Top of the Pops

It’s safe to say that the CDU’s now on steady course to retain the chancellorship in Germany with the Greens’ prior gains down to exhaustion with the status quo. The Greens are now back down 20% vs. the 28% support for the CDU. I pulled last week’s FT graphic cause it looked better, but there’s been about a 1% move since. Future speculation will undoubtedly also look at the role of the Biden administration — the White House’s summit approach to stabilize relations with Russia included the artful reclassification of the contractors building Nord Stream 2 as a ‘Swiss’ company rather than a Russian one. Checking public responses to the COVID crisis measures is a useful way to break down the ‘status quo’ around the recovery and the CDU’s in-built advantage. 38% of respondents per Pew felt that Germany’s anti-COVID support measures didn’t go far enough, 43% said it was about right, and 15% said it went too far. Simply put, a significant majority of the public aren’t demanding more action.

If you’re Moscow, this is great news. Not so much because of the frequently inflated strategic gains made from business-to-business and person-to-person contacts. Rather it’s that CDU leader Armin Laschet apparently opposes mutual debt obligations between members of the Eurozone/EU — “Under the Maastricht rules, every country is responsible for its own debts” — and sees COVID as an aberration for economic policy. The fundamental imbalances baked into the Eurozone can only be resolved if German workers are paid more and Germans consume more in relation to how much they export, a massive structural challenge for the political economy of a country that relies on exports for roughly 47% of its GDP and has built its financial and industrial institutions to support the interests of capital and exporters. So long as the conservative strain of German ordoliberalism lives on, the EU/Eurozone will lag once again in their recoveries from COVID and decline further in relative power terms with the salient exception of carbon and climate regulation.

What’s going on?

The Central Bank’s growing hawkishness is already worsening MinFin’s forecast for the cost of servicing debt for 2022-2024. The current budget had assumed costs of 1.37 trillion rubles ($18.99 billion) for 2022 and 1.6 trillion rubles ($22.18 billion), which have risen to 1.44 trillion rubles ($19.96 billion) and 1.75 trillion rubles ($24.23 billion) respectively. The Central Bank’s understandable panic about inflation is creating a unvirtuous cycle. The more they raise rates, the more expensive it is to borrow. The more expensive it is to borrow, the more MinFin cracks the whip to cut spending. The more it cuts spending, the deeper the lasting economic damage from COVID. As inflation has picked up again, the market’s now anticipating Nabiullina will announce rate hikes to 6.75% and get even more aggressive to try and head off price increases. For now, the impacts as noted by the Audit Chamber are minimal. Moscow retains far more room to use fiscal policy without running large debt risks or necessarily increasing inflation by a significant degree. The latter would be inevitable if they really do believe an investment boom is needed. There are concerns that Russia can’t keep attracting investors to buy its debt — this is a fair point given the role state banks have played sustaining demand. But it’s unclear where that limit lies or why borrowing via domestic banks poses a serious risk. After all, any more money spent on stimulus would improve the creditworthiness of borrowers and that’s where the risks really lie for Russia’s banking sector.

In a small but significant budgetary innovation, the Federal Treasury has transferred the % earned on interest in the Treasury Account used to balance funds back to regional budgets. As of May 1, 2021, about 1.4 billion rubles ($19.38 million) were transferred through this method, a small source of income but one comparable to tax revenues on the extraction of gravel, clay, and sand:

Top 10 regions by income from deposits, mln rubles

This latest approach — a nifty bit of penny-pinching to avoid drawing on the federal budget — is also being applied to regions that don’t even have the legal right to place money in bank deposits based on the budget codex. Altai krai doesn’t even manage its 20 billion rubles ($276.89 million) of liquid reserves and was transferred 90 million rubles ($1.25 million), about 15% of its non-tax revenues. Yamal-Nenets received 10% of its non-tax revenues via the maneuver and Dagestan 13% of its non-tax revenues. Earnings on operations from deposits are down for the obvious reason that regional governments had to draw on their liquid reserves to cover spending and debt last year. These are never going to make a huge dent to improve regional finances, but it does tell us that the Treasury and MinFin are coming up with new ways to get more money out without affecting budget deficits.

BCG has published a study showing that rising demand for telecommunications services and data consumption will make the sector a larger aggregate polluter than airlines in 10 years’ time. They accounted for 3-4% of all CO2 emissions during the COVID crisis and by 2040, could account for 14% per the consultancy. As expected, the sector contests that vigorously. BCG is pointing to a secular trend that relates to most of the success stories we see in the Russian economy — annual demand for data will grow as much as 60% annually in the years ahead. Firms will be scrambling to open up data centers in areas with abundant clean energy, transparent and friendly data regulations, and great digital infrastructure. Norway’s done particularly well on that front because of its huge sources of hydropower. Russian operators are getting more serious about emissions for the same reasons the metallurgical sector are. European regulations and the desire to compete for foreign markets necessitate private businesses step up where the Russian state has lagged. Early work from the likes of MTS is focused on ‘greening’ office buildings and improving energy efficiency. That’s just a start, but still a decent sign since telecoms account for a fairly small share of emissions in Russia given its much larger polluting industries. This will be another industry that will probably lead efforts to go greener while older manufacturing industries that historically pollute a lot and have provided employment to key regime voting demographics will lag a bit since any change in investment will likely parallel attempts to improve productivity that create some risks for labor. It’s not all doom and gloom on the green front. But these firms don’t produce many financial rents. Rather they produce data and information that are increasingly sought after by state organs tasked with managing repression, public opinion, and political dissent.

Business ombudsman Boris Titov delivered a presentation covering the effects of the pandemic on small and medium-sized businesses and it’s grim. Two-thirds of companies were significantly affected and they collectively lost 3.1 trillion rubles ($42.95 billion) in turnover. The number of SMEs late on debt payments has risen from 20% to 30% and their share of the economy in GDP terms has fallen back to 2015 levels at 19.8%, a 1% decrease since the start of the crisis. The state accounts for about 50% in Titov’s calculations. While things did improve during 3Q last year when cases were lower and restrictions eased, there was an observed 13% decline in demand during 1Q when the vaccination campaign was underway and things supposedly on the up-and-up. A majority of firms are now raising their prices as input costs rise and stopping any business development plans (read: investment). All of these stem pretty obviously from the limited fiscal support the sector received with the focus on tax breaks and credit extensions. Titov is adamant that new measures are urgently needed. To name a few things from his wishlist: restructuring debts for firms that lost 30+% of their turnover, ease the hiring process for foreign nationals, freeze increases in utility fees through 2023, extend the inspection moratorium through 2022, and halve the fines associated with code violations since they’re an easy way for local officials to pilfer businesses for petty cash. One thing’s abundantly clear — the economic policy response was never particularly concerned with the fallout for small businesses insofar as it failed to connect the dots. Since these companies are far more reliant on domestic demand and disposable incomes, demand for their goods and services fell along with real incomes during the pandemic whereas bigger firms that make their money supplying sectors, exporting, extracting resources, or else have some sort of built-in stabilizer once they can access credit did far better overall.

COVID Status Report

21,650 new cases and 611 deaths were officially recorded in the last day. Deaths have reached record levels in both Moscow and St. Petersburg as the current wave looks to get worse. It’s expected cases will peak in a few weeks’ time and that the excess mortality data we’ll see will be brutal. Moscow mayor Sergei Sobyanin is clear that the city has all the vaccines it needs, unlike other regions now beginning to face shortfalls of supply. Hospitalizations and deaths still seem to be a function of vaccine successes based on what we’ve seen from Israel where vaccinated individuals account for a large number of cases, but the actual new cases tend to cluster around kids and young people before reaching older individuals who’ve gotten both vaccines who then tend to recover at home or else are asymptomatic. The R rate is still worth tracking and based on the level of testing in Russia — admittedly way behind the UK here — we can see some divergence based around vaccination rates. I included Turkey since they’ve had a much more successful ramp up for vaccinations (35% with at least one dose now):

The R in the UK is higher than in Russia with most restrictions effectively lifted, but the rise in cases hasn’t led to a surge in deaths (yet) and hospitalizations haven’t increased in the same way they have visibly in Russia. Assuming that testing probably understates the spread, the overall lesson is that current infections are spreading at a rate comparable with the October surge. I’m hopeful that cases will peak in the next 2 weeks as restrictions have more of an effect, but Russia’s beginning to lag further on vaccinations compared to a country like Turkey. Uncertainty is going to last awhile, I fear.

By Hook or By Crooks

Putin has finally ordered the government to give him a roadmap for Russia to decarbonize its economy by 2050 as the weight of business complaints about European policy forced the Kremlin to act. Estimates for losses linked to the application of carbon adjustment tariffs vary by source, but it’s safe to say somewhere in the range of $2.5-5 billion a year in lost tax revenues makes sense. Since the state accounts for half of the economy (officially) and Russian policymakers conceive of the economy through the lens of the budget and state reserves, that’s a decently large hit. Moscow’s manage to compress the first 4 of the 5 stages of grief into a year — most recently they were bargaining and moaning about competitiveness and now that Mishustin’s been tasked with some strategy work, they’re pushing through depression to acceptance. We still have to wait and see. Plenty of dates for executive orders pass without any punishment for failure.

The shift in formal policy follows what I’d describe as a bit of narrative engineering designed to locate the challenge of decarbonization into a discourse that the presidential administration and Putin understand. In a way, EU policy was depicted not just as an attempt to punish Russian firms but almost like a low-level kind of economic warfare. Economy minister Maxim Reshetnikov has used the language of a “war of barriers” when talking about global trends, the rediscovery of industrial strategy by Western economies now slowly evolving out of their neoliberal consensus, and the use of trade measures to pursue climate policy goals. Decarbonization only broke through with the leadership after weeks of painting it in political terms as a threat or challenge, one that matches the language of the national economic security strategy. Rosneft CEO Igor Sechin called for the creation of a certification system to assess the relative climate impact of any given barrel of oil such that his company could sell “green oil” from Vostok instead of a thankless, brutal pursuit of a totally renewable/green energy system. The most important point, however, is that we’re now seeing the regime’s mobilization politics filter into the recognition that it can’t wall off the Russian economy from these larger market and policy forces beyond its control without yet grasping what it’s likely to mean.

Take the budget. The following is monthly federal budget data going back to January 2013. It’s a bit hard to make out but what’s most important are the trends the previous 3 years and the first 4 months of revenues this year:

We’re seeing the combined effects of the ruble’s further devaluation, redoubling of localization and import substitution efforts, and falling consumer spending power shift the structure of revenues at the same time that rising inflation levels are as well. If you look at the structure of revenues, it becomes clearer that producer price inflation is affecting the balance between oil & gas revenues and the rest, led by taxes on domestic production:

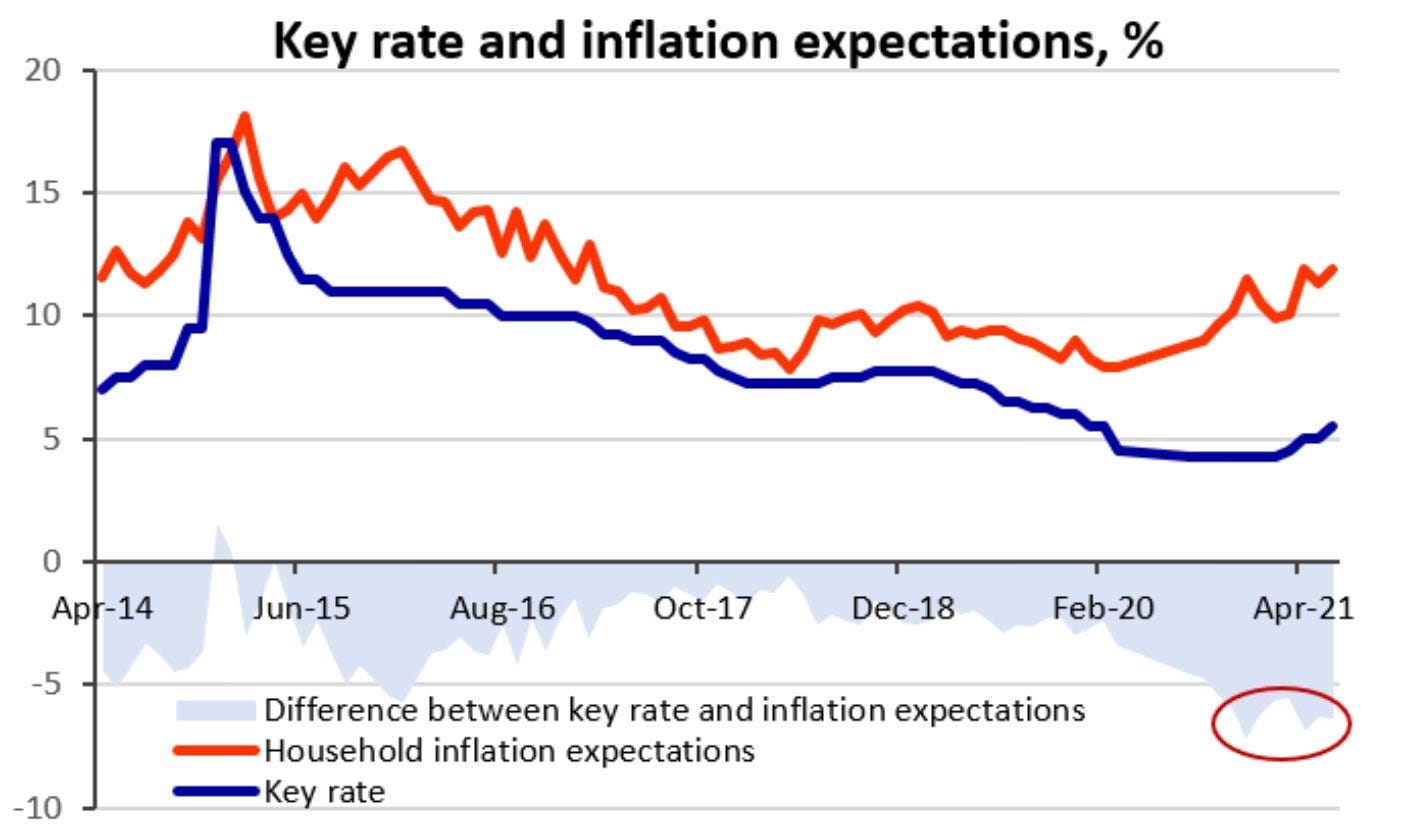

Enterprises are now expecting 7% annualized inflation based on the Central Bank’s most recent report, which should increase tax receipts on production while slowly eroding consumption taxes as people try to spend less and more formal and informal measures are taken to cap consumer costs as much as possible. This all comes back to the gap between public inflation expectations and the key rate hitting a high and prompting an even more hawkish approach from the Central Bank:

Decarbonization isn’t just about retooling the physical infrastructure that holds economies and systems of value extraction together. It’s about retooling the financial and political infrastructure creating incentives and raising and redistributing resources to manage what can be an incredibly disruptive process. If the Kremlin is serious about selling a decarbonization plan to the international community and foreign partners, it has to grapple with accepting a higher rate of inflation for some period of time in order to sustain the investment boom that’s needed. As we’ve seen in the last 2 years, even marginal shifts in supply/demand balances domestically or for supply chains linked to foreign markets or reliant on imports create large inflationary pressures because of power of the deflationary bloc in Moscow and for the regime. It retains its power over the systemic opposition and decision-making by promising to fight inflation and let those over 40-45 keep what they have while sacrificing growth that definitionally requires a higher level of inflation, at least until more capacity comes online thanks to higher levels of investment into equipment, plants, and labor productivity. It’s easy for the conversation around the financial plumbing of the energy transition to focus mostly on green financing — ‘green’ bonds, carbon lending requirements, climate stress testing, those sorts of innovations that fit within status quo institutional frameworks. The HSE estimates up to $50 billion could be raised by Russian firms selling carbon quotas in a trading scheme that could presumably be reinvested.

But while the deflationists like Kudrin have called for the state to privatize more of its assets and pull back from the economy — something I think is definitely important from an institutional perspective in a lot of contexts — decarbonization requires an activist state that’s effective. Only if the regime trains its eye on the problem and really fosters an expansive policy debate while committing adequate resources can we see meaningful changes. The horizontal permission structure whereby every individual and agency or institution is just trying to please the person one rung up the ladder by solving a problem on paper won’t work. Perversely, Russia needs a strong state more than ever to guide markets to achieve better outcomes while the system built by Putin and his team has hollowed out the state’s capacity to actually act in coordinated fashion in any area where significant rents and financial interests are threatened. The decarbonization strategy will be a fascinating read to see just who won out behind closed doors.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).