Top of the Pops

President Jeenbekov is now former president having resigned his post in Bishkek with Sadyr Japarov now sworn in as prime minister after the Supreme Court reviewed his criminal cases - he was in prison for taking hostages before being named PM - and cleared him. With Jeenbekov out, the safest operating assumption is that Japarov is about to go after his political opponents and act on his nationalist beliefs. Early days, but it does seem that experienced political players have exploited the protests to position themselves for what comes next, and that we’re about to see a lot more fights over the potential nationalization of Kumtor mine, China’s economic presence in the country, and with northern elites.

What’s going on?

Analysts from the Central Bank warn that the best of Russia’s economic recovery is already behind it. Disinflationary factors for prices have proved weaker than expected for September, job growth has effectively stopped and secret unemployment is rising, and recovery for industrial activity is basically just tracking adherence to OPEC+ cut levels. Without a new stimulus plan and recovery in business investment, risks for consumer price inflation seem a bit higher than last month and Russia will come back from this commodity shock with an even weaker growth arc as there’s no longer pent-up demand from earlier lockdowns and excess savings have run out or are running out.

The IEA doesn’t see market balance for oil anytime soon. It’s significant for Russian firms and MinEnergo that have been trying to put a happy face on and hold OPEC+ together. It seems safe for now, but the seasonality of demand as well as differential costs of compliance - Russian upstream Capex into greenfields is particularly at risk from long-run cuts on top of lower prices/weak demand - are going to become a problem next year.

Title: Supply and Demand Dynamics for Oil (Mln bpd)

Left Axes: Red = demand Black = supply Right Axis: Green = oil stocks

MinEkonomiki is looking at lengthening the planning horizon over which companies can claim investment tax deductions to try and foster more business investment. Regional governments are responsible for establishing and collecting data for regional investment projects receiving state support. 15 projects worth 850 billion rubles ($10.9 billion) have made the cut thus far, with the ministry specifically looking at extending deductions for investments into industrial buildings.

The pandemic has pushed the food retail chains Dixie, Bristol, and Krasnoye and Beloye (Red and White) to merge into the DKBR Mega Retail Group. That makes them the first new company to join RBK’s top-20 firms in the last six years since the post-Crimea sanctions and oil shock hit. While an interesting development, it goes to show how concentrated big industries have become: 51% co-owners of DKBR Igor Kesaev and Sergei Katsayev also co-own Megapolis, another top-20 firm for RBK and the country’s largest tobacco distributor.

COVID Status Update

Today, instead of another graph on infection rates, here’s a quick chart from a Vedomosti piece on Maersk’s profit growth for Q3:

Title: Number of container ship calls to world ports every week (avg. for last 4 weeks used), brought to you by UNCTAD

Container ship visits have made up a lot of lost ground, but the mix of stimulus running short, seasonal changes in demand, and rising infection rates globally are crimping recovery.

A Week at the Coalface

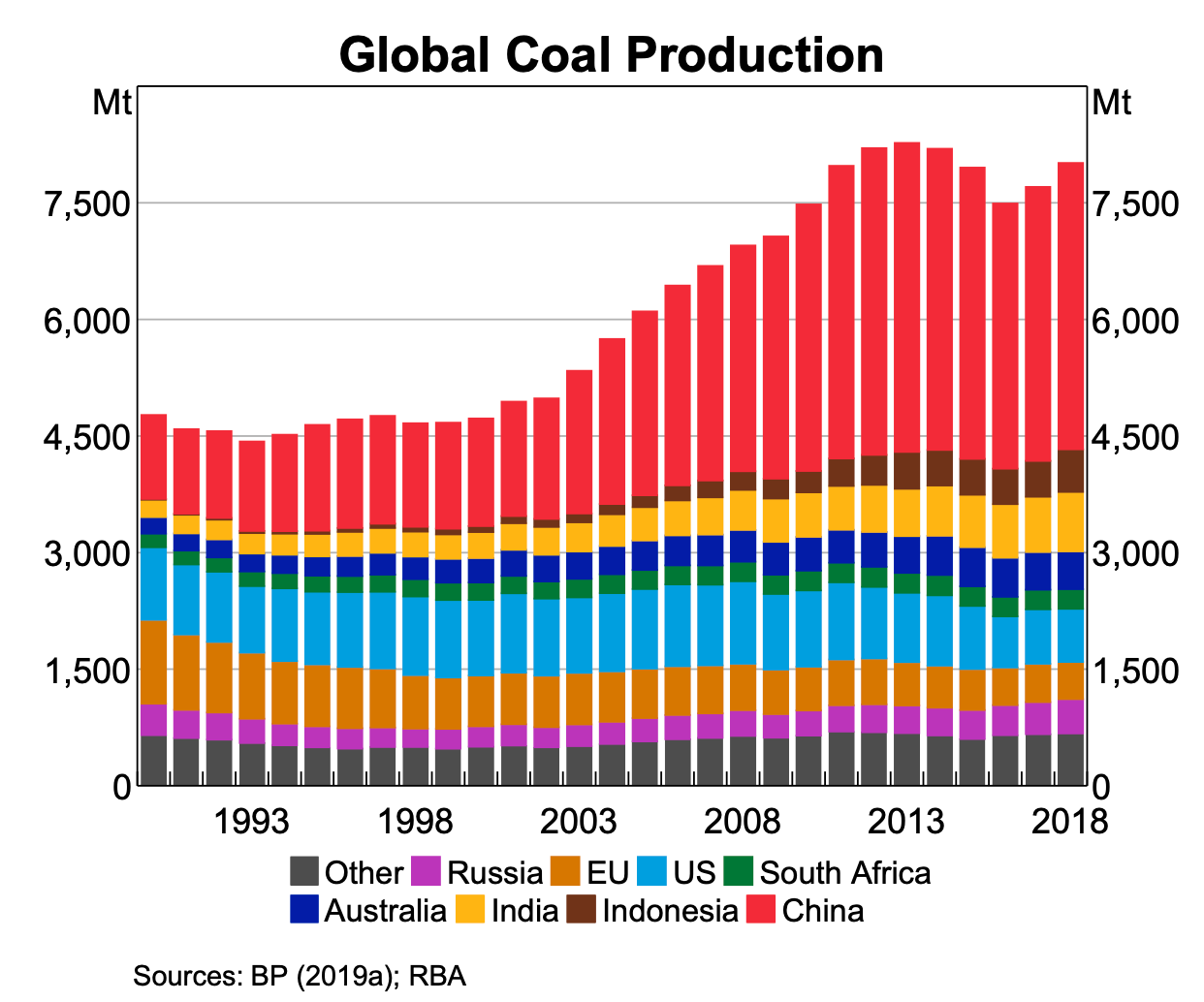

Looks like China has begun refusing imports of Australian coal in a serious blow for Australian exporters as relations between Beijing and Canberra have hit a low point. Though the ban on Australian coal imports had first been floated as a rumor, mining firm BHP has confirmed that its Chinese customers have begun refusing deliveries. Since 2009, Australia’s coal exports have accounted for an average of about 3% of GDP. Russia’s footprint on global coal markets is fairly analogous in size. It’s stark when you see just how much China dominates production, however. This is from the previous link, a report from the Reserve Bank of Australia:

Any Australian import ban is a net benefit to Russias’ coal exporters, many of whom four years ago were being warned about the potential of stranded assets by then prime minister Dmitry Medvedev. If Russia’s serious about doubling its exports to China as China aims to reduce its total coal mining operations and consolidate production in fewer, larger, more efficient, and better integrated mines, the political spat is theoretically good news. But coal is getting hit from all sides at the moment - too dirty, not making enough money, and less and less competitive against other power sources. MinEkonomiki predicted that Russian coal production would fall 10.5% for the year. What’s important to remember alongside declining production, however, is just how much coal feeds inputs for steel and related industrial production. Russia’s steel output is also weaker, dropping 3.3% year-on-year as of late September. Consider how the geography of steel production has changed in the last 11 years as well as how total production keeps rising. These are from the folks at World Steel:

Demand is still growing strong. It’s only going to accelerate further given its role in renewable energy sources. Per one WSJ piece last year (with an agenda, but on point), a large wind turbine can take as much as 900 tons of steel to build. Not just China, but other steel sectors are going to need coal to make the necessary inputs (it is crazy to see that China’s increased global market share while talking up moving towards an economic model driven by domestic consumption…). I’ll return to this next week after digging around for some data, but it’s safe to say that while Russia’s thermal coal exports might enjoy a temporary lift because of the tiff with Australia and short-run dynamics in China, the bigger driver for export earnings longer-term is going to be coking coal and the stuff you need for industrial manufacturing. It’s also an area where carbon taxes and related mechanisms breakdown somewhat.

For example, if Russian coal mines are too dirty to meet EU spec and EU markets prefer to buy from countries trying harder to adhere to environmental targets (assuming coal is included under relevant rules), that depresses the sale cost for Chinese steel manufacturers importing coking coal from Russia who can then realize better profit margins, invest more into production, and most importantly, export to an EU market whose carbon adjustment mechanisms might not apply equally in this instance. But in order to account for the total carbon cost inputs into an exported product with a longer supply chain, it’d be easiest to apply a blanket levy at the expense of not actually achieving targeted aims with trade and effectively just offering market protection for European firms. That leaves one open to retaliation. The supply chain becomes the hardest part of fitting in such adjustment mechanisms if there isn’t an international agreement.

Russia’s steel sector was staring down a potential 25% fall in domestic demand back in early April due to the combined impacts of COVID and very low oil prices. It’s stabilized much closer to last year’s levels, but is still weak and recovery since August is basically stagnant. If domestic demand doesn't keep growing - OPEC+ cuts will also weigh on it - that means any noted production increases are either just being bought and stockpiled (only likely true for specific projects, such as Gazprom’s contracts for construction) or else have to find export markets for sale. A weaker domestic market will create more pressure on Russian firms to think internationally about rules and regulations, with surely interesting consequences to follow.

Twist of Inflate

This is a smaller story that caught my eye today, but it looks like Rosstat is now factoring in the cost of antiseptics and masks into its inflation index to better reflect cost realities. One wonders how that ends up filtering through to things like medical care when people get desperate and have a hard time securing hospital beds. The bigger point is that the pandemic, in this instance, is literally affecting the statistical basis upon which one of the most important macroeconomic indicators of the health of the economy is calculated. That’s something worth considering much more expansively in plenty of developed economies, especially when looking at things like rent or education costs vs. more traditional consumer price indices for foodstuffs, clothes, fuel costs and heating, and so on. Lockdowns make all of us reconsider basics like physical activity. This was an interesting grab from an article on Oct. 11 about the market for services pertaining to wellbeing (yoga, different exercise regimes, meditation etc.) or “wellness” as us western softies call it:

Title: How the market for fitness services is growing in Russia

Red = market size, billions of rubles Blue = growth year-on-year, %

Note that 132.7 billion rubles for 2019 is still pretty small - it’s a little over 25% of the revenues that Lenta, the country’s 5th largest food retailer (graphic linked in bullet point 4 at the top) earns in a year. Services such as fitness and wellbeing remain a much smaller part of the economy. But the ways in which the extractive sector and commodity prices underpin the business cycle and employment could, theoretically, create more dramatic cost inflation for services clustered in larger cities with higher rents and mortgages, the latter of which is now subsidized for residential purposes but for which small and medium-sized businesses are increasingly on the hook without much more state help on the way. I’m curious to dig more and see if Rosstat’s statistics might understate inflation because of the composition of the index, and how that interacts with the emergent impacts of persistently lower oil prices and weaker to contracting oil demand on the country’s consumer sectors.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).