What’s going on?

The Federal Tax Service is launching a pilot program to reduce the turnaround for VAT reimbursements to one month, covering 3,400 firms with reimbursements worth about 219.2 billion rubles ($2.8 billion) per quarter. The plan is a further step to improve tax collection and accounting that saves on administrative costs, but more crucially, should help spur demand around the edges by paying back companies more quickly so they can theoretically redeploy capital.

The Audit Chamber points the finger at MinPrirody and regional authorities over the ineffectiveness of waste collection reforms and systemic waste of money, partially driven no doubt by the lack of basic data about the volumes and composition of waste in the regions. The picture the Audit Chamber data paints is dire taken from 39 of 85 regions. Bad news given how salient the issue has been for local protests and basic political organization:

Blue = the world Red = Russia

Left to Right: Waste generated, mln tons per year, Average waste generated per person (kg), % of waste recycled

Metallurgical firms are lobbying deputy prime minister Andrei Belousov to change the sector tax code. Led by Novolipetsk Steel, there’s a proposal that starting Jan. 1 2021, projects with a greater than 10% growth from the base level of extraction are exempted from the coefficient of 3.5 applied to their tax obligations (presumably to encourage investment to increase capacity). Similarly, many hope to keep the severance tax for mining projects at the current level and limit any tax increases per the coming budget consolidation in Moscow to temporary measures. The lobbying comes just one week after the Duma passed the severance tax increase via the 3.5 coefficient and repealed a series of severance tax exemptions.

Yesterday, 14 members of the Government Assembly of the Republic of Altai offered their expression of no confidence in regional governor Oleg Khorokhordin’s performance over the last year. Khorokhordin won election last year with 58.82% of the vote (and less than 50% turnout with some helping hands sealing the win). It’s worth following since investment into the Altai was up 15% year-on-year as of June despite COVID, with the 41.8 billion rubles ($533.8 million) invested dominantly flowing into agriculture and extractive industries (read: mining). Khorokhordin met with Alexander Shokin of the Russian Union of Industrialists and Entrepreneurs in early August trying to court investment.

Our Brand is Crisis Management

Per RBK, new COVID-19 cases across Russia are on the rise and are now past 8,000 a day. That doesn’t exactly jive with the latest order that tough lockdown measures not be taken. If infection rates rise further - there’s already concern in Moscow that the burden on city hospitals is rising fast as over a quarter of national cases are in Moscow proper - it’ll be bad news for the ruble’s stability.

The non-resident share of OFZ issuances has declined steadily from about 34% in February to 29% as of September 1, a trend likely to continue. Clearly sanctions risks around Navalny are also likely to spook some as few people predicted relations with Germany souring so quickly and the United States, the Anglosphere, and EU have rallied in support of the Belarusian opposition. But the small capital inflows for OFZ purchases helped manage some of the ruble’s decline from a weakening current account earlier in the year. As much as traders may be driving the exchange rate - noted by Macro Advisory - the fundamentals are still cause for concern. The economy rode out the worst of the storm so far on external demand. Unfortunately, China’s credit cycles and expansions of credit lead the way on prices, whether that’s from shady banks securing loans with physical volumes of commodities, real demand being exported, or else over-production due to the misallocation of resources that is then absorbed by the domestic market via state infrastructure initiatives and so on. S&P pulled this handy chart together:

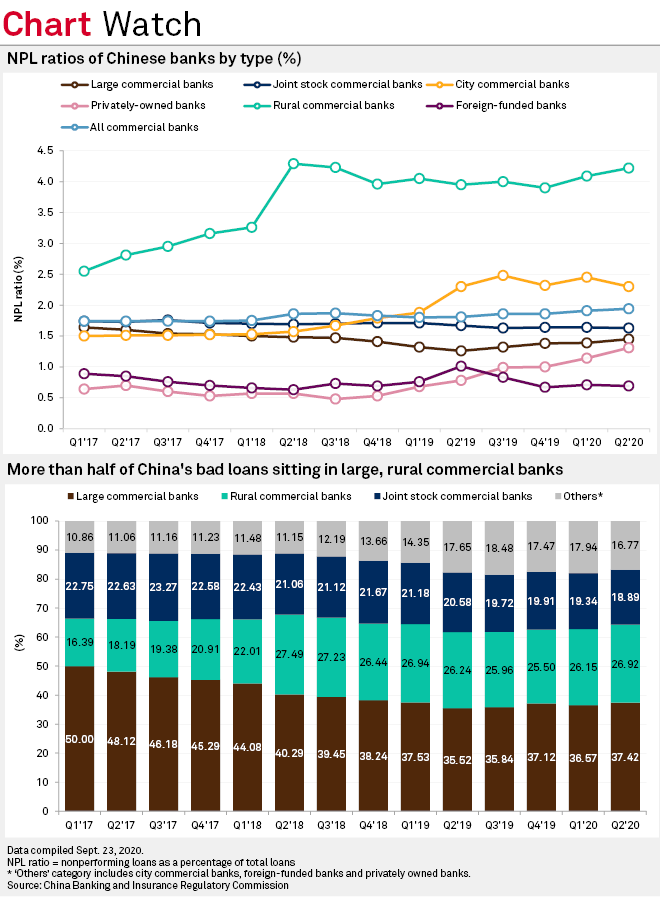

It’s not just the worsening credit profile of Russian firms you have to worry about. China’s recovery, already unevenly boosting supply and not demand, is disproportionately hurting rural debtors as commercial banks and privately-held banks see their NPLs rise. China can restructure its debts as it pleases, but there’ll be pain for consumers. That’s why Russian domestic demand is probably a more important variable to ride out coming volatility and make sense of any ceiling or floor, especially since another burst of devaluation will start to create problems for banks. An uptick in infections without adequate health measures or a larger fiscal support package will hit domestic demand harder. Oil just took its first monthly price per barrel loss since April and even a middle of the road demand forecast from Mercuria holds that it won’t recover for 18 months. Here’s hoping Moscow’s ready.

A Little Bit of (Black) Gold and a Pager

Reports are out there per data from the CBR and Raffeisenbank that the Russian banking sector is facing a currency liquidity crunch:

Title: The Situation with Currency Liquidity Continues to Worsen

Y-Axes = bln US$

Yellow = Excess Foreign Exchange Liquidity (Left Axis)

Gray line = Highly Liquid Currency Assets (Right Axis)

Green line = Accounts Drawn (Right Axis)

Some of this is a relatively basic crisis story. Banks are giving out more cash since more people are panicked, struggling, stuffing stuff under their mattress for emergencies, and also seeing the interest rate for deposits drop. All the crazier is that imports, roughly half of which are machines and related parts, are down 15-17% YoY right now. That’s literally back to levels last seen in 2007, but the comparative declines in export earnings and slowed domestic activity from the OPEC+ deal among other things means the current account isn’t improving (at least fast enough). But the more interesting aspect of the problem is how it intersects with Russia’s current account, namely its dependence on oil, gas, and other hydrocarbon exports for about 80% of foreign currency earnings.

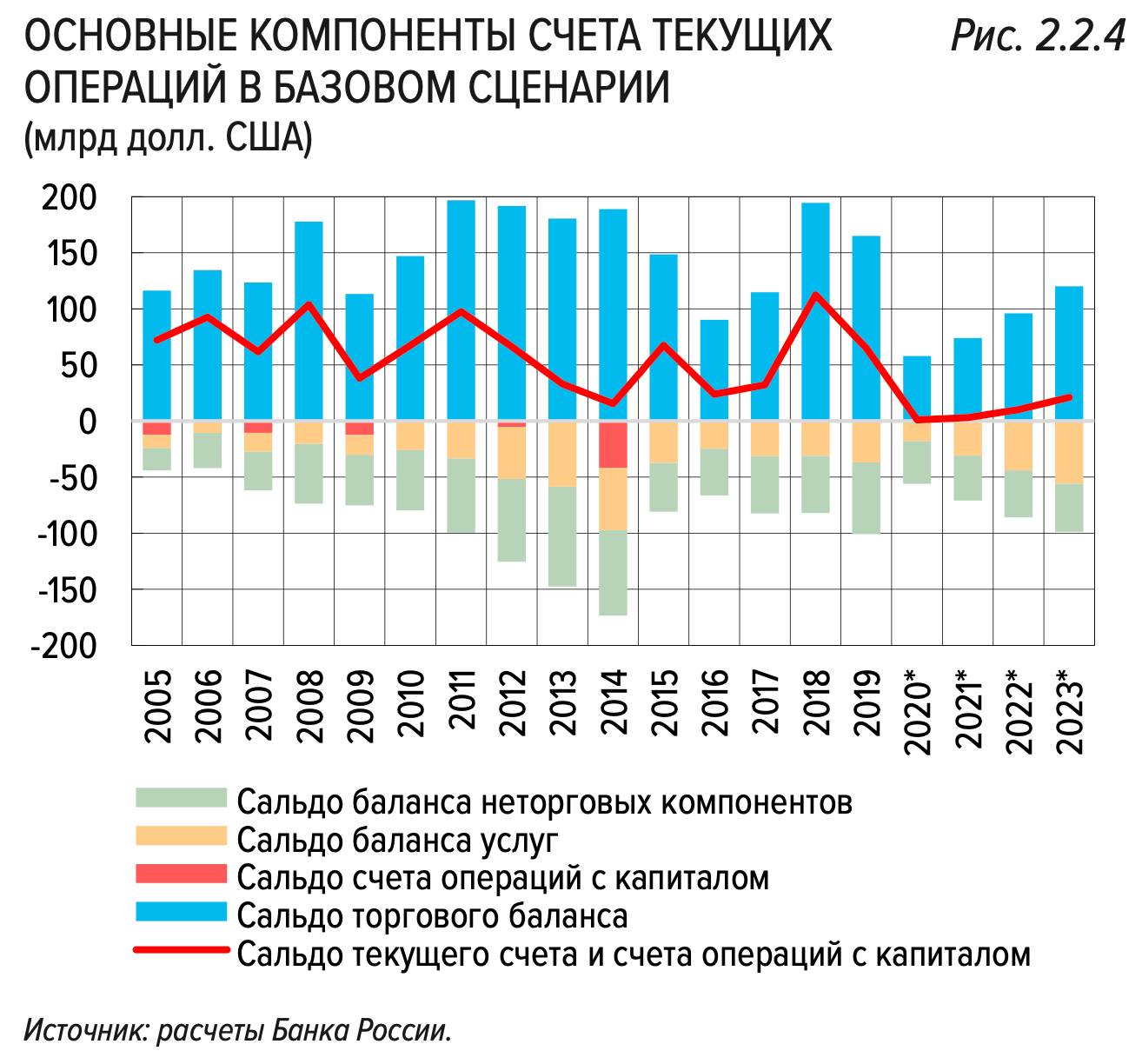

Interfax reported that Prime Minister Mishustin sent a directive aimed at Rosneft, Gazprom, and diamond giant Alrosa ordering them to limit the size of their currency holdings and, in the case of Alrosa, reduce the holdings in currency to levels last seen as of October 1 2018. Basically, the government just admitted that banks are in trouble and while the Central Bank is going to undertake operations on the open market to build up reserves (unclear what the balance is between US dollars and Euros), these companies are the backstop. Take a look at the CBR’s forecast for the current account, driven by hydrocarbon prices:

Light Green = non-trade balance Peach = services balance Light Red = capital operations balance Blue = trade balance Red Line = current account and capital operations balance

Basically, the current account recovers slowly as the oil price rises back towards $55 a barrel in the CBR/MinEnergo models. With it, the inflow of dollars and Euros improves. What’s fascinating about this current episode is the extent to which a company like Rosneft is really a vital cog in the “accumulation machine” the Kremlin relies upon to maintain the stability of the ruble and the banking sector. Rosneft Vice President Didier Casimiro lamented that the decisions taken by BP and Shell to shift towards renewables herald not just a growing divide between NOCs and IOCs, but “an existential threat for supply. It is an existential threat for price volatility.” The irony, of course, being that a supply crunch would make the business case for Rosneft’s latest plans to expand production viable, unless of course the unstated concern (much likelier in my view) is that US shale can only roar back to life in such a scenario. In reality, Rosneft’s just complaining cause it’s not equipped to pivot to new modes of foreign currency accumulation, which in the longer-run risks its political power within Russia.

China’s new commitment to achieve net zero carbon emissions by 2060 should rattle Rosneft and Gazprom. Not because their export earnings are at any risk for now. Demand in China, if anything, has more room to grow. But if Rosneft’s truly committed to its forecast that the world needs a minimum $2.8 trillion of investment into power generation and utilities through 2030, it better wise up fast and Gazprom better pay attention. Oil’s realistic price ceiling is a lot lower than it was just a year ago, and natural gas with it. Russia’s current account is going to have to adjust. It seems likely that the managers at these companies will first target acquisitions like property with their cash-in-hand to make the best of a bad situation while still getting the money into the banking system at a time it desperately needs the reserves. The COVID hits just keep coming. Live by external demand, die by it too.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).