Top of the Pops

VTimes had a great writeup on the long arc of equity returns, the rise of the US to dominate equity markets, and more this morning. I liked this graphic which breaks down market share of equities between developing markets, including both China and South Korea in that category:

As we can see, Russia only accounted for 3% of developing market equity at the end of 2020. That’s a bit mad to contemplate. You can see the effect of commodity prices, Russian macro, sanctions, and general failures of domestic reform and policy at play if you play around with World Bank data. In 2009 after the initial shock of the financial crisis, domestically listed Russian companies were valued at 62.3% of GDP. By 2018, that had fallen to 34.5%. If you pull the value of stocks traded annually in % terms, Russia traded 98.26% of pre-GFC GDP in 2007 on the equity markets, then driven by mania and that garish and undeserved confidence of Gazprom, Rosneft, and the energy sector that valuations would keep rising. In 2019, that value was just 10.6%. In the US, the post-financial crisis figure is often above 200% and in China, it’s generally above 100-120%. Over-financialization brings instability and distorts economic development, yes. You still need deep financial markets to finance things, create means for firms to raise funds or else secure loans, and so on. That Russia’s financial markets are historically so driven by commodity price cycles reflects the relative size and worth of SOEs and oil & gas firms on top of the country’s macroeconomic structures. In an age where financial markets are moving to introduce risk premia for carbon, demand greater transparency and reporting requirements for environmental impact, and more, a combination of financial underdevelopment with dependence on hydrocarbon industries for valuations and market churn is deadly. Take the long view from 1900-2020 per the VTimes piece, the US has offered far better annual returns than emerging markets. Other advanced economies fare much worse. The intricacies of domestic austerity/demand suppression, the Eurodollar market and London, and more play a role. But the US offers far better returns in that long view than developing markets and that gap becomes more worrisome when we start to consider the financial impact of the energy transition on top of uneven and unequal levels of development and global imbalances. If Russia doesn’t start applying the same scramble to ‘green’ industrial policies to its financial sector, it’ll double the effects of stagnation in the real economy by robbing itself of crucial sources of capital for future investment.

What’s going on?

Political curators’ favorite “damping mechanism” — employment levels — are steadily improving with unemployment expected to return to pre-crisis levels by the end of the year according to MinTrud. Vedomosti’s writeup emphasizes that the government is spending twice as much on unemployment this year as it had planned — a grand total of 135.6 billion rubles ($1.76 billion). It then rattles off expected spending levels through 2024, with a net increase of 117.7 billion rubles ($1.52 billion) planned for the period compared to the original pre-crisis projections. The assumption, from what I gather, is that the more rapid opening of the economy, refusal to re-impose public restrictions, and credit schema for SMEs and cheap(er) credit for large firms from low interest rates have come together to make the jobs recovery much swifter than past crises. The ministry notes that it took several years to achieve pre-crisis employment levels after 2008-2009 and 2014-2015. What they left out was that in both cases, the Bank of Russia hiked rates bigly to stanch outflows of capital, making it that much harder for many businesses to recover. That’s the good news. Even a hawkish monetary policy this year won’t have to large an effect on business recovery, I expect. But the flip-side is that the state is spending very, very little on unemployment support and appears to expect to be lauded for its approach. This is a glaring problem for the obvious reason that anyone who lost a full-time job last year — let’s allow that some may collect unemployment but work under the table or find ways to freelance — can’t spend much now and collective income levels are lower for consumers, which then imposes a drag on the types of jobs created post-2015 across the economy and affects a lot of newer SMEs. This suggests a lot of confidence things are sorting themselves out, and they may well be. It’s still a very miserly policy approach.

Imports appear to have largely recovered to pre-crisis levels, putting pressure on the ruble and the current account coming out of 1Q. While analysts are taking up how rising domestic demand is the driver, the other major macro component’s pretty straightforward — oil prices rose back to pre-crisis levels:

Title: Import dynamics from countries outside the near abroad

Red Line = growth month-on-month Blue = cars/machines and appliances/equipment Green = other positions

In year-on-year terms, the value of imports climbed 24% in March vs. a 15% rise for February. Imports are surging in despite the lack of evidence incomes are yet recovering significantly and higher savings rates. Putin apparently only just noticed that housing prices in European Russia really are up 20-30% and doled out further instructions to the Federal Anti-Monopoly Service to look into the housing price explosion. It now reportedly takes an average of 15 months for Russians to pay off ‘problem’ debts that are restructured to ensure lenders collect whose average value rose 29.3% in 2020 and those Russians now paying these off are often spending a quarter of their earnings doing so. In 2019, it usually took less than 12 months. And then we have the un-ending food price inflation, which will hopefully come down now that export prices for wheat have decreased slightly. Any import recovery without income recovery amid large price increases for both tradable goods (cars, food, clothes) and non-tradables (potentially medical care, housing) means that the net financial valuation of imports headed into the country corresponds to a lower level of buying power for most consumers and their higher costs. In other words, these things still aren’t being manufactured domestically in high enough quantities or qualities, Russian consumers are spending more of there earnings to be able to buy them, and/or it’s actually firms benefiting from commodity prices and intermediate orders driving a lot of the growth. None of that supports consumer recovery particularly strongly.

The Russian Union of Enterprises of the Cooling Industry — I admit to laughing when I first read that — has penned a letter sent to MinPrirody, the Federal Customs Service (FTS), and Rosprirodnadzor warning that new import rules intended to take effect on April 18 might disrupt supply chains for refrigerants like freon. The specific problem stems from a lack of clarity from new EAEU provisions that imply firms must be licensed to import hydrofluorocarbons without defining how licenses might be obtained. The Union proposed its own approach. Without a fairly speedy resolution, shortages are expected to appear on consumer markets, which would also prove a problem for refrigerator repairs as Russians with declining incomes try to stretch equipment’s operating lives further and shy from making large purchases if they can be avoided. It’s a recipe for yet for more price inflation so long as imported parts can’t be replaced domestically as a result of shortage. What’s insane to contemplate is that freon prices are now on the rise as a result of domestic shortages, and without enough coolants, food retail chains are going to have to bid up prices to make sure their own refrigerator capacity is maintained. Imagine yet more food price inflation because things spoil as a result of shortages. Positively, MinPromTorg is firefighting by saying it’ll issue licenses, but that firms can’t apply for them until the law takes effect on April 18 which is a remarkably byzantine way of admitting that no one at the ministry was competent enough or willing to mention to their boss that it is vital to smooth the transition by avoiding that type of cutoff. The EAEU legislation sets out a 15 working day period for license issuance — 3 weeks. It’ll blow over, but this episode is fantastic proof of just how detached Russian policymakers often appear to be.

Turns out that Russia’s strategic partnership with China doesn’t buy it much in the way of economic support in times of need. New data shows that for 1Q-3Q, Chinese investors pulled out 52% of all FDI in the real sector of the Russian economy — a lowly $3.74 billion pre-COVID which fell to $1.83 billion. Investments in Russian debt instruments declined by $100 million — again a lowly $1.45 billion pre-crisis down to $1.35 billion. Since 2014, China’s investment into the real sector is down around 40%, so much for friends like these. It can be admittedly difficult to disaggregate — Chinese investors are also using firms registered in Singapore or Cyprus or the Caymans or the Netherlands and so on — but the overall lesson is clear: political partnership and even the threat of security coordination has not fostered widespread trust or interest between private investors from China and their Russian counterparts for projects in Russia proper. It doesn’t take an MIT economics PhD to realize that the institutional problems scaring off western investors are just as worrisome for Chinese investors, even in sectors untouched by sanctions fears. Russia has completely failed to draw in investment under the Belt and Road Initiative as a driver, as much a result of its own concessions law snafus as corruption. If growth returns to pre-crisis trend, don’t expect any breakthrough. If it’s even weaker, then why would Chinese investors bother? US sanctions have doubled the problem by creating incentives to reduce economic cooperation as well.

COVID Status Report

New cases came in at 9,150 with 402 reported deaths. A mini surge in cases in Moscow to the highest levels seen since January has triggered initial fears that we might be seeing the start of a 3rd wave. It’s statistically a small increase, so they may well be exaggerated and it could just be statistical noise. The overall vaccination rate (both doses) nationally, however, is just 4% and back when Veronica Skvortsova warned of a 3rd wave, she said it would be unavoidable unless they vaccinated 25% of the population by May. That’s obviously not happening. Rospotrebnadzor is communicating that as long as a mask regime is kept in place, there won’t be a 3rd wave. That doesn’t inspire confidence given how lax restriction enforcement has generally been and how much harder it will be to enforce once most restrictions are removed — I’m parking aside approaches like denying the elderly use of public transport, which really wasn’t great (but probably helped a bit). Then there’s this coverage from Vesti.ru noting that COVID infections are getting worse i.e. more often leading to pneumonia or heavier symptoms and conditions. It’s truly difficult to pick apart what’s floated to calm people, what regional stories are positive, and which ones are mostly spin without more local context but the possibility of a 3rd wave seems far more serious than official communications indicate.

Margin-al Call

MinEnergo has been fighting for true oil sector fiscal reform for over a decade, cognizant of an abiding reality that MinFin, various government cabinets, the presidential administration, and Putin have been loathe to admit is a serious problem for the Russian economy: costs of production were rising and new greenfield discoveries weren’t keeping pace with plans to maintain output levels. Significant increases past 2013 levels could be achieved via improvement at the existing production base, but not much further without large new finds. Between 2014 and 2019, Russia managed to increase output by about 680,000 barrels per day (bpd) to 11.54 million bpd by playing a bit loose with OPEC+, ramping up horizontal drilling efforts, and providing rising levels of tax breaks for old production core to Rosneft’s base of Soviet fields in West Siberia. Because of the persistent fiscal conditions on top of price forecasts, the OPEC+ cuts, and outlook for demand, MinEnergo now projects Russia will never produce as much oil it did in 2019. It’s decline, faster or slower, from here on out. The following dollar values are nominal, so they slightly overstate the trend but I wanted to grab the arc of pre-COVID production and export growth vs. total earnings:

The decision to keep pushing up production post-2014 made sense for Russian firms since investment decisions are relatively price insensitive above $35 a barrel. In effect, the fiscal regime created a perfect storm of conditions whereby firms would have incentives to keep boosting output despite the lower price environment, increasingly supported by tax breaks or fiscal tweaks. Output rose, partially to compensate some export earnings losses from lower prices, but that didn’t mean capital was being used most effectively. The latest forecast from MinEnergo comes a little over half a year after it held the view that Russia had to increase its market share once demand returned. That seems impossible without substantial domestic reforms.

On the one hand, MinEnergo is artfully using COVID as an excuse to demand a lower tax rate for the sector. This makes perfect sense and we shouldn’t assume the doom and gloom their finding presents actually reflects a belief that the sector is in trouble. That said, the forecast provided aligns with those made around 2010 used to justify pushing offshore Arctic oil — Eastern Siberia will eventually account for 45+% of national output and every effort has to be made to lengthen the runway for heavily depleted production in West Siberia. How future changes in production interact with Russian macro and budget priorities is the problem, as is the efficacy of foregoing state revenues to stimulate investments into a sector likelier than not to see long-term declining equity values and returns if it lags its western competitors technologically. Lukoil CEO Vagit Alekperov just met with Putin to ask for tax breaks to develop offshore findings in the Russian Caspian, something Putin has not commented on nor indicated any preference as he’s surely waiting for others to weigh in. Now that oil & gas revenues finally rose 3.3% year-on-year in March, it’s hard to imagine MinFin’s feeling generous about letting the sector off the hook when it needs to consolidate another budget.

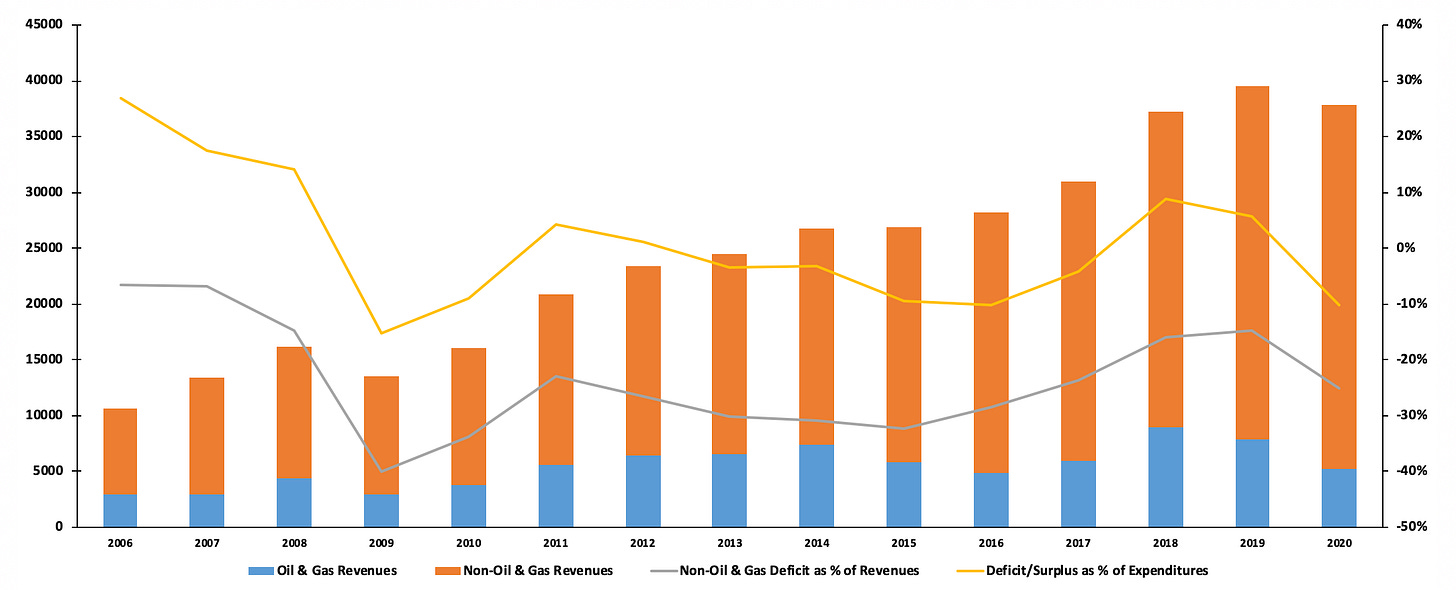

If production has peaked and the only means available is to reduce the sector’s tax burden to compensate for the higher cost and lower quality of much of the newer reserves that have been discovered, the distributional question for Russian politics is who pays for peak oil? Unwinding oil revenue dependence is far easier structurally when the economy is growing strongly and there aren’t doubts about future demand levels. In the current scenario, Russia’s still heavily dependent on hydrocarbon revenues but because of its moral panics about deficits, the only option is to raise taxes on consumption, incomes, wealth, and the population at large. MinFin went so far as to fire back at Levada respondents complaining that they had a high tax burden by pointing out that Russians have one of the lowest effective tax rates in the world. That points to the reality that MinFin may well have to raise them, but also that hydrocarbon-backed low tax rates aren’t perceived as a ‘gift’ when incomes keep falling. The following is a little messy with the second y-axis, but a useful snapshot of the persistence of the fiscal problem even with higher non-oil & gas revenues:

First, the oil & gas revenues wildly underestimate the effective tax rate by excluding VAT, corporate taxation, etc. But it’s clear we can see a massive buildup for tax revenues via other forms of taxation. The deficit/surplus for the budget has been kept within the -10/+10% band against expenditures, on top of the 3-5% of the budget that has gone unspent every year since 2016 because of MinFin’s tight grip on finances. But even with the rising rate of net non-oil & gas revenues, MinFin records non-oil & gas revenue deficits exceeding 10% of the value of all revenues combined. In other words, if that’s 10-15% of the projected revenues needed not coming from other sources, it ostensibly has to be pulled from the oil & gas sector somehow. What’s even crazier is that the calculation for that deficit was lower in 2006-2007 when there was limited fiscal need to increase other revenues than in 2019-2020. According to the current methodology, the relative shortfall for non-oil & gas revenues was smaller when they were less salient and necessary over 20% in 2020 despite increases to VAT, increased profit tax collection, etc. “Progress” on this front isn’t fictional, but certainly been mythologized a fair bit by the state since the other unspoken problem here lies with inflation. My guess is that if we were to calculate inflation, the relative shifts in fiscal capacity are smaller and role of foreign currency earning firms greater.

The current situation is a triple-bind: Russia’s still building fiscal policy on the basis of oil revenues, the demand outlook is highly uncertain and can disincentivize easing the tax burden politically, and Russia lacks the flexibility that Saudi Arabia has to alter output levels once investments are made. In other words, Russia’s traditionally been a marginal oil producer only able to expand market share incrementally due to geology and geography when demand has increased and has historically wasted a great deal of its own capital when trying to do so amid lower prices. This dynamic played out between 1979 and 1984 when the incentive was to keep pushing output up to maintain revenue levels despite falling global demand and low prices, a dynamic that played out again after 2014-2015 because of the structure of the tax code and need to offset, if marginally, lost export revenues. Once demand begins to fall, the two best options are to reduce domestic demand for crude oil and refined products to increase export earnings and to achieve efficiency gains as production costs have in many contexts deflated since 2014-2015. Increasing the fiscal burden on the population may induce the former, but at the expense of economic growth and, therefore, other types of revenues.

While this is going on, inflation in Russia’s now hitting annualized highs not seen since 2016, 5.8% as of March. If the Central Bank hikes rates to quash it, people will consume less, earn less, and be worse off for it. If the Ministry of Finance raises taxes to quash it, the same effect occurs unless that money is invested into projects effectively. The higher inflation goes and longer it lasts, the more political pressure there is to avoid any tax increases on consumers, reinforcing the logic of soaking the oil sector despite its admitted inability to raise output further. The worst part of peak production is that it implies a steady and unavoidable decline for intermediate demand across the Russian economy without fiscal relief, which perversely amplifies the effect of the oil price on the real sector because continued demand growth has propped it up since 2014-2015. When prices rise high enough, stagnation is maintained. When prices fall too much, contraction is much likelier. Unlike Middle Eastern producers, the costs of production in Russia are rising over time. It will have to cede more to the industry domestically to maintain output, but can only do so bearing significant risks for economic growth unless the mining sector can somehow generate comparable rents (and then face the same types of problems). I think MinEnergo’s change in tone is primarily aimed at policy lobbying, but it’s been warning the Kremlin about this reality for years. One wonders what happens if the presidential administration actually listens.

Like what you read? Pass it around to your friends! If anyone you know is a student or professor and is interested, hit me up at @ntrickett16 on Twitter or email me at nbtrickett@gmail.com and I’ll forward a link for an academic discount (edu accounts only!).