Top of the Pops

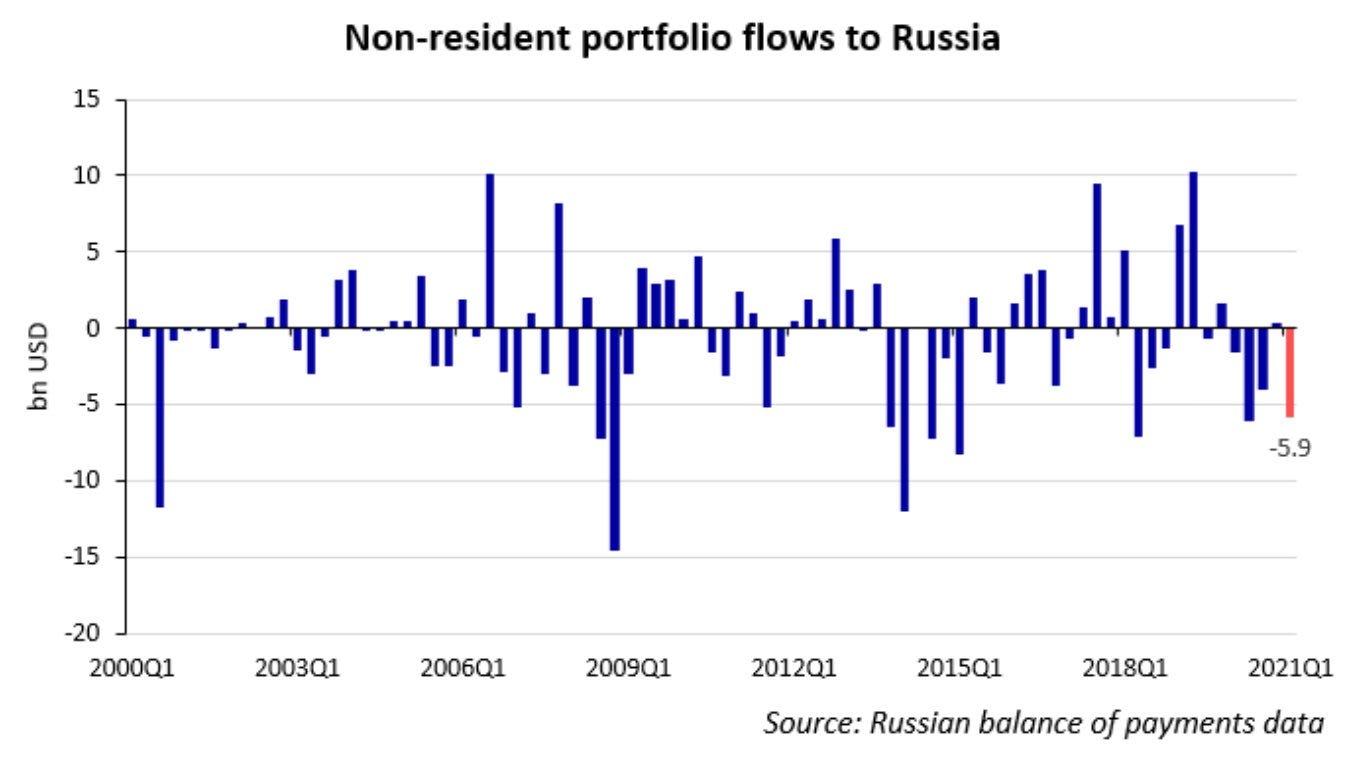

The current spike in political risks amid rising domestic inflation and limited price upside for oil exports has triggered an outflow of non-resident portfolio holdings at levels seen during the initial stages of the pandemic and expansion of sanctions in 2018. The Kremlin may think that the tough stance and buildup near the Ukrainian border is worth it politically, but it’s creating a longer-run drag on investor expectations for the Russian economy since it’s likelier to incur a more aggressive sanctions response from Biden despite his own public disavowal that he’d target sovereign debt:

The situation is also a bit odd because of the cumulative effect of US monetary and fiscal policy. The rise in US Treasury yields — sold as inflation risks by the economic old guard — has really been about ‘reflation’ after decades of relatively stagnant growth. Initially investors bought in for the yield, reducing the appetite for emerging market debt and hurting emerging market currencies as the dollar’s the safest currency on the planet to hold in the worst of times, let alone when earnings on USD assets might rise a bit. But the Federal Reserve’s commitment to keep rates low and initial jitters are subsiding some, pushing investors to look back to emerging markets once more. Instead of sovereign debt, however, they’re looking at corporate debt, generally in the form of eurobonds issued by emerging market firms in a foreign currency — usually USD, Euros, sometimes yen, GBP, or Swiss francs. This is doubly a pressure point for Russia because of the ruble’s political risks of devaluation from a new sanctions shock on top of a weak issuing economy. The result is a greater degree of financial pressure on Russian firms to maintain their access to foreign capital markets to issue such bonds because of persistent currency risks created by the Kremlin’s approach to Ukraine. Long story short, the Kremlin’s approach to the buildup — more than a restrained signal to Kyiv that if it wants to act, Moscow will reply in kind — is actually increasing Russian corporates’ dependence on foreign finance via the eurobonds needed to maintain foreign investor interest at a time when terrible domestic growth on top of rising inflation and geopolitical risks makes Russia less attractive. Sanctions aren’t impeding Russian behavior. That would imply the Kremlin understands the economy, let alone would allow it to override its security prerogatives. But they are having unintended consequences that may cost Russia. The European Parliament is now debating cutting them off from SWIFT as an issue. So much for breaking the Trans-Atlantic alliance.

What’s going on?

MinEnergo’s announced that in its general roadmap for the sector through 2035, further offshore reserves won’t be developed because the lack of adequate technology or ‘better’ tech renders them unprofitable even accounting for exemptions from mineral extraction taxes (MET). In the most optimistic scenario, it’ll halve in that time to 15 million tons annually — about 300,000 barrels per day, most of which comes from Sakhalin Island’s reserves. It also suggests the ministry does not expect Lukoil to produce at significant volume offshore, notable given Alekperov is currently lobbying for tax exemptions to develop Caspian reserves in expectation of continued demand growth. MinEnergo’s;’ calculations show that current tech can’t profitably extract offshore in Russia unless oil’s at $80-90 a barrel, a price range at which we’d see faster fuel switching for cars as EV costs continue to come down and a stronger dollar weighs on emerging market demand in the near term at least. It’s also high levels of dependence on imported offshore tech and the failures of localization thus far that hinder further efforts since a significant chunk of earnings from Arctic offshore projects in particular would be recycled into imports instead of providing domestic industrial stimulus, one of the core ‘roles’ of Russia’s oil sector. The new roadmap apparently eschews any hopes of fully replacing imported tech for deep drilling operations. If demand peaks in the next few years — something I think is pretty likely barring an explosion of economic growth in Europe and more aggressive reform approach in China — then Arctic deposits aren’t ever going to be needed anyway.

By the looks of it, COVID has been pretty bad for FDI in Russia and led to a net decline in the national FDI stock. Net inflow for 2020 declined 67% to a lowly $3.4 billion. Both axes are in USD billion, with LHS showing gross volumes and the RHS showing the net balance:

Orange = inflows Purple = outflows Green Line = turnover

As we can see here, pre-Crimea FDI flows weren’t great either. The 2012-13 spike, I’m assuming, comes out of the structure of the TNK-BP mega deal or things like it from a spurt of consolidation and early investments in East Siberia. What’s striking is that the decline in gross flows seems to follow the oil price based on scale, which isn’t to say that sanctions didn’t obviously hav a negative affect that’s significant, but to reiterate that it’s ultimately Russia’s legal and business climate on top of its economic policies that are most to blame. Once domestic consumer demand enters decline, the space for western firms to invest into production begins to shrink steadily, particularly given preferences to award contracts when possible to Russian firms that frequently can’t compete with imports without policy interventions. What’s even crazier is that Russia’s foreign national on its national accounts lags earnings from FDI placed domestically after several decades of current account surpluses. If the post-COVID recovery is weaker than initially advertised, I’d expect FDI levels to remain depressed below their 2017-2019 ‘recovery’ period.

As usual, Dmitry Rogozin has bad news: Roskosmos has lost out on several satellite contracts for foreign customers because of US sanctions risks. The deals lost were worth up to 13 billion rubles ($167.3 million), a trifling sum when you consider that the Audit Chamber has found individual violations of budget requirements worth 30 billion rubles ($386 million) and back in mid-2018, it found violations worth 760 billion rubles (now $9.78 billion). The epic economic mismanagement of the program and its subsidiaries poses a much larger problem financially for the than these lost contracts, though they are an important leading indicator of potential further tightening of US scrutiny over Roskosmos’ dealings. However, sales of the RD-180/RD-181 to the US accounted for 1/3rd of earnings for Energomash, the subsidiary affected. It’s a big blow over time given that the Russian defense sector’s model has historically been reliant on export earnings to control budget costs domestically. The US is expected to cease purchases of further RD-180s starting next year, a process that’s been delayed by the lack of alternatives from when sanctions were first introduced. For now, Rogozin’s talking up lunar research and the development of new rocket systems. Speculation he was being sacked on Telegram continues to pop up intermittently. Rogozin’s likely safe for now as he’s always been taken care of. But Roskosmos may start losing more export contracts if it can’t find a way around sanctions or improve its R&D performance.

Telegram is preparing an IPO in the next 2 years according to Vedomosti. Current thinking appears to be to float between 10-25% of the company with an expected market valuation in the range of $30-50 billion. The question is which financial center ends up hosting the firm’s shares, something worth following in future coverage given the implications for Russia Inc.’s links to western finance. Over 40% of Telegram’s users are in Asia and an Asian exchange may well prove more attractive politically while also dodging the same types of potential scrutiny from the SEC in the US, the Financial Services Authority in the UK, or the Committee of European Securities Regulators. It’s unclear if that would mean Singapore, Shanghai, Hong Kong, or Tokyo (I’m going to assume a listing on South Korea is out of the cards). But at the beginning of March, the company issued $1 billion of 5-year maturity bonds in the City of London with a coupon under 7% and the option to convert one’s bond holdings into shares with a 10% discount vs. the price. That would suggest London’s still in the lead and would make sense given other Russia IPOs launched on the British market. Telegram’s one of the few Russian corporate brands that’s got a huge international consumer/user base, and one that will probably be immune to policy risks given the service has provided individuals with useful messaging capabilities in other authoritarian or semi-authoritarian contexts that Western capitals have no interest in undermining and it’s not like they’re slapping sanctions on Twitter or Facebook or Google for helping states suppress their own populations.

COVID Status Report

8,320 new cases alongside a new low of 277 deaths were reported for the last 24 hours. The low figures are welcome, but a bit suspect given the traditional time lag between Russia and waves of COVID in Europe — the latest wave to hit Europe generally starts up in Russia about 6 weeks to 2 months later. Given that trajectory, we’d expect to see a resurgence in cases because of the miserly vaccination rates, unless so many people have gotten sick that herd immunity has been built up and retained (though this would not make much sense based on the American experience). The FMBA just won a patent for a medication that strengthens immunity against COVID to be administered via nasal spray. It’s in testing trials. The de facto evolution from vaccines appears to be rushing out medications Russians are likelier to take that help fight the infection, which may drive down the caseload assuming there’s a pickup in infection rates due to warmer weather, COVID fatigue, and the lax approach the country’s taken overall to the pandemic. There’s a lack of agreement among experts in Russia as to whether you can meaningfully model the spread of the virus at this stage. The next few weeks should, in theory, be telling, but as long as mortality and infection data is manipulated by the Operational Staff, it’s hard to know given how long the current infection and death rates have plateaued (relatively speaking).

For Want of a Mortgage-backed Security…

As Russian banks have seen their incomes off of traditional banking activities decline, they’re starting to invest greater sums of money into the real economy and business activities outside their core competences. Some of this is to a consequence of the Bank of Russia’s response to COVID. For the first time in Putin’s Russia, the response to a shock was to cut the key rate to increase liquidity instead of hiking it massively to stanch capital outflows, a consideration that was an absolute necessity in 2008-2009 so long as the exchange rate was actively managed and perceived to be a requirement in 2014-2015 because of sanctions risks on top of the developing oil shock hitting after a domestically-caused recession had started in 2013. When rates on interbank borrowing drop, you then see a decline (if more muted) in rates quoted to consumer/corporate borrowers since banks can more easily borrow themselves and want to retain customers and win business. But the lower rates reduce the spread on loans, affecting profitability. Add to that large Russian banks have access to financial resources lots of firms struggle to make full use of or face a great deal of uncertainty using, suddenly it makes sense that banks could carve out positions in real sector businesses. It’s obviously the approach German Gref’s team at Sber has taken. Lower rates and spreads on loans, however, aren’t the real problem. The real economy and Russian economic policy are to blame.

Last year’s lending expansion staved off disaster for the economy, but also reinforced a structural issue: falling income levels means fewer Russians could afford to borrow at market rates, triggering an expansion of state subsidies most notably seen with the mortgage program. Banks couldn’t afford the risk at without help, and this also pushed margins while providing some earnings. Structurally since 2014, banks loan portfolios have shrunk vs. the amount of funds they themselves borrow — it’s fallen from 90% in 2014 to 76% last year :

The reason is simple. There are fewer and fewer quality borrowers since the poorer Russians get, the less they can consume, and the less that Russian businesses can, in the aggregate, generate profits outside of resource sectors or export-led sectors or else the businesses that live and die with budget assignations since demand for goods and services falls. In effect, the Russian economy is unable to absorb higher levels of credit because of stagnation and declining consumer/corporate demand relative to the amount of money parked in the banking system, not because of artificial constraints on the debt-to-GDP ratio. The refusal to use public spending and public deficits to lift the economy has hit the banks’ ability to support real economy growth. We can see this with investment rates and sources of funding. I pulled data from 2000 on just to emphasize the fall in investment activity for fixed capital assets in the last 8 years in % annual growth terms as well as the changing composition of how investment is funded:

Bank loans have never driven investment activity, but what’s striking is just how much post-2014 the share of firms and investors’ own funds drive rises in terms of investment financing. When you also consider how much money was flooding in pre-2008, it’s actually surprising how relatively muted the investment activity is for the 2000s, but that’s for another time. The main takeaways from the above graph are that as investment growth in constant prices has declined, investment is increasingly financed out of pocket and foreign borrowing has never actually been a large source of investment financing. These problems are domestic overall. More broadly, the rate of lending has lagged the expansion of bank reserves. We can discern some of that trend from the following in the same VTimes piece that shows the gap between 2020 and 2021 borrowing growth rates for subsidized lending and un-subsidized lending:

From Left: large business, refinancing, unsecured consumer loans, mortgages, auto loans

The first from left for both years measure nominal % growth and the right color for both years measures it after subtracting subsidized loans. Without subsidies, large businesses would have scarcely been able to borrow last year to maintain operations, subsidies drove up mortgage growth by 13%, subsidies for refinancing were huge for household balance sheets in 2020, and most worrying, unsecured consumer borrowing is up in 2021 more than 2020. As the quality of borrowers keeps declining, firms making investments rely more their own earnings. What this really suggests is the expansion of state activity in the economy and its role generating regulatory rents is simultaneously harming credit growth because import substitution and related measures keep increasing domestic prices without creating enough new jobs or stipulating the provision of more income support, pushing firms earning those rents to finance their investment plans via rent extraction (price markups, sole supplier contracts, etc.) to the detriment of intermediate and consumer demand in the economy as well, and forcing banks to find new sources of income since these trends also indirectly link more investment and borrowing activity to state spending or guarantees such as the subsidy schema used to blunt COVID’s effect on the economy.

Western banks — I’m including China effectively in this category given scale at this point — tend to turn to speculation and/or trading when profits fall from interest rate compression. When money’s cheap and easy and the economy has been run with a deflationary regime weakening labor’s bargaining power, stagnating wages, and leaving lots of slack, investors hunt for yield in riskier assets and banks try to supply them with those assets when possible to retain and win business. But Russian banks are limited in their ability to expand abroad by existing or potential sanctions and the Russian economy lacks the required depth of financial markets to generate the same types of assets or returns, especially since inflation is always a fair bit higher amid stagnation. It makes sense for Russian banks, therefore, to try and extract money from services in the real economy, especially if they have the size to generate rents by being close to the state (here’s looking at you, Gref!). When the bankruptcy moratorium ends, there’ll be a flood of losses from defaults as well. Moody’s expects a worsening in quality for 20-30% of restructured loans and no less than 20% of the subsidized loans, which may require 900 billion rubles ($11.64 billion) of reserves to cover default losses. It’ll also increase the cost of credit across the economy as banks have to be more cautious without those de facto subsidies/support in place.

The big lesson here is that Russian banks are turning to non-financial services as much out of economic necessity from stagnation and the effects of rent-seeking financing investment as they are the more obvious political ploys to have a stake in AI and the “future economy.” The austerity framework for macroeconomic policy encourages rentierism, exactly the phenomenon that anyone under the age of 50 has witnessed play out in developed economies hostage to the monetarist turn from the Reagan/Thatcher revolutions and Europe’s collective decision to liberalize capital accounts in order to realize a currency union. For the west, property, educational, and healthcare are the obvious rackets. In Russia, it’s a bit of everything except the smallest businesses, low margin sectors, or retail/service shops and chains. The more big firms and SOEs finance investments out of pocket using the rents they accumulate and incomes fall, the more that the banking sector has to scramble for new income since lending is constantly getting riskier. The Bank of Russia’s new hawkish course for rate hikes will paradoxically worsen this, on the one hand improving the spread on loans but on the other, hurting consumer demand that is increasingly debt-financed. The best thing Putin could do for his own electoral strategy, the banks, industrial policy, all of it would be to just give people money. Barring that, these dynamics will continue to worsen.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).