Top of the Pops

First up, the OPEC+ JMMC has recommended that cuts to balance out overproduction be held in place until September. It’s a tacit admission that demand is not recovering as strongly as was suggested by market bulls, and also a lingering risk for economies like Russia since output restraint suppresses aggregate domestic demand and higher prices tend to nudge inflationary pressures upwards. But the bigger inflation story today comes from looming sugar shortages as producers suspended production at fixed prices at the end of March waiting for state subsidies of 5 rubles per kilogram to get producers to sell at a fixed price of 36 rubles. On March 22, the government promised to provide subsidies to maintain the price. The “solution” created an economic incentive for producers to cut production until, and now producers are set to quote wholesalers and retailers the market rate or else simply not produce until payment materializes. The standoff also highlights the problem of physical size in the Russian economy — production is fairly concentrated in the center of Russia, which means that any interruptions due to contract or pricing disputes or else increases in price filter into the regions differentially. What’s worse, while producers may assure the state that retailers have several weeks stockpiled in warehouses, retailers have to know what producers intend to do in order to plan their own distribution and supply management approaches. The situation’s “always critical” for that reason, making even minimal disruptions significant for local prices. MinPromTorg is standing its ground saying that the December agreement is prolonged as of April 1 unless the parties announce they’re leaving it. I doubt any producer wants to incur the wrath of Moscow at the moment, but they have to run a profit to maintain production levels. For some reference, I pulled NY sugar futures (I wanted to line up against London, but the data was messy and didn’t add much):

Sugar futures in Russia, for instance, have historically correlated as much as 90% to spot prices, so we can see that while a great deal of sugar price increases domestically are part of a broader commodity price rise globally, the new round of measures, domestic production shortfalls, and pressures to avoid imports are now driving up prices beyond what might be observed based on international pricing dynamics.

What’s going on?

The HSE’s review of the impact of 2020 makes for good reading (or skimming). I won’t pretend to have gotten deeply into the 330+ pages there. It did catch my eye that the structure of the social spending response was such that poverty among families with children aged 3-7 declined while people without kids were “sacrificed” and saw their poverty rate double, though it remains low overall, a story several outlets picked up on. One of the more interesting observations buried in the section on value-added production was that part of the reason Russia managed as well as it did (and as poorly as it did) on the producer-side meeting demand was that Russian firms aren’t as locked into just-in-time supply chain management as their western peers, the result being that there were frequently additional stocks that could be drawn down as needed during production interruptions. The problem, of course, is that these stocks contribute to pricing shifts at the local and regional level, and can end up creating bursts of price inflation if production costs rise more quickly than price markups and a producer, less able to adjust in response to demand, has to make a judgement call that can prove costly. I need to spend some more time going through this more thoroughly, but it’s a good reminder that every time an analyst throws out the idea that Russia’s response and economic performance were somehow impressive during the worst of the pandemic, they’re generally arguing that the things that make Russia’s economy so much weaker than it probably should be given its development/growth potential the last few decades are a strength.

In an interesting development, investment activity surveys from the HSE show that in 2020, business intentions to buy imported capital goods and actual purchases were roughly in line — 37% intending vs. 38% actually buying them. In past years, actual purchases had far outstripped intentions to buy among the roughly 23,000 firms surveyed:

Title: Evaluation of firm dependence on imports (out of total % of investments)

Yellow = very high Red = high Green = low Grey = hard to answer

As we can see, levels of high dependence have steadily dropped with low dependence ticking up slightly. But what’s more telling is that very high dependence levels haven’t changed and hard to answer has ticked up as well. The sense I get from these findings is that import substitution has had an appreciable effect for a lot of industries, but raised costs at the same time incomes have been falling. Key sectors and imports like IT or high-end services for oil & gas haven’t changed much. Lower import dependence probably also correlates to exchange rate volatility. Firms have had to find ways to deal, and many have probably succeeded, but at the price of inefficiency, higher input costs, and constant demand deflation. The 2021 figures for investment plans in 1Q show they’re virtually nil. Import substitution, when achieved by suppressing purchasing power at the firm level and via subsidies and protections for state-backed efforts, doesn’t foster long-run growth or higher investment levels.

Electronics retailers note that in the last year, computer prices have risen at least 20% and a whopping 10-12% for 1Q this year alone. So far, retailers have absorbed most of the cost by paying more for imports without passing it onto consumers. That’s not great for 2021 profits given the likely weakness of the consumer recovery. Based off 1Q data excluding the last week of March, the average prices of a computer bought in retail was about 54,300 rubles ($730 averaging the exchange rate). At the same time, pricing data shows that prices do actually decline locally in some cases month-on-month, which reflects the fact that retailers are charging prices based on local surpluses or deficits of stock in hand. The problem now, of course, is that work-from-home arrangements require more investment into computers and related gear but domestic manufacturers lack the capacity to meet rising demand, at least for now. The effect of this logically leads to an increase in imports, which are themselves affected by the supply chain interruptions and bottlenecks that became apparent in 1Q this year. Overall, things have stabilized domestically except for the microchip shortages other industrial supply chains globally are still resolving. Then add in shipping since most of this stuff’s imported — container rates for Asian imports rose 5-fold between October 2020 and January, for instance — and you’ve got yet another source of price inflation that the CBR can’t manage with a rate hike and that will filter into firms’ spending plans.

The volume of investment into commercial real estate hit a 5-year low for Jan.-March this year, with total sales of land/properties at a lowly 67 billion rubles ($884.4 million), down just 1 billion rubles from the same period in 2020. Commercial property investments accounted for just 19 billion rubles ($250.6 million). 71% of deals were to acquire land to build housing vs. 29% to invest in commercial properties. There’s some cause for hope — lots of commercial deals didn’t come through in 1Q because of drawn out negotiations given the business climate and uncertainty. It’s expected the volume will rise significantly and commercial deals will account for 60+% of total deals for land and property in 2021. The rush of money into housing evidently follows the price surge from last year and emerging housing deficits across the country. What I find confusing about the projections for commercial deals’ recovery is that a 3rd wave of the virus and a likely lower than initially hoped oil price ceiling with current cuts largely held in place into summer depresses investment and consumption levels somewhat. Housing is sucking up a lot of capital right now, and while capital isn’t technically ‘scarce,’ demand right now is. I’m waiting for 2Q data before assuming anything more, but on its face, if low levels of commercial investment reflect deals that weren’t closed in 1Q but are ongoing, that doesn't augur particularly strong numbers ahead since the case rate was declining steadily over 1Q and the economic outlook was, supposedly, improving. Rather I think it reflects the bad news in February with savings rates on the rise at the same time incomes haven’t recovered and indebtedness is up, hence commercial ventures have to ask themselves if they’re really confident new locations are going to earn decently.

COVID Status Report

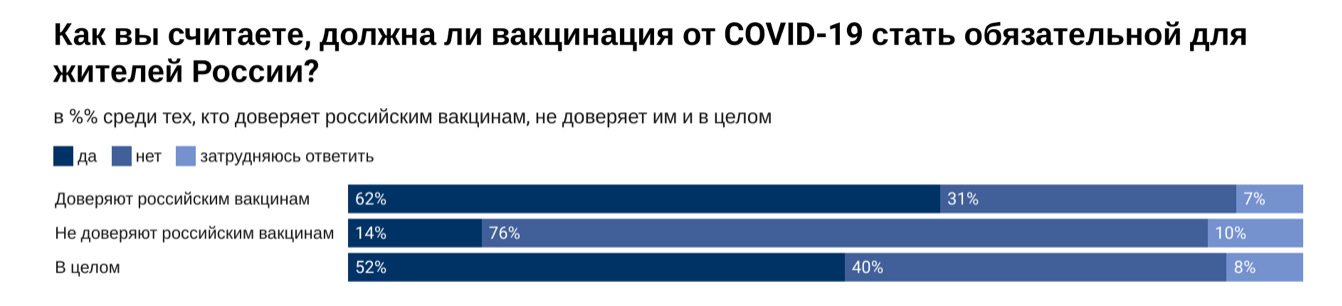

New cases reported at 9,169 and deaths reported at 383. The likelihood of a 3rd wave seems all the higher considering some grim polling from Levada on just how much Russian doctors distrust vaccines, think COVID-19 was artificially created abroad, and more. The biggest “are you ****ing serious!?” moment comes from the topline figure among doctors as to whether or not vaccines should be made mandatory for residents in Russia:

Descending: Among those who trust Russian vaccines, among those who don’t trust Russian vaccines, in total

Dark Blue = yes Middle = no Light Blue = hard to say

Just 52% support it overall. Some of that could be tempered by appeals to individual rights or other social constructs as to whether or not the state can make it mandatory in the first place, but it’s not a great look. There’s definitely something to that given that 38% of doctors are already vaccinated and another 31% plan to be vaccinated despite 1 in 7 being anti-vax and 23% saying they don’t plan to be vaccinated. I’m still horrified by the implications of that data. One wonders what transnational cooperation between healthcare systems with the West and Russia would actually look like if Russia’s own medical professionals are so (relatively) skeptical of the benefits or logic of the most important defense against COVID.

Quota Rota

Minister of Economic Development Maxim Reshetnikov has confirmed that the cap and trade emissions scheme for Sakhalin is moving beyond the roadmap stage into actual policy implementation and that Nizhigorod and Kaliningrad regions are ready to follow suit. The Duma will debate a bill this month that legally requires companies to account for their emissions and would create the legal basis for cap and trade schema to operate effectively. It’s a significant step in the right direction, all the more interesting because it seems that the policy will be expanded via regional experimentation, a process that could unintentionally create competitive advantages for exporting firms at the domestic level if they move more operations into regions with a better system in place incentivizing emissions reductions depending on how carbon adjustment mechanisms will be implemented in the EU and by other states. It’s a problem of data and fairness — it’s easiest to slap on an additional tariff to all goods from a nation failing to implement policy at the highest levels in keeping with an importer’s environmental requirements, but in this case, the EU could further incentivize federal policy changes by rewarding Russian regions that go the extra mile.

The European Parliament is gunning for the implementation of an adjustment mechanism no later than 2023. There’ll be more pressure than ever from domestic producers competing against imports to move faster given that EU carbon prices have more than doubled in the last year and are likely to keep rising:

MinEnergo is only now just finally getting round to working out a system to verify the impact of climate-friendly projects, a crucial building block for future assurance efforts with trade partners that Russia’s holding up its end of the bargain on climate issues. It’s the only way an EU importer can verify that the net impact on the planet is equal to what would be produced domestically. We know that the presidential administration and government would like to see the carbon sink effect from Russia’s forests included in its net impact as a way to further reduce Russia’s obligations and effectively free-ride off of the investments others are making that might spur non-oil & gas demand for Russian exports. It gets worse. They want to create a new source of rents from it. The current plan is to effectively lease parts of the taiga to Russian businesses to allow them to offset their emissions. It’s a scam that could be right out of Dead Souls. The businesses don’t have to change their actual behavior or get cleaner, they just pay the state to doctor their accounting and greenwash it, thus opening up easier access (in theory) to foreign credit or domestic investors searching for greener investments and avoiding import levies if they’re exporting to the EU or any other market with an adjustment system in place. The estimate is that Russia’s forests offset 620 million tons of CO2, roughly 38% of national emissions. That’s a huge “cheat code” for trade relations, one I’m quite confident won’t pass muster with trade partners. You’d think policymakers would want to sort out problems like a deficit of bicycles now appearing on the market to reduce city emissions, but then again, you’d expect they’d find a way to engineer a rent out of the exercise.

I have plenty of problems with the approach the Biden administration’s taken to its latest infrastructure package, though it’s a sizable investment and will have a very positive impact on climate policy in the US and emissions reduction. But what’s most important to see if you’re a policymaker in Moscow trying to figure out what spillover effects EU policies will have in a world where the US and China are also getting more aggressive is the shift in political discourse taking place in the US:

Greening the US economy, even if that’s not necessarily the chief aim of the current bill, is a matter of competitiveness. That logic becomes self-reinforcing once carbon externalities are introduced into tariffs and trade regulations — I do wonder what happens with non-tariff barriers and other requirements that aren’t tariffs, since they’re “where the action is” for more contemporary trade debates. In an era of explicit competition, it’s not just the global imbalances driving trade wars and financial fistfights that matter. It’s how states adapt to the rising opportunity costs of inaction on the climate, the collective action problems it poses, and are able to adjust to protect their own industries or at else help them manage the transition.

The fact that Russian regions seem to be more actively leading the way pushing for a cap and trade system has a lot of political merit for Putin and Mishustin. It allows them to use the regions are incubators experimenting with the idea, learn from mistakes, and also deflect criticism while seeing if it makes sense to match these schema with a federal one. But this approach is also short-sighted. The longer a federal policy is deferred, the costlier its implementation will be depending on what external partners are doing and, worse, SOEs and large companies can more readily exploit regional-level initiatives for their own gain in ways that distort spending and reduce the efficacy of any fiscal policy, namely spending, meant to address climate issues.

Take the example of Gazpromneft, which has just launched a road construction subsidiary planning to build up to 350 km of roads by 2025. Why? Because the company’s bitumen production has risen to 2.9 million tons annually and instead of realizing profits selling it at arm’s length in a country that systemically underinvests in infrastructure even when it announces big spending plans, the company realizes it could get more building roads for its own projects and in regions that need the help. The company’s aiming to build between its own fields in Khanty-Mansiysk and Tiumen’ regions. Imagine that both regions have imposed a cap and trade scheme that carries penalties for exceeding a certain pollution limit and also stipulates offset requirements for economic activity. If you’re Gazpromneft, you provide more fiscal resources, are really big, and get some of your earnings in USD or other foreign currency. You have an easier time negotiating lease terms for forests, assuming that’s the offset run through the state’s forestry fund/ministry, and now that you produce enough bitumen, you can provide lower construction quotes to regional governments to win bids for projects sourcing your own stuff before inevitably running into delays and cost overruns. But once that happens, the regional government has nowhere else to go. The medium-sized construction firms aren’t going to win contracts as easily, might cost more, or lack the size necessary and other construction contractors close to the regime are going to be waiting for whenever a federal project comes up. What you’ve done, in effect, is introduce a new mechanism for SOEs and parastatals to use their scale and influence to generate new rents and further distort the transition process, especially if the domestic programs are forgiving and allow them to effectively write off emissions using forests rather than simply making them one component of an emissions reduction policy program. The companies that own hydrocarbon infrastructure — here I really mean the refineries that actually refine products used for construction but upstream assets as well — are going to engineer new rents for themselves to effectively underwrite polluting activities that require a much harsher disciplining mechanism like a carbon tax.

It’s a classic problem for Russian governance, but one that’s more acute on matters pertaining to the energy transition because of its differentiated fiscal and financial impact across the regions. At the same time companies like Gazpromneft might try to engineer new rents from construction contracts, regional governments will have to find new sources of revenues if earnings from oil & gas begin to decline as border adjustments take a chunk out of export profits and external demand on key export markets falls. And then there’s the financial impact for Russia’s most important exporting firms managing the balance of payments and much of the fiscal system:

Lower prices for oil & gas tend to drive debt increases for Russian energy firms, particularly Rosneft since it likes to leverage up massively, acquire stuff willy-nilly, and then pay down the debt by agreeing to sell future barrels of oil to China in exchange for an upfront payment. Those strategies make even less sense once additional costs are imposed on their products and other exporters do their best to fill the gap. Moscow’s policy problem here is that its policy approach is consciously fractured and intended to insulate the federal government from responsibility for as long as possible while working out what exactly it can do. I’m quite sympathetic given the practical issues of state capacity in Russia, but the energy transition is the type of problem for which states build capacity by leaping into it, not by waiting to see what the damage looks like. The regime’s approach was sustainable so long as a figure like Trump ran the executive branch in Washington. EU policy is the prime motivator, but US policy is beginning to cast a shadow as is China’s slow embrace of decarbonization. The Duma may want to get more aggressive in debating the topic and fast before it becomes a crisis measure that leads to even worse policymaking.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).