production cuts per current agreements. That’s going to have to change, I think, but I’d prepare for another accidental price war if Vostok Oil moves quickly.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).