All over but the shouting

The US-German deal on Nord Stream is completely fine and a decent get for Kyiv

Top of the Pops

A reminder that this will be the last week on Substack for OGs and OFZs. My reasoning and what to expect for pricing and paywalling going forward are broken down here. I’ll begin the move to Ghost at week’s end and will aim to be up and running again around August 16 after a much needed honeymoon in Chicago. If you want to get your first 3 months’ subscription discounted at Ghost, subscribe sometime this week for the monthly plan or else the annual plan, which will rollover whenever it’s renewed — I’m still working out the logistics for how those rollovers work but will provide all of the relevant promo codes, probably via Substack or else personal email (reach me at nbtrickett@gmail.com) before launching on Ghost.

Thanks to Tatiana Evdokimova, we can see that austerity’s off to a rollicking start in 2021 because of the fast oil price recovery. Thanks to US stimulus efforts, things have settled:

Revenue collection is overshooting while spending is steadily falling off of the 2020 high last summer. What’s perhaps more fascinating to see is how much expenditure undershot from 2006-2010 against targets in the first half of the year. That doesn’t mean those trends hold out for annualized figures, but it does suggest that the Russian economy suffered unnecessarily from pent up budget-driven demand until 3Q when oil prices were steadily rising and external debts were steadily paid being paid off. Stagnation then imposed a new level of discipline from 2013 onwards. It’s tragic that 2020 was the only year to even out budget execution so well and avoid the usual 4Q dash for cash. And all of this still factors in trillions of rubles that have gone unspent since 2014 without any clear justification aside from the presumable fear that real investment would lead to real corruption and the need to maintain an extra cushion against sanctions despite having other tools available.

What’s going on?

Roman Abramovich’s RFP Group has reportedly walked away from investing $1 billion into a pulp and paper mill on the Amur river in northern Khabarovsk krai. There used to be a mill in the area in the Soviet period that went under, and it turns out we know why: the economics offer almost no return per company sources. The hope from Yuri Trutnev, the regime’s minder for the Far East, was to build a mill that could process 400-600,000 cubic meters of wood a year. The firm’s view is small investments into pellet production make more sense. That’s a problem for Moscow for two reasons: the Far East’s share of regional revenues for its annual budgets fell by 14% between 2016-2020 and the state’s plan to tackle illegal logging operations with Chinese operators requires more capacity to refine timber into products. It turns out the export ban on roundwood wasn’t an inflation-control measure so much as a means of reining in regional firms getting too chummy with Chinese outfits that’ll sell raw products to Chinese mills just over the border without paying taxes in Russia. Expecting the 2022 ban, those Chinese mills have moved over the border into Russia where they utilize lots of manual labor and don’t follow recycling and waste removal regulations. They’re undercutting any new competition at the same time the Russian Far East needs more value-added industries that pay taxes and reduce regional budgetary exposure to commodity price swings. Funny how all of these things come together. The new plan to create a state export monopolist makes more sense in light of these challenges — you create a political interest group locally and regionally to crack down on the illegal trade, create a new source of budgetary rents, and allow for more manual control over exports. The more things change, the more they stay the same.

The Higher School of Economics has published its monthly update on trade in the national current account adjusted for seasonality and it shows us a few things — the ruble depreciation last year wasn’t just about oil (political risk and imports were big too) and we’d expect more ruble weakness right now based on trade since imports are currently recovering faster than exports. Since December 2020, trade turnover is up 23.6% in monetary terms. So what’s going on with the import recovery and is it good news?

Title: Dynamic indicators of foreign trade, 2013-2021 (% vs. Jan. 2013)

Black = trade balance Red = export Cyan = import

The short answer is that the import recovery is likely unequal, credit-driven for households, and otherwise led by exporters or manufacturers. The % share of overdue credit fell .58% between December and June — 7.26% to 6.68% — because of the huge expansion of consumer borrowing. Consumers now owe a combined 12.55 trillion rubles ($168.42 billion) and borrowed 1.18 trillion rubles ($15.84 billion) between December and June alone. You get a bifurcating effect with rising interest rates since only those left who are still creditworthy get loans, which reduces the % overdue but sidesteps the underlying problem that demand is weakening and defaults for those being denied will likely rise. In the first half of 2021, a post-2013 record of about 545,800 small businesses went under. That’s almost double the figures for Jan.-June in 2020. At the same time, there were a record 60,000 mortgage issuances in Moscow. These all may seem disparate, but they point to a considerable K-shaped recovery based on one’s socioeconomic class and home given that 7 in 10 Russians are consciously saving with concern about earnings, rising prices, or else another shock like COVID down the line.

Rusal and Oleg Deripaska, Putin’s favorite blogger, are now warning that the incoming export duties on metallurgical products taking effect on August 1 may reduce production by hundreds of thousands of tons. The sector is appealing to MinEkonomiki to request MinPromTorg, who’ve in turn made it clear they won’t budge. Deputy director Roman Andriushin told journalists that the nature of the duties isn’t clear, which is to say that no one really knows why the duties are supposed to help achieve their intended policy goal. Rusal stands to lose 24% of its EBITDA from the duties and is by far the biggest loser from the sector. As a reminder, the duties are set at 15% of the price of any given metal per ton and then adjusted based on each specific metal, most likely determined by increases in relative price levels domestically and available stockpiles. Andriushin makes a stronger point that the company already operates by price reporting requirements and price increase limits set by a 2013 Federal Anti-Monopoly Service (FAS) decision and also allow domestic consumers to agree to long-der supply contracts with indexed prices and hedging mechanisms to protect against large fluctuations. That’s a long way of saying that there are already legal instruments and decisions intended to manage large upwards price increases in place that, while ineffective during COVID, probably make more sense than export duties. I find this situation rather comical as an American who was in Washington D.C. when everyone had pet theories about why Rusal got off relatively easy in the end with the US Treasury. That a company singled out as an arm of the regime led by a Kremlin insider is now so openly being thrown under the bus by regime domestic policy priorities goes to show just how warped the Western media’s looking glass can become because of the relative disinterest in the heterogeneity of the Russian economy and how it intersects, shapes, and is shaped by regime politics and interest group coalitions.

The Federal Anti-Monopoly Service (FAS) just authorized Sibur’s acquisition of 100% of the voting shares in TAIF, merging two big rubber and polymer producers on the Russian market. FAS had some stipulations that point to how the ongoing consolidation of Russia’s largest corporations and strategic sectors, admittedly uneven but structurally a trend since 2014, runs against the imperative to manage domestic price levels for political purposes. First, Sibur has to supply a plan to FAS laying out its trade policy for any goods it produces for which it accounts for over 50% of the domestic market. That’s not a huge problem since the two firms specialize in different product segments so the acquisition won’t give them crazy pricing power. Sibur has to prioritize domestic consumers for supply contracts and sales. There’s a bit about ensuring counter-agents’ rights and also a requirement that pricing following transparent indices linked to exchange prices or over-the-counter trade prices wherever the good in question is being consumed and/or produced and utilize long-term contracts. Since the state can’t stop global price levels from changing, it’s trying to lock in the largest firms into long-term indexed deals that often offer a time lag of some sort before an upwards price adjustment, giving the state more time to react if need be and moderating price level changes during periods of high upwards or downwards price volatility. That’s always been a bugbear for Rosneft and other SOEs. But the explicit point about ensuring competition while prioritizing domestic consumers takes on new significance in a context where the state’s made it clear that it’s willing to impose restrictions and duties on exports in an ad hoc fashion when needed. Investors and firms will in a fair number of cases be biased towards justifying projects economically based off domestic demand levels given greater policy uncertainty, and that undermines some aspects of business planning for the export sector. We shouldn’t make too much of that change, it’s just important to recognize the degree to which preferences for autarky are affecting regulatory and business decisions.

COVID Status Report

23,704 new cases and 783 deaths were recorded in the last day. The drop-off in the official data implying a peak shows up in the publicly available estimate for the R rate to capture how many new infections happen per new case — despite an R being near or at 1 for much of May, case fatality was clearly rising over that period. These reporting gaps come as the Operational Staff’s official data now marks 150,000+ deaths from COVID and new research comparing Russian mortality data to world data from the Fund for the Liberal Mission suggests that as much as 45% of Russians may be infected with MinZdrav registries reporting over 29 million cases thus far. The methodology has to be checked, but that scale seems appropriate given data distortions, underreporting, and the extent to which we don’t have a complete view of reporting pressures, lack of capacity, testing availability etc. It’s great to see vaccine take-up rise, but Kazakhstan’s at a higher % now than Russia, see just how quickly Turkey surged by comparison, and how slow Ukraine’s rollout is going:

I’d be really curious to see the first academic treatments of why different regions have differential take-up rates, the role of federal transfers, geography, and other questions of political economy at the local and regional level when things settle down. Excess mortality data for April-August/September will make for grim reading.

Lviv and Let Live

There’s been the expected outpouring of frustration at the deal announced between Washington and Berlin over Nord Stream 2 that, as usual, launders all of the empirically incorrect strategic tropes about the project, exaggerates the relevance of kleptocracy to its completion, ignores the original context for transit via Ukraine, and substitutes hard conversations for easy ones. None of this is to say there aren’t political stakes to the project or that it isn’t geopolitical in nature. Of course it is. It still has a market basis, none of these arguments are applied to the Southern Gas Corridor despite Baku’s active exploitations of the same kleptocratic influence networks, and the issue of Germany killing its nuclear power ambitions also somehow never comes up. No one should pretend this was a stunning coup for Zelensky’s government and reform efforts in Ukraine, it’s not a betrayal or calamity and represents material progress and decent news for Ukraine. So what was agreed? Here’s the Wall Street Journal version. This is what people panicking today are focused on because they prefer hyperventilation to the slow boring of diplomacy:

$50 million for green energy infrastructure in Ukraine

Germany talks up energy in the Three Seas initiative

Try to ensure access to $3 billion in annual transit fees from Russia (unclear mechanism)

US retains prerogative to apply sanctions if Russia uses pipelines coercively

No kill switch for its use from Germany

Germany doesn’t stop future energy sanctions if need be

Here’s the Bloomberg version:

Merkel agreed Germany would sanction Russia in response to coercive energy diplomacy, including pushing the EU to sanction energy exports directly

The lack of explicit sanctions language is intended to allow for ambiguity so Moscow can’t predict the response

US and Germany would promote green investments including a $1 billion green fund with an initial German investment of $175 million into said fund

Germany would commit to use political leverage to get Gazprom to extend its transit contract up to 10 years after the current one expires in 2024

The US retains freedom of action from prior sanctions warnings to impose additional sanctions as needed and would rescind existing waivers if energy is used as a coercive tool

The outrage came from assuming the WSJ account was more substantively true and a Politico piece revealing that State Department officials were doing their job by asking Zelensky’s team in Kyiv to not come out swinging against the deal while finalizing it. I think it’s pretty obvious the Bloomberg reporting is closer to reality given Blinken’s understanding of the failures of US coercive efforts against Soviet natural gas exports via pipeline in 1982-1983 and the fact that Germany actually made significant political concessions. Those concessions will likely be handed to an incoming CDU leader, Armin Lanschet, who’ll lack the same level of institutional and political capital and be forced to do more to define himself and German foreign policy after Merkel leaves the scene. For a great thread covering why the decline in Gazprom’s delivery volumes via Ukraine is a market concern as a result of choices made by Ukrainian regulators, I give you the one, the only Laurent Ruseckas:

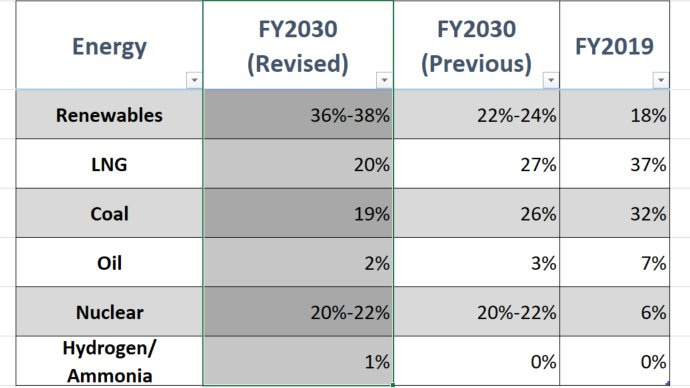

The key point later on in the thread is that the GTSOU in Ukraine offered Gazprom pipeline capacity that was interruptible, and therefore not guaranteed, at the same price as guaranteed capacity when one would normally offer a discount since there is no guarantee deliveries will always arrive. Dependence on Russia isn’t materially affected since Europe is just buying gas via a different pipeline, market integration across the EU continues to deepen, Ukraine hasn’t bought supplies direct from Russia in years, and there’s never been any evidence the Russian military would suddenly support a massive offensive once the pipeline is completed. One can talk about bribes and corruption buying influence in Germany, but no one wants to link the excessive political power of German exporters and bankers in the Eurozone, its inequalities, and the failure to adjust fiscal policy after 2008 to the straitjacket European states have placed on substantive ‘greening’ gains for years, going so far as to kill nuclear plants that would otherwise compete with imported gas volumes. It also misrepresents the increasingly interconnected nature of natural gas markets as LNG production has risen globally. Japan just revised its 2030 energy mix targets and now plans to reduce annual LNG power generation demand by 50% in the next decade:

Japan accounted for 20% of global LNG import demand last year. This is a huge announcement that’ll redirect more deliveries to China and other markets with rising LNG consumption needs as well as free up more supply cross-regionally to make its way to Europe. And demand isn’t set to grow in Europe much anymore, if at all, based on likely demand post-COVID (from the IEA) though these are from June 2020:

Zelensky is going to get a White House visit where Biden will have to announce something to show progress. We don’t know if late July is still in the cards, but the timing would certainly be auspicious now. Ukraine, the US, Poland, and Lithuania are holding military drills in late July too. At some point, the screeching around the pipeline has to stop. The new complaints that the project represents strategic corruption seem to skip over that the 2006 transit dispute was resolved through the creation of a trading entity to the benefit of oligarchs friendly with Moscow in Ukraine, literally strategic corruption. If anything, this was an attempt to cut Ukrainian elites out of the rents. Look at German household electricity prices against the EU-27:

After taxes and VAT, Germans pay more for power than anyone else. No wonder German politicians want to ensure they get more pricing power by acting as a market gas hub linked to Russia and the North Sea. The US just pulled off a diplomatic coup — Germany’s moved on what was a red line for its own policy considerations for the last 5 years, the US isn’t fronting much else, and sanctions instruments have been agreed to as a means of backstopping German efforts to maintain transit. In short, I’ve got no idea what the screaming is about. It’s not perfect. Nothing ever is. But Kyiv came out about as well as possible given the circumstances.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).